Is Nys 2024 Homeowner Tax Rebate Taxable 2022 Homeowner Tax Rebate Credit Check Lookup Note The homeowner tax rebate credit was a one year program which ended in 2022 The credit is not available for future years If you have questions about the program or received a letter regarding your 2022 payment see Frequently asked questions Lost stolen destroyed and uncashed checks

How to register 1 Gather the following information Property Key at the top of your letter names and Social Security numbers for all owners of the property and their spouses primary residence of the owners and their spouses approximate date the owners purchased the property and the names of the sellers address of any residential property You may be thinking of the homeowner tax rebate credit HTRC checks that we issued in 2022 HTRC was a one year program for 2022 only you will not receive an HTRC check for 2023 or other years The STAR program is separate from HTRC and STAR benefits are granted in the form of either

Is Nys 2024 Homeowner Tax Rebate Taxable

Is Nys 2024 Homeowner Tax Rebate Taxable

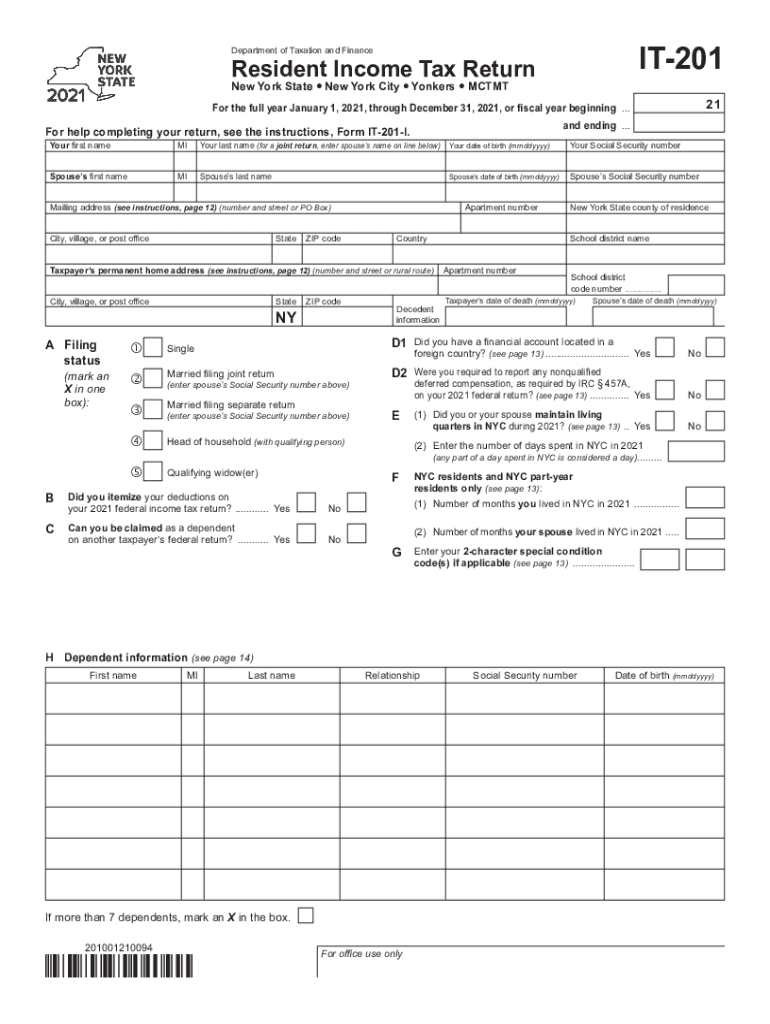

https://perinton.org/wp-content/uploads/2022-Homeowner-Tax-Rebate-Credit-HTRC-1-600x503.png

Homeowner Tax Rebate Credit Checks On Their Way To NYS Residents WWTI InformNNY

https://www.informnny.com/wp-content/uploads/sites/58/2022/06/GettyImages-985842598-2.jpg?w=1920&h=1080&crop=1

