Mt State Tax Rebate 2024 The Individual Income Tax Rebate amount depends on a taxpayer s 2021 filing status and the amount of tax paid for 2021 which can be found on line 20 of the 2021 Montana Form 2 For those whose filing status was single head of household or married filing separately the rebate will be either 1 250 or the line 20 amount whichever is less

Simplification for Tax Year 2024 2 2 Updates from the 2023 Legislature for Tax Year 2023 2021 Individual Income Tax Rebates 2022 and 2023 Montana Property Tax Rebates Medical Savings Accounts Pass Through Entity Tax Montana Adoption Tax Credit Form ADPT Contractor s Gross Receipts limit increased 3 3 The Montana Property Tax Rebate provides qualifying Montanans up to 675 of property tax relief on a primary residence in both 2023 and 2024 The qualifications to claim the rebate are at GetMyRebate mt gov The fastest way for taxpayers to apply for and get the rebate is by applying online

Mt State Tax Rebate 2024

Mt State Tax Rebate 2024

https://www.taxuni.com/wp-content/uploads/2023/01/Virginia-Tax-Rebate-1024x576.jpg

Homeowner Renters District 16 Democrats

https://ld16nj.com/wp-content/uploads/2022/10/Homeowners-2.jpg

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

Rebates on 2021 Montana income taxes If you were a full year Montana resident who paid your state taxes on 2020 and 2021 income on time you should receive a rebate of up to 1 250 for your 2021 taxes If you meet those requirements but paid less than 1 250 in 2021 you should have your entire payment refunded The rebate provides Montanans up to 675 of property tax relief on a primary residence in both 2023 and 2024 WHAT ARE THE QUALIFICATIONS To qualify for the property tax rebate you must have 3 Owned a Montana residence for at least seven months in 2022 3 Lived in that Montana residence for at least seven months in 2022

However taxpayers can also have their rebate mailed to them by check The department will process claims as they are received and distribute rebates by December 31 2023 Montana homeowners will be eligible for a second property tax rebate up to 675 in 2024 for property taxes paid on a principal residence for 2023 Last November the The governor s budget provides Montanans with 2 000 in property tax rebates for their primary residence over 2023 and 2024 The 500 million proposal represents the largest state administered tax rebate in the country the governor announced yesterday with the Montana Board of Investments the State of Montana has reaffirmed its

Download Mt State Tax Rebate 2024

More picture related to Mt State Tax Rebate 2024

2021 Form PA PA 1000 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/585/571/585571881/large.png

Idaho Tax Rebate 2023 Your Comprehensive Guide To Saving Money Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/03/Idaho-Tax-Rebate-2023-768x679.png

One time Tax Rebate Checks For Idaho Residents KLEW

https://klewtv.com/resources/media2/16x9/full/1015/center/80/bcd0e069-efe3-406d-b87f-b52ab4b43fd3-large16x9_IdahoTaxRebateCheckpic.jpg

Welcome to the State of Montana newsroom where breaking news in Montana State Government is posted for various state agencies with a 1 000 property tax rebate in both 2023 and 2024 the governor s budget reduces the income tax rate most Montanans pay from 6 5 to 5 9 and substantially increases the state s earned income tax credit The Montana Department of Revenue will begin issuing rebates of 2021 individual income taxes to over 530 000 qualifying Montana taxpayers beginning July 3 The department anticipates distributing most rebates by August 31 Best of all taxpayers do not need to apply for the rebate

Individual taxpayers would qualify for up to 1 250 in rebates on their 2021 state income tax bill Montana s 2024 ballot will host a suite of consequential elections among them a race that could decide the balance of the U S Senate two open seats on the Montana Supreme Court two U S House races Montana s governorship and a The Home Electrification and Appliance Rebate Program rebates are tiered based on your gross household income and eligibility is capped at 150 AMI Appliances and HVAC systems must also meet certain efficiency standards Both programs can be utilized for single family multi family and manufactured housing

Renters Rebate Mn Instructions RentersRebate

https://i0.wp.com/www.rentersrebate.net/wp-content/uploads/2022/12/2022-rent-certificate-form-fillable-printable-pdf-forms-handypdf-2.png?fit=640%2C800&ssl=1

