Rebate Under Section 87a Budget 2024 Section 87A rebate does not allow in old regime if your income go above 5 00 000 But A New proviso inserted in section 87A by the Finance Act 2023 w e f 1 4 2024 Applicable from FY 2023 24 Provided that where the total income of the assessee is chargeable to tax under sub section 1A of section 115BAC and the total income

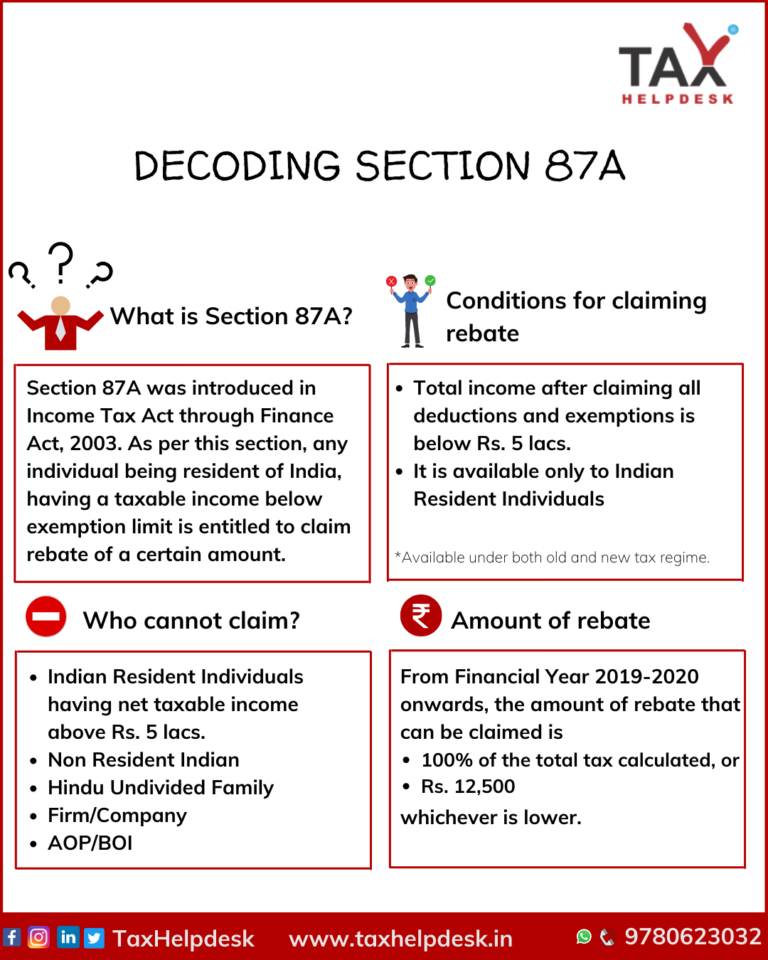

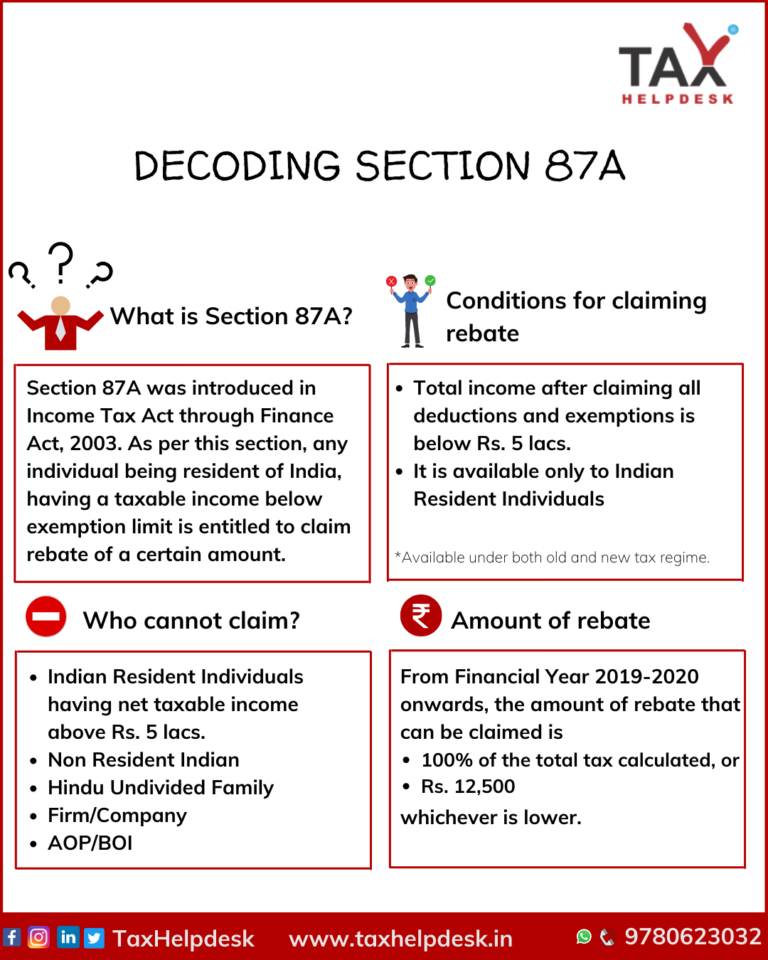

Section 87A of the Income tax Act 1961 allows an individual to claim tax rebate provided their taxable income does not increase the specified level This tax rebate effectively makes zero tax outgo of an individual Budget 2023 has proposed to extend the amount of tax rebate under new tax regime from taxable income of Rs 5 lakh to Rs 7 lakh Rebate u s 87A for FY 2023 24 AY 2024 25 In the fiscal year 2023 24 AY 2024 25 senior citizens with taxable income up to Rs 7 00 000 under the new tax regime are eligible for a rebate of Rs 25 000 or the amount of tax payable whichever is lower Tax Rebate Under Section 87A Find out Who can claim Income Tax Rebate u s 87A for FY

Rebate Under Section 87a Budget 2024

Rebate Under Section 87a Budget 2024

https://www.godigit.com/content/dam/godigit/directportal/en/contenthm/87a-rebate.jpg

Union Budget 2023 24 Finance Bill 2023 Rates Of Income Tax Rates Of TDS On Salaries And

https://www.gconnect.in/gc22/wp-content/uploads/2023/02/Finance-Bill-2023-1536x806.jpg

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

