Montana State Income Tax Rebate 2024 Updates from the 2023 Legislature for Tax Year 2024 Simplification Reduced Tax Rate and Expanded Montana Earned Income Tax Credit Long Term Capital Gains Tax Rate Military Retirement Exemption for Certain Military Retirees Expanded Qualified Endowment Credit De Minimis Filing Requirement for Certain Nonresidents 5 5

Montana Tax Rebates New Mexico Rebate Checks Pennsylvania Rebate South Carolina Tax Rebate Virginia Tax Rebate 2023 By Kelley R Taylor last updated December 02 2023 Stimulus Senate Bill 121 will reduce the top rate of 6 5 to 5 9 effective as previously scheduled on Jan 1 2024 The bill also increases the Montana Earned Income Tax Credit from 3 of the federal credit to 10 Apportionment changes Senate Bill 124 amends the current apportionment formula from three factor with double weighted sales to single

Montana State Income Tax Rebate 2024

Montana State Income Tax Rebate 2024

https://data.formsbank.com/pdf_docs_html/312/3122/312294/page_1_thumb_big.png

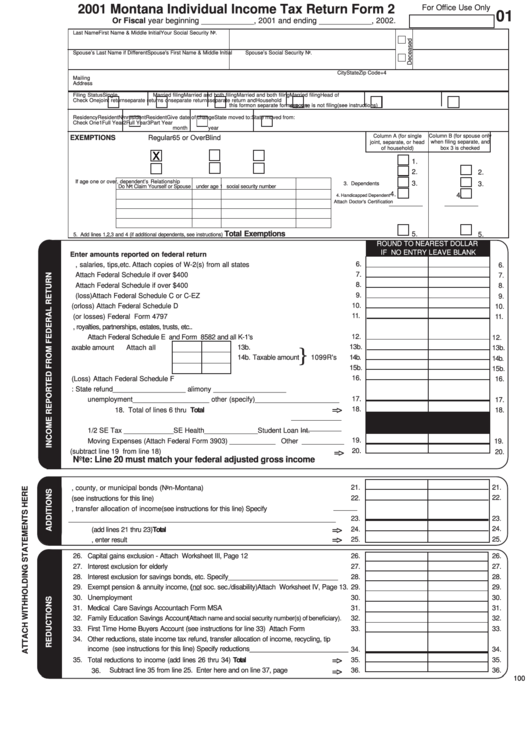

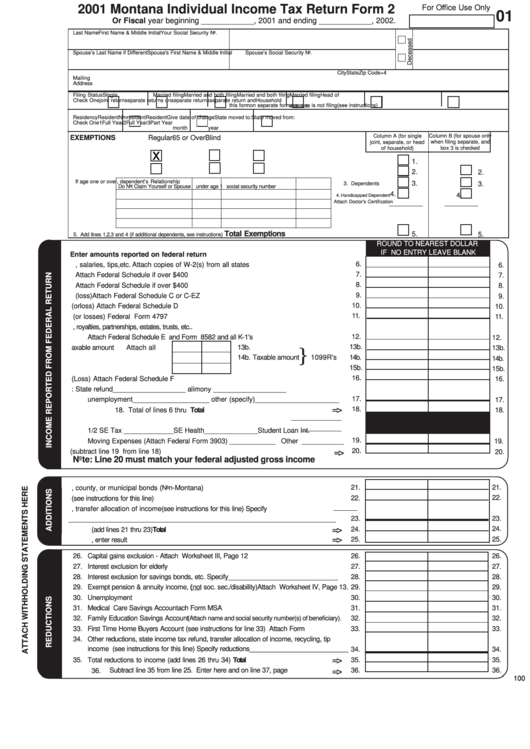

Montana State Income Tax Withholding Form WithholdingForm

https://www.withholdingform.com/wp-content/uploads/2022/08/cryptocurrenty-income-tax-concept-image-free-image-download.jpg

Montana State Tax Form 2023 Printable Forms Free Online

https://www.taunyafagan.com/wp/wp-content/uploads/2021/01/2020-Montana-Individual-Income-Tax-Help-Form.png

