Property Tax Rebate Montana 2024 The rebate provides Montanans up to 675 of property tax relief on a primary residence in both 2023 and 2024 WHAT ARE THE QUALIFICATIONS To qualify for the property tax rebate you must have 3 Owned a Montana residence for at least seven months in 2022 3 Lived in that Montana residence for at least seven months in 2022

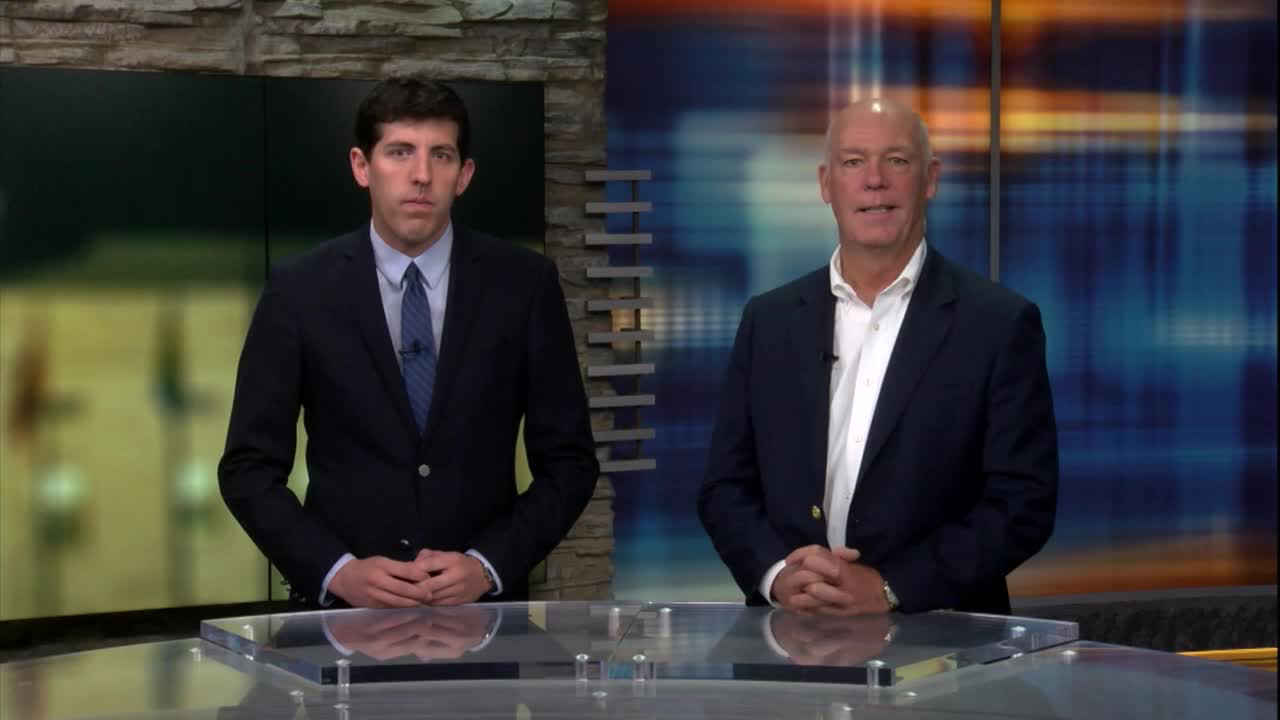

The department says taxpayers can apply for the 2022 property tax rebates through its online TransAction Portal or via a paper form during an application period that runs from Aug 15 2023 to Oct 1 2023 To apply through the TransAction Portal you ll need the following information Your home address Gov Gianforte celebrating property tax relief for Montanans with Rep Tom Welch R Dillon At a local residence in Dillion the governor ceremonially signed House Bill 222 carried by Rep Welch which provides a property tax rebate of up to 675 in both 2023 and 2024 for Montana homeowners at their primary residence

Property Tax Rebate Montana 2024

Property Tax Rebate Montana 2024

https://images.squarespace-cdn.com/content/v1/5d8d4c603aab2563d4a30208/9e98951b-5acf-419a-afcd-ce4692a6a772/2023-12-31+property+tax+rebate+DEADLINE.2-insta.jpg

This US States Property Tax Rebate For Residents How To Qualify

https://www.lamansiondelasideas.com/wp-content/uploads/2023/03/Montana-Tax-Refunds-and-Rebates.jpg

Property Tax Rebate In Montana Sandra Johnson Realtor

https://bigskyliving.com/wp-content/uploads/2023/05/Property-Tax-Rebate-in-Montana.jpg

