Sc Income Tax Rebate 2024 Employers use the Withholding Tables to determine how much South Carolina Income Tax is withheld from workers paychecks With the table updates less taxes are being withheld from paychecks in 2023 which may result in reduced refunds next year For those who owed money on their returns or who received small refunds in 2023 changing

For the latest information about South Carolina Withholding Tax and the SC W 4 visit dor sc gov withholding Exemptions You may claim exemption from South Carolina withholding for 2024 for one of the following reasons For tax year 2023 you had a right to a refund of all South Carolina Income Tax withheld because you had no tax CHARLOTTE N C South Carolina s Department of Revenue announced it will begin accepting 2023 individual income tax returns on Jan 29 and there are three changes you need to know about

Sc Income Tax Rebate 2024

Sc Income Tax Rebate 2024

https://media.wltx.com/assets/WLTX/images/1e76bedd-4e31-41ea-878c-c0599b7949f2/1e76bedd-4e31-41ea-878c-c0599b7949f2_1140x641.jpg

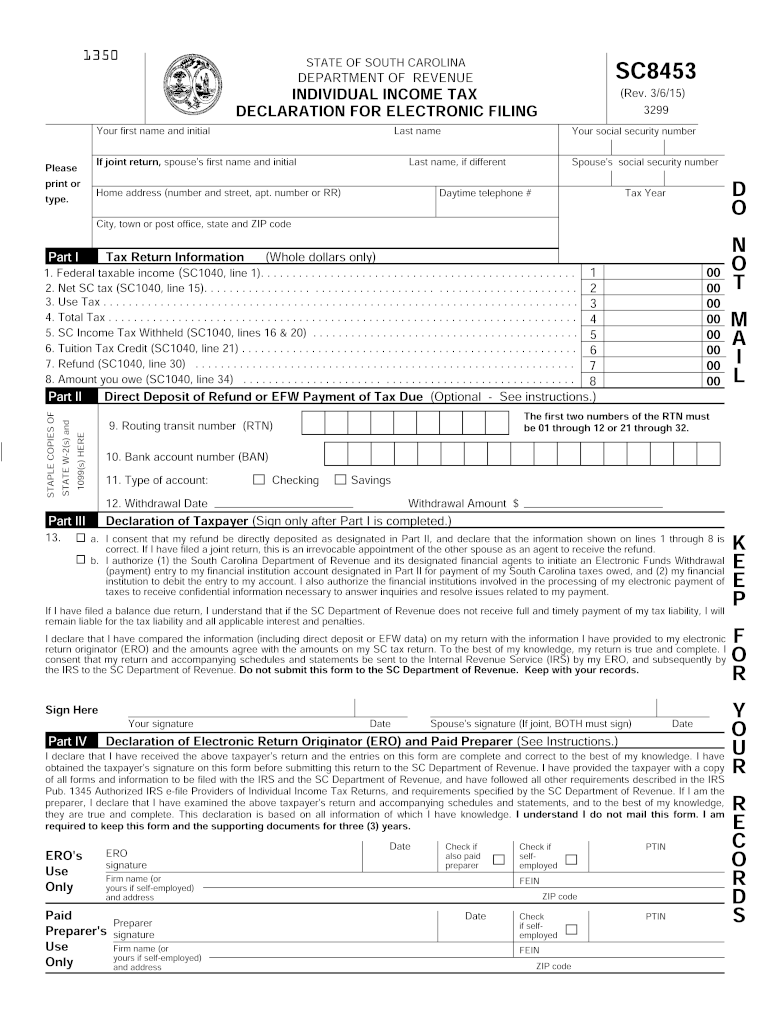

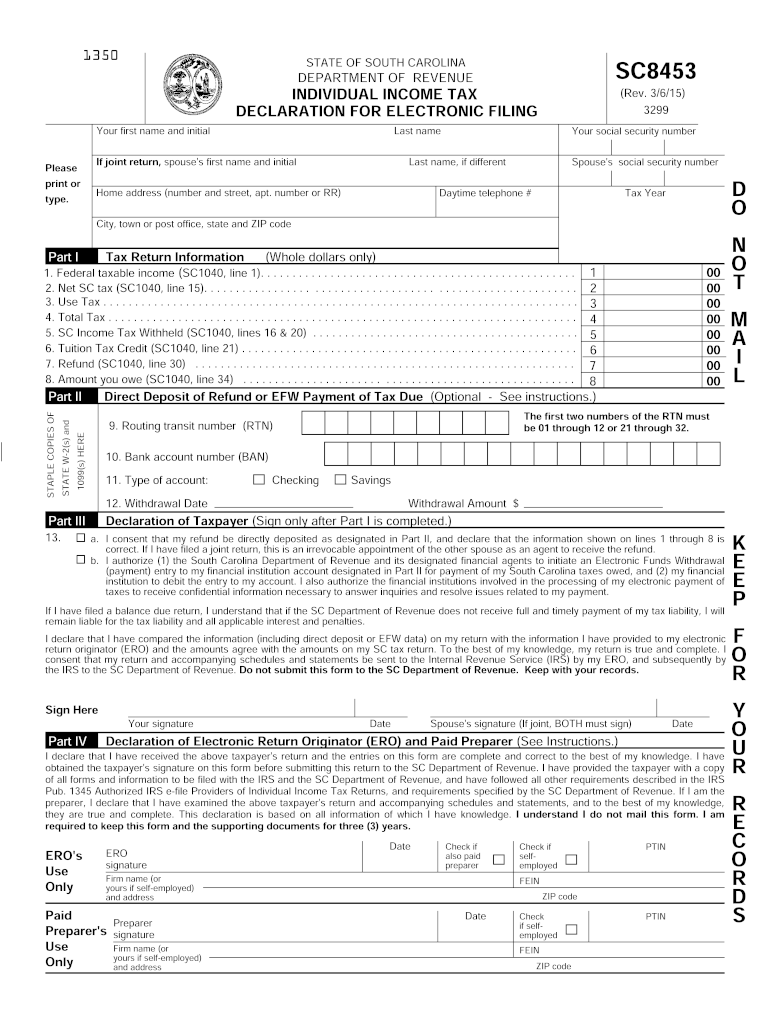

8453 2015 2023 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/6/967/6967362/large.png