The latest entrant is Montana where lawmakers passed reforms Monday The top income tax rate will fall to 5 9 in 2024 from 6 75 now Gov Greg Gianforte called it the largest tax cut in Montana history and it builds on his 2021 cut that dropped the rate from 6 9 The state s tax code will also collapse to two brackets from seven In its current form it would provide rebates of up to 500 per homeowner for taxes paid in 2022 and 2023 The Montana Department of Revenue estimates that about 292 000 households would be eligible each year House Bill 192 as amended Friday would put 480 million into income tax rebates Individual taxpayers would qualify for up to 1 250 in

This comes after the Montana Legislature signed two tax rebate bills pulling hun 18 Jan 2024 22 48 27 GMT 1705618107587 What that means for full time Montana residents who paid state Welcome to the State of Montana newsroom where breaking news in Montana State Government is posted for various state agencies with a 1 000 property tax rebate in both 2023 and 2024 the governor s budget reduces the income tax rate most Montanans pay from 6 5 to 5 9 and substantially increases the state s earned income tax credit

Download Montana State Income Tax Rebate 2024

More picture related to Montana State Income Tax Rebate 2024

Montana Income Tax MT State Tax Calculator Community Tax

https://www.communitytax.com/wp-content/uploads/2020/01/image17.jpg

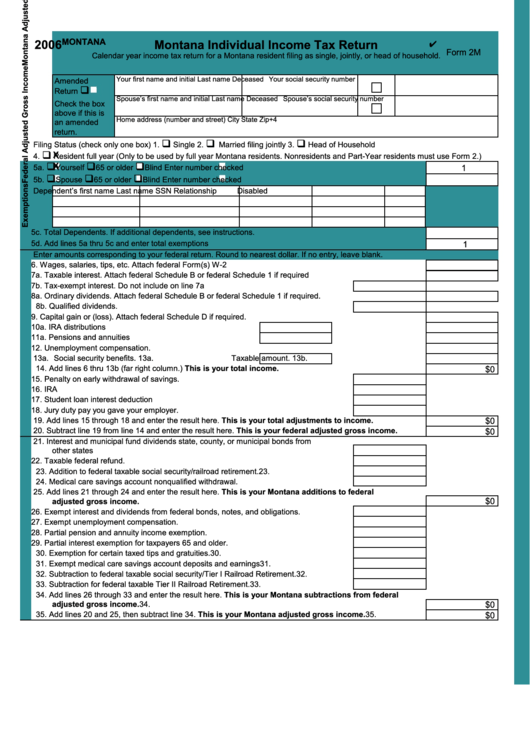

Fillable Form 2m Montana Individual Income Tax Return 2006 Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/213/2130/213013/page_1_thumb_big.png

Montana Income Tax Information What You Need To Know On MT Taxes

https://www.taunyafagan.com/wp/wp-content/uploads/2021/10/2023-Montana-Individual-Income-Tax-Help-Form.png

