Tax Deduction 2024 The deduction for commuting between home and work will decrease in 2024 because its threshold is raised from 750 to 900 and the temporary increases to the

The standard deduction will increase by 750 for single filers and by 1 500 for joint filers Table 2 Seniors over age 65 may claim an additional standard deduction IRS Tax Tip 2024 01 Jan 4 2024 Tax credits and deductions change the amount of a person s tax bill or refund People should understand which credits and deductions they

Tax Deduction 2024

Tax Deduction 2024

https://www.taxdefensenetwork.com/wp-content/uploads/2021/12/20212022-Standard-Deduction-.jpg

Income Tax Calculator Ay 2023 24 Excel Apnaplan Pay Period Calendars 2023

http://www.sensystechnologies.com/blog/wp-content/uploads/2022/04/20220429_120210.jpg

Mastering Your Taxes 2024 W 4 Form Explained 2024 AtOnce

https://www.patriotsoftware.com/wp-content/uploads/2022/12/2023-Form-W-4.png

FS 2024 11 April 2024 A deduction reduces the amount of a taxpayer s income that s subject to tax generally reducing the amount of tax the individual may have to pay How much is the standard deduction for 2024 The IRS released the 2024 standard deduction amounts for returns normally filed in April 2025 These amounts are provided in the chart below

The IRS has released the standard deduction amounts for 2024 which increase the amounts that will be available on 2023 tax returns 22 Popular Tax Deductions and Tax Breaks for 2023 2024 A deduction cuts the income you re taxed on which can mean a lower bill A credit cuts your tax bill directly Learn more about

Download Tax Deduction 2024

More picture related to Tax Deduction 2024

Federal Tax Revenue Brackets For 2023 And 2024 Nakedlydressed

https://thecollegeinvestor.com/wp-content/uploads/2022/10/TCI_-_2023_Federal_Tax_Brackets_1600x974.png

Tax Deductions For 2023 Ontario Image To U

https://www.wiztax.com/wp-content/uploads/2022/10/2.png

Mileage Tax Deduction Rules 2024

https://media.freshbooks.com/wp-content/uploads/2023/10/Mileage-Tax-Deduction-scaled.jpg

The standard tax deduction is a set amount that taxpayers are automatically allowed to deduct from their taxable income thus lowering their total tax owed The The standard deduction will rise to 14 600 for single taxpayers a 750 increase the agency announced Thursday For married couples who file jointly it will

The 2024 standard deduction for tax returns filed in 2025 is 14 600 for single filers 29 200 for joint filers or 21 900 for heads of household Use our income tax calculator to calculate tax payable on your income for FY 2024 25 old tax regime vs new tax regime as per Union Budget 2024 FY 2023 24 and FY 2022 23

Your First Look At 2023 Tax Brackets Deductions And Credits 3

https://db0ip7zd23b50.cloudfront.net/dims4/default/c317e21/2147483647/resize/633x10000>/quality/90/?url=http:%2F%2Fbloomberg-bna-brightspot.s3.amazonaws.com%2F62%2F5a%2Fccfa233d46c391d75869b746dda0%2Fede7658103254185b6b3a08ad7ad5c0a

2024 Standard Tax Deduction Shocks Taxpayers

https://www.mortgagerater.com/wp-content/uploads/2024/02/2024-tax-deductions.png

https://www.vero.fi/.../changes-to-taxation-in-2024

The deduction for commuting between home and work will decrease in 2024 because its threshold is raised from 750 to 900 and the temporary increases to the

https://taxfoundation.org/data/all/federal/2024-tax-brackets

The standard deduction will increase by 750 for single filers and by 1 500 for joint filers Table 2 Seniors over age 65 may claim an additional standard deduction

100 Tax Deduction On Your Donation In Malaysia Jul 26 2021 Johor

Your First Look At 2023 Tax Brackets Deductions And Credits 3

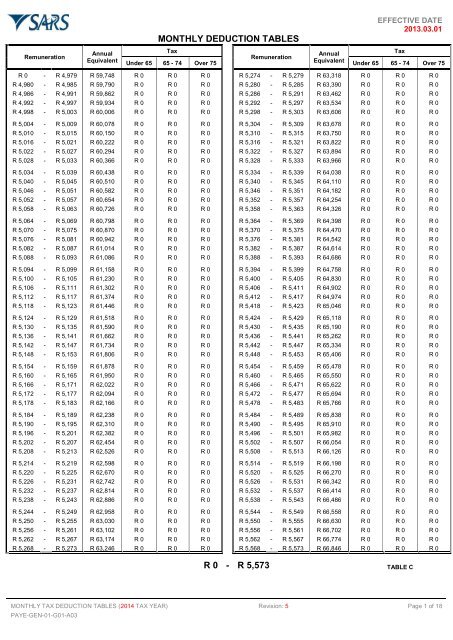

2022 Paye Tax Tables Brokeasshome

Printable Itemized Deductions Worksheet

Tax deduction checklist Etsy

Excel Payroll Calculator 2023 JeremyMaiya

Excel Payroll Calculator 2023 JeremyMaiya

EXCEL Of Tax Deduction Form xlsx WPS Free Templates

Tax Deduction On Payment To Release Bumi Lot Sep 01 2022 Johor

2024 Filing Jointly Tax Brackets Alta Jewell

Tax Deduction 2024 - Income Tax Calculator How to calculate Income taxes online for FY 2023 24 AY 2024 25 2024 25 2023 24 with ClearTax Income Tax Calculator Refer examples tax