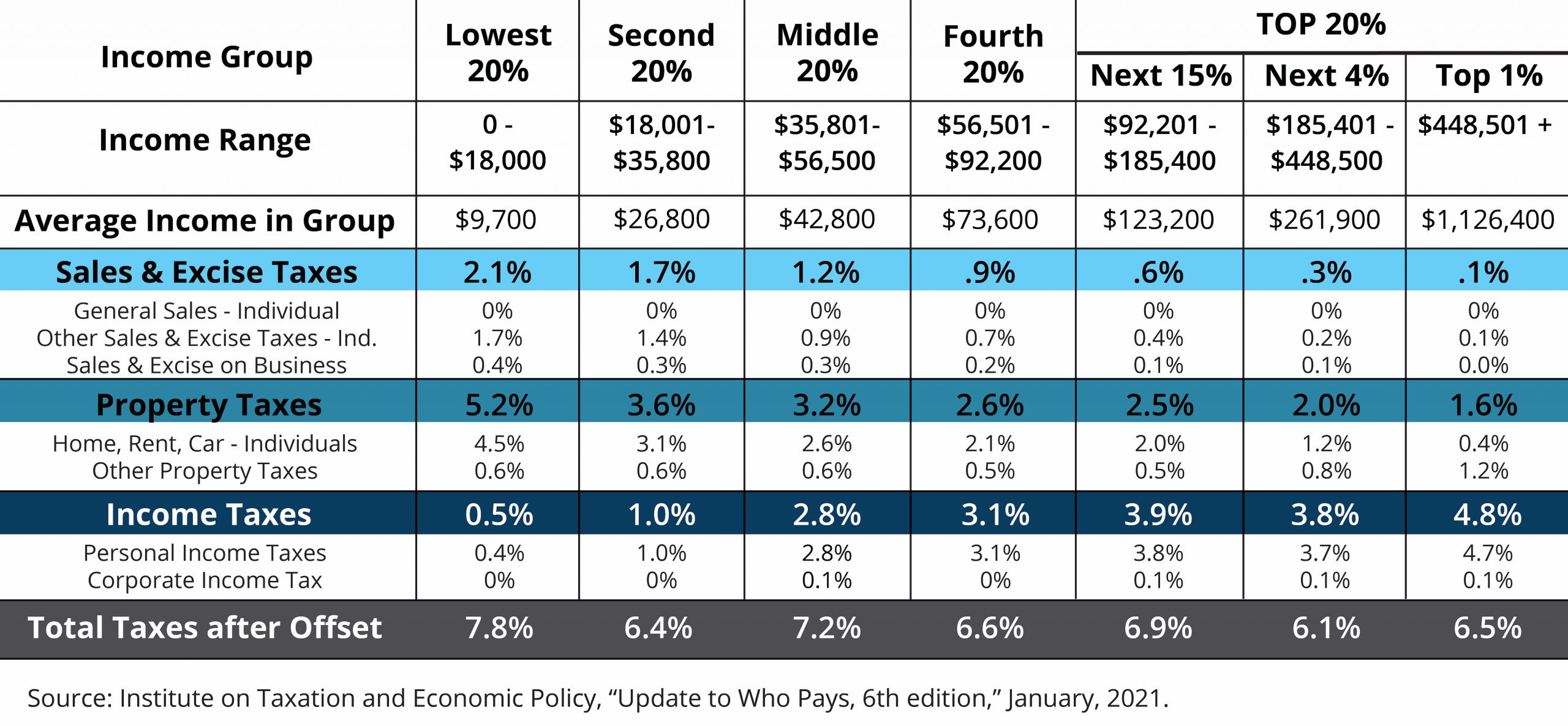

Policy Basics Who Pays Taxes In Montana Montana Budget Policy Center

https://mbadmin.jaunt.cloud/wp-content/uploads/2021/03/tax-tables--scaled.jpg

https://mtrevenue.gov/taxes/montana-tax-rebates/individual-income-tax-rebate-house-bill-192/

The Individual Income Tax Rebate amount depends on a taxpayer s 2021 filing status and the amount of tax paid for 2021 which can be found on line 20 of the 2021 Montana Form 2 For those whose filing status was single head of household or married filing separately the rebate will be either 1 250 or the line 20 amount whichever is less

https://mtrevenue.gov/download/112298/?tmstv=1701716155

Simplification for Tax Year 2024 2 2 Updates from the 2023 Legislature for Tax Year 2023 2021 Individual Income Tax Rebates 2022 and 2023 Montana Property Tax Rebates Medical Savings Accounts Pass Through Entity Tax Montana Adoption Tax Credit Form ADPT Contractor s Gross Receipts limit increased 3 3

Be Aware Of Montana Property Tax Rebate Scams Tax News You Can Use Montana Department Of Revenue

Renters Rebate Mn Instructions RentersRebate

Property Tax Rebate Pennsylvania LatestRebate

Missouri State Tax Rebate 2023 Printable Rebate Form

300 Bonus Tax Rebate For Thousands Of Families By Check Or Direct Deposit Do You Qualify

Tax Rebate In Thailand For 2023 Save Up To 40 000 THB

Tax Rebate In Thailand For 2023 Save Up To 40 000 THB

What Is A Tax Rebate U s 87A How To Claim Rebate U s 87A Scripbox

Take Home Pay Calculator Montana CALCLUT

SC State Tax Rebate 2023 Eligibility And Claiming Process Explained PrintableRebateForm

Mt State Tax Rebate 2024 - Gov Gianforte celebrating property tax relief for Montanans with Rep Tom Welch R Dillon At a local residence in Dillion the governor ceremonially signed House Bill 222 carried by Rep Welch which provides a property tax rebate of up to 675 in both 2023 and 2024 for Montana homeowners at their primary residence