Spouse Rebate 2024 If you re 65 or older or receive disability benefits and paid rent or property taxes last year you qualify if you meet the income requirements The income limit is 35 000 per household for homeowners and 15 000 per household for renters If you receive Social Security benefits the state only counts half of that towards the income cap

On January 19 2024 the Ways and Means Committee made a significant bipartisan move by approving the Tax Relief for American Families and Workers Act of 2024 This legislation is designed to provide crucial support to American job creators small businesses and working families By accelerating the end of the COVID era Employee Retention Tax If you have not received your benefit by January 12 2024 contact us This program provides property tax relief to New Jersey residents who own or rent property in New Jersey as their principal residence and meet certain income limits The current filing season for the ANCHOR benefit is based on 2020 residency income and age

Spouse Rebate 2024

Spouse Rebate 2024

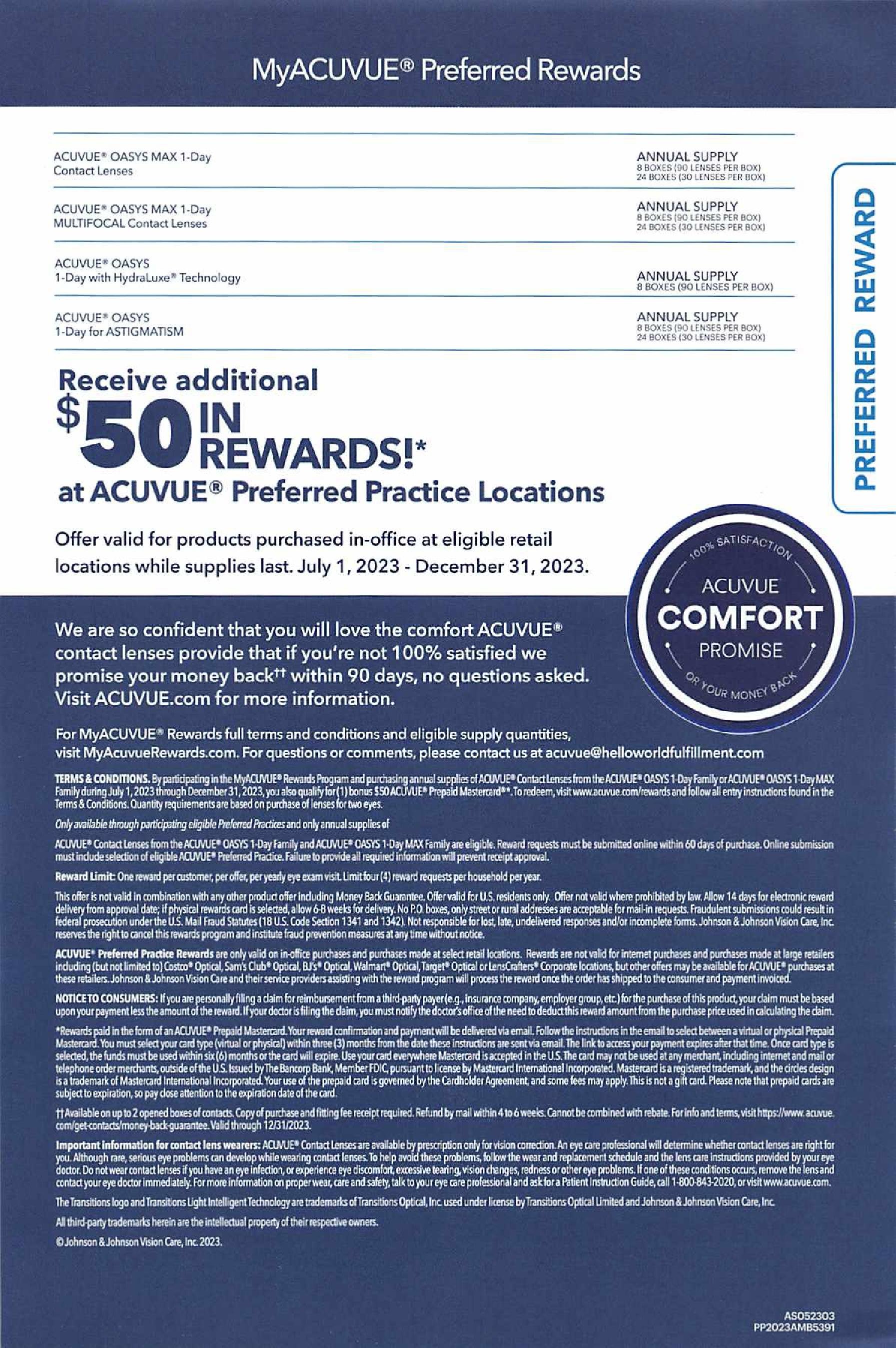

https://images.squarespace-cdn.com/content/v1/58c880d7893fc0f2350b0bbd/1690319254436-Z50KGZF5UOG5W2JEO2WB/Acuvue+Rebates+exp+12.31.2023_6.jpg

