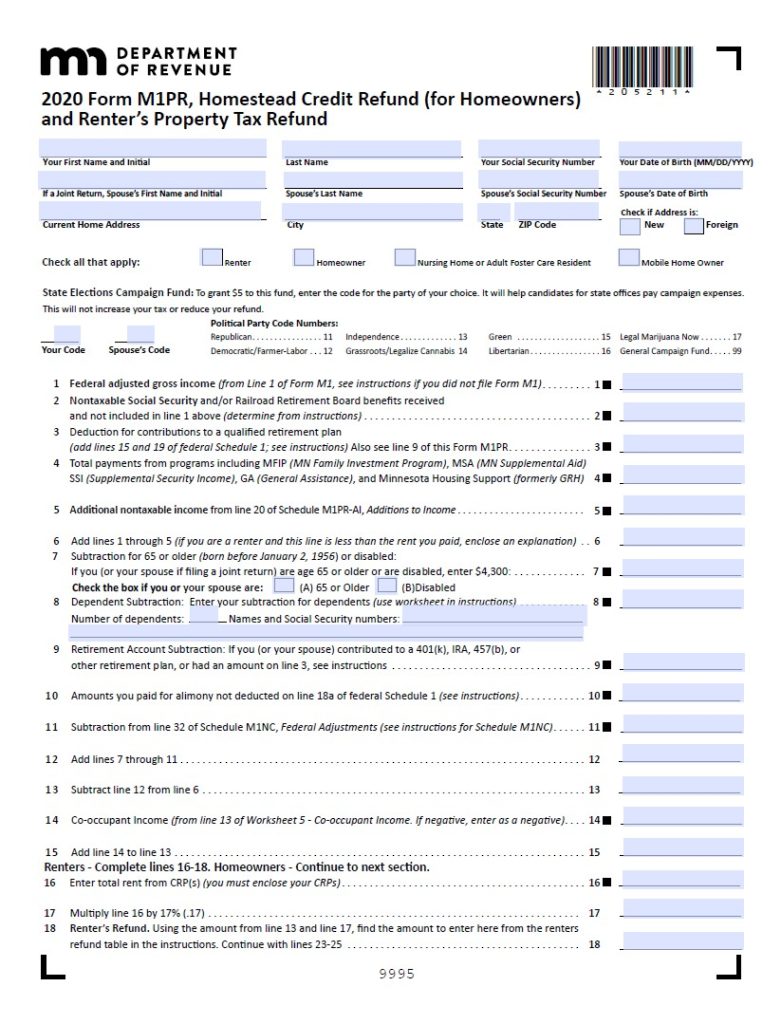

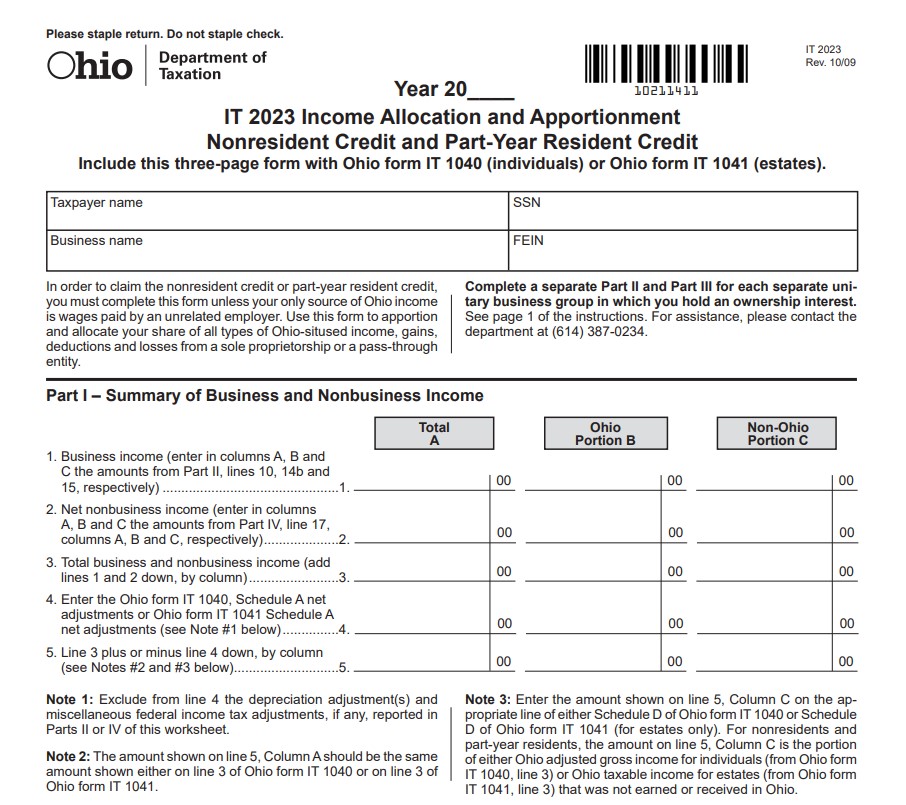

Renters Rebate Mn 2024 Form Renter s Property Tax Refund Forms and Instructions Form M1PR Homestead Credit Refund for To check your refund status go to www revenue state mn us after July 1 and enter Where s My Refund into the Search box With this system you can 2024 or you believe the rent amount or any other amounts entered on your CRP are