https://freefincal.com/wp-content/uploads/2019/02/Screen-Shot-2019-02-02-at-8.49.53-AM.png

Rebate under section 87A From assessment year 2024 25 onwards an assessee being an individual resident in India 2024 Section 80LA 5 3 2 In order to further incentivise leasing of aircraft from IFSC 24 1 Pursuant to the announcement in the Union Budget 2021 22 about Gold Exchange Individual taxpayers can claim a rebate under Section 87A if their total taxable income is within Rs 5 lakh for the old tax regime or Rs 7 lakh for the new tax regime for the fiscal year 2023 24 LIVE Budget 2024 Expectations Salaried Class Eyes Hike in Section 80C and Basic Exemption Limit Industry Status for Real Estate Among Key

Section 87A of the Income Tax Act 1961 provides for a 100 tax rebate if the income tax liability is up to Rs 12 500 in respect of AY 2023 24 and onwards for resident individuals with taxable income up to Rs 500 000 under the existing tax regime As announced in the last Budget effective from April 1 2023 the basic exemption limit was hiked to Rs 3 lakh from Rs 2 5 lakh under the new tax regime while the rebate under Section 87A of the

Download Rebate Under Section 87a Budget 2024

More picture related to Rebate Under Section 87a Budget 2024

Rebate Of Income Tax Under Section 87A YouTube

https://i.ytimg.com/vi/lgmblbkc7Qs/maxresdefault.jpg

Rebate Under Section 87A Of Income Tax Act Insights From StairFirst

https://stairfirst.com/blog/wp-content/uploads/2020/06/Adobe_Post_20200522_1633240.06060677195840691-1-2048x1536.png

