Irs Child Tax Credit 2021 Eligibility If you are eligible for the Child Tax Credit but did not receive advance Child Tax Credit payments you can claim the full credit amount when you file your 2021 tax return

Below are frequently asked questions about the Advance Child Tax Credit Payments in 