Nys Tax Rebates 2024 Currently New Yorkers can combine IRA tax credits with New York State incentives and programs helping homeowners cut energy use save more money contribute to a cleaner healthier planet Now is the time to start your clean energy future free from fossil fuels including natural gas oil and propane

Don t Miss Valuable Tax Credits This Filing Season National Earned Income Tax Credit Day Is January 26 Credits worth up to 11 888 are available to eligible New Yorkers For Release Immediate Friday January 26 2024 For media inquiries only contact Ryan Cleveland 518 457 7377 On National Earned Income Tax Credit Awareness Day January 26 the New York State Department of Taxation Real property tax relief credit Who is eligible You are entitled to this refundable credit if you meet all of the following requirements for the tax year you are subject to tax under Tax Law Article 22 you were a New York State resident for all of the tax year your qualified gross income is 250 000 or less

Nys Tax Rebates 2024

Nys Tax Rebates 2024

https://www.northjersey.com/gcdn/-mm-/e12712590430b2876b51073aa0fd9d0df788d233/c=0-357-3866-2541/local/-/media/2017/05/08/Bergen/NorthJersey/636298617519756307-20170508-173344.jpg?width=3200&height=1808&fit=crop&format=pjpg&auto=webp

Understanding Income Tax Reliefs Rebates Deductions And Exemptions In Malaysia

https://ringgitplus.com/en/blog/wp-content/uploads/2020/02/Tax-Rebates-800x534.jpg

It 201 X Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/584/982/584982169/large.png

To be eligible for a homeowner tax rebate credit in 2022 you must have qualified for a 2022 STAR credit or exemption had income that was less than or equal to 250 000 for the 2020 income tax year and a school tax liability for the 2022 2023 school year that is more than your 2022 STAR benefit 1 01 STAR benefit checks and exemptions reflected on school property tax bills have already started filling New Yorkers inboxes and mailboxes and will continue to do so through the end of the

The tax rebate forms for certain programs will be available in the fall of 2023 or early 2024 The rebates will provide an upfront discount or a refund If the program you are interested in provides a tax credit instead of a rebate you will need to file this information when you file your taxes 2022 Homeowner Tax Rebate Credit Check Lookup Note The homeowner tax rebate credit was a one year program which ended in 2022 The credit is not available for future years If you have questions about the program or received a letter regarding your 2022 payment see Frequently asked questions Lost stolen destroyed and uncashed checks

