Recovery Rebate Credit Error 2024 Your Recovery Rebate Credit will reduce the amount of any tax you may owe for 2021 or be included in your tax refund and can be direct deposited into your financial account You can use a bank account prepaid debit card or alternative financial products for your direct deposit

The deadlines to file a return and claim the 2020 and 2021 credits are May 17 2024 and April 15 2025 respectively The Recovery Rebate Credit is a refundable credit for those who missed out on one or more Economic Impact Payments The May 17 2024 deadline is fast approaching for taxpayers who have not yet filed a 2020 tax return to claim a refund of withholdings estimated taxes or their 2020 Recovery Rebate Credit

Recovery Rebate Credit Error 2024

Recovery Rebate Credit Error 2024

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/how-to-claim-recovery-rebate-credit-turbotax-romainedesign-1.png

Recovery Rebate Credit Here s How You Can Qualify For 1 400 Payments Marca

https://phantom-marca.unidadeditorial.es/d6b6bb8dde4d78d0f51f6bbc03766e1e/resize/1320/f/jpg/assets/multimedia/imagenes/2022/01/31/16436644359926.jpg

2022 Irs Recovery Rebate Credit Worksheet Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/who-could-qualify-for-2nd-stimulus.jpeg

Millions of taxpayers have received math error notices adjusting their returns including the amount of recovery rebate credit RRC child tax credit or other items claimed on their return Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program

Most taxpayers eligible for Economic Impact Payments linked to the Coronavirus tax relief have already received or claimed their payments via the Recovery Rebate Credit But for those who haven t yet filed a tax return for 2020 the legal deadline is May 17 2024 Two EIPs EIP1 and EIP2 were issued to eligible taxpayers during 2020 and early 2021 These EIPs were advanced payments of the Recovery Rebate Credit RRC a refundable credit claimed on the 2020 Individual Tax Return How do I get these EIPs if I didn t receive them or got an incorrect amount

Download Recovery Rebate Credit Error 2024

More picture related to Recovery Rebate Credit Error 2024

Recovery Rebate Credit Stimulus Check 2022 Turbotax Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/how-to-claim-stimulus-recovery-rebate-credit-on-turbotax-7.png?fit=1003%2C552&ssl=1

Strategies To Maximize The 2021 Recovery Rebate Credit

https://www.kitces.com/wp-content/uploads/2021/04/03-How-The-2021-Recovery-Rebate-Can-Reduce-Overall-Tax-Liability-For-Married-Taxpayers-Filing-Separately-2048x799.png

Recovery Rebate Credit Form Printable Rebate Form

http://printablerebateform.net/wp-content/uploads/2022/04/Recovery-Rebate-Credit-Form-2023.png

Taxpayers eligible for recovery rebate credits for tax year 2020 have until May 17 2024 to file a tax return to claim the payment By law taxpayers can make a claim for refund up to three The Internal Revenue Service is sending out notices to tax filers who made mistakes claiming that they were owed extra stimulus cash through the recovery rebate credit on their 2021 federal

The IRS will adjust your refund if you claimed the Recovery Rebate Credit but didn t qualify or overestimated the amount you should have received If a correction is needed the IRS will calculate the correct amount of the Recovery Rebate Credit make the correction to the tax return and continue processing it Unlock the secrets of the Recovery Rebate Credit before the 2024 deadline with our comprehensive guide Discover eligibility how to claim and maximize your credit especially for U S expats

Recovery Rebate Credit Form Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/07/Recovery-Rebate-Credit-Form-2021-768x767.jpg

Turbotax Recovery Rebate Credit Error 2023 Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/where-to-enter-recovery-rebate-credit-in-turbotax-recovery-rebate-15.jpg

https://www.irs.gov/newsroom/recovery-rebate-credit

Your Recovery Rebate Credit will reduce the amount of any tax you may owe for 2021 or be included in your tax refund and can be direct deposited into your financial account You can use a bank account prepaid debit card or alternative financial products for your direct deposit

https://www.irs.gov/newsroom/irs-reminds-eligible...