This spring the governor also delivered Montanans 120 million in permanent long term property tax relief and secured up to 1 350 in property tax rebates for Montana homeowners over the next two years Eligible Montana homeowners may now claim their first rebate up to 675 at getmyrebate mt gov The deadline for claims is October 1 2023 Montana homeowners will be eligible for a second property tax rebate of up to 675 in 2024 for property taxes paid on a principal residence for 2023 For additional information about the property tax rebate or to check on the status of the income or property tax rebates visit the Montana Department of Revenues Website

However taxpayers can also have their rebate mailed to them by check The department will process claims as they are received and distribute rebates by December 31 2023 Montana homeowners will be eligible for a second property tax rebate up to 675 in 2024 for property taxes paid on a principal residence for 2023 Last November the The Montana Property Tax Rebate provides qualifying Montanans up to 675 of property tax relief on a primary residence in both 2023 and 2024 The qualifications to claim the rebate are at GetMyRebate mt gov The fastest way for taxpayers to apply for and get the rebate is by applying online

Download Property Tax Rebate Montana 2024

More picture related to Property Tax Rebate Montana 2024

Income And Property Tax Relief Montana s 675 Rebate For 2023 Explained

https://ridgecrestpact.org/wp-content/uploads/2023/08/Income-and-Property-Tax-Relief-Montanas-675-Rebate-for-2023-Explained-1024x576.jpg

