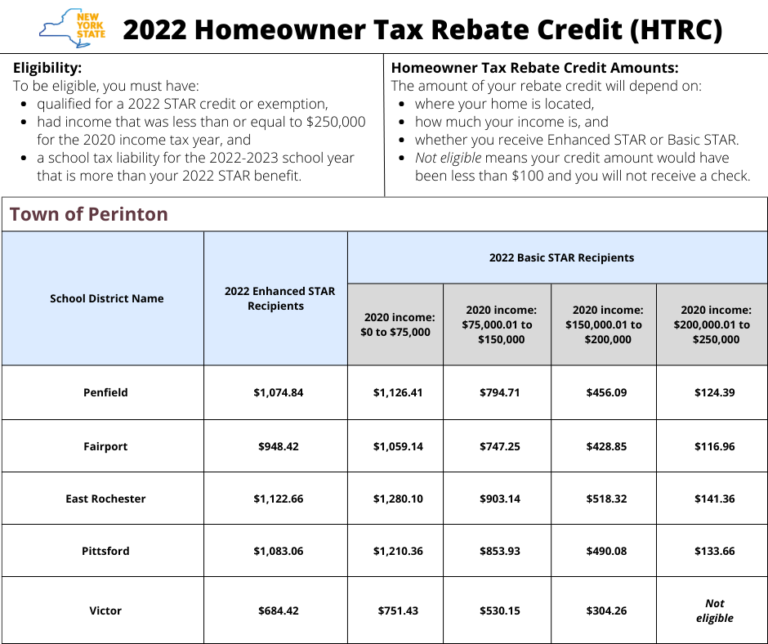

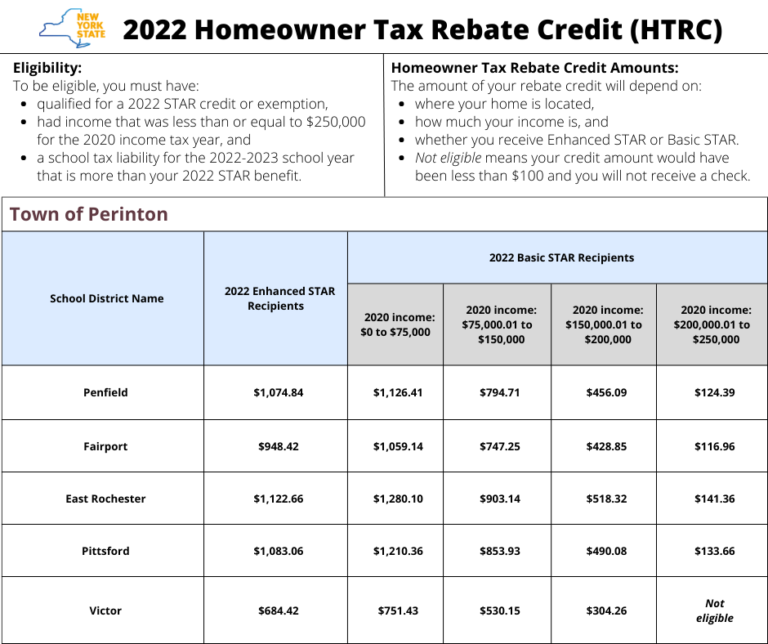

Nys Homeowners Tax Rebate 2024 To be eligible for a homeowner tax rebate credit in 2022 you must have qualified for a 2022 STAR credit or exemption had income that was less than or equal to 250 000 for the 2020 income tax year and a school tax liability for the 2022 2023 school year that is more than your 2022 STAR benefit

Who is eligible You are entitled to this refundable credit if you meet all of the following requirements for the tax year you are subject to tax under Tax Law Article 22 you were a New York State resident for all of the tax year your qualified gross income is 250 000 or less Back to Inflation Reduction Act Combine IRA Savings with State Incentives to Upgrade Your Home and Ditch Fossil Fuels The Inflation Reduction Act IRA helps New Yorkers get the latest clean energy technologies and equipment that will save energy for years to come

