Minnesota Tax Rebates 2024 Published December 10 2023 According to Minnesota Gov Tim Walz the IRS will tax state rebates sent to many Minnesota residents last year These rebates commonly known as Walz checks

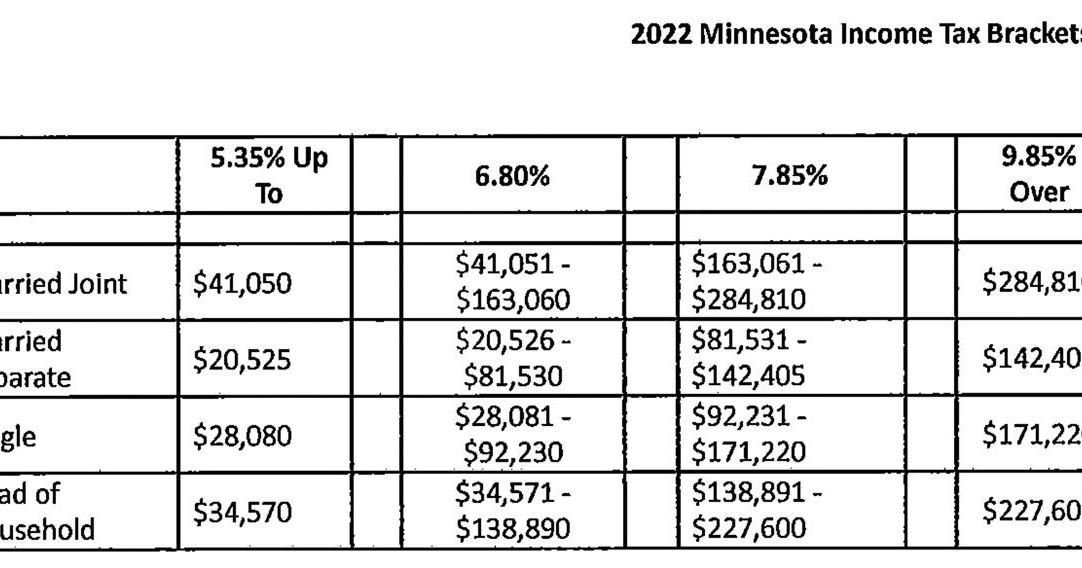

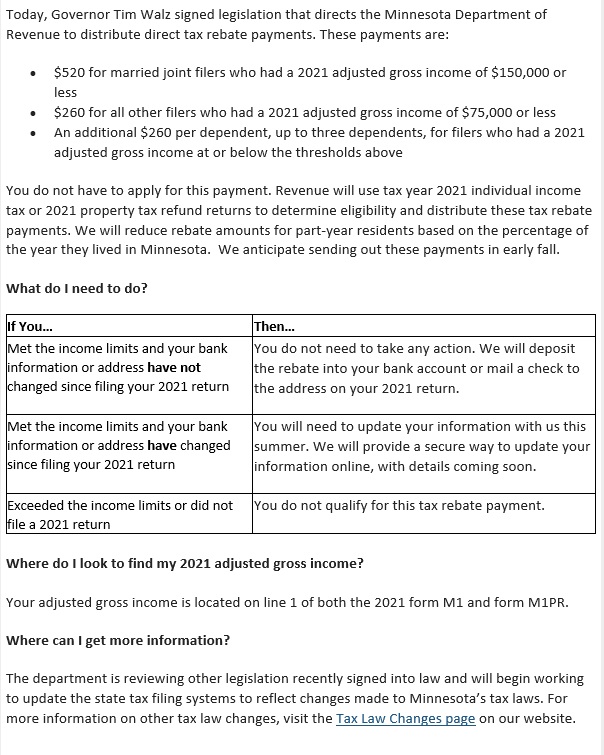

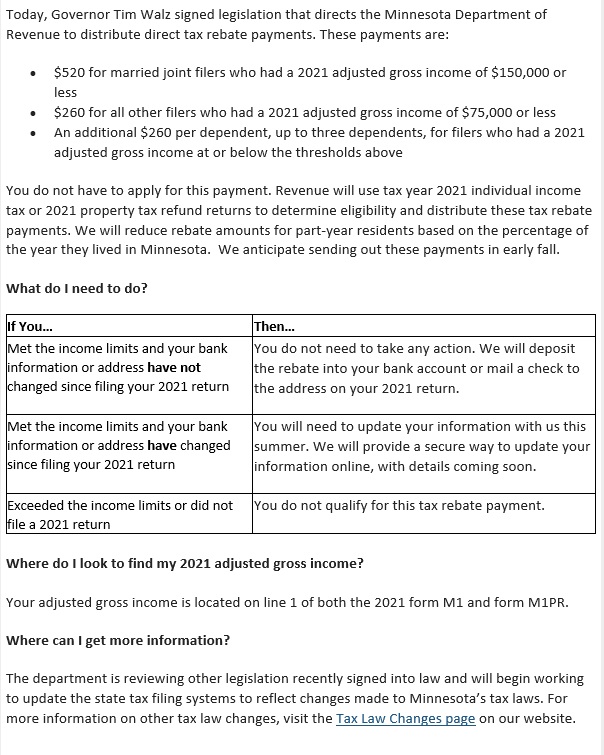

Direct Tax Rebate Payments The tax bill included a one time income tax rebate for tax year 2021 T he credit equals 520 for a married couple filing a joint return and 260 for a single filer head of household or married taxpayer filing a separate return If taxpayers have dependents the credit is increased by 260 per dependent up to an In the application of the Minnesota EV Tax Rebate Program an Electric Vehicle is defined as a motor vehicle that is able to be powered by an electric motor drawing current from rechargeable storage batteries fuel cells or other portable sources of electrical current and meets or exceeds applicable regulations in Code of Federal Regulations title 49 part 571 and successor requirements

