Mn Property Tax Rebate 2024 Property taxes or rent paid on your primary residence in Minnesota Regular Property Tax Refund Income Requirements If you are and You may qualify for a refund of up to A renter Your total household income is less than 73 270 2024 Your property must be classified as your homestead or you must have applied for homestead

Major changes are summarized below We will share updated guidance and tax forms for affected tax years as soon as they are available generally in early fall Individuals Individual Income Tax Tax Credits for Individuals Property Tax Refunds Other Tax Rebates and Refunds Businesses Business Income Tax Minnesota allows a property tax credit to renters and homeowners who were residents or part year residents of Minnesota during the tax year 2024 The deadline for claiming the 2023 refund is August 15 2024 The refund will be deposited into the account indicated in the e file process The account cannot be a foreign account

Mn Property Tax Rebate 2024

Mn Property Tax Rebate 2024

https://www.signnow.com/preview/513/825/513825734/large.png

Deadline For Tax And Rent Relief Extended

https://www.senatorhughes.com/wp-content/uploads/2022/06/property-tax-rebate-2021-booklet.jpg

M1pr Form 2022 Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/459/835/459835865/large.png

That permanent change would be effective for property taxes payable in 2024 but the bill would beef up the refund program even more on a onetime basis For refunds on taxes payable in 2023 the increase in property taxes would only need to be 6 and the maximum refund would be 2 500 The deadline for filing claims based on taxes payable in 2023 is August 15 2024 taxpayers filing claims after that date will not receive a refund How many homeowners receive refunds and what is the total amount paid 508 238 homeowners received refunds based on 2020 property taxes payable and 2019 incomes

