Tax Incentives For Ev Cars If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles Qualified two wheeled plug

The IRS has given automakers a little more wiggle room around which electric vehicles will qualify for a federal tax credit worth up to 7 500 The change which gives companies a few more The EV tax credit is a federal tax incentive for taxpayers looking to go green on the road Here are the rules income limit qualifications and how to claim the credit in 2024

Tax Incentives For Ev Cars

Tax Incentives For Ev Cars

http://albertaev.ca/wp-content/uploads/2022/06/ev-incentive-1024x333.png

2023 EV Tax Credit How To Save Money Buying An Electric Car Money

https://img.money.com/2022/12/News-Save-buying-electric-car-using-tax-credits.jpg?quality=85

Tax Incentives For Electric Cars Uk Kami Mcallister

https://www.rousepartners.co.uk/wp-content/uploads/2019/09/company-car-tax-benefits.jpg

Consumer Reports details the list of 2023 and 2024 model year electric vehicles and plug in hybrids that qualify for federal tax credits of up to 7 500 under the Inflation Reduction Act Today s guidance marks a first step in the Biden Administration s implementation of Inflation Reduction Act tax credits to lower costs for families and make electric vehicles

The government is offering a hefty tax credit to buyers of electric vehicles but taking advantage of it is not straightforward Here s what you need to know All electric plug in hybrid and fuel cell electric vehicles purchased new in 2023 or after may be eligible for a federal income tax credit of up to 7 500

Download Tax Incentives For Ev Cars

More picture related to Tax Incentives For Ev Cars

Could Tax Reform Be End To EV Incentives The Truth About Cars

https://cdn-fastly.thetruthaboutcars.com/media/2022/06/30/8648345/could-tax-reform-be-end-to-ev-incentives.jpg?size=720x845&nocrop=1

America s EV Incentives Change From New Year s Eve New Tax Credit

https://images.hindustantimes.com/auto/img/2022/12/30/1600x900/Electric-Vehicles-Tax-Credit-Explainer_1672378825590_1672378825725_1672378825725.jpg

Incentives For Ev Cars Todrivein

https://todrivein.com/wp-content/uploads/2023/06/incentives-for-ev-cars_featured_photo.jpeg

If you bought a new qualified plug in electric vehicle EV between 2010 and 2022 you may be eligible for a new electric vehicle tax credit up to 7 500 under Internal Revenue Code Section All electric and plug in hybrid vehicles purchased new from 2010 through 2022 may be eligible for a federal income tax credit of up to 7 500 The credit amount will vary based on the capacity

Tax credits up to 7 500 are available for eligible new electric vehicles and up to 4 000 for eligible used electric vehicles You can claim the credit yourself or work with your dealership Federal Tax Credits under the Inflation Reduction Act The following terms were introduced by the Biden Administration in the summer of 2022 and went into effect on January

EV Tax Credits How To Get The Most Money For 2023

https://sm.pcmag.com/t/pcmag_me/help/e/ev-tax-cre/ev-tax-credits-how-to-get-the-most-money-for-2023_82w5.1920.jpg

How To Calculate Electric Car Tax Credit OsVehicle

https://cdn.osvehicle.com/how_is_tax_credit_for_ev_calculated.png

https://www.irs.gov/newsroom/qualifying-clean...

If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles Qualified two wheeled plug

https://www.npr.org/2023/12/28/1219158071

The IRS has given automakers a little more wiggle room around which electric vehicles will qualify for a federal tax credit worth up to 7 500 The change which gives companies a few more