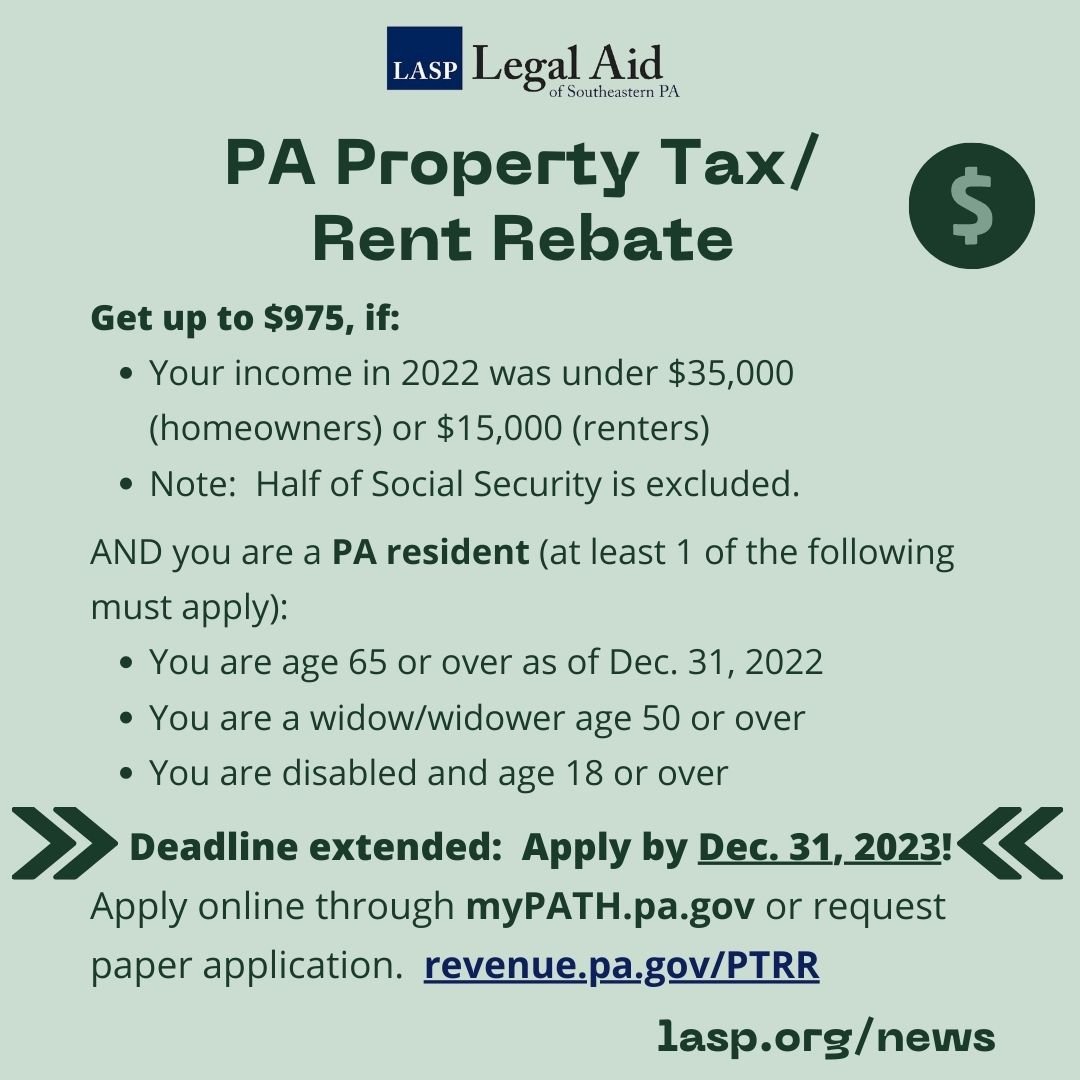

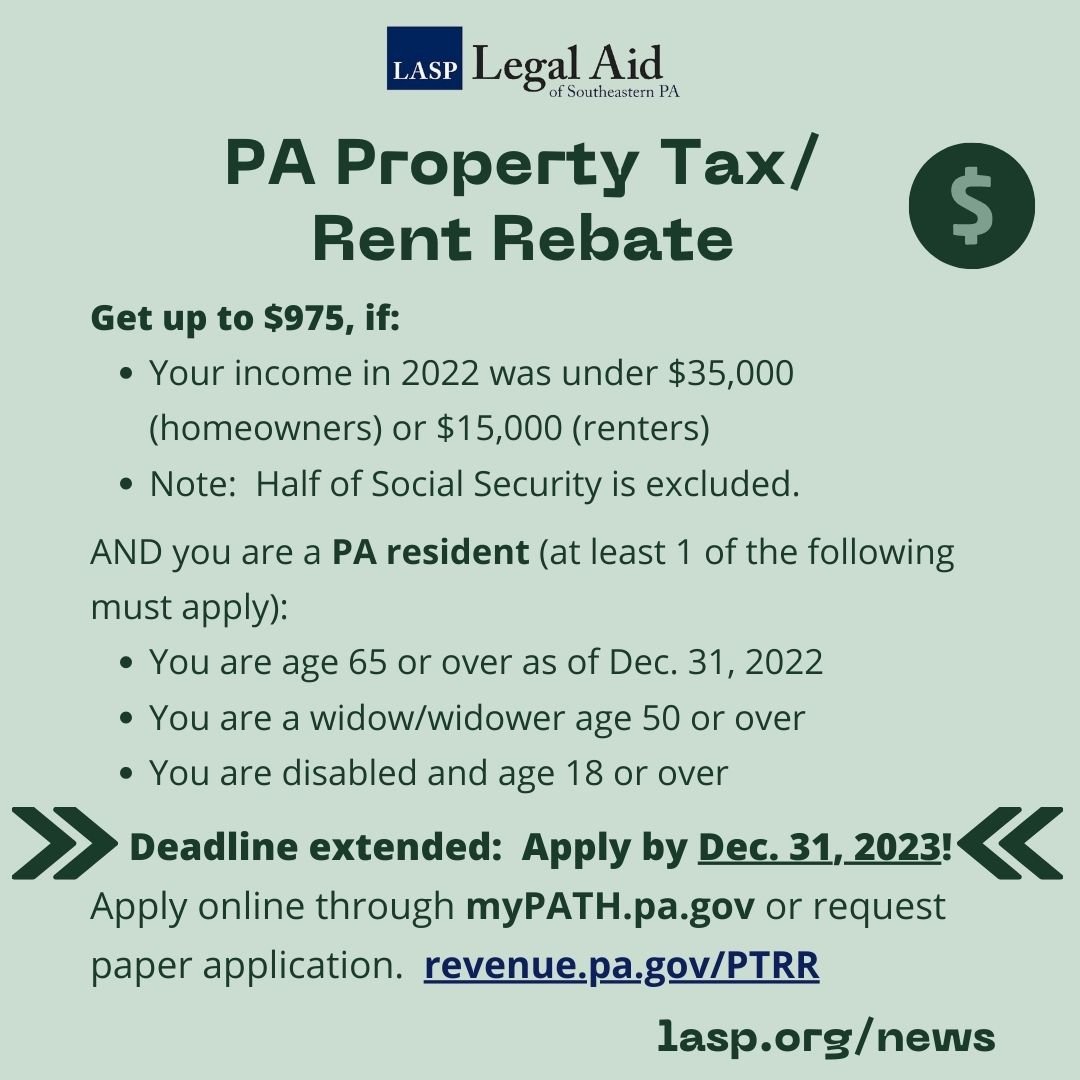

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

Here s How To Claim Your Montana Property Tax Rebate

https://townsquare.media/site/1107/files/2023/08/attachment-Tax-Rebate.jpg?w=980&q=75