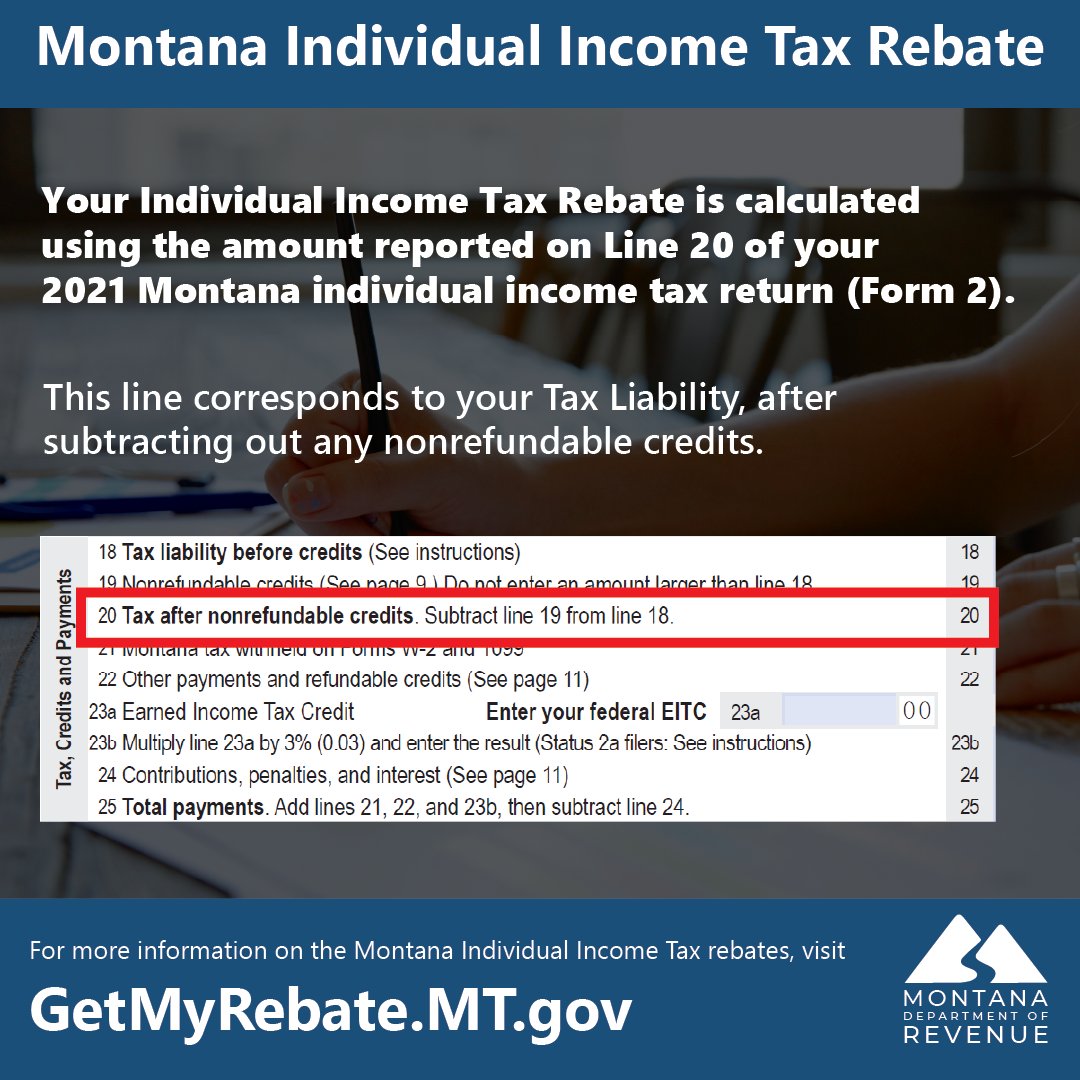

If you were a full year Montana resident who paid state taxes on 2021 income you should receive a rebate of up to 1 250 the 2023 rebate is applicable to November 2023 and May 2024 payments 1 Rebates on 2021 Montana income taxes If you were a full year Montana resident who paid your state taxes on 2020 and 2021 income on time you should receive a rebate of up to 1 250 for your 2021 taxes If you meet those requirements but paid less than 1 250 in 2021 you should have your entire payment refunded

If you were a full year Montana resident who paid your state taxes on 2020 and 2021 income on time you should receive a rebate of up to 1 250 for your 2021 taxes If you meet those requirements but paid less than 1 250 in 2021 you should have your entire payment refunded The Montana Department of Revenue reports the higher rate will apply to income above 20 500 for single taxpayers and married couples filing separately above 30 750 for heads of household and

Individual Income Tax Rebate

https://custercountymt.gov/wp-content/uploads/2023/06/June-2023-Tax-Rebate.jpg

Montana Income Tax MT State Tax Calculator Community Tax

https://www.communitytax.com/wp-content/uploads/2020/01/image7.jpg

https://mtrevenue.gov/download/112298/?tmstv=1701716155

Updates from the 2023 Legislature for Tax Year 2024 Simplification Reduced Tax Rate and Expanded Montana Earned Income Tax Credit Long Term Capital Gains Tax Rate Military Retirement Exemption for Certain Military Retirees Expanded Qualified Endowment Credit De Minimis Filing Requirement for Certain Nonresidents 5 5

https://www.kiplinger.com/taxes/state-stimulus-checks

Montana Tax Rebates New Mexico Rebate Checks Pennsylvania Rebate South Carolina Tax Rebate Virginia Tax Rebate 2023 By Kelley R Taylor last updated December 02 2023 Stimulus