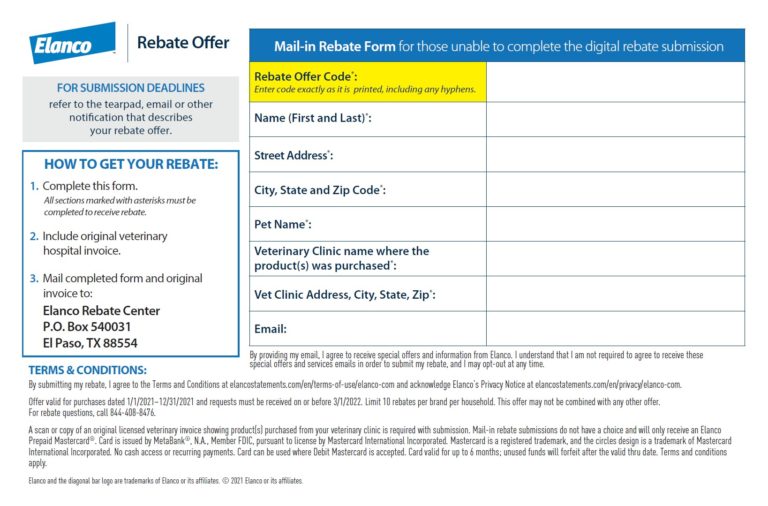

Mobil One Offical Rebate Printable Form Printable Forms Free Online

https://printablerebateform.net/wp-content/uploads/2021/07/Trifexis-Rebate-Form-2021-768x506.jpg

Airforce Wife Military Spouse Life

https://i.pinimg.com/originals/7e/d8/81/7ed881f34800bba0df36d0224cdac895.png

Tax Tip 2024 01 Jan 4 2024 Tax credits and deductions change the amount of a person s tax bill or refund People should understand which credits and deductions they can claim and the records they need to show their eligibility Beginning Jan 1 2023 the credit equals 30 of certain qualified expenses including Qualified energy efficiency improvements installed during the year Residential energy property expenses Home energy audits There are limits on the allowable annual credit and on the amount of credit for certain types of qualified expenses

If your loved one occupied his or her own home and paid property taxes the department will calculate the rebate for you using the number of days method to prorate the taxes paid If rent was paid during the claim year the department will multiply the rent paid by 20 percent 0 20 to determine the amount of rent paid for the rent rebate The Residential Clean Energy Credit equals 30 of the costs of new qualified clean energy property for your home installed anytime from 2022 through 2032 The credit percentage rate phases down to 26 percent for property placed in service in 2033 and 22 percent for property placed in service in 2034

Download Spouse Rebate 2024

More picture related to Spouse Rebate 2024

Lensrebates Alcon Com

https://www.royacdn.com/unsafe/Site-88a5128c-aaae-4122-b1ad-472be343579c/rebate/2022_1H_Existing_Wearer_Rebate_page_001.jpg

The Spouse 1994

https://m.media-amazon.com/images/M/MV5BM2QyMjFkMmEtZmZiYS00YjAwLTk2M2UtOWIwYzllNDcxNDM5XkEyXkFqcGdeQXVyODU3MTgzMDE@._V1_.jpg

When Is Military Spouse Day In The USA Military Spouse Day Countdown How Many Days Until

https://blankcalendarpages.com/holiday/images/military-spouse-day.jpg

Taxpayers will be able to access the Form 1099 MISC on and after January 31 2024 ADOR split my rebate with my ex spouse No The rebate will either be issued to the direct deposit account provided on the 2021 Arizona individual income tax return or ADOR will send a rebate check to the last known address of the qualifying taxpayer The latest such increase 3 2 percent becomes effective January 2024 SSI amounts for 2024 The monthly maximum Federal amounts for 2024 are 943 for an eligible individual 1 415 for an eligible individual with an eligible spouse and 472 for an essential person In general monthly amounts for the next year are determined by increasing the

How to maximize your 2024 tax refund according to a CPA 02 34 Many Americans got a shock last year when the expiration of pandemic era federal benefits resulted in their receiving a smaller tax a In general Paragraph 6 of section 24 h of the Internal Revenue Code of 1986 is amended 1 by striking credit Subsection and inserting credit A I N GENERAL Subsection and 2 by adding at the end the following new subparagraphs B R ULE FOR DETERMINATION OF EARNED INCOME i I N GENERAL In the case of a taxable year beginning after 2023

