Recovery Rebate Tax Credit 2024 Currently for 2023 if the child tax credit exceeds a taxpayer s tax liability they may receive up to 1 600 of the credit as a refund based on an earned income formula calculated as 15 percent of earned income above 2 500 The proposal would increase the 1 600 limit on refundability to 1 800 for tax year 2023 1 900 in 2024 and 2 000

The 2020 RRC can be claimed for someone who died in 2020 The 2020 RRC and 2021 RRC can be claimed for someone who died in 2021 or later Filing deadlines if you haven t yet filed a tax return To claim the 2020 Recovery Rebate Credit file a tax return by May 17 2024 2021 Recovery Rebate Credit file a tax return by April 15 2025 Get free help If you re eligible to claim the 2020 Recovery Rebate Credit you must file a tax return by May 17 2024 to claim the credit If you re eligible to claim the 2021 Recovery Rebate credit you must file a tax return by April 15 2025 to claim the credit

Recovery Rebate Tax Credit 2024

Recovery Rebate Tax Credit 2024

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/how-to-claim-recovery-rebate-credit-turbotax-romainedesign-3.png?fit=633%2C623&ssl=1

Recovery Rebate Credit Santa Barbara Tax Products Group

https://www.sbtpg.com/wp-content/uploads/2021/01/recovery-rebate-credit.jpg

Strategies To Maximize The 2021 Recovery Rebate Credit

https://www.kitces.com/wp-content/uploads/2021/04/03-How-The-2021-Recovery-Rebate-Can-Reduce-Overall-Tax-Liability-For-Married-Taxpayers-Filing-Separately-2048x799.png

The IRS has issued a reminder to those who may be entitled to the Recovery Rebate Credit to file a tax return and claim their money before the deadline I know what you re thinking wasn t On January 19 2024 the Ways and Means Committee made a significant bipartisan move by approving the Tax Relief for American Families and Workers Act of 2024 This legislation is designed to provide crucial support to American job creators small businesses and working families By accelerating the end of the COVID era Employee Retention Tax

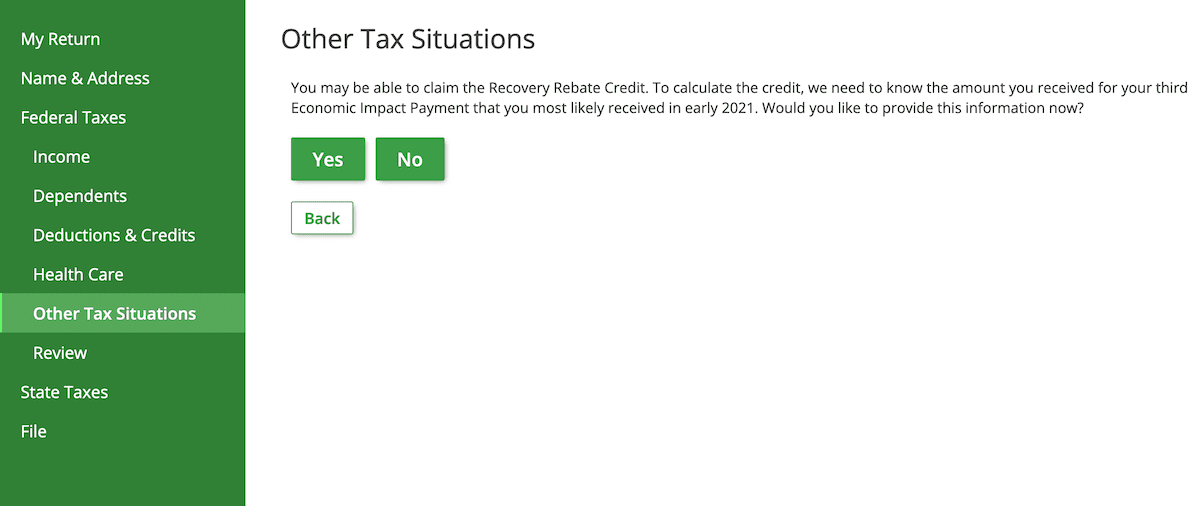

What s the Recovery Rebate Credit If you didn t get a third stimulus check or you didn t get the full amount you may be able to claim the recovery rebate credit on your 2021 tax return to FY 2024 COVID 2 and made changes to the Earned Income Tax Credits 3Excludes Recovery Rebate Credits associated with all Economic Impact Payments FY 2021 Budget Authority 38 512M of which 23 4 03M was obligated in FY 2021 12 673M was obligated in FY 2022 2 236M is estimated to be obligated in FY 2023 and 200M estimate d in FY