Published August 17 2023 at 5 29 AM MDT Montana homeowners can now apply to claim up to 675 in property tax rebates Residents who owned and lived in their home for at least seven months in 2022 qualify The deadline to apply through the Montana Department of Revenue is Oct 1 The rebate application requires the home s physical address The Montana Property Tax Rebate is available for eligible homeowners in 2024 offering up to 675 in relief for property taxes paid on a principal residence The department has approved over 180 000 claims totaling 120 million which is about 80 of estimated potential claims

The Property Tax Rebate is a rebate of up to 500 a year of property taxes on a principal residence paid for 2022 and 2023 Individuals should check eligibility and will have to apply for Montana s seven individual income tax brackets will be consolidated into two in 2024 Previously the top rate was set to drop to 6 5 percent down from 6 75 percent but Senate Bill 121 will reduce it further to 5 9 percent The bill also raises the state Earned Income Tax Credit to 10 percent of the federal credit

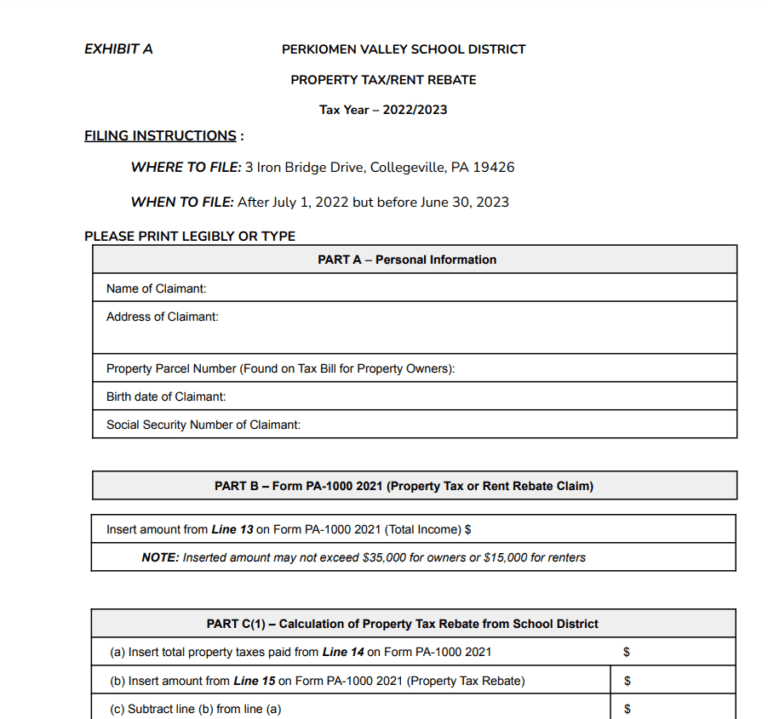

Property Tax Rebate Pennsylvania LatestRebate

https://www.latestrebate.com/wp-content/uploads/2023/02/form-pa-1000-property-tax-or-rent-rebate-claim-benefits-older-2.png

Pennsylvanians Can Now File Property Tax Rent Rebate Program Applications Online Beaver County

https://s3.amazonaws.com/static.beavercountyradio.com/wp-content/uploads/2021/01/25060432/unnamed-7-1536x1024.jpg

https://leg.mt.gov/content/Committees/Interim/2023-2024/Revenue/Meetings/July-2023/property-relief-flyer.pdf

The rebate provides Montanans up to 675 of property tax relief on a primary residence in both 2023 and 2024 WHAT ARE THE QUALIFICATIONS To qualify for the property tax rebate you must have 3 Owned a Montana residence for at least seven months in 2022 3 Lived in that Montana residence for at least seven months in 2022

https://montanafreepress.org/2023/08/15/how-to-claim-your-montana-tax-rebates-august-update/

The department says taxpayers can apply for the 2022 property tax rebates through its online TransAction Portal or via a paper form during an application period that runs from Aug 15 2023 to Oct 1 2023 To apply through the TransAction Portal you ll need the following information Your home address

Property Tax Rebate Form For Seniors In Pa Printable Rebate Form

Property Tax Rebate Pennsylvania LatestRebate

Property Tax Rebate For Montana Residents

PA Property Tax Rebate What To Know Credit Karma

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of Southeastern Pennsylvania

Individual Income Tax Rebate

Individual Income Tax Rebate

Montana Homeowners Can Now Claim Property Tax Rebate

2021 Form PA PA 1000 Fill Online Printable Fillable Blank PdfFiller

Ways To Find Your geocode For Montana Property Tax Rebate

Property Tax Rebate Montana 2024 - The Montana Property Tax Rebate provides qualifying Montanans up to 675 of property tax relief on a primary residence in both 2023 and 2024 The qualifications to claim the rebate are at GetMyRebate mt gov The fastest way for taxpayers to apply for and get the rebate is by applying online