Nys Tax Rebate Credit 2024 Don t Miss Valuable Tax Credits This Filing Season National Earned Income Tax Credit Day Is January 26 Credits worth up to 11 888 are available to eligible New Yorkers For Release Immediate Friday January 26 2024 For media inquiries only contact Ryan Cleveland 518 457 7377 On National Earned Income Tax Credit Awareness Day January 26 the New York State Department of Taxation

Inflation Reduction Act Homeowners Back to Inflation Reduction Act Combine IRA Savings with State Incentives to Upgrade Your Home and Ditch Fossil Fuels The Inflation Reduction Act IRA helps New Yorkers get the latest clean energy technologies and equipment that will save energy for years to come The income limit for this program for 2024 is 98 700 The Bulletin Seagulls swirl around the Statue of Liberty at the end of the day in New York City on December 7 2023 New York state

Nys Tax Rebate Credit 2024

Nys Tax Rebate Credit 2024

https://townsquare.media/site/497/files/2022/06/attachment-RS28849_ThinkstockPhotos-623211702-scr.jpg?w=1200&h=0&zc=1&s=0&a=t&q=89

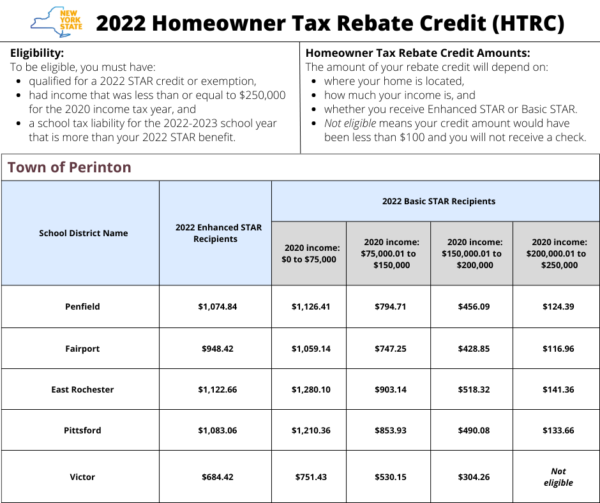

NYS Homeowner Tax Rebate Credit HTRC Info Town Of Perinton

https://perinton.org/wp-content/uploads/2022-Homeowner-Tax-Rebate-Credit-HTRC-1-600x503.png

Homeowner Tax Rebate Credit Checks On Their Way To NYS Residents WWTI InformNNY

https://www.informnny.com/wp-content/uploads/sites/58/2022/06/GettyImages-985842598-2.jpg?w=1920&h=1080&crop=1

Real property tax relief credit Who is eligible You are entitled to this refundable credit if you meet all of the following requirements for the tax year you are subject to tax under Tax Law Article 22 you were a New York State resident for all of the tax year your qualified gross income is 250 000 or less The New York Department of Taxation and Finance will soon begin sending direct financial assistance to 1 75 million New Yorkers who received the Empire State Child Credit and or the Earned Income Credit on their 2021 state tax returns accelerated the distribution of 2 2 billion in tax relief to more than 2 million New Yorkers through the

Flexible Income Lookback Taxpayers can choose to use either current or prior year income to calculate the child tax credit in 2024 and 2025 providing flexibility in determining eligibility Inflation Adjustment Starting in 2024 the child tax credit will be adjusted for inflation to keep up with the rising cost of living Business tax relief The Inflation Reduction Act consists of both tax credits and tax rebates The tax rebate forms for certain programs will be available in the fall of 2023 or early 2024 The rebates will provide an upfront discount or a refund If the program you are interested in provides a tax credit instead of a rebate you will need to file this information

Download Nys Tax Rebate Credit 2024

More picture related to Nys Tax Rebate Credit 2024

NYS 2023 Homeowner Tax Rebate Tax Rebate

https://i0.wp.com/www.tax-rebate.net/wp-content/uploads/2023/05/NYS-2023-Homeowner-Tax-Rebate.jpg?fit=996%2C728&ssl=1

Nys School Tax Relief Checks Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/09/NYS-Drive-Clean-Rebate-Form-1024x812.png

Your Stories Q A Where Is My NYS Homeowner Tax Rebate Credit Check YouTube

https://i.ytimg.com/vi/ZN9k_nErOQE/maxresdefault.jpg

As of January 1 2024 the IRS allows buyers to transfer the IRA tax credit to a car dealership to reduce the upfront purchase price of a new or used EV Alternatively buyers can claim the tax credit later when filing their tax returns The Biotechnology Tax Credit allows investors and owners of qualified emerging technology companies QETCs focused on biotechnology to claim a tax credit against the General Corporation Tax and Unincorporated Business Tax for amounts paid or incurred for certain facilities operations and employee training in New York City The extension of

NYS Clean Heat also provides rebates for ground source heat pumps which are eligible for a 30 IRA tax credit and 25 New York State income tax credit Heat pump systems are being installed more frequently across New York and the U S with national heat pump sales surpassing gas furnaces in 2022 IRA Savings on Solar and Energy Storage 2022 Homeowner Tax Rebate Credit Check Lookup Note The homeowner tax rebate credit was a one year program which ended in 2022 The credit is not available for future years If you have questions about the program or received a letter regarding your 2022 payment see Frequently asked questions Lost stolen destroyed and uncashed checks