The deadlines to file a return and claim the 2020 and 2021 credits are May 17 2024 and April 15 2025 respectively The Recovery Rebate Credit is a refundable credit for those who missed out on one or more Economic Impact Payments

The Recovery Rebate Credit Calculator ShauntelRaya

Recovery Rebate Credit Form Printable Rebate Form

Recovery Rebate Credit 2023 2024 Credits Zrivo

IRS Updates Info On Recovery Rebate Credit And Pandemic Response Scott M Aber CPA PC

Can I Claim Recovery Rebate Credit In 2023 Recovery Rebate

How To Claim Recovery Rebate Credit With No Income Recovery Rebate

How To Claim Recovery Rebate Credit With No Income Recovery Rebate

What Is The Recovery Rebate Credit 2023 Detailed Information

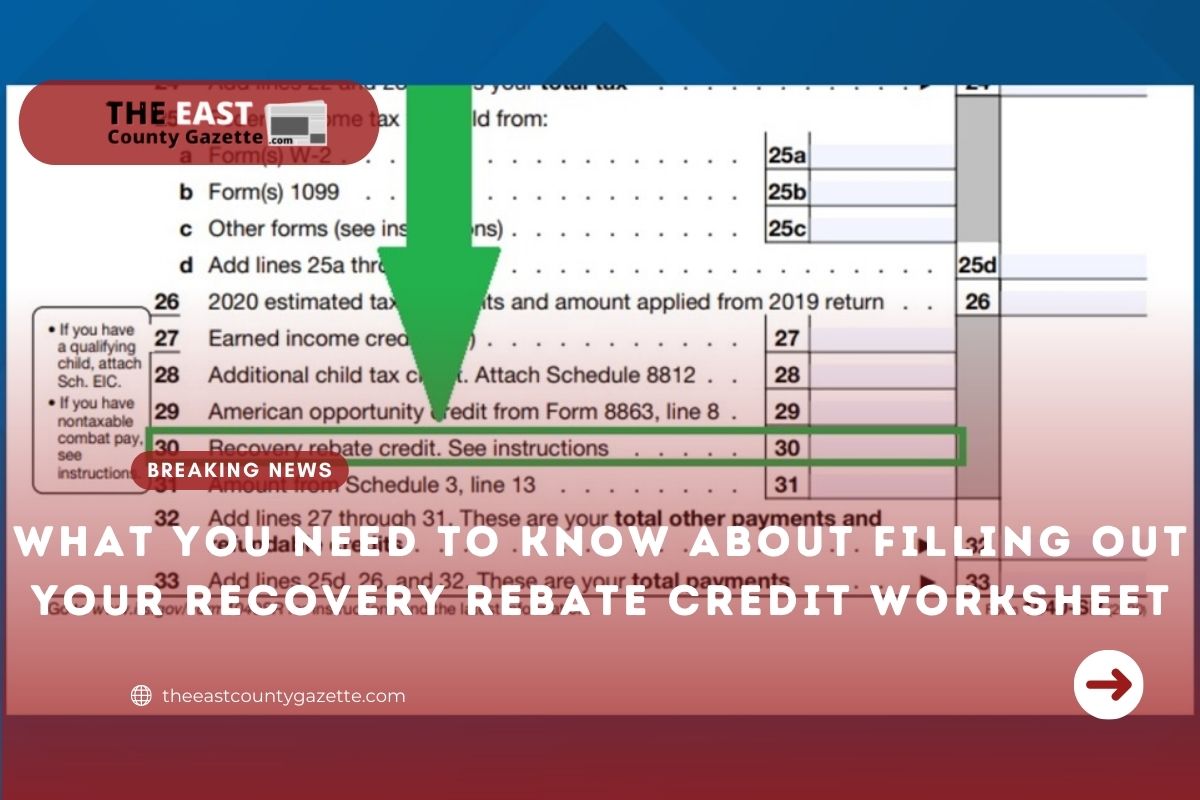

What You Need To Know About Filling Out Your Recovery Rebate Credit Worksheet

IRS Letter Needed To Claim Stimulus Check With Recovery Rebate Credit

Recovery Rebate Credit Error 2024 - Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program