Nyc Property Tax Rebate 2024 Property tax benefits Tax exemptions and abatements Landlord Express Access Portal LEAP Property tax bills View property tax bills Make a payment Property tax rates Payment plans Request a refund Other Senior citizen rent increase exemption SCRIE Disability rent increase exemption DRIE Guides and reports City of New York 2024

The Cooperative and Condominium Tax Abatement reduces the property taxes of eligible condominium and co op owners Individual unit owners do not apply for the abatement Instead managing agents and boards apply on behalf of their entire development The Cooperative Condominium Abatement Portal is now open for tax year 2024 25 applications and Highlights from the new 2024 25 assessment roll Tax class 2 residential rentals over 10 units had market value changes solely due to market forces of 1 9 citywide including 3 47 in Manhattan and 1 69 in Queens Brooklyn will see tax increases of 11 85 and the Bronx 7 74

Nyc Property Tax Rebate 2024

Nyc Property Tax Rebate 2024

https://wp.zillowstatic.com/streeteasy/2/new-property-taxes-ask-us-eec09a.jpg

NYC s Most Expensive Apartments Have The Lowest Tax Rates Metrocosm

http://i0.wp.com/metrocosm.com/wp-content/uploads/2015/04/NYC-property-tax.png

NYC Property Tax Bills How To Download And Read Your Bill

https://www.hauseit.com/wp-content/uploads/2022/11/NYC-Property-Tax-Bills.jpg

Some New York City homeowners were eligible to receive a 150 property tax rebate The deadline to apply for the property tax rebate was March 15 2023 This was a one time rebate Most recipients of the School Tax Relief for Homeowners STAR exemption or credit automatically qualified and did not need to take any action to receive the rebate On August 24 2022 Mayor Adams signed Local Law 82 into law The bill authorizes a one time property tax rebate up to 150 to hundreds of thousands of eligible New York homeowners The bill was introduced Intro 600 and voted on by the City Council in early August passing by a unanimous vote following a public hearing