Income Tax Rebate U s 87A For The Financial Year 2022 23

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhjaMWWuh9Yw1oHqfkfrIaYbLGaB376RebKDTPXR4-jMTYYQRhPBXomiwY9EVzEmXIgQ2oXuDWoror_llXVa0a4CVcBPyG3JecnKbrFpU1YAcL3BqdldNxiSh81eUspfAXJiNGbHbVcluzwXjoIUmqkZimUhTYHrQKq1Zu6xuaat2LRf6h-UCOGnP3s/w640-h596/87a.jpg

Here s the earliest folks in SC can get their tax refunds in 2024 2024 01 21 BY PATRICK MCCRELESS pmccreless thestate Both the IRS and the S C Department of Revenue recently announced that they d start accepting 2023 income tax returns on Jan 29 Meanwhile the filing deadline for both federal and state returns is April 15 South Carolina business income tax returns that were originally due between Aug 29 and Feb 15 are now due on Feb 15 2024 Estimated tax payments originally due between Sept 15 2023 and

According to the South Carolina Department of Revenue taxpayers may see reduced refunds because the state is withholding less taxes this year The South Carolina General Assembly voted in 2022 to The department is reminding families to review all deductions and tax credits to see what they may be able to claim on their returns Tax season begins on Jan 29 2024 and returns are due Monday