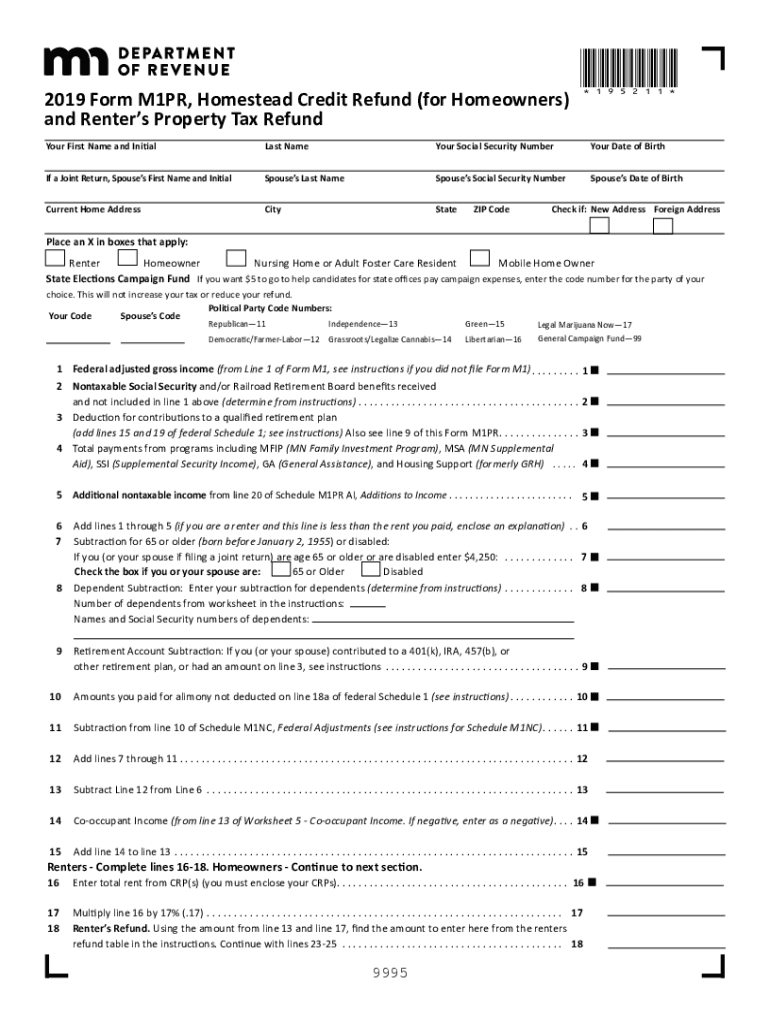

2024 If you own use your Property Tax Statement Get the tax form called the 2023 Form M 1PR Homestead Credit Refund for Homeowners and Renter s Property Tax Refund You can call 651 296 3781 to get a form or write to Minnesota Tax Forms Mail Station 1421 600 N Robert St St Paul MN 55146 1421 Qualifying homeowners have property tax increases of more than 12 and more than 100 over the previous year s taxes To be eligible homeowners must currently own and live in the same house they lived in the previous year The refund is 60 of the increase in excess of the greater of 12 or 100

Download Mn Property Tax Rebate 2024

More picture related to Mn Property Tax Rebate 2024

Form It 2023 Income Allocation And Apportionment Printable Pdf Download Free Hot Nude Porn Pic

https://data.formsbank.com/pdf_docs_html/262/2629/262988/page_1_thumb_big.png

PA Rent property Tax Rebate Deadline Is Dec 31

https://www.gannett-cdn.com/-mm-/c7d45056378a34e0c7b84c67f874fae8f3653a44/c=0-377-1735-1357/local/-/media/2015/11/17/PAGroup/YorkDailyRecord/635833565265831604-ThinkstockPhotos-479013272.jpg?width=3200&height=1680&fit=crop

Mn Dept Of Revenue Form M1pr Instructions Essentially cyou 2022

https://www.pdffiller.com/preview/393/455/393455515/large.png

Minnesotans who lived in the state for at least part of 2021 filed a Minnesota tax return or property tax refund and are below a certain income threshold will receive a check Here are the check totals 260 for individuals with adjusted gross income of 75 000 or less In 2020 over 99 700 homeowners claimed refunds based on their property tax increase from payable 2019 to 2020 The average refund amount was 99 How are claims filed Refund claims are filed using the Minnesota Department of Revenue DOR Schedule M1PR the homestead credit refund form

Click Property Tax Refund in the Minnesota Quick Q A Topics menu to expand This refund does not transfer to your Minnesota Form M1 File by August 15 2024 Your 2023 Form M1PR should be mailed delivered or electronically filed with the department by August 15 2024 The final deadline to claim the 2023 refund is Aug 15 2024 The Minnesota Department of Revenue announced Monday it s finished processing the one time tax rebate payments It sent just over 2 million direct deposits and paper checks totaling nearly