Nys Homeowners Tax Rebate 2024

Nys Homeowners Tax Rebate 2024

https://perinton.org/wp-content/uploads/2022-Homeowner-Tax-Rebate-Credit-HTRC-1-768x644.png

NYS 2023 Homeowner Tax Rebate Tax Rebate

https://i0.wp.com/www.tax-rebate.net/wp-content/uploads/2023/05/NYS-2023-Homeowner-Tax-Rebate.jpg?fit=996%2C728&ssl=1

Nys Tax Rebate Checks 2023 Tax Rebate

https://i0.wp.com/www.freerebate.net/wp-content/uploads/2023/02/this-is-an-attachment-of-new-stimulus-checks-up-to-1-050-are-going-out-soon-to-nys-homeowners-from-nys-taxation-rebate-checks-2023-post.png?w=979&ssl=1

The income limit for this program for 2024 is 98 700 The Bulletin Seagulls swirl around the Statue of Liberty at the end of the day in New York City on December 7 2023 New York state 2022 Homeowner Tax Rebate Credit Check Lookup Note The homeowner tax rebate credit was a one year program which ended in 2022 The credit is not available for future years If you have questions about the program or received a letter regarding your 2022 payment see Frequently asked questions Lost stolen destroyed and uncashed checks

For the property tax relief credit income is defined as federal adjusted gross income FAGI from two years prior modified so that the net amount of loss reported on Federal Schedule C D E or F doesn t exceed 3 000 the net amount of any other separate category of loss doesn t exceed 3 000 and The FY 2024 Budget adds 50 million for a Homeowner Stabilization Fund to finance home repairs in 10 communities across the state that have been identified as having high levels of low income homeowners of color and homeowner distress

Download Nys Homeowners Tax Rebate 2024

More picture related to Nys Homeowners Tax Rebate 2024

Money In Your Pocket Who Qualifies For Tax Cut Property Tax Rebate In NYS 2023 Budget WRGB

https://cbs6albany.com/resources/media2/16x9/full/1015/center/80/6df365a4-868a-491a-b350-4442a687917a-large16x9_thumb_196074.png

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

Nys School Tax Relief Checks Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/09/NYS-Drive-Clean-Rebate-Form-1024x812.png

To be eligible to receive a check residents must have qualified for a 2022 STAR credit or exemption have an income at or below 250 000 for the 2020 income tax year and a school tax Publication 532 2024 A publication is an informational document that addresses a particular topic of interest to taxpayers Subsequent changes in the law or regulations judicial decisions Tax Appeals Tribunal decisions or changes in Department policies could affect the validity of the information contained in a publication Publications

NY Homeowner Tax Rebate Credit HTRC is a one year tax credit program for eligible homeowners The amount of the credit is between 250 and 350 and will be available through 2023 To be eligible homeowners must be Eligible for the 2022 School Tax Relief STAR credit or exemption We ve mailed nearly two million homeowner tax rebate credit checks to eligible New York homeowners and many more are on their way

Virginia Tax Rebate 2024

https://www.taxuni.com/wp-content/uploads/2023/01/Virginia-Tax-Rebate.jpg

New York State To Mail Out Homeowner Tax Rebate Credit Checks DSJ

https://dsj.us/wp-content/uploads/2022/06/homeowners-tax-rebate-checks.jpg

https://www.tax.ny.gov/pit/property/homeowner-tax-rebate-credit.htm

To be eligible for a homeowner tax rebate credit in 2022 you must have qualified for a 2022 STAR credit or exemption had income that was less than or equal to 250 000 for the 2020 income tax year and a school tax liability for the 2022 2023 school year that is more than your 2022 STAR benefit

https://www.tax.ny.gov/pit/credits/real-property-tax-relief-credit.htm

Who is eligible You are entitled to this refundable credit if you meet all of the following requirements for the tax year you are subject to tax under Tax Law Article 22 you were a New York State resident for all of the tax year your qualified gross income is 250 000 or less