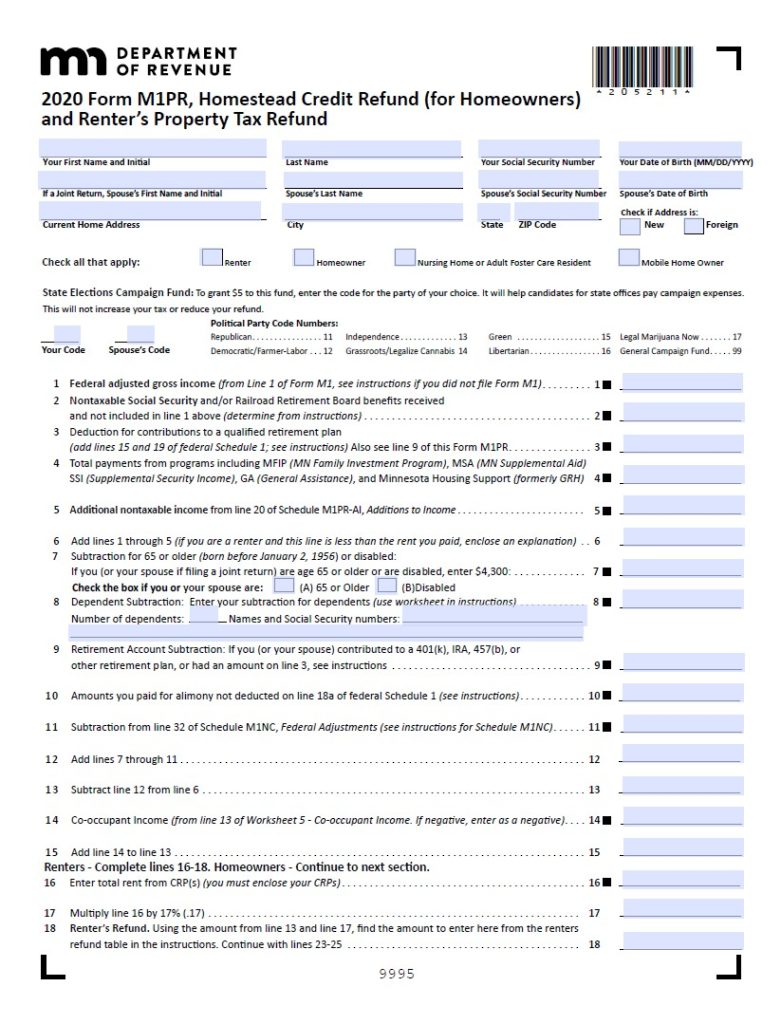

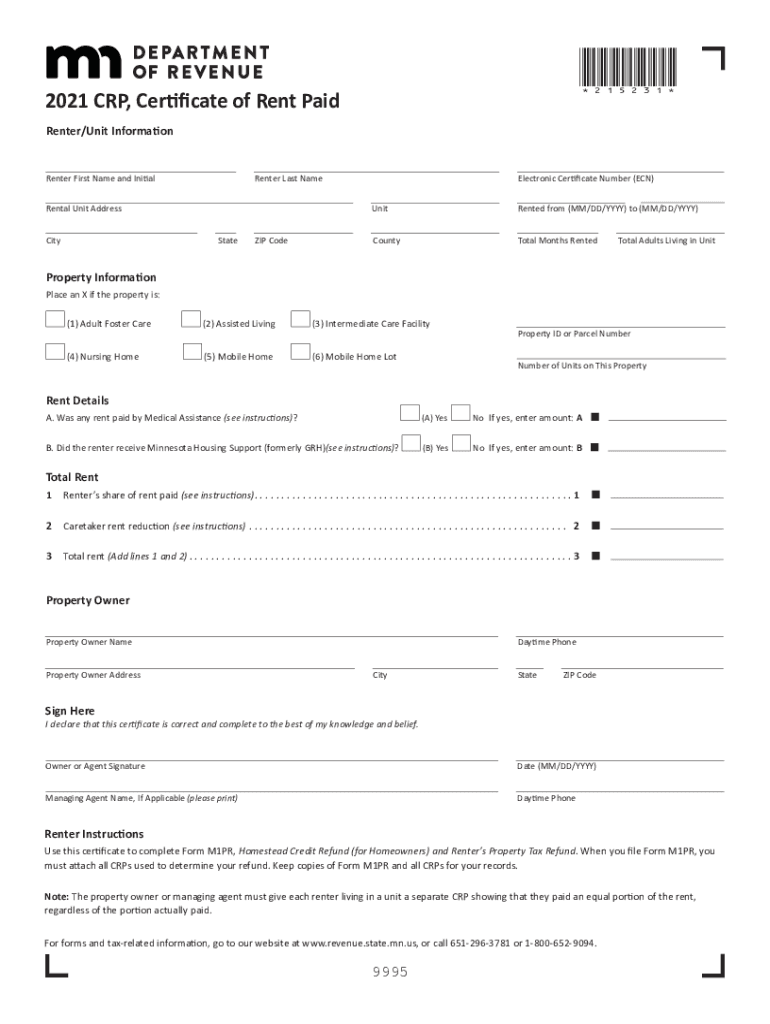

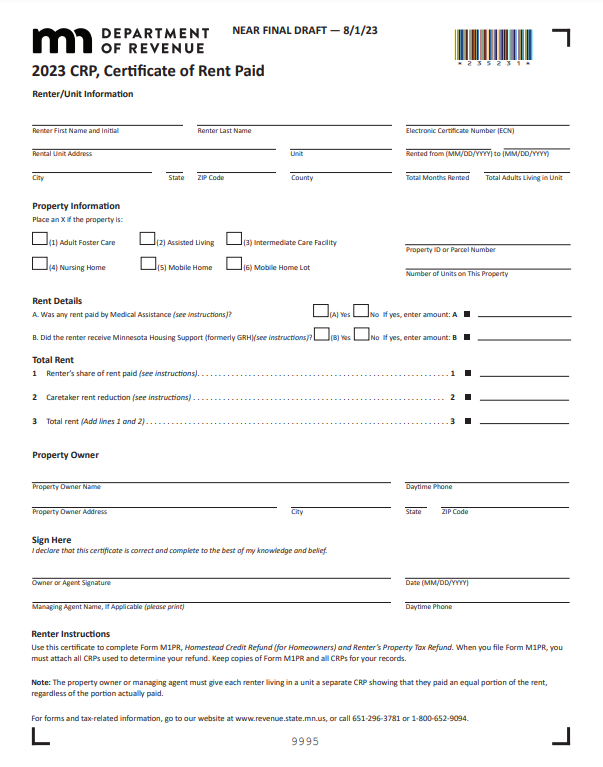

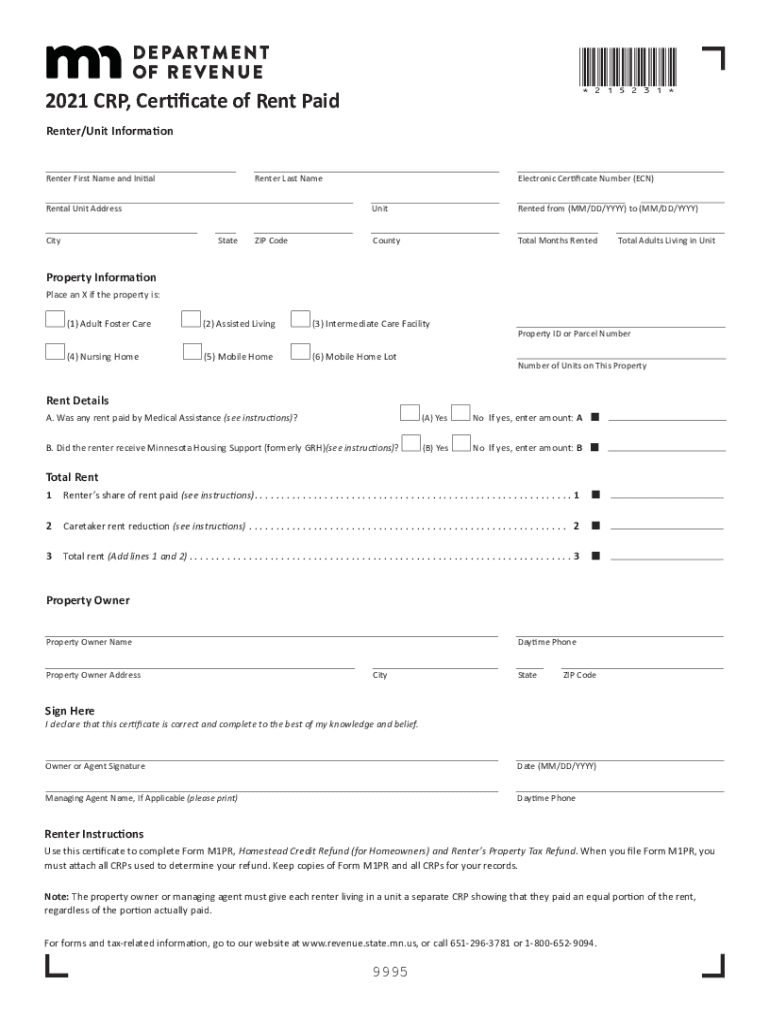

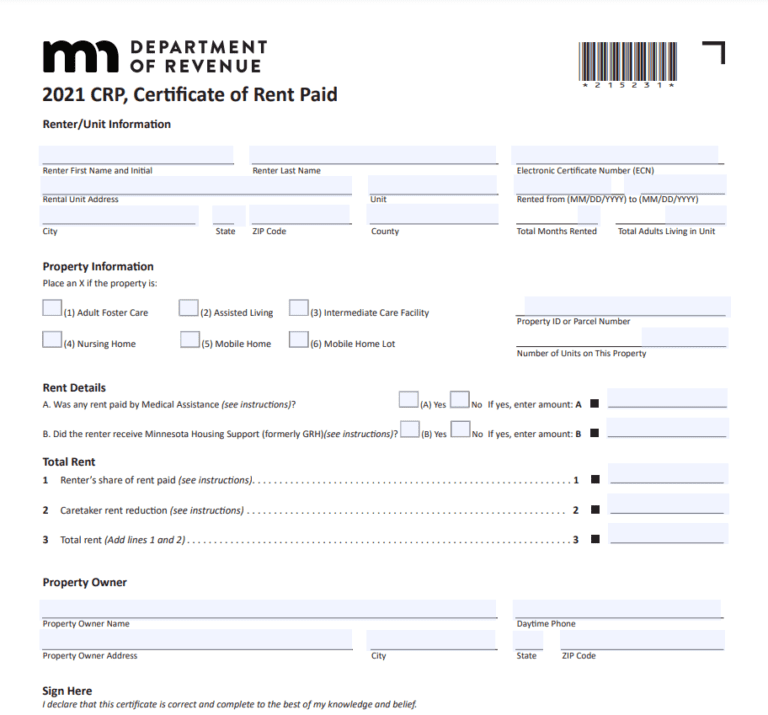

Renter Homeowner Nursing Home or Adult Foster Care Resident Mobile Home Owner State Elections Campaign Fund To grant 5 to this fund enter the code for the party of your choice It will help candidates for state ofices pay campaign expenses This will not increase your tax or reduce your refund Renters will need the CRP to apply for the Renter s Property Tax Refund The Minnesota Department of Revenue has expanded access to their CRP system in e Services and you will be able to create CRPs using e Services by January 1 2024 all residential property owners and managing agents will be able to use e Services Minnesota Department of

