Solar Rebates 2024 Vs 2024 The U S government offers a solar tax credit that can reach up to 30 of the cost of installing a system that uses the sun to power your home Simple tax filing with a 50 flat fee for every

The solar tax credit which is among several federal Residential Clean Energy Credits available through 2032 allows homeowners to subtract 30 percent of the cost of installing solar heating While everyone in the U S can claim the federal solar tax credit ITC no matter where you live rebates are usually tied to your location and vary state by state The ITC allows you to claim 30 of the total cost of your solar panel installation on your taxes which results in thousands of dollars in savings for you as a homeowner

Solar Rebates 2024 Vs 2024

Solar Rebates 2024 Vs 2024

https://s3.amazonaws.com/solarassets/wp-content/uploads/2022/10/SREC-markets-map.jpg

Complete Guide For WA Solar Panel Rebates 2023

https://www.empowersolaraustralia.com.au/wp-content/uploads/2023/05/d235aa88-c955-4234-ae4c-5b9c2f6a3814.jpg

2024 PNG

https://png.pngtree.com/png-clipart/20220922/original/pngtree-colorful-2024-year-png-image_8627329.png

Energy Efficiency and Electrification Rebates for 2024 Update Per the latest guidance from the US Department of Energy the home electrification rebates listed below are expected to be available in some areas in the second half of 2024 and available in most areas by early 2025 Solar Incentives by State in 2024 Solar Solar Learning Center Solar Rebates Incentives Solar Incentives by State Solar Incentives by State Thanks to the Inflation Reduction Act the Federal Solar Investment Tax Credit is at 30 until the end 2032 which is a great start to reducing the cost of your solar system

An average 20 000 solar system is eligible for a solar tax credit of 6 000 The Inflation Reduction Act extended the federal solar tax credit until 2035 To qualify for the federal solar tax credit you must own the solar panels have taxable income and it must be installed at your primary or secondary residence Here s a quick example of the difference in a 26 credit versus a 30 credit for a 27 000 solar system At the full 30 level your credit would be 8 100 compared to 7 020 at 26 That s a savings difference of 1 080 compared to the previous year

Download Solar Rebates 2024 Vs 2024

More picture related to Solar Rebates 2024 Vs 2024

Solar Panel Rebates Incentives Grants Available In Alberta

https://www.livezeno.com/wp-content/uploads/2022/04/Solar-rebates-1440x720.png

Gradient 2024 New Year Gradient 2024 Year PNG And Vector With Transparent Background For Free

https://png.pngtree.com/png-clipart/20220922/original/pngtree-gradient-2024-new-year-png-image_8627331.png

Federal Solar Tax Credits For Businesses Department Of Energy

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2023-05/Summary-ITC-and-PTC-Values-Chart-2023.png?itok=_P0koCpu

South Carolina offers a solar tax credit worth up to 25 of their total system cost while New Mexico offers a tax credit of up to 6 50 per square foot of solar panel installation until 2032 Net metering is a way for you to earn credits from your utility company for the electricity your solar panels produce The investment tax credit ITC is a tax credit that reduces the federal income tax liability for a percentage of the cost of a solar system that is installed during the tax year 1 The production tax credit PTC is a per kilowatt hour kWh tax credit for electricity generated by solar and other qualifying technologies for the first 10

Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed on or before December 31 2019 were also eligible for a 30 tax credit It will decrease to 26 for systems installed Nebraska Solar Incentives Available in 2024 Nebraska Solar Panels Cost Is It Worth Going Solar in Nebraska Frequently Asked Questions FAQs Solar power accounts for just 0 3 of the