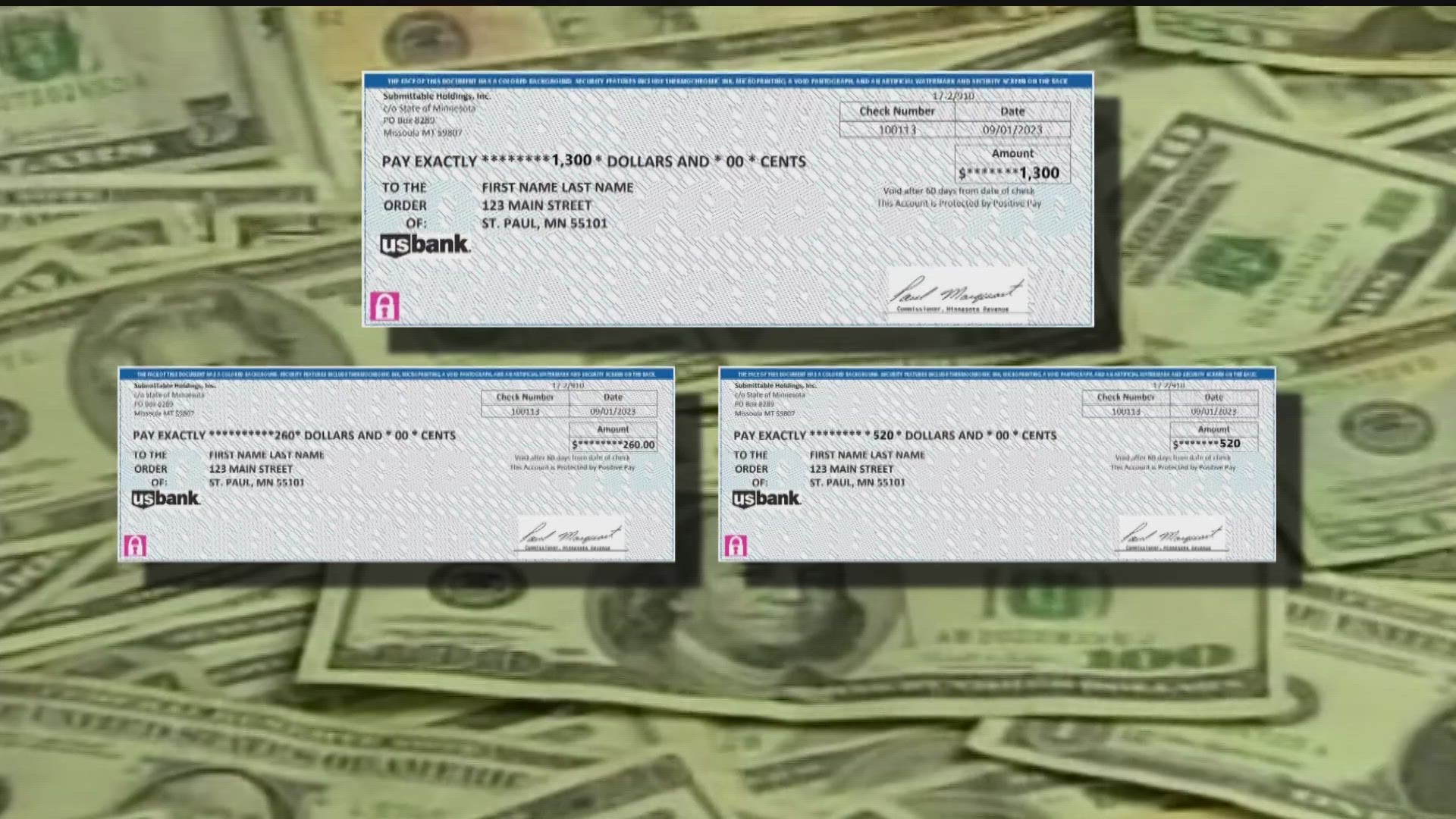

The Montana Income Tax Rebate Are You Eligible

Individual Income Tax Rebate

When Will We Get The Extra Tax Rebate Checks In Montana Details

Minnesota Tax Rebate Checks From Montana Company Are Legitimate Kare11

Montana Department Of Revenue On Twitter Your Individual Income Tax Rebate Is Calculated Using