NYS Homeowner Tax Rebate Credit Checks Being Mailed Out

https://townsquare.media/site/497/files/2022/06/attachment-RS28849_ThinkstockPhotos-623211702-scr.jpg?w=1200&h=0&zc=1&s=0&a=t&q=89

The FY 2024 Budget adds 50 million for a Homeowner Stabilization Fund to finance home repairs in 10 communities across the state that have been identified as having high levels of low income homeowners of color and homeowner distress The amount of the credit is the product of the amount of real property tax which exceeds 6 of the taxpayer s qualified gross income QGI and a specified rate based on the taxpayer s QGI To claim the credit the computed amount must exceed 250 The maximum credit allowed is 350

A school tax liability for the 2022 2023 school year that is more than your 2022 STAR benefit Note By law we can t issue checks for the Homeowner tax rebate credit that are less than 100 If the amount of the credit calculated was less than 100 you will not receive a check To learn more please visit our Homeowner tax rebate credit Definition of income for property tax relief For the property tax relief credit income is defined as federal adjusted gross income FAGI from two years prior modified so that the net amount of loss reported on Federal Schedule C D E or F doesn t exceed 3 000 the net amount of any other separate category of loss doesn t exceed 3 000 and

Download Is Nys 2024 Homeowner Tax Rebate Taxable

More picture related to Is Nys 2024 Homeowner Tax Rebate Taxable

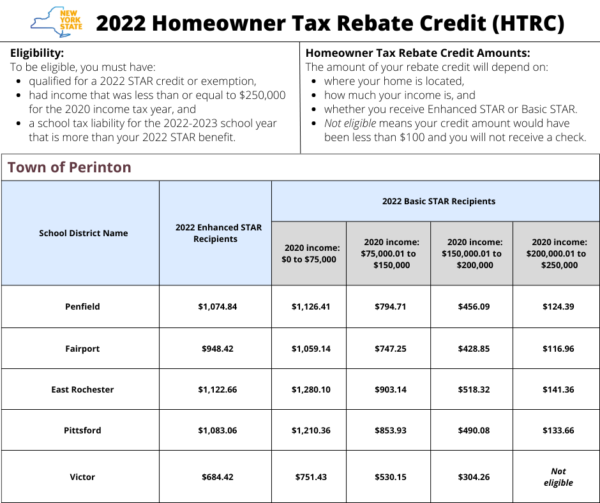

2023 Nys Tax Form Printable Forms Free Online

https://www.pdffiller.com/preview/584/982/584982095/large.png

NYS Homeowner Tax Credit Talks Lyons Main Street

https://static.wixstatic.com/media/0e0fa1_815d22e1cacf4551823c50c8085bfdde~mv2.jpg/v1/fill/w_1545,h_1530,al_c,q_90/0e0fa1_815d22e1cacf4551823c50c8085bfdde~mv2.jpg

Confusion Over When Eligible New Yorkers Will Get Their Homeowner Tax Rebate Check CNYcentral

https://chittenango.com/wp-content/uploads/2022/08/bb776db9-9697-43c3-882f-8577bedc9e89-large16x9_tax_rebate.PNG

Accelerates a 1 2 Billion Dollar Middle Class Tax Cut and Provides a Homeowner Tax Rebate Credit for Almost 2 5 Million New Yorkers Provides Up to 250 Million in Tax Credits and Relief for Small Businesses COVID 19 Related Expenses and Exempts 15 Percent in Eligible Small Business Income from Taxation Through a Tax Relief Program The amount of the credit is between 250 and 350 and will be available through 2023 To be eligible homeowners must be Eligible for the 2022 School Tax Relief STAR credit or exemption Make less than 250 000 a year based on federal adjusted gross income from tax year 2020 and Have a school tax liability for the 2022 2023 school year