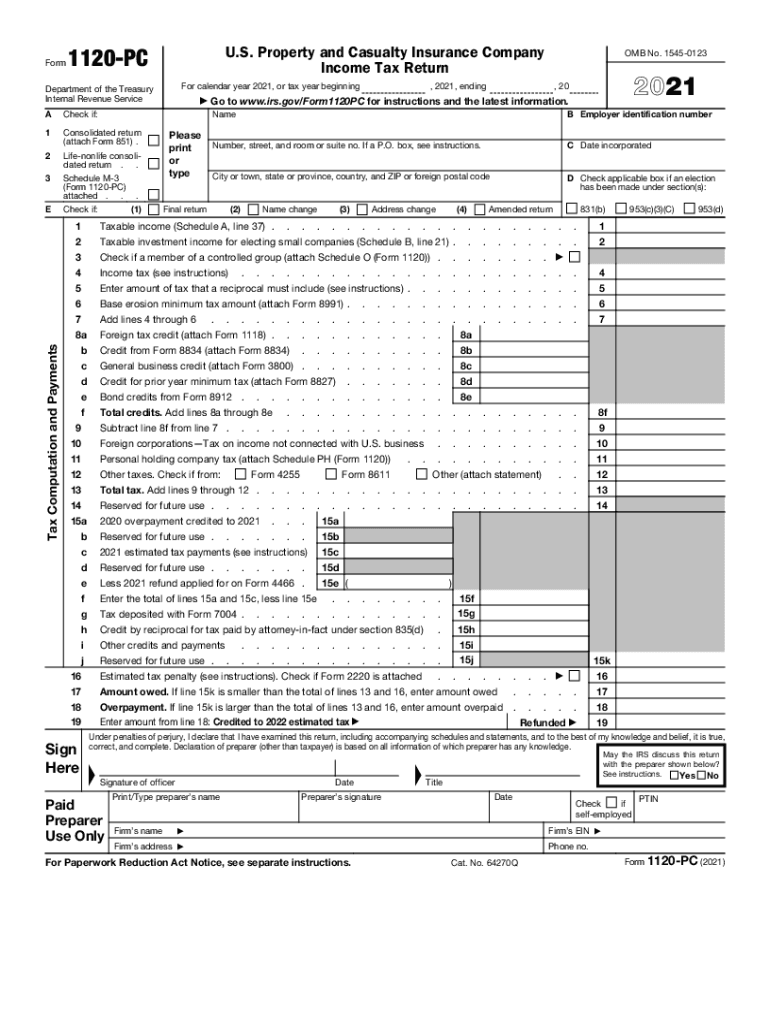

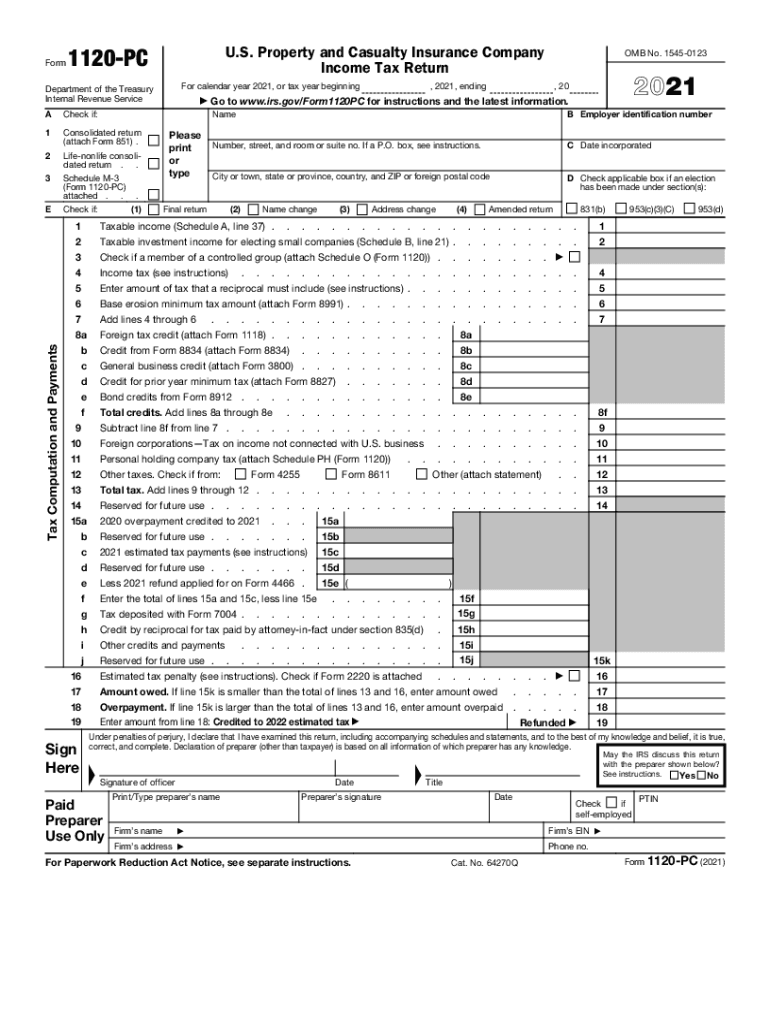

2021 Form IRS 1120 PC Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/578/940/578940595/large.png

Renters Rebate Mn Instructions RentersRebate

https://i0.wp.com/www.rentersrebate.net/wp-content/uploads/2022/12/2022-rent-certificate-form-fillable-printable-pdf-forms-handypdf-2.png?fit=640%2C800&ssl=1

https://www.revenue.state.mn.us/sites/default/files/2023-12/m1pr-inst-23.pdf

Property taxes or rent paid on your primary residence in Minnesota Regular Property Tax Refund Income Requirements If you are and You may qualify for a refund of up to A renter Your total household income is less than 73 270 2024 Your property must be classified as your homestead or you must have applied for homestead

https://www.revenue.state.mn.us/tax-law-changes

Major changes are summarized below We will share updated guidance and tax forms for affected tax years as soon as they are available generally in early fall Individuals Individual Income Tax Tax Credits for Individuals Property Tax Refunds Other Tax Rebates and Refunds Businesses Business Income Tax