State And Local Sales Tax Rates Midyear 2021 Tax Foundation

State And Local Sales Tax Rates Midyear 2021 Tax Foundation

Montana Tax Rebate 2023 Benefits Eligibility How To Apply PrintableRebateForm

Unraveling The Montana Tax Rebate 2023 Your Comprehensive Guide USRebate

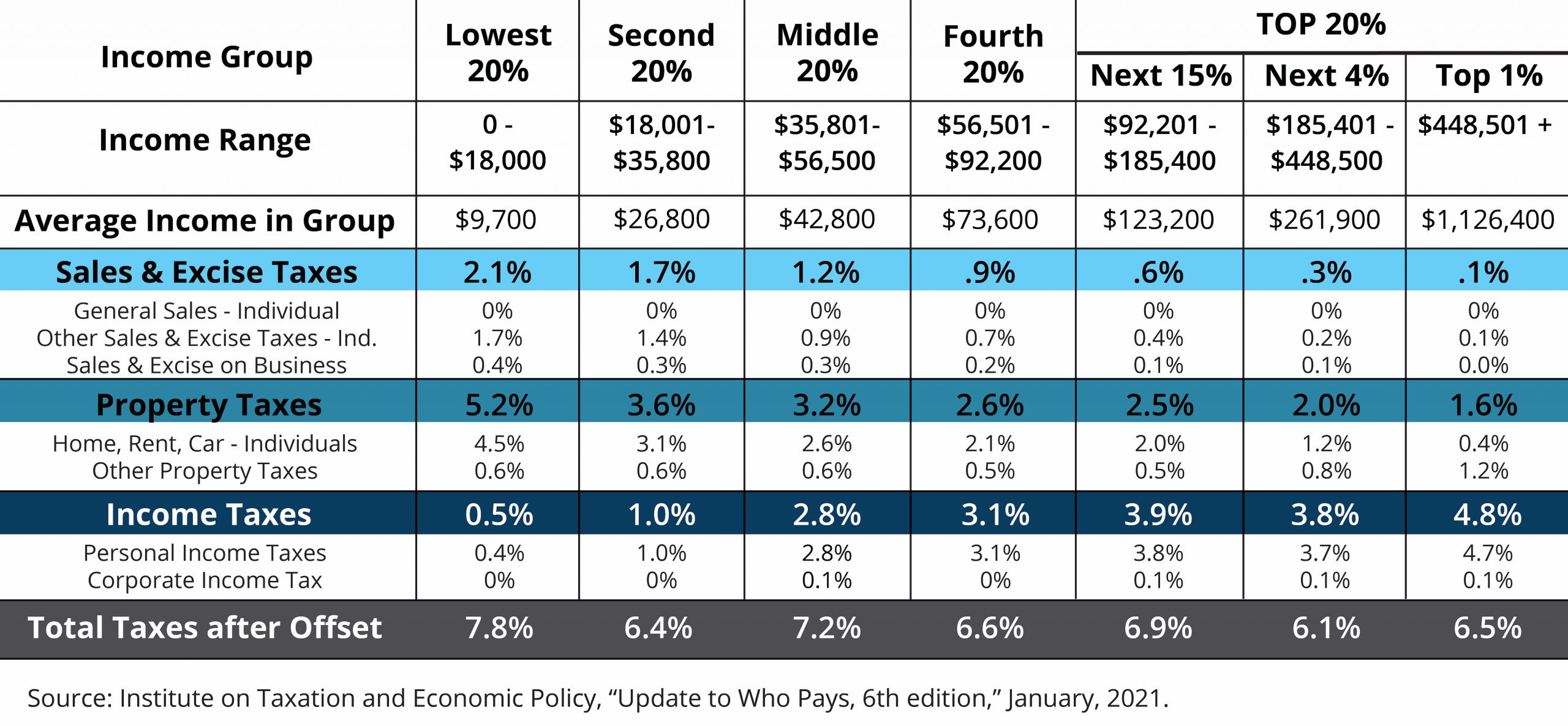

Policy Basics Who Pays Taxes In Montana Montana Budget Policy Center

Montana State Income Tax Rebate 2024 - Montana Head of Household Filer Tax Tables Montana Residents State Income Tax Tables for Head of Household Filers in 2024 Personal Income Tax Rates and Thresholds Tax Rate Taxable Income Threshold 4 7 Income from 000 00 to