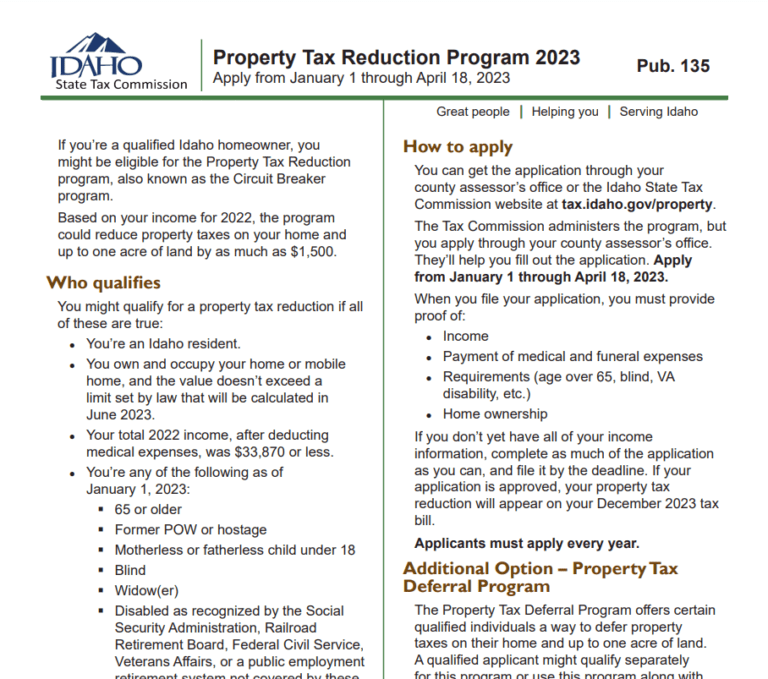

State Of Idaho Tax Rebate 2024 You might be eligible for the Property Tax Reduction program if you re an Idaho resident and homeowner The program could reduce your property taxes by 250 to 1 500 on your home and up to one acre of land Note This program won t reduce solid waste irrigation or other fees that government entities charge Read more about this program

The Property Tax Reduction Program to receive additional property tax assistance Deferred taxes and interest must be repaid to the state of Idaho when ownership of the property changes or the property no longer qualifies for the Homeowner s Exemption Contact your county assessor for additional program information and an application Idaho Grocery Credit The grocery tax credit offsets the sales tax you pay on groceries throughout the year For most Idaho residents it averages 100 per person You must be an Idaho resident to be eligible and you might be able to claim a grocery credit for your dependents too This page explains Idaho grocery credit requirements and

State Of Idaho Tax Rebate 2024

State Of Idaho Tax Rebate 2024

https://yt3.ggpht.com/L8ln24UqY6J3yFHVvOufWF6YuZYTeEGNQCvmxnat4KC_I01YlXGKIdbzOBvo4tM7ipXXJ42bPQ=s900-c-k-c0x00ffffff-no-rj

One time Tax Rebate Checks For Idaho Residents KLEW

https://klewtv.com/resources/media2/16x9/full/1024/center/80/bcd0e069-efe3-406d-b87f-b52ab4b43fd3-large16x9_IdahoTaxRebateCheckpic.jpg

SC State Tax Rebate 2023 Eligibility And Claiming Process Explained PrintableRebateForm

https://printablerebateform.net/wp-content/uploads/2023/02/SC-State-Tax-Rebate-2023-768x994.png

IRA page 216 Section 50121 Rebates for energy efficiency retrofits will range from 2 000 4 000 for individual households and up to 400 000 for multifamily buildings This offers grants to states to provide rebates for home retrofits up to 2 000 for retrofits reducing energy use by 20 or more and up to 4 000 for retrofits saving 35 You can check the tax amount you reported on line 20 of your 2020 tax return also called a Form 40 Service members will find their total on line 42 of their 2020 Form 43 which is for

Most taxpayers can calculate how much their rebate will be by taking 10 of the number that is on line 20 of form 40 Idaho State Tax Commission You can calculate 10 of 2020 taxes paid by taking 10 of the tax amount reported on Form 40 line 20 or Form 43 line 42 for eligible service members using that form Amount of the 2022 rebate whichever is greater 75 per taxpayer and each dependent 12 of the tax amount reported on Form 40 line 20 or Form 43 line 42 for eligible service members using that form

Download State Of Idaho Tax Rebate 2024

More picture related to State Of Idaho Tax Rebate 2024

Idaho Tax Collections Dip Below Expectations For August KBOI

https://idahonews.com/resources/media2/16x9/full/1015/center/80/ed3056dc-973a-429a-aa1d-f69aef452fc3-large16x9_AP22257734976020.jpg

Missouri State Tax Rebate 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/04/Missouri-Tax-Rebate-2023-768x587.png

Idaho House Approves Massive Income Tax Cut And Rebate Plan Bonner County Daily Bee

https://hagadone.media.clients.ellingtoncms.com/img/photos/2021/03/19/0320_Tax_Rebate_Plan_AP_t1170.jpg?5cc718665ab672dba93d511ab4c682bb370e5f86