Income Tax Rebate U s 87A For The Financial Year 2022 23

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhjaMWWuh9Yw1oHqfkfrIaYbLGaB376RebKDTPXR4-jMTYYQRhPBXomiwY9EVzEmXIgQ2oXuDWoror_llXVa0a4CVcBPyG3JecnKbrFpU1YAcL3BqdldNxiSh81eUspfAXJiNGbHbVcluzwXjoIUmqkZimUhTYHrQKq1Zu6xuaat2LRf6h-UCOGnP3s/w640-h596/87a.jpg

In Budget 2023 the tax rebate for individuals has been increased to INR 25 000 which means individuals having taxable income up to INR 7 00 000 can claim rebate under 87A under new tax regime which shall be applicable from FY 2023 24 AY 2024 25 onwards What are the Eligibility Criteria to Claim a Rebate u s 87A Rebate u s 87A for FY 2023 24 AY 2024 25 Under the new income tax regime the amount of the rebate under Section 87A for FY 2023 24 AY 2024 25 has been modified by Finance Act 2023 A resident individual with taxable income up to Rs 7 00 000 will receive a tax rebate upto Rs 25 000 tax The rebate under former old tax regime if chosen

The rebate amount under Section 87A allows a tax rebate of up to Rs 12 500 for individuals with taxable income up to Rs 5 00 000 FY 2022 23 Under Budget 2023 the government announced that any individual opting for the new tax regime and having taxable income up to Rs 7 lakh will be eligible for a tax rebate of Rs 25 000 The present 100 Percent tax rebate under section 87A up to total income of Rs 5 lakhs was introduced by the Finance Act 2019 w e f 01 04 2020 Section 87A Rebate for AY 2024 25 Section 87A rebate has been increased to Rs 7 lakhs under New Tax Regime However no changes has been made in the rebate for those not opting New Tax Regime

Know New Rebate Under Section 87A Budget 2023 PropertyRebate

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2023/05/know-new-rebate-under-section-87a-budget-2023.jpg

Know New Rebate Under Section 87A Budget 2023

https://studycafe.in/cdn-cgi/image/fit=contain,format=webp,gravity=auto,metadata=none,quality=80,width=1200,height=730/wp-content/uploads/2023/02/Know-new-rebate-under-section-87A-Budget-2023.jpg

https://taxguru.in/income-tax/marginal-relief-u-s-87a-tax-regime-u-s-115bac1a.html

Section 87A rebate does not allow in old regime if your income go above 5 00 000 But A New proviso inserted in section 87A by the Finance Act 2023 w e f 1 4 2024 Applicable from FY 2023 24 Provided that where the total income of the assessee is chargeable to tax under sub section 1A of section 115BAC and the total income

https://economictimes.indiatimes.com/wealth/tax/who-is-eligible-for-tax-rebate-under-section-87a-of-the-income-tax-act/articleshow/97574684.cms

Section 87A of the Income tax Act 1961 allows an individual to claim tax rebate provided their taxable income does not increase the specified level This tax rebate effectively makes zero tax outgo of an individual Budget 2023 has proposed to extend the amount of tax rebate under new tax regime from taxable income of Rs 5 lakh to Rs 7 lakh

Income Tax Rates TDS On Salaries And Rebate Under Section 87A Finance Bill 2023 Budget 2023

Know New Rebate Under Section 87A Budget 2023 PropertyRebate

New Income Tax Slab And Tax Rebate Credit Under Section 87A With Automated Income Tax Revised

Tax Rebate Under Section 87A In Old New Tax Regime FinCalC

Income Tax Rebate Under Section 87A

All You Need To Know About Section 87A At TaxHelpdesk TaxHelpdesk

All You Need To Know About Section 87A At TaxHelpdesk TaxHelpdesk

Is Section 87A Rebate For Everyone SR Academy India

Tax Rebate For Individual Most Individual Tax Rates Go Down Under The TCJA Pease CPAs To

Section 87A Tax Rebate FY 2023 24 Under Old New Tax Regimes

Rebate Under Section 87a Budget 2024 - The Budget 2023 24 has increased the rebate offered under Section 87A from the current income level of Rs 5 lakh to Rs 7 lakh under the new tax regime from assessment year 2024 25 onwards the entire income of an individual resident in India will be exempted from paying tax if his income does not exceed Rs 7 lakh Rebate under Section