Property Tax Rebate Checks Are Coming Here s How Much Money You re Due

Virginia Tax Rebate 2024

Nys Star Tax Rebate Checks 2022 StarRebate

Nys Rebate Check For Property Tax Tax Rebate

Your Stories Q A Where Is My NYS Homeowner Tax Rebate Credit Check YouTube

Homeowner Tax Rebate Credit Checks On Their Way To NYS Residents WWTI InformNNY

Homeowner Tax Rebate Credit Checks On Their Way To NYS Residents WWTI InformNNY

When Will The Hudson Valley Receive Their Homeowners Tax Rebate

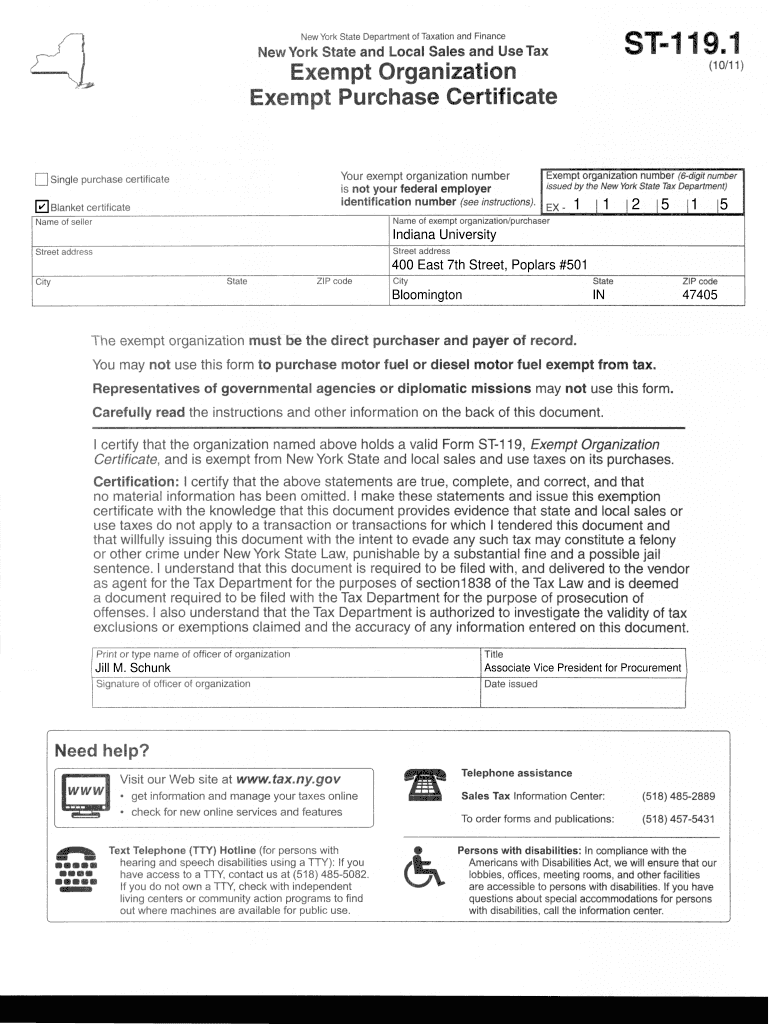

New York State Tax Exempt Form St 119 ExemptForm

Property Tax Rebate Pennsylvania LatestRebate

Nys Homeowners Tax Rebate 2024 - 2022 Homeowner Tax Rebate Credit Check Lookup Note The homeowner tax rebate credit was a one year program which ended in 2022 The credit is not available for future years If you have questions about the program or received a letter regarding your 2022 payment see Frequently asked questions Lost stolen destroyed and uncashed checks