BOISE Idaho KMVT KSVT The Idaho State Tax Commission starts processing 2023 Idaho individual income tax returns on Monday January 29 The Internal Revenue Service begins processing federal Sales tax collections were 6 6m above forecast Since the revised forecast accepted the results of Jul Nov the state is now 122 2m ahead of forecast cumulatively For individual income tax collec tions the expectation was for 170 9m in withholding collections and the actual result was 168 7m Refunds came in less than half of

The Internal Revenue Service issued new guidance late last week that anyone who received a tax rebate does not need to report the payment on their 2022 tax return People who were full time The Idaho Senate has followed the House lead in approving a state income tax rebate bill The 27 7 party line vote on Tuesday came after an hour long debate in which several senators declared the proposal not perfect but a good way to return some of the Gem State s projected 1 9 billion budget surplus to taxpayers

Want To Track Your 2022 Tax Rebate Check Out This Tool From The Idaho State Tax Commission

https://idahocapitalsun.com/wp-content/uploads/2022/04/income-tax-491626_1920-768x512.jpg

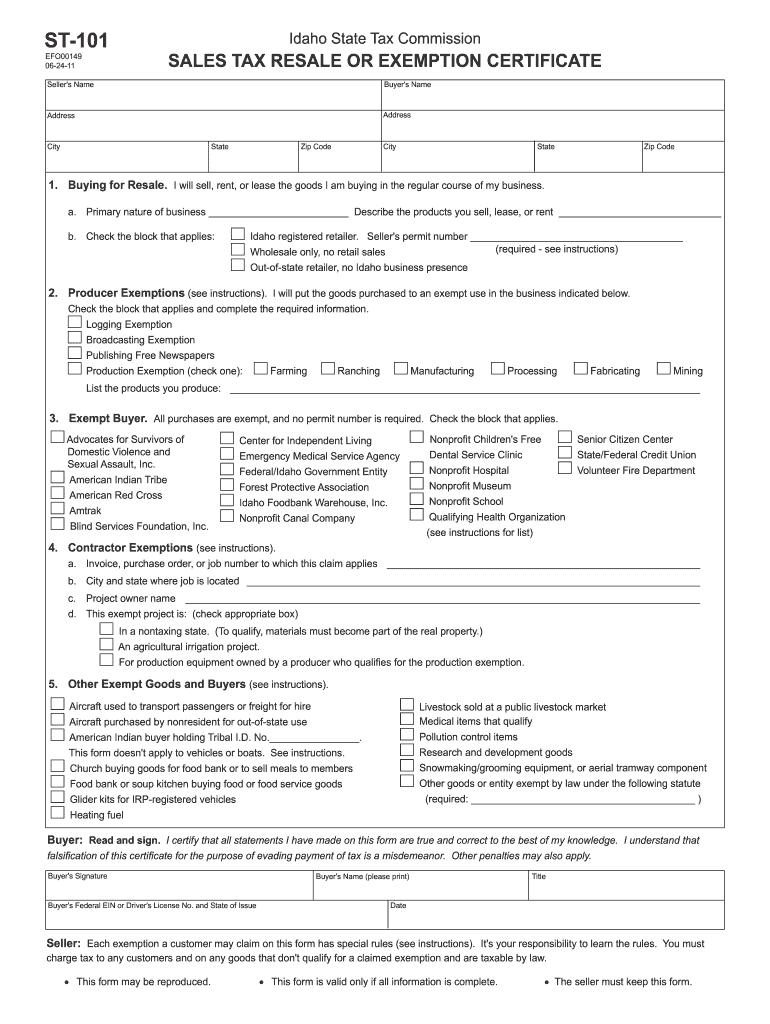

ST 101 Idaho State Tax Commission Tax Idaho Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/6/55/6055080/large.png

https://tax.idaho.gov/taxes/property/homeowners/reduction/

You might be eligible for the Property Tax Reduction program if you re an Idaho resident and homeowner The program could reduce your property taxes by 250 to 1 500 on your home and up to one acre of land Note This program won t reduce solid waste irrigation or other fees that government entities charge Read more about this program

https://tax.idaho.gov/wp-content/uploads/pubs/EBR00135/EBR00135_12-05-2023.pdf

The Property Tax Reduction Program to receive additional property tax assistance Deferred taxes and interest must be repaid to the state of Idaho when ownership of the property changes or the property no longer qualifies for the Homeowner s Exemption Contact your county assessor for additional program information and an application

Idaho Tax Rebate 2023 Your Comprehensive Guide To Saving Money Printable Rebate Form

Want To Track Your 2022 Tax Rebate Check Out This Tool From The Idaho State Tax Commission

Wondering About Your Idaho Tax Rebate Track Its Status With A New Online Tool Idaho Capital Sun

Homeowner Renters District 16 Democrats

Final Chance To Get One time Rebates Between 300 To 600 From 500million Pot See If You re

States Tapping Historic Surpluses For Tax Cuts And Rebates The Columbian

States Tapping Historic Surpluses For Tax Cuts And Rebates The Columbian

4923 H 2014 2024 Form Fill Out And Sign Printable PDF Template SignNow

Here s How You Can Track Your Idaho Special Session Tax Rebate East Idaho News

P55 Tax Rebate Form By State PrintableRebateForm

State Of Idaho Tax Rebate 2024 - You can check the tax amount you reported on line 20 of your 2020 tax return also called a Form 40 Service members will find their total on line 42 of their 2020 Form 43 which is for