Renters Rebate Mn 2024 Form

Renters Rebate Mn 2024 Form

https://printablerebateform.net/wp-content/uploads/2021/07/Minnesota-Renters-Rebate-Form-2021-781x1024.jpg

Renters Rebate Mn 2021 2024 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/578/948/578948407/large.png

Renters Rebate Form Printable Rebate Form

http://printablerebateform.net/wp-content/uploads/2022/05/Renters-Rebate-Form-MN-2023.png

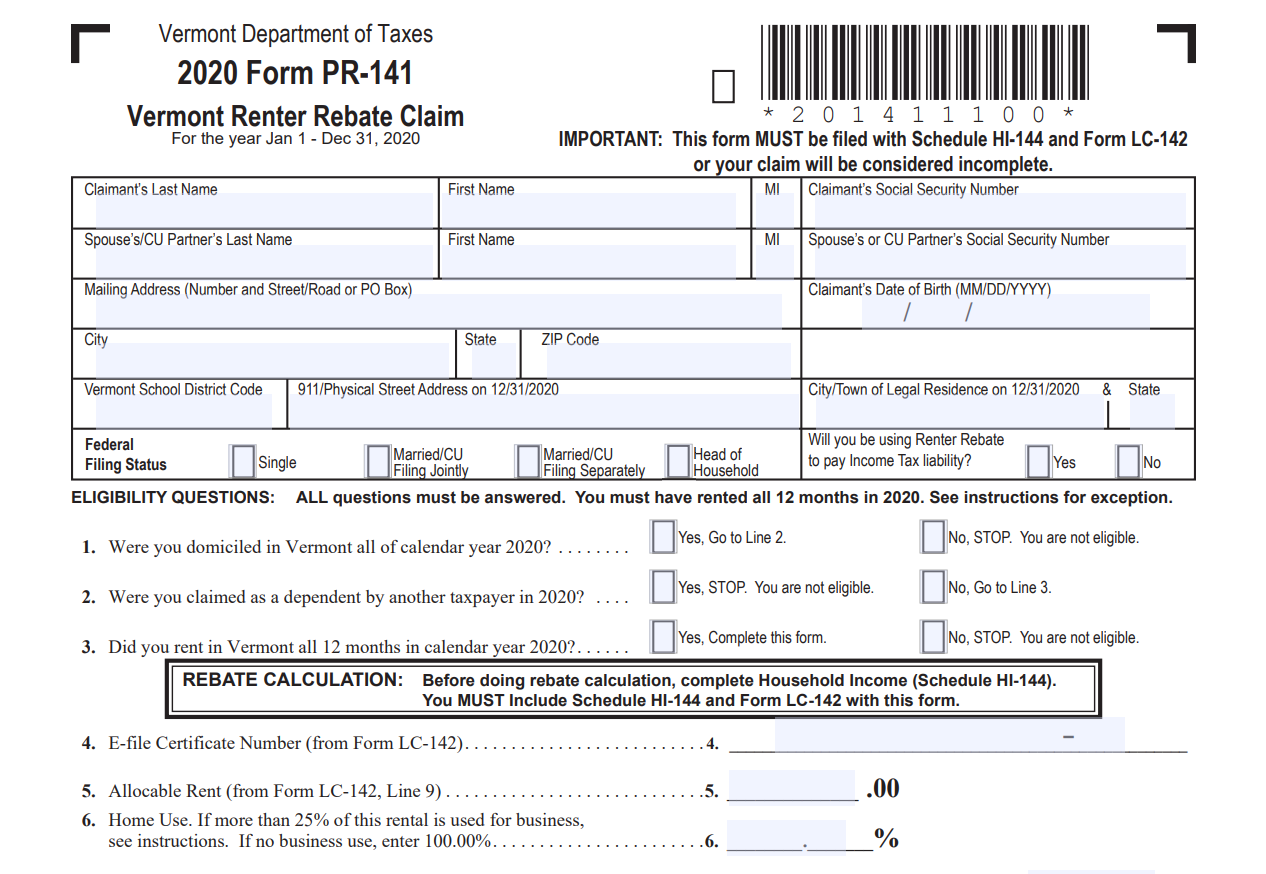

If you rent your landlord must give you a Certificate of Rent Paid CRP by January 31 2024 If you own use your Property Tax Statement Get the tax form called the 2023 Form M 1PR Homestead Credit Refund for Homeowners and Renter s Property Tax Refund Who can get a refund How do I get my refund What if my landlord doesn t give me the CRP Where can I get help with tax forms Quiz The Renter s Refund Property Tax Refund Are you ready Try to answer the questions below 1 Can I get a property tax refund if I own my own house