NEW YORK WWTI Residents are encouraged to check their mail since New York State has begun mailing Homeowner Tax Rebate checks to homeowners The homeowner tax rebate credit is a one year program that is providing direct property tax relief to about 2 5 million eligible homeowners this year Those who qualify don t need to do anything More on NY tax credits Hochul wants to send 2 2 billion in property tax rebate checks in fall of election year More on NY s budget proposal Tax cuts health care worker bonuses 10 things to

Your Stories Q A Where Is My NYS Homeowner Tax Rebate Credit Check YouTube

https://i.ytimg.com/vi/ZN9k_nErOQE/maxresdefault.jpg

New York State Begins Mailing Out Homeowner Tax Rebate Credit Checks Wgrz

https://media.wgrz.com/assets/WGRZ/images/1045202f-604f-4386-8a31-35efff450899/1045202f-604f-4386-8a31-35efff450899_1920x1080.jpg

https://www.tax.ny.gov/pit/property/htrc/lookup.htm

2022 Homeowner Tax Rebate Credit Check Lookup Note The homeowner tax rebate credit was a one year program which ended in 2022 The credit is not available for future years If you have questions about the program or received a letter regarding your 2022 payment see Frequently asked questions Lost stolen destroyed and uncashed checks

https://www.tax.ny.gov/pit/property/htrc-registration.htm

How to register 1 Gather the following information Property Key at the top of your letter names and Social Security numbers for all owners of the property and their spouses primary residence of the owners and their spouses approximate date the owners purchased the property and the names of the sellers address of any residential property

Money In Your Pocket Who Qualifies For Tax Cut Property Tax Rebate In NYS 2023 Budget WRGB