Get Up To A 300 Rebate On Bausch Lomb Contact Lenses Sunshine Optometry

https://images.squarespace-cdn.com/content/v1/58c880d7893fc0f2350b0bbd/1671046938649-FD50N05XDSCYNJTD97B7/2023-01+to+2023-06-30+B%26L+Rebate+Form+Front.jpg

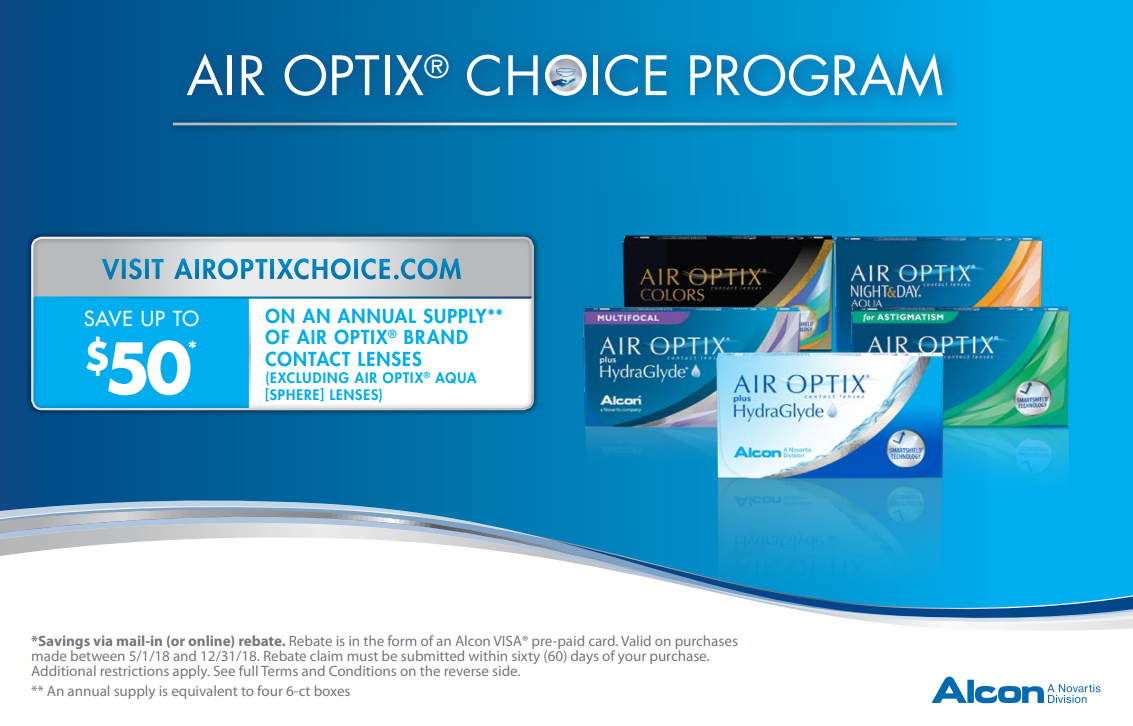

Alcon Rebate Form 2023 Printable Rebate Form

http://printablerebateform.net/wp-content/uploads/2023/01/Alcon-Rebate-Form-2023.png

https://www.spotlightpa.org/news/2022/09/pa-property-tax-rebate-status-pennsylvania-guide/

If you re 65 or older or receive disability benefits and paid rent or property taxes last year you qualify if you meet the income requirements The income limit is 35 000 per household for homeowners and 15 000 per household for renters If you receive Social Security benefits the state only counts half of that towards the income cap

https://tax.thomsonreuters.com/blog/understanding-the-tax-relief-for-american-families-and-workers-act-of-2024/

On January 19 2024 the Ways and Means Committee made a significant bipartisan move by approving the Tax Relief for American Families and Workers Act of 2024 This legislation is designed to provide crucial support to American job creators small businesses and working families By accelerating the end of the COVID era Employee Retention Tax

What You Need To Know About Spouse Benefits For Railroad Retirement Highball Advisors

Get Up To A 300 Rebate On Bausch Lomb Contact Lenses Sunshine Optometry

Seresto Rebate Form PrintableRebateForm

Printable Alcon Rebate Form 2023 Printable Forms Free Online

Pensioner Rebate Doubled To Provide Support Bundaberg Now

New Wearer Rebate Alcon New Wearers Can Save Up To 225 On Your Contact Lens Purchase

New Wearer Rebate Alcon New Wearers Can Save Up To 225 On Your Contact Lens Purchase

Rebate Air Optix Printable Rebate Form

Top 5 Body Soul Health Tips For Military Spouses Spousehood

Military Spouses

Spouse Rebate 2024 - The Residential Clean Energy Credit equals 30 of the costs of new qualified clean energy property for your home installed anytime from 2022 through 2032 The credit percentage rate phases down to 26 percent for property placed in service in 2033 and 22 percent for property placed in service in 2034