Minnesota Tax Rebates 2024

Minnesota Tax Rebates 2024

https://jnba.com/wp-content/uploads/2023/07/mn-tax-refund.png

Minnesota Tax Rebates Are Arriving Here s How Much To Expect Kare11

https://media.kare11.com/assets/KARE/images/a7690272-fb68-424b-9cd1-314821528328/a7690272-fb68-424b-9cd1-314821528328_1140x641.jpg

Minnesota Tax Rebate 2023 Your Comprehensive Guide PrintableRebateForm

https://printablerebateform.net/wp-content/uploads/2023/04/Minnesota-Tax-Rebate-2023-768x679.png

Those making 75 000 or less received 260 couples making 150 000 or less got 520 and parents in those income brackets got another 260 per child for up to three kids with the maximum January 12 2024 2 22 PM Gov Tim Walz announces details of the rebate program providing up to 1 300 for Minnesota families during a press conference at the State Capitol in St Paul Ben

260 for individuals with adjusted gross income of 75 000 or less 520 for married couples who filed a joint return with an adjusted gross income of 150 000 or less An additional 260 added for each dependent filed on the tax return with a maximum of three dependents totaling 780 Michael J Bologna Minnesota taxpayers who banked nearly 1 billion in rebate checks earlier this year are required to pay federal income taxes on the payments in 2024 the state Department of Revenue confirmed Wednesday Revenue officials had hoped the rebates sent to 2 4 million taxpayers would enjoy tax free treatment at the federal level

Download Minnesota Tax Rebates 2024

More picture related to Minnesota Tax Rebates 2024

Minnesota Tax Rebates To Begin Arriving This Week Albert Lea Tribune Albert Lea Tribune

https://www.albertleatribune.com/wp-content/uploads/sites/14/2023/08/Screen-Shot-2023-08-15-at-6.50.18-PM.png?w=1024

Minnesota Tax Rebates Claiming Your 1 300 Stimulus Check Now

https://www.lamansiondelasideas.com/wp-content/uploads/2023/08/Stimulus-Check-in-Minnesota-Tax-Rebates-summer.jpg

Minnesota Income Tax Brackets Standard Deduction And Dependent Exemption Amounts For 2022

https://bloximages.chicago2.vip.townnews.com/walkermn.com/content/tncms/assets/v3/editorial/0/23/0239d6a0-5dd4-11ec-bd8c-8fec48e13613/61ba32c9dc80e.image.jpg?crop=1082%2C568%2C59%2C0&resize=1082%2C568&order=crop%2Cresize

The Minnesota Department of Revenue announced Monday it s finished processing the one time tax rebate payments It sent just over 2 million direct deposits and paper checks totaling nearly By Peter G Pupke On May 24 2023 Minnesota Governor Tim Waltz signed an omnibus tax bill that includes a one time tax rebate and a child care credit for low income families The bill also revises the state s IRC conformity date enacts a net investment income tax conforms the state to the federal tax on foreign corporations changes some

Depending on Minnesotans income and the size of their rebate check the federal tax could take between 26 and 286 of the rebate The Minnesota Department of Revenue says it will be Minnesota Solar Incentives Tax Credits And Rebates Of 2024 By Timothy Moore Contributor Fact Checked Lexie Pelchen Editor Published Sep 18 2023 12 00pm We earn a commission from partner

Brian Bakst On Twitter About Those Minnesota Tax Rebates This From MNRevenue

https://pbs.twimg.com/media/Fw6fqA5XgAwr7Mx.jpg

NJ ANCHOR Property Tax Rebates Who Can Qualify In 2024

https://www.northjersey.com/gcdn/-mm-/e12712590430b2876b51073aa0fd9d0df788d233/c=0-357-3866-2541/local/-/media/2017/05/08/Bergen/NorthJersey/636298617519756307-20170508-173344.jpg?width=3200&height=1808&fit=crop&format=pjpg&auto=webp

https://www.kiplinger.com/taxes/irs-will-tax-walz-check-minnesota-rebates

Published December 10 2023 According to Minnesota Gov Tim Walz the IRS will tax state rebates sent to many Minnesota residents last year These rebates commonly known as Walz checks

https://www.revenue.state.mn.us/tax-law-changes

Direct Tax Rebate Payments The tax bill included a one time income tax rebate for tax year 2021 T he credit equals 520 for a married couple filing a joint return and 260 for a single filer head of household or married taxpayer filing a separate return If taxpayers have dependents the credit is increased by 260 per dependent up to an

Tax Cuts And Rebates Minnesota House Of Representatives

Brian Bakst On Twitter About Those Minnesota Tax Rebates This From MNRevenue

New Federal Tax Brackets For 2023

Understanding Income Tax Reliefs Rebates Deductions And Exemptions In Malaysia

Minnesota Solar Power For Your House Rebates Tax Credits Savings Tax Credits Incentive

Who Will Get A Tax Rebate In Minnesota And When Will They Get It MinnPost

Who Will Get A Tax Rebate In Minnesota And When Will They Get It MinnPost

Minnesota Fillable Tax Forms Printable Forms Free Online

Tax Rebates 2023 Minnesota Governor Wants To Use State Surplus For Tax Rebates Washington

Tax Refund 2023 Latest Tax Refund News Updates

Minnesota Tax Rebates 2024 - Those making 75 000 or less received 260 couples making 150 000 or less got 520 and parents in those income brackets got another 260 per child for up to three kids with the maximum