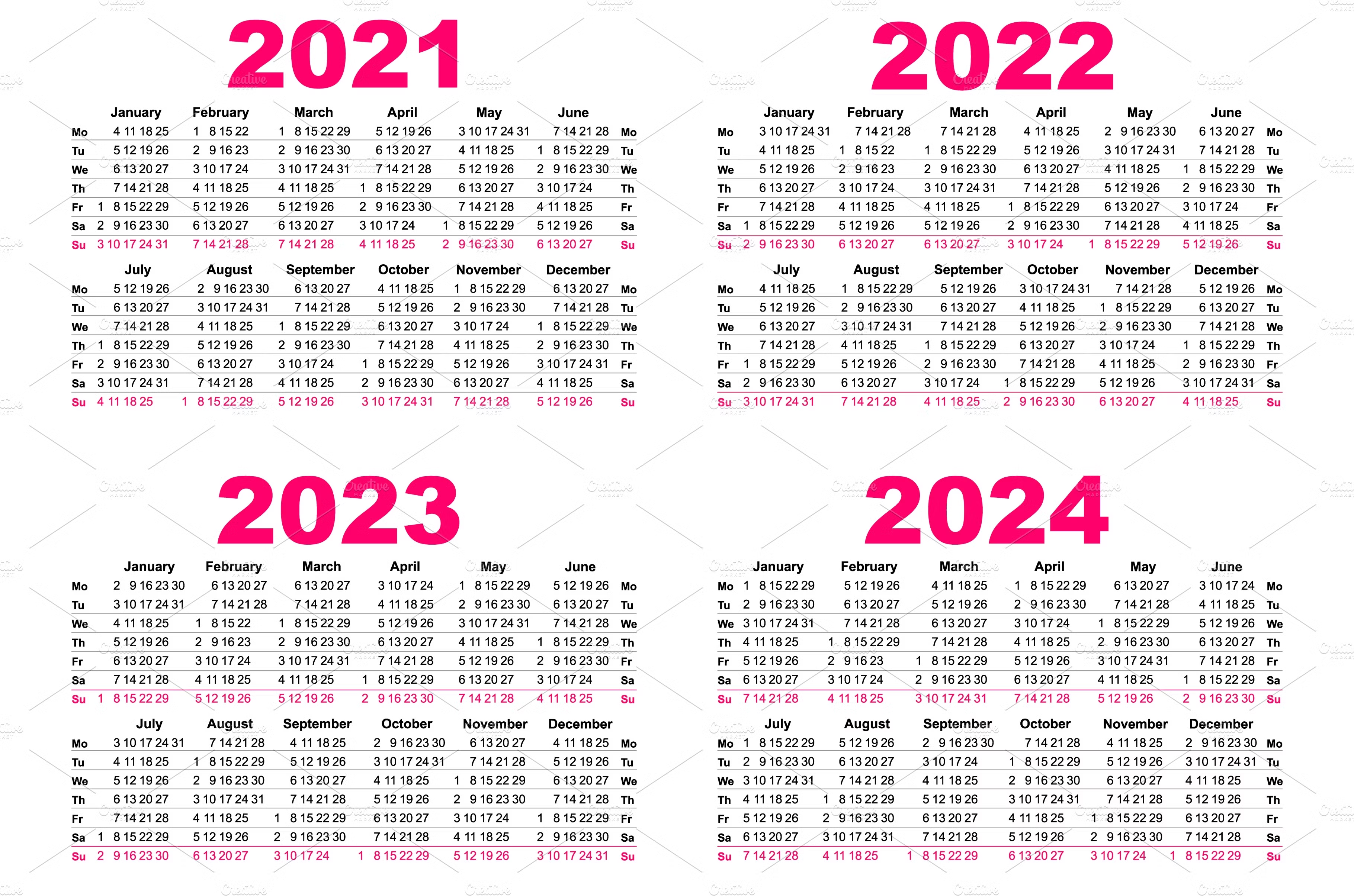

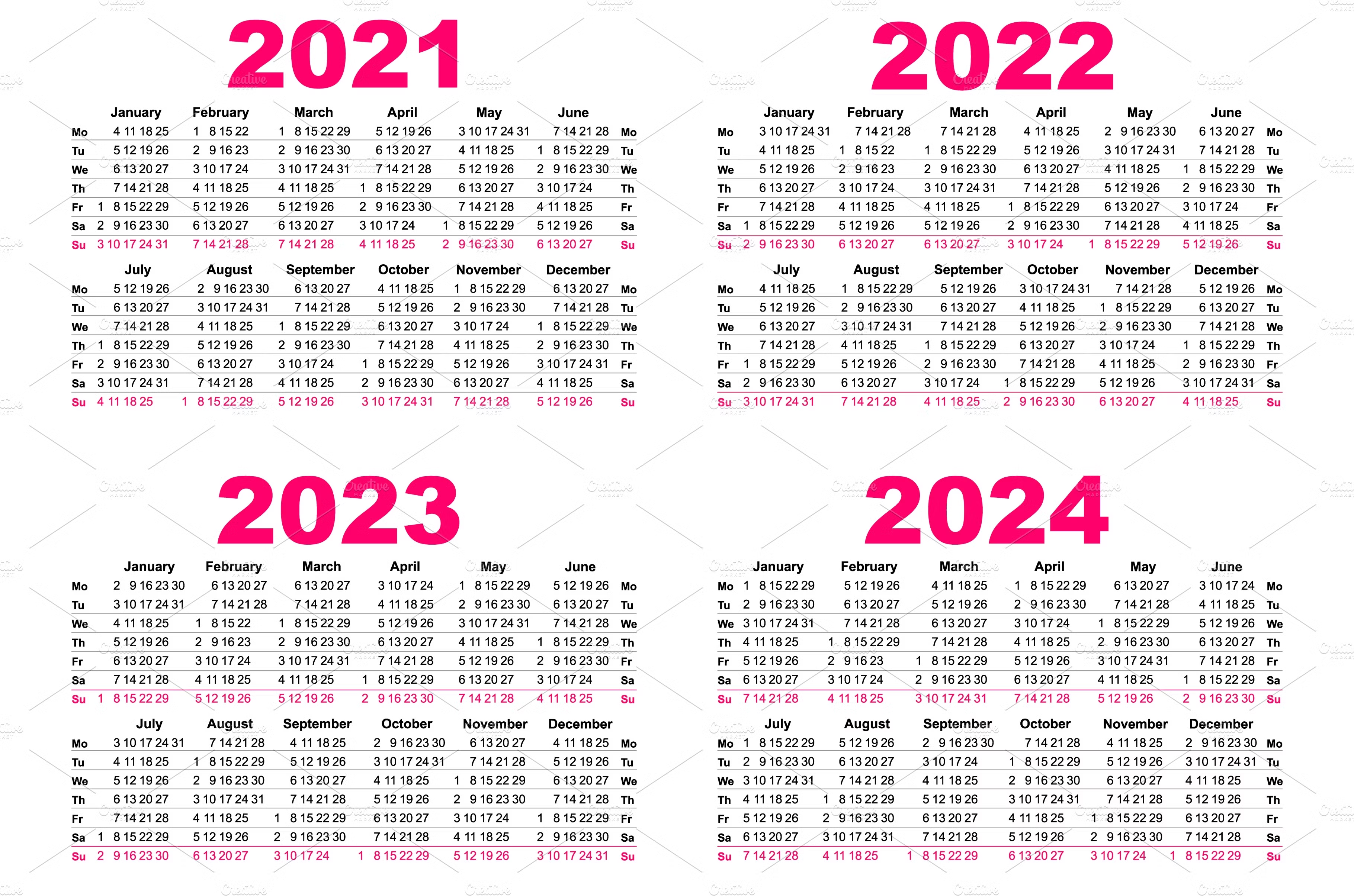

2024 Lunar Calendar Cool Awasome List Of January 2024 Calendar Design

https://images.creativemarket.com/0.1.0/ps/9617199/3640/2410/m1/fpnw/wm1/310_setcalfou-.jpg?1608606831&s=7121d7d49e681c4a6825576c62623512

Solar Tax Credits Rebates Missouri Arkansas

https://soleraenergyllc.com/wp-content/uploads/2022/07/Graphic-1000x1024.jpg

https://www.nerdwallet.com/article/taxes/solar-tax-credit

The U S government offers a solar tax credit that can reach up to 30 of the cost of installing a system that uses the sun to power your home Simple tax filing with a 50 flat fee for every

https://www.consumerreports.org/home-garden/alternative-energy/how-the-residential-clean-energy-solar-tax-credit-works-a1771685058/

The solar tax credit which is among several federal Residential Clean Energy Credits available through 2032 allows homeowners to subtract 30 percent of the cost of installing solar heating

2024 Buick Encore GX Debuts With Wildcat Influence New Avenir Trim

2024 Lunar Calendar Cool Awasome List Of January 2024 Calendar Design

Buy Appointment Book 2023 2024 Weekly Appointment Book 2023 2024 8 X 10 Jul 2023 Jun

Buy 2024 Wall 2024 Jan 2024 Dec 2024 12 X 24 Open 12 Month Wall 2024 With Unruled

2024 Cadillac XT4 Starts At 39 090 A 1 600 Increase Over 2023 Autoblog

Tolminator 2024

Tolminator 2024

2023 Vs 2024

2024 PNG

2024 9GAG

Solar Rebates 2024 Vs 2024 - In this guide we ll talk about the state of solar energy in 2024 how you can take advantage of solar rebates and incentives and the benefits you ll enjoy once you install your solar system Solar Panel Costs Are Dropping Rapidly The solar industry is growing and much of its growth is due to falling costs