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of Southeastern Pennsylvania

2021 Form IRS 1120 PC Fill Online Printable Fillable Blank PdfFiller

Minnesota Fillable Tax Forms Printable Forms Free Online

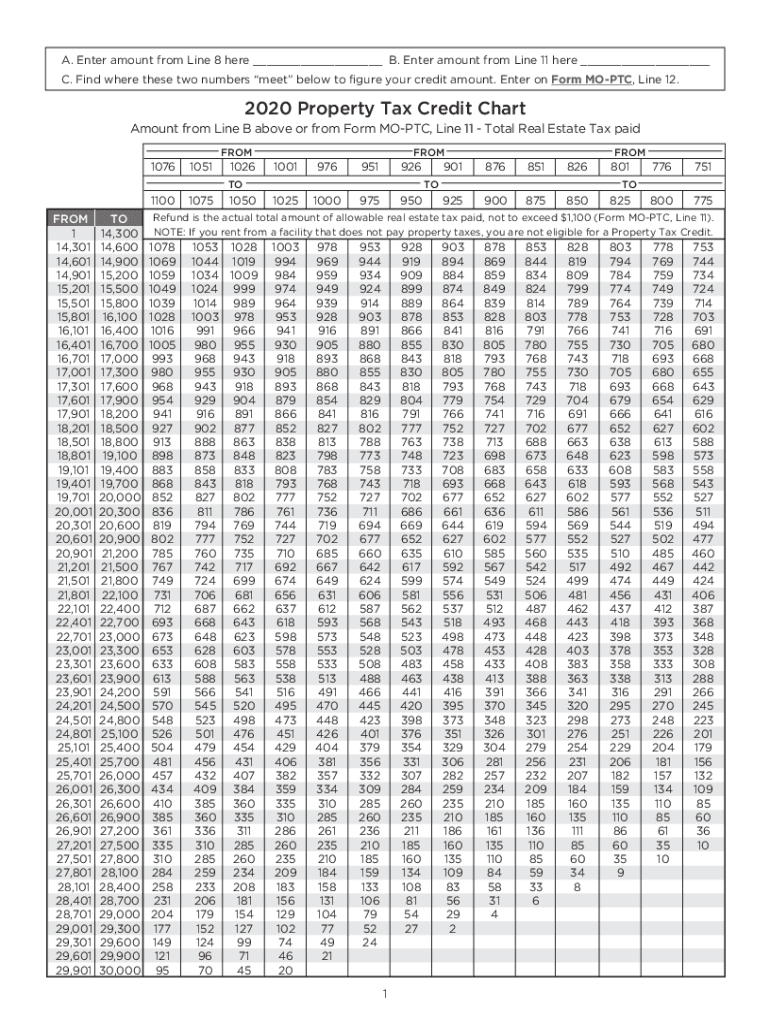

2020 Form MO MO PTC Chart Fill Online Printable Fillable Blank PdfFiller

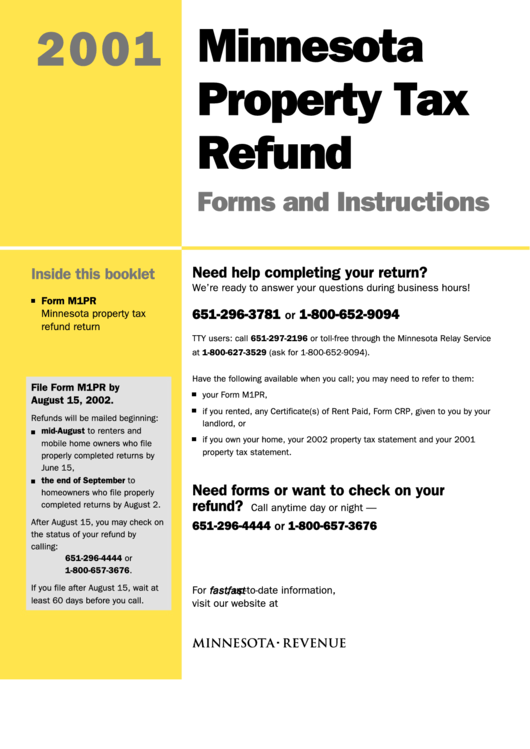

Instructions For Minnesota Property Tax Refund Printable Pdf Download

Who Qualifies For MN Property Tax Credit Leia Aqui Who Qualifies For A Minnesota Property Tax

Who Qualifies For MN Property Tax Credit Leia Aqui Who Qualifies For A Minnesota Property Tax