Download Recovery Rebate Tax Credit 2024

More picture related to Recovery Rebate Tax Credit 2024

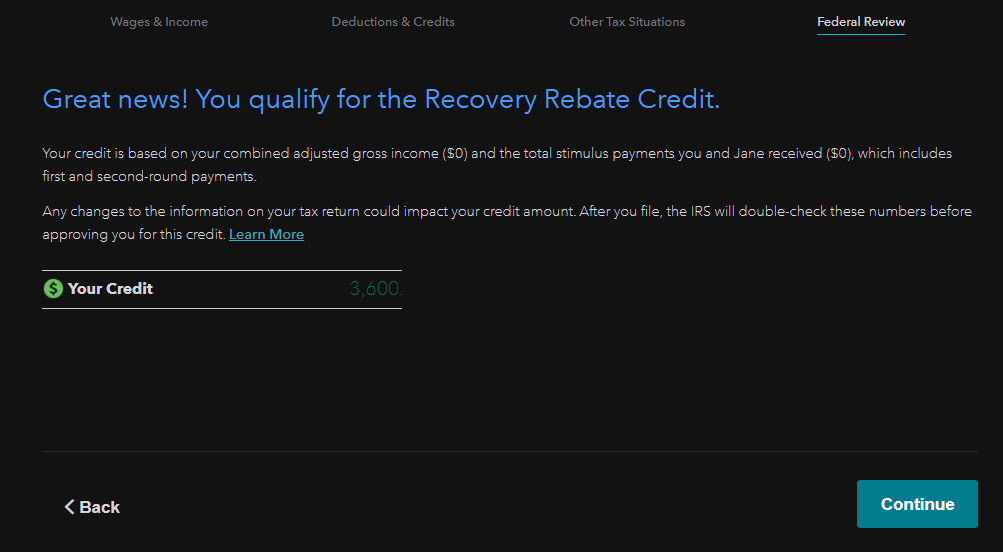

How To Claim Stimulus Recovery Rebate Credit On TurboTax

https://www.irsofficesearch.org/wp-content/uploads/2021/02/recovery-rebate-credit.png

Line 30 Recovery Rebate Credit 2022 Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/tax-implications-of-covid-19-passport-software-inc.png

Recovery Rebate Credit For Newborn In 2022 Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/irs-recovery-rebate-tax-credit-2022-how-to-claim-it-next-year-marca-11.jpg

If you do qualify for a recovery rebate TurboTax will make sure you get all that you re entitled to Just prepare your taxes normally and we ll take care of the rest Who is eligible for a recovery rebate In general people who had Major life changes such as having a baby or getting married or divorced A sizable increase or decrease in income Top tax credits and deductions for 2024 There are numerous tax credits and deductions though many are only available to qualifying filers Some of the most common deductions include Child Tax Credit CTC For filers who are also caregivers for children the CTC provides up to 2 000 for each child or dependent under the age of 17

If you re one of the many who are owed stimulus money you may be able to claim the amount as a recovery rebate tax credit on your 2020 or 2021 federal tax return Featured Partner Recovery Rebate Credit With this option enabled the Recovery Rebate Credit Worksheet won t be added to your returns automatically During final review a diagnostic will generate informing you that stimulus payments should be entered if the client didn t receive all EIP they were entitled to You can always add the worksheet to a return

Recovery Rebate Credit 2021 Tax Return

https://www.efile.com/image/other-taxes-2.png

10 Recovery Rebate Credit Worksheet Pdf Worksheets Decoomo

https://i2.wp.com/lh5.googleusercontent.com/proxy/lGA90iOjY_1LO-OBBI3qmZMyKEj47RMisqIykTyVbIbO-V2GqH4xUV92z9Uq0pojRygogoMZtKIKKsqfiqET_2bvfJQoMviJq-wHNdbSR8ZyQ-ukMly2632ZZ7bKcCkHDaCeogT6Skm16tenIHu_TkBU8w=w1200-h630-p-k-no-nu

https://taxfoundation.org/blog/bipartisan-tax-deal-2024-tax-relief-american-families-workers-act/

Currently for 2023 if the child tax credit exceeds a taxpayer s tax liability they may receive up to 1 600 of the credit as a refund based on an earned income formula calculated as 15 percent of earned income above 2 500 The proposal would increase the 1 600 limit on refundability to 1 800 for tax year 2023 1 900 in 2024 and 2 000

https://www.irs.gov/newsroom/irs-reminds-eligible-2020-and-2021-non-filers-to-claim-recovery-rebate-credit-before-time-runs-out

The 2020 RRC can be claimed for someone who died in 2020 The 2020 RRC and 2021 RRC can be claimed for someone who died in 2021 or later Filing deadlines if you haven t yet filed a tax return To claim the 2020 Recovery Rebate Credit file a tax return by May 17 2024 2021 Recovery Rebate Credit file a tax return by April 15 2025 Get free help

Recovery Rebate Credit How To Get It Taxes For Expats US Expat Tax Service

Recovery Rebate Credit 2021 Tax Return

What Is The Recovery Rebate Credit And Do You Qualify The Approachable Accountant

Recovery Rebate Credit 2024 Eligibility Calculator How To Claim

Recovery Rebate Credit Cg Tax Audit Advisory

2020 Tax Year Recovery Rebate Credit Calculation Expat Forum For People Moving Overseas And

2020 Tax Year Recovery Rebate Credit Calculation Expat Forum For People Moving Overseas And

Recovery Rebate Credit Form Printable Rebate Form

Does A Tax Credit Give You Money Leia Aqui Do You Get Money From Tax Credit

4 Tips What Is Recovery Rebate Credit 2021 Alprojectalproject

Recovery Rebate Tax Credit 2024 - The maximum tax credit available per child is 2 000 for each child under 17 on Dec 31 2023 Only a portion is refundable this year up to 1 600 per child For tax year 2021 the expanded child