Your Stories Q A Where Is My NYS Homeowner Tax Rebate Credit Check YouTube

New York State Begins Mailing Out Homeowner Tax Rebate Credit Checks Wgrz

Nys School Tax Relief Checks Printable Rebate Form

Nys Star Tax Rebate Checks 2022 StarRebate

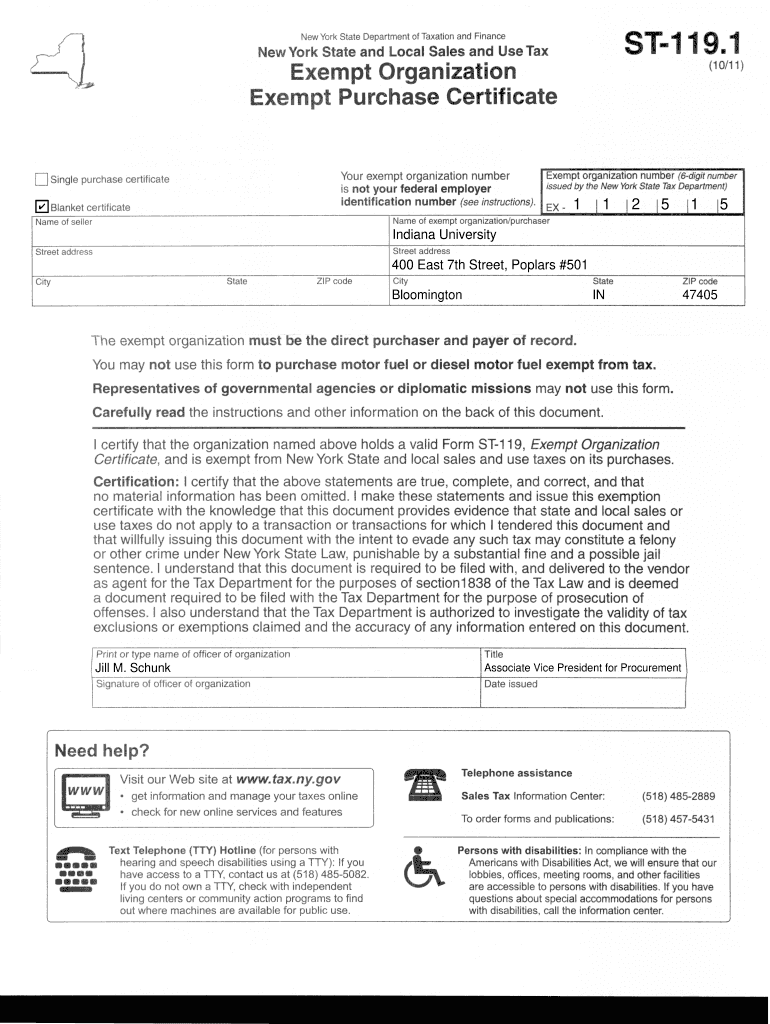

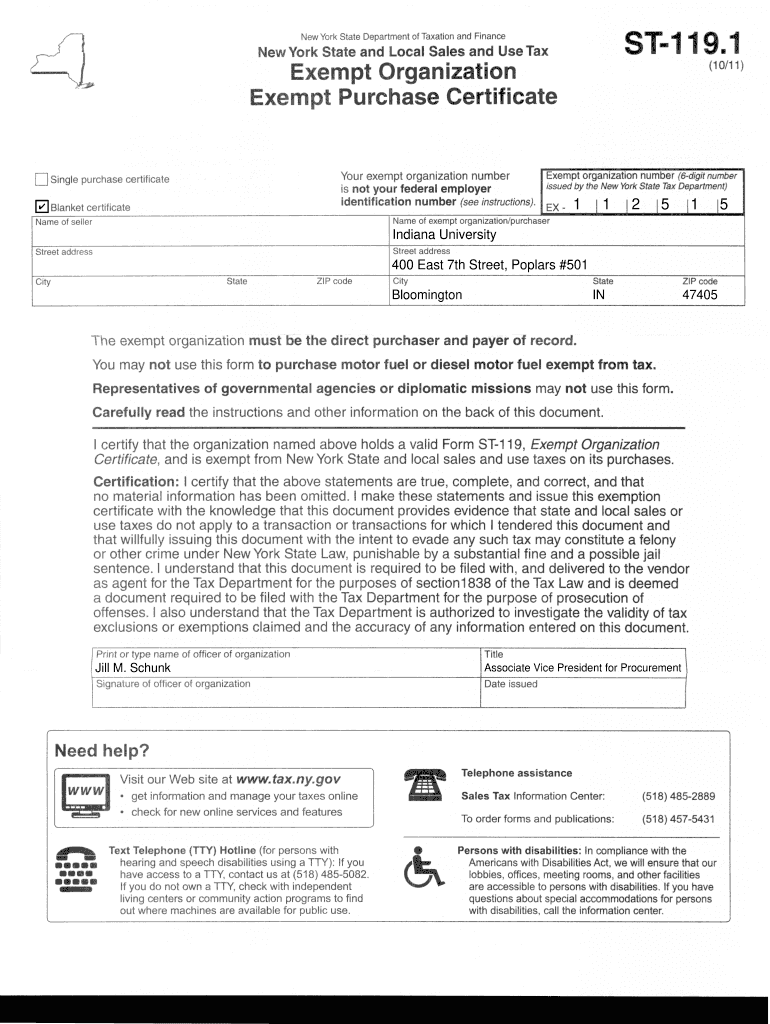

Nys Sales Tax Exempt Form 119 1 ExemptForm

Nys Sales Tax Exempt Form 119 1 ExemptForm

Nys Rebate Check For Property Tax Tax Rebate

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

Nys Withholding Tax Forms 2022 WithholdingForm

Is Nys 2024 Homeowner Tax Rebate Taxable - Definition of income for property tax relief For the property tax relief credit income is defined as federal adjusted gross income FAGI from two years prior modified so that the net amount of loss reported on Federal Schedule C D E or F doesn t exceed 3 000 the net amount of any other separate category of loss doesn t exceed 3 000 and