Mn Renters Rebate Refund Table RentersRebate

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of Southeastern Pennsylvania

Mn Fillable Tax Forms Printable Forms Free Online

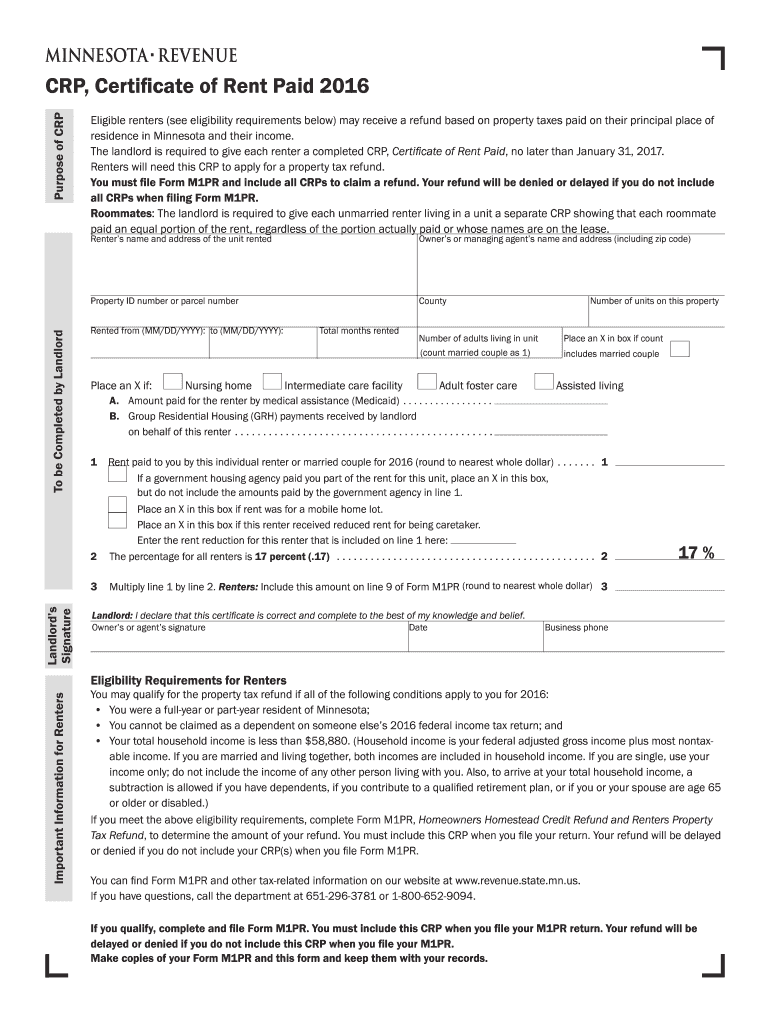

Mn Property Tax Rebate 2024 - You must give each renter a CRP by January 31 2024 Renters will need the CRP to apply for the Renter s Property Tax Refund The Minnesota Department of Revenue has expanded access to their CRP system in e Services and you will be able to create CRPs using e Services by January 1 2024 all residential property owners and managing agents