Download Nys Tax Rebates 2024

More picture related to Nys Tax Rebates 2024

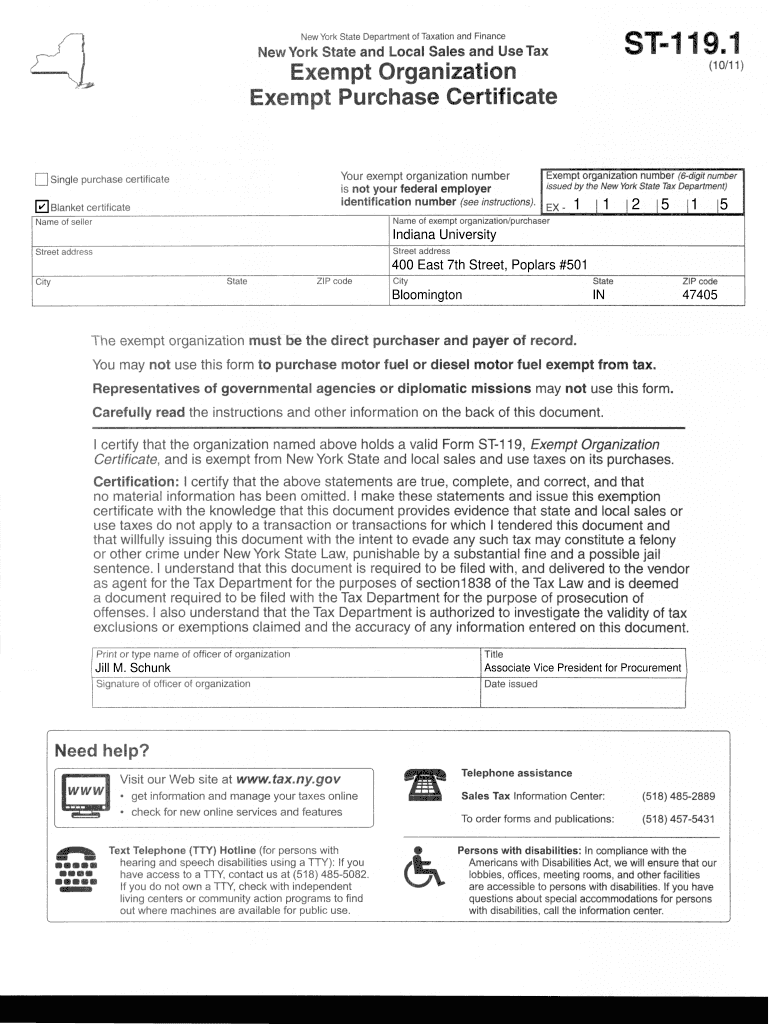

New York State Tax Exempt Form St 119 ExemptForm

https://www.exemptform.com/wp-content/uploads/2022/08/nys-tax-exempt-form-st-119-1-fill-out-and-sign-printable-pdf-template-5.png

Printable New York State Tax Forms Printable Forms Free Online

https://www.viralcovert.com/wp-content/uploads/2018/11/new-york-state-tax-form-it-201-x.jpg

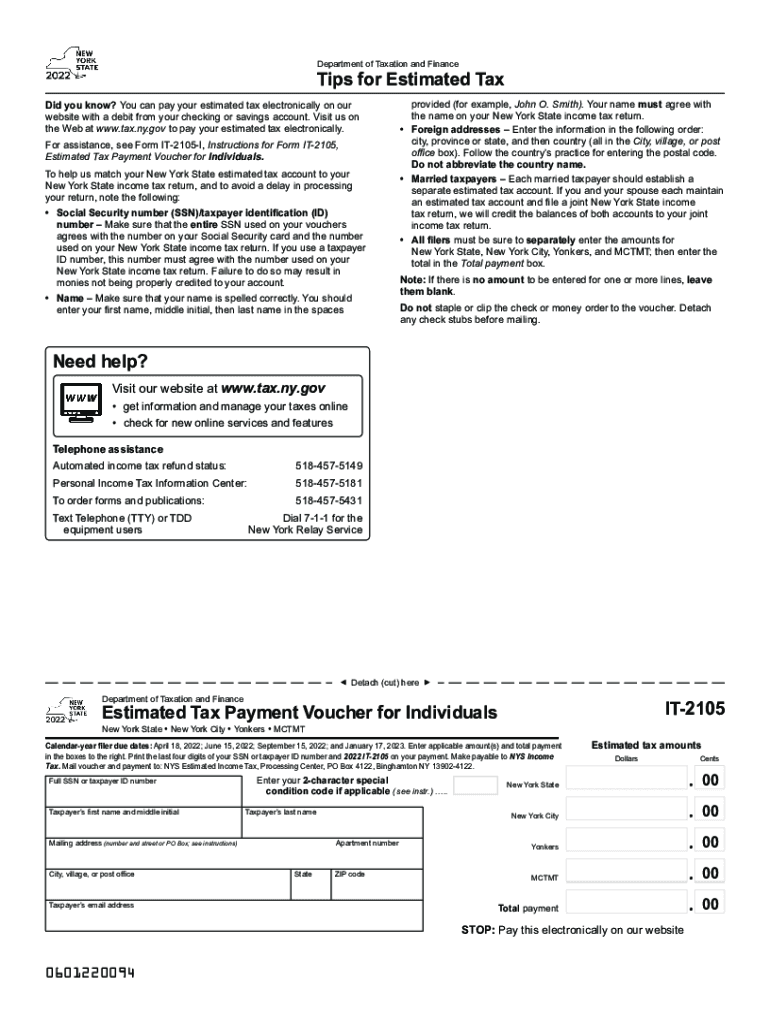

2022 Form NY IT 2105 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/584/978/584978857/large.png

For the property tax relief credit income is defined as federal adjusted gross income FAGI from two years prior modified so that the net amount of loss reported on Federal Schedule C D E or F doesn t exceed 3 000 the net amount of any other separate category of loss doesn t exceed 3 000 and the aggregate amount of all losses The New York Department of Taxation and Finance will soon begin sending direct financial assistance to 1 75 million New Yorkers who received the Empire State Child Credit and or the Earned Income Credit on their 2021 state tax returns accelerated the distribution of 2 2 billion in tax relief to more than 2 million New Yorkers through the

As of January 1 2024 the IRS allows buyers to transfer the IRA tax credit to a car dealership to reduce the upfront purchase price of a new or used EV Alternatively buyers can claim the tax credit later when filing their tax returns From 2023 through 2032 New Yorkers can claim up to 3 200 in efficiency tax credits a year for eligible purchases including Up to 1 200 for home envelope improvements including efficient windows exterior doors insulation and electrical panel upgrades

Form St 127 Nys And Local Sales And Use Tax Exemption Certificate ExemptForm

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/form-st-127-nys-and-local-sales-and-use-tax-exemption-certificate-4.png