Download Sc Income Tax Rebate 2024

More picture related to Sc Income Tax Rebate 2024

Personal Income Tax Relief Malaysia 2023 YA 2022 The Updated List Of What You Should Claim

https://i0.wp.com/blog.fundingsocieties.com.my/wp-content/uploads/2023/03/Personal-Income-Tax-Relief-Malaysia-2023-YA-2022.png?fit=1200%2C628&ssl=1

Income Tax Rebate Under Section 87A

https://www.wintwealth.com/blog/wp-content/uploads/2023/01/Income-Tax-Rebate-Income-Tax-Rebate-Under-Section-87A.jpg

SC State Tax Rebate 2023 Eligibility And Claiming Process Explained PrintableRebateForm

https://printablerebateform.net/wp-content/uploads/2023/02/SC-State-Tax-Rebate-2023-768x994.png

COLUMBIA S C In recent years South Carolina has seen a reduction in personal income tax rates from 7 in 2022 to 6 5 in 2023 As the new year approaches so do changes to the tax rates come The rebate can be up to 800 and will be based on your 2021 South Carolina income tax liability minus credits South Carolina issued rebates in two phases depending on the date your 2021 South

Tax Cuts South Carolina s current top state tax rate is seven percent The new spending plan will immediately lower that to 6 5 percent for the 2022 tax year Over the next five years the top rate will gradually decrease 0 1 percent every year until it s six percent provided the state economy meets certain performance measures Client Alerts June 23 2022 The South Carolina General Assembly passed tax reform legislation providing targeted relief to individuals and to manufacturers including i a one time rebate of up to 700 in 2021 taxes for individuals ii cuts to the individual income tax rates and iii a reduction of the effective property tax assessment

Scoppe SC Shoppers Paid For My 800 Income Tax Rebate

https://bloximages.newyork1.vip.townnews.com/postandcourier.com/content/tncms/assets/v3/editorial/d/6b/d6b3ac84-f7f4-11ec-8c3d-43a5b08736e0/62bcc8c988d5d.image.jpg?resize=1035%2C689

Tax Rebate On Income Upto 5 Lakh Under Section 87A

https://blog.saginfotech.com/wp-content/uploads/2021/04/income-tax-rebate.jpg

https://dor.sc.gov/reminder-your-state-tax-refund-may-be-lower-next-year-due-to-withholding-adjustments

Employers use the Withholding Tables to determine how much South Carolina Income Tax is withheld from workers paychecks With the table updates less taxes are being withheld from paychecks in 2023 which may result in reduced refunds next year For those who owed money on their returns or who received small refunds in 2023 changing

http://dor.sc.gov/forms-site/Forms/SCW4_2024.pdf

For the latest information about South Carolina Withholding Tax and the SC W 4 visit dor sc gov withholding Exemptions You may claim exemption from South Carolina withholding for 2024 for one of the following reasons For tax year 2023 you had a right to a refund of all South Carolina Income Tax withheld because you had no tax