The deadline for filing claims based on rent paid in 2022 is August 15 2024 taxpayers filing claims after that date will not receive a refund How many renters receive refunds and what is the total amount paid 305 455 renters received refunds in 2020 based on rent paid in 2019 and 2019 incomes Minnesota Homeowner and Renter Refund Overview Form M1PR is used by both homeowners and renters to claim a refund on property taxes that have either been paid directly to one s county for homeowners or indirectly via rent paid to one s landlord for renters Homeowners can qualify for one or two different types of refunds Renters can qualify for a single refund

Download Renters Rebate Mn 2024 Form

More picture related to Renters Rebate Mn 2024 Form

New Jersey Renters Rebate 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/02/New-Jersey-Renters-Rebate-2023.jpg

Missouri Renters Rebate 2023 Printable Rebate Form

http://printablerebateform.net/wp-content/uploads/2023/02/Missouri-Renters-Rebate-2023.jpg

2019 2023 Form VT LC 142Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/552/936/552936350/large.png

What are the maximums For refund claims filed in 2021 based on rent paid in 2020 and 2020 household income the maximum refund is 2 210 Renters whose income exceeds 62 960 are not eligible for refunds How are claims filed Refund claims are filed using Minnesota Department of Revenue DOR Schedule M1PR Minnesota Legislature signed tax law changes for the tax year 2022 into effect on May 24th 2023 These tax law changes effect the calculation of the Minnesota Property Tax Refund M1PR and provides a one time increase of the 2022 Homestead Credit Refund or Renter s Property Tax Refund claimed on Form M1PR The state released the updated forms in June

Your net property tax increased by more than 12 from 2023 to 2024 AND The increase was at least 100 Renters with household income of less than 73 270 can claim a refund up to 2 570 You must have lived in a building where the owner of the building Was accessed the property tax Paid a portion of the rent receipts instead of the property tax Published December 10 2023 According to Minnesota Gov Tim Walz the IRS will tax state rebates sent to many Minnesota residents last year These rebates commonly known as Walz checks were

2022 Renters Rebate Mn Instructions RentersRebate

https://www.rentersrebate.net/wp-content/uploads/2023/05/pa-renters-rebate-form-2022-rentersrebate-72.jpg

Renters Rebate Vt 2022 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/06/Renters-Rebate-Vt.png

https://www.revenue.state.mn.us/sites/default/files/2023-12/m1pr-inst-23.pdf

Renter s Property Tax Refund Forms and Instructions Form M1PR Homestead Credit Refund for To check your refund status go to www revenue state mn us after July 1 and enter Where s My Refund into the Search box With this system you can 2024 or you believe the rent amount or any other amounts entered on your CRP are

https://www.revenue.state.mn.us/sites/default/files/2023-12/m1pr-23.pdf

Renter Homeowner Nursing Home or Adult Foster Care Resident Mobile Home Owner State Elections Campaign Fund To grant 5 to this fund enter the code for the party of your choice It will help candidates for state ofices pay campaign expenses This will not increase your tax or reduce your refund

Connecticut Renters Rebate 2023 Printable Rebate Form

2022 Renters Rebate Mn Instructions RentersRebate

MN Renters Printable Rebate Form

Maine Renters Rebate 2023 PrintableRebateForm

Ohio Renters Rebate 2023 Printable Rebate Form

Mn Renters Rebate Refund Table RentersRebate

Mn Renters Rebate Refund Table RentersRebate

Renters Printable Rebate Form

2022 Minnesota Renters Rebate RentersRebate

Minnesota Renters Rebate Efile RentersRebate

Renters Rebate Mn 2024 Form - Who can get a refund How do I get my refund What if my landlord doesn t give me the CRP Where can I get help with tax forms Quiz The Renter s Refund Property Tax Refund Are you ready Try to answer the questions below 1 Can I get a property tax refund if I own my own house