Printable New York State Tax Forms Printable Forms Free Online

https://data.formsbank.com/pdf_docs_html/265/2657/265736/page_1_bg.png

https://www.nyserda.ny.gov/All-Programs/Inflation-Reduction-Act/Inflation-Reduction-Act-homeowners

Currently New Yorkers can combine IRA tax credits with New York State incentives and programs helping homeowners cut energy use save more money contribute to a cleaner healthier planet Now is the time to start your clean energy future free from fossil fuels including natural gas oil and propane

https://www.tax.ny.gov/press/rel/2024/eitcday012624.htm

Don t Miss Valuable Tax Credits This Filing Season National Earned Income Tax Credit Day Is January 26 Credits worth up to 11 888 are available to eligible New Yorkers For Release Immediate Friday January 26 2024 For media inquiries only contact Ryan Cleveland 518 457 7377 On National Earned Income Tax Credit Awareness Day January 26 the New York State Department of Taxation

36 NYS School Districts Poised To Exceed Tax Cap Including 4 In CNY No Rebates Syracuse

Form St 127 Nys And Local Sales And Use Tax Exemption Certificate ExemptForm

Nys Withholding Tax Forms 2022 WithholdingForm

1 000 Tax Rebate Residents In This State May Receive Extra Money This Summer Here s How To Be

How To Get Energy Efficiency Improvement Rebates Air Assurance

Tax Rebates Worth At Least 75 To Start Going Out To 25 000 People This Week All You Need To

Tax Rebates Worth At Least 75 To Start Going Out To 25 000 People This Week All You Need To

Primary Rebate South Africa Printable Rebate Form

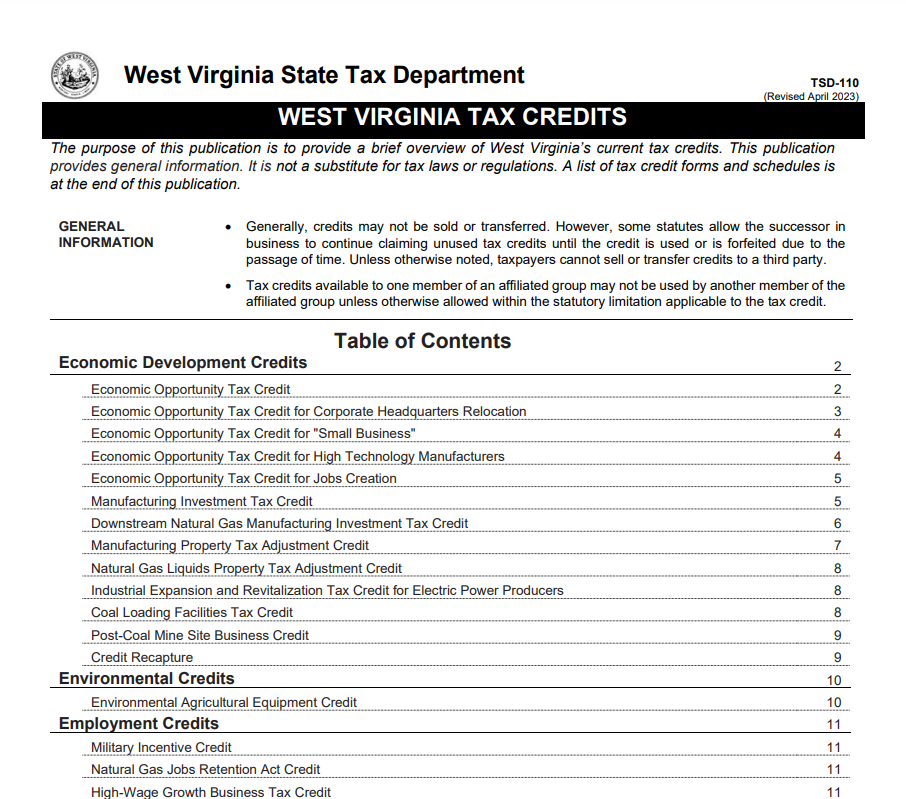

West Virginia Tax Rebate 2023 Claiming Tax Rebates WV Tax Relief PrintableRebateForm

NYS OPDV OGS And DOH Partner For Sexual Assault Awareness Month And Denim Day Installation On

Nys Tax Rebates 2024 - The FY 2024 Budget also creates a nation leading program to combat childhood lead exposure in New York residential buildings in 24 of the highest risk areas outside of New York City The program first proposed by Governor Hochul in her State of the State Address requires certain multi family residential buildings to be certified as free of