UK Tax Incentives For Businesses Using Electric Vehicles FACT3

EV Tax Credits How To Get The Most Money For 2023

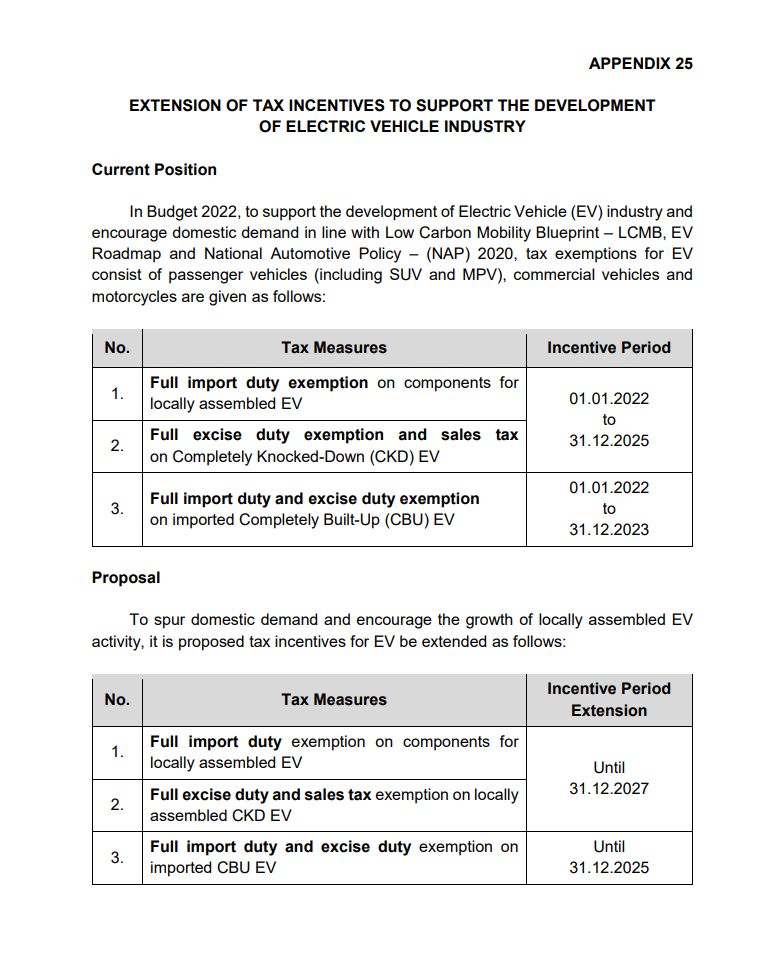

Budget 2023 New EV Incentives That Were Not Announced In Parliament

Uk Tax Incentives For Electric Vehicles Kirstie Mccormack

TAX INCENTIVES FOR HEALTH CARE PRACTICAL TAX PLANNING

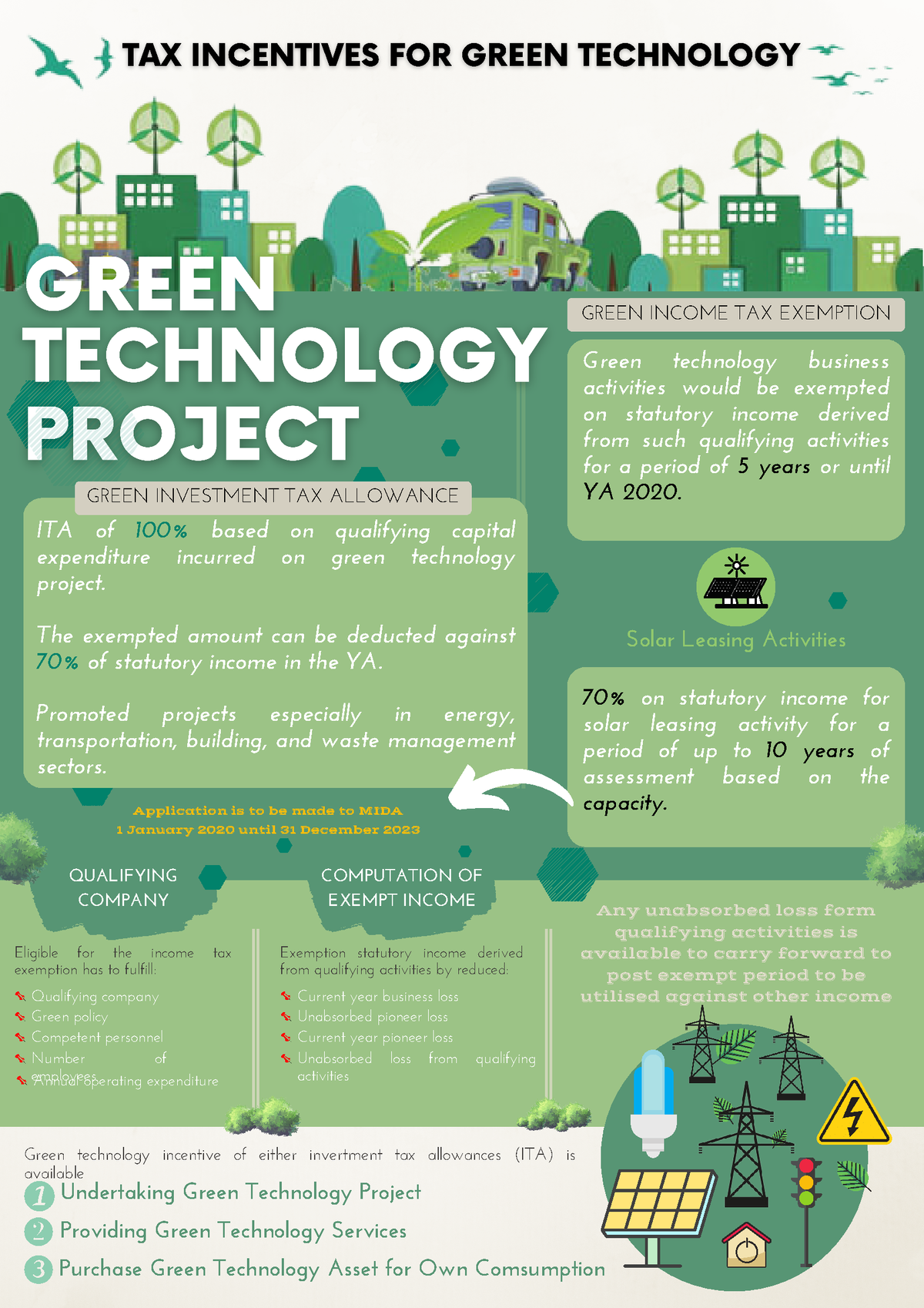

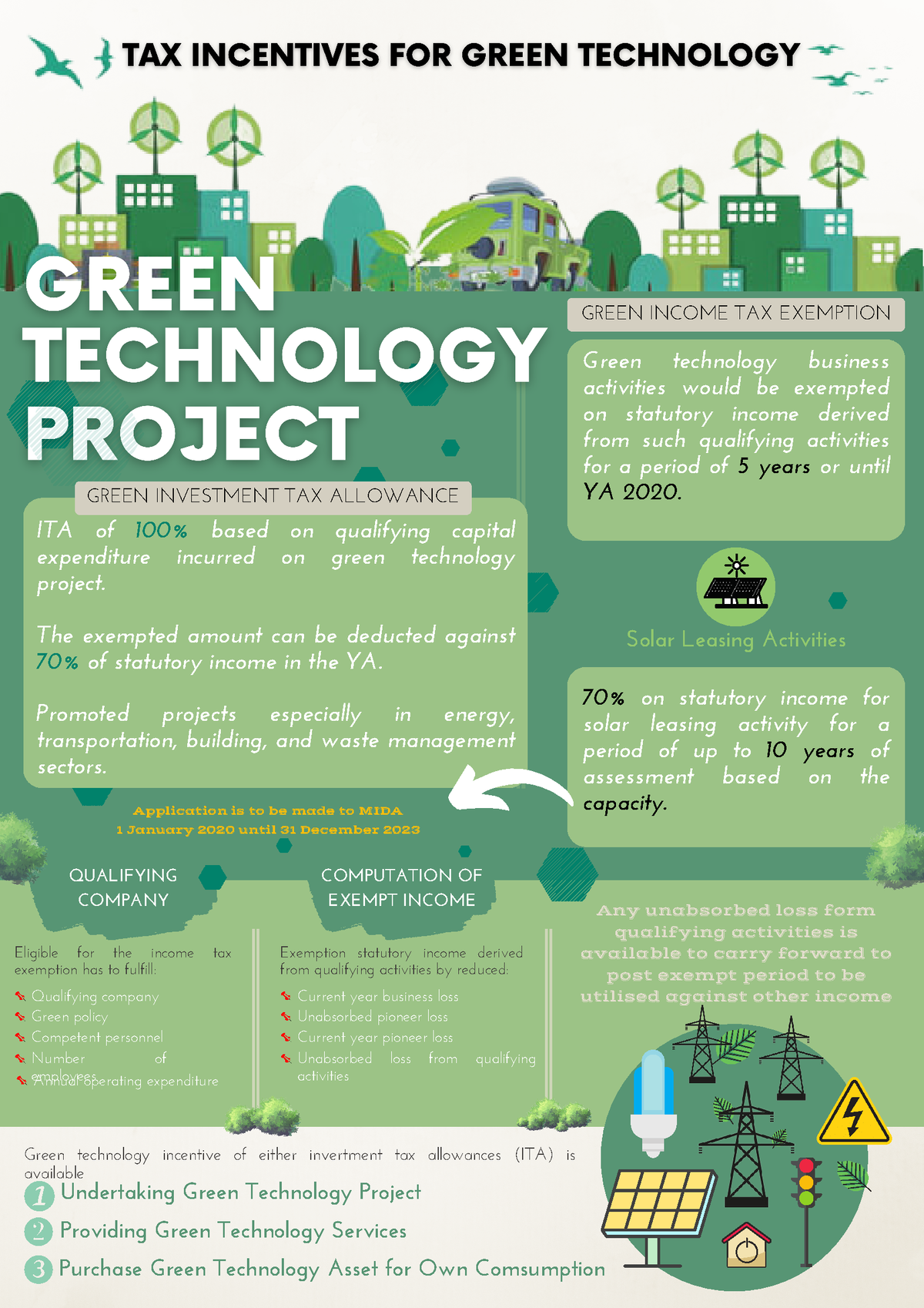

TAX Incentives FOR Green Technology Wan Sharmirizal GREEN INCOME

TAX Incentives FOR Green Technology Wan Sharmirizal GREEN INCOME

The EV Tax Credit Can Save You Thousands If You re Rich Enough Grist

Has Irs Extended The Credit For Electric Cars OsVehicle

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

Tax Incentives For Ev Cars - If you re shopping for or researching an electric vehicle in 2024 you ve probably heard that significant changes in the federal tax credit of up to 7 500 for EVs and plug in