Money In Your Pocket Who Qualifies For Tax Cut Property Tax Rebate In NYS 2023 Budget WRGB

https://cbs6albany.com/resources/media2/16x9/full/1024/center/80/6df365a4-868a-491a-b350-4442a687917a-large16x9_thumb_196074.png

Nys Tax Rebate Checks 2023 Tax Rebate

https://i0.wp.com/www.freerebate.net/wp-content/uploads/2023/02/this-is-an-attachment-of-new-stimulus-checks-up-to-1-050-are-going-out-soon-to-nys-homeowners-from-nys-taxation-rebate-checks-2023-post.png?w=979&ssl=1

https://www.tax.ny.gov/press/rel/2024/eitcday012624.htm

Don t Miss Valuable Tax Credits This Filing Season National Earned Income Tax Credit Day Is January 26 Credits worth up to 11 888 are available to eligible New Yorkers For Release Immediate Friday January 26 2024 For media inquiries only contact Ryan Cleveland 518 457 7377 On National Earned Income Tax Credit Awareness Day January 26 the New York State Department of Taxation

https://www.nyserda.ny.gov/All-Programs/Inflation-Reduction-Act/Inflation-Reduction-Act-homeowners

Inflation Reduction Act Homeowners Back to Inflation Reduction Act Combine IRA Savings with State Incentives to Upgrade Your Home and Ditch Fossil Fuels The Inflation Reduction Act IRA helps New Yorkers get the latest clean energy technologies and equipment that will save energy for years to come

NYS Tax Lien Removal How To Take It Off Your Property And Credit

Money In Your Pocket Who Qualifies For Tax Cut Property Tax Rebate In NYS 2023 Budget WRGB

Tax Rebate Checks Come Early This Year Yonkers Times

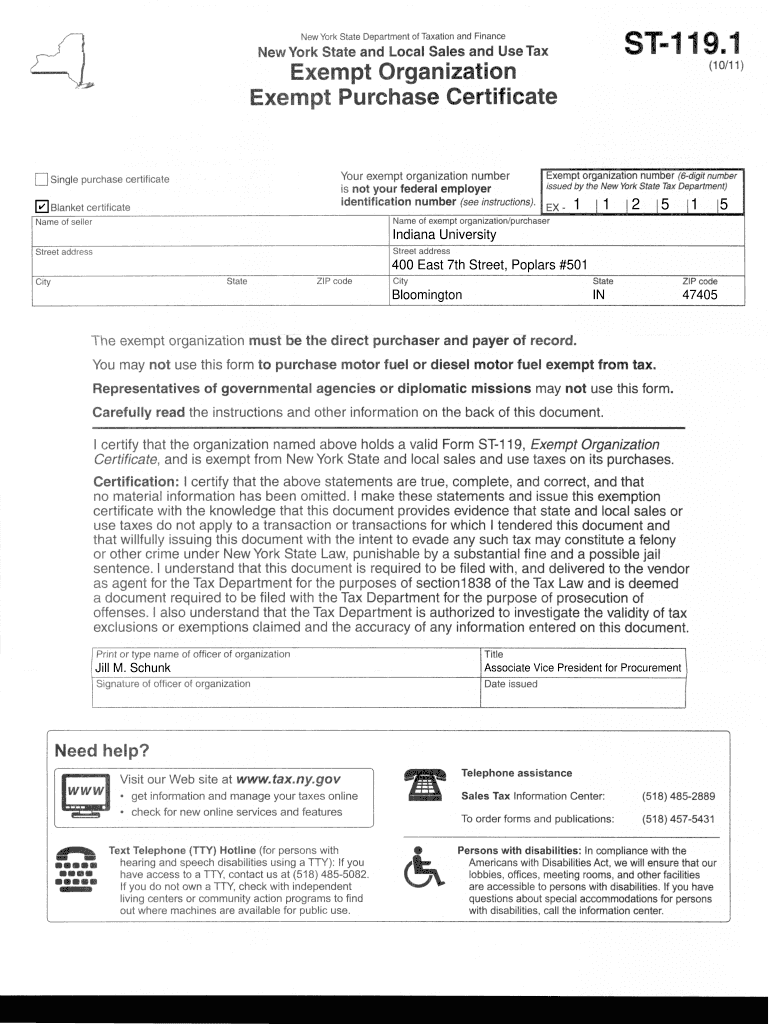

New York State Tax Exempt Form St 119 ExemptForm

New York State Begins Mailing Out Homeowner Tax Rebate Credit Checks Wgrz

Printable New York State Tax Forms Printable Forms Free Online

Printable New York State Tax Forms Printable Forms Free Online

Electric Car Credit Income Limit How The Electric Car Tax Credit Works For Businesses

Nys Rebate Check For Property Tax Tax Rebate

Nys Star Tax Rebate Checks 2022 StarRebate

Nys Tax Rebate Credit 2024 - This is a solar rebate program for between 0 20 and 0 80 per watt installed depending on your location and utility company One time Rebate is provided once when you install your system Between 1 950 and 3 000 depending on your system size utility company and location in NY New York Solar Sales Tax Exemption