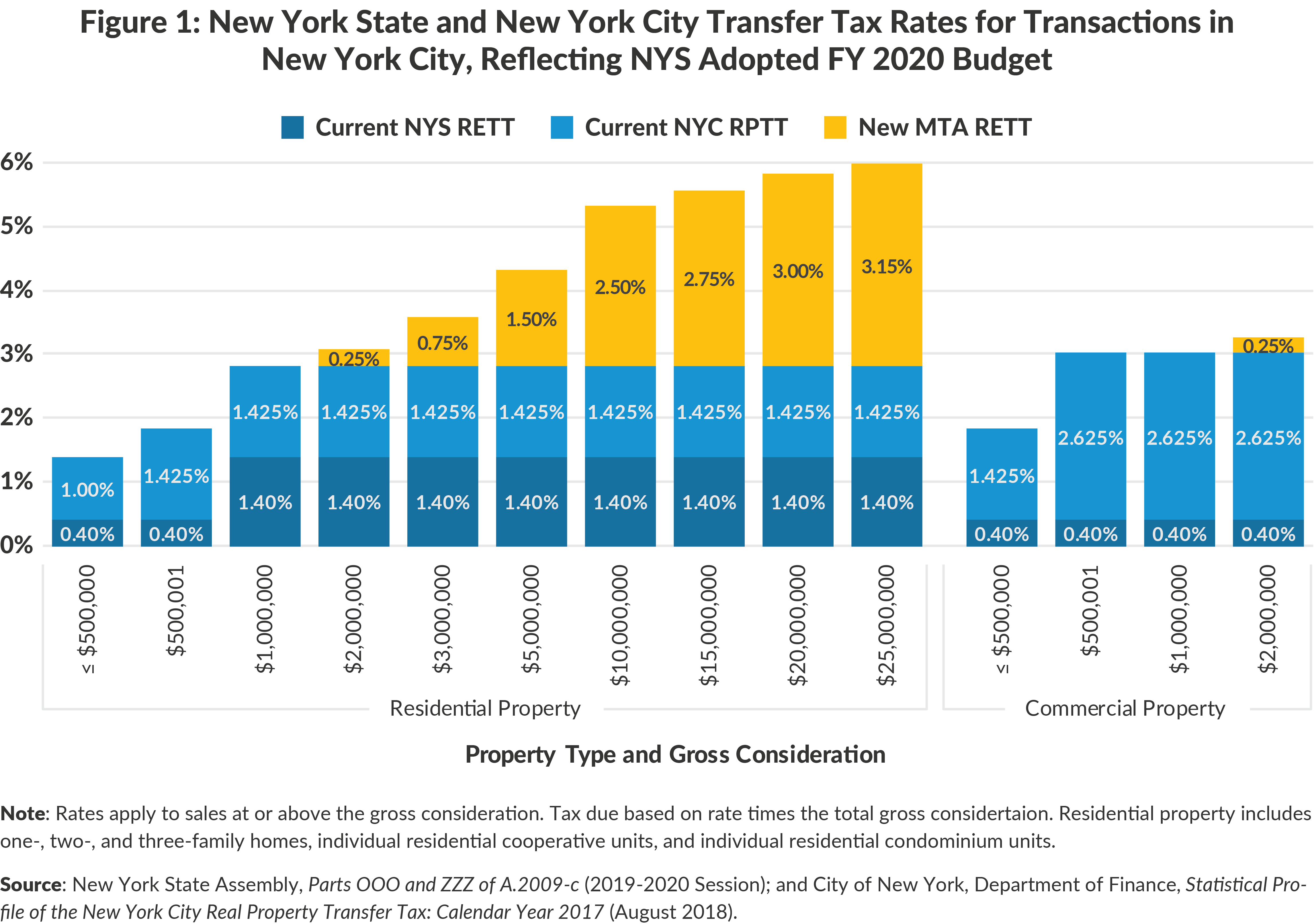

Payment information Automatic payments Late payments Update property bills and information Real property transfer Property tax and interest deferral program Late payments Other agency charges Requirement to pay by electronic funds transfer On September 28 2023 the New York City Council amended the property tax rates for fiscal 2024 7 1 2023 6 30 2024 The tax year 2023 24 tax rates will now be as follows The tax class two multi family residential rate is 12 502 which is the highest rate since tax year 2018 19 and is 23 5 bps higher than

Download Nyc Property Tax Rebate 2024

More picture related to Nyc Property Tax Rebate 2024

Nyc Property Tax Rate 2020 Change Comin

https://wp.zillowstatic.com/streeteasy/2/GettyImages-700714161-c25a1c.jpg

How To Calculate Your NYC Property Tax Rate Localize

https://blogmedia.localize.city/blog/wp-content/uploads/2021/08/property-taxes.png

What Is The Basic STAR Property Tax Credit In NYC Hauseit

https://www.hauseit.com/wp-content/uploads/2021/01/Basic-STAR-Tax-Exemption-NYC-Property-Tax-Bill-Example-1536x1026.png

The program offers a break on a portion of school property taxes or a rebate check for all eligible homeowners for 2024 is 98 700 Seagulls swirl around the Statue of Liberty at the end of 2022 Homeowner Tax Rebate Credit Check Lookup Note The homeowner tax rebate credit was a one year program which ended in 2022 The credit is not available for future years If you have questions about the program or received a letter regarding your 2022 payment see Frequently asked questions Lost stolen destroyed and uncashed checks

The amount of the credit is the product of the amount of real property tax which exceeds 6 of the taxpayer s qualified gross income QGI and a specified rate based on the taxpayer s QGI To claim the credit the computed amount must exceed 250 The maximum credit allowed is 350 Property taxes first surpassed 9 000 per home in 2020 STATEN ISLAND N Y Mayor Eric Adams today signed legislation to provide a one time property tax rebate of up to 150 to hundreds of

How To Get Property Tax Rebate PropertyRebate

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2023/05/pa-property-tax-rent-rebate-apply-by-12-31-2022-new-1-time-bonus-55.jpg?resize=1583%2C2048&ssl=1

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

https://www.nyc.gov/site/finance/property/property.page

Property tax benefits Tax exemptions and abatements Landlord Express Access Portal LEAP Property tax bills View property tax bills Make a payment Property tax rates Payment plans Request a refund Other Senior citizen rent increase exemption SCRIE Disability rent increase exemption DRIE Guides and reports City of New York 2024

https://www.nyc.gov/site/finance/property/landlords-coop-condo.page

The Cooperative and Condominium Tax Abatement reduces the property taxes of eligible condominium and co op owners Individual unit owners do not apply for the abatement Instead managing agents and boards apply on behalf of their entire development The Cooperative Condominium Abatement Portal is now open for tax year 2024 25 applications and

Tax Rebate For First Time Homeowners How To Claim Your Tax Rebate

How To Get Property Tax Rebate PropertyRebate

Nyc Nfp Renewal Fill Online Printable Fillable Blank PdfFiller

Property Tax Rebate Pennsylvania LatestRebate

2021 Form PA PA 1000 Fill Online Printable Fillable Blank PdfFiller

Deadline For Tax And Rent Relief Extended

Deadline For Tax And Rent Relief Extended

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of Southeastern Pennsylvania

Nyc Property Tax Rate 2020 Change Comin

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of Southeastern Pennsylvania

Nyc Property Tax Rebate 2024 - The Senior Citizen Homeowners Exemption SCHE provides a reduction of 5 to 50 on New York City s real property tax to seniors age 65 and older To be eligible for SCHE you must be 65 or older earn no more than 58 399 for the last calendar year and the property must be your primary residence The exemption must be renewed every two years