Fortune India Business News Strategy Finance And Corporate Insight

Scoppe SC Shoppers Paid For My 800 Income Tax Rebate

2021 Form PA PA 1000 Fill Online Printable Fillable Blank PdfFiller

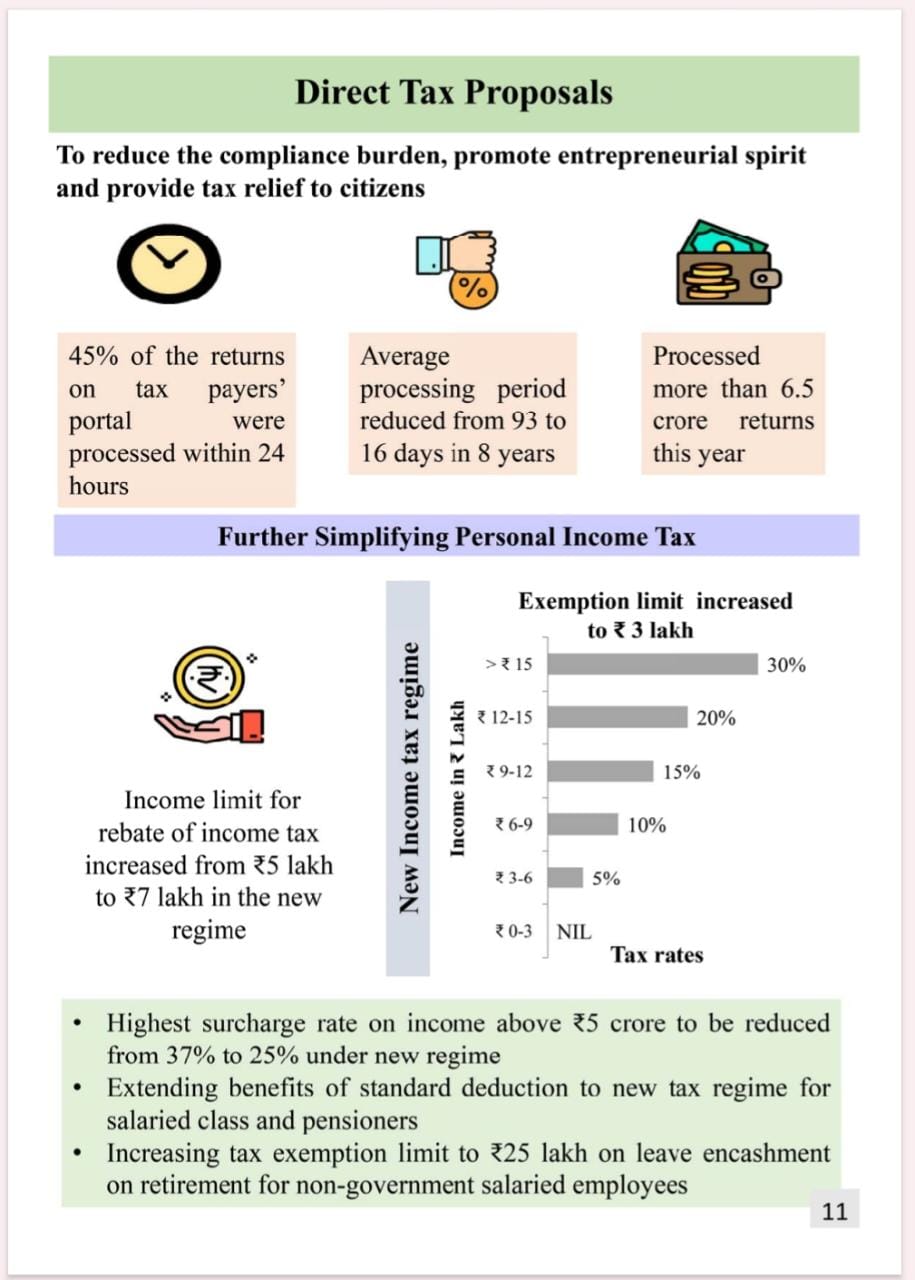

Income Tax Slabs Overhauled Under New Regime Rebate Limit Up Check New Tax Rates BetaVersa

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax Calculation Examples FinCalC TV

Rebate And Releif Of Tax Rebate 87a Of Income Tax Rebate And Relief Of Tax In Hindi

Rebate And Releif Of Tax Rebate 87a Of Income Tax Rebate And Relief Of Tax In Hindi

Income Tax Rebate Under Section 87A Union Budget 2023 YouTube

Budget 2023 24 Finance Bill 2023 Rates Of Income Tax Rates Of TDS On Salaries And Rebate

Georgia Income Tax Rebate 2023 Printable Rebate Form

Sc Income Tax Rebate 2024 - Here s the earliest folks in SC can get their tax refunds in 2024 2024 01 21 BY PATRICK MCCRELESS pmccreless thestate Both the IRS and the S C Department of Revenue recently announced that they d start accepting 2023 income tax returns on Jan 29 Meanwhile the filing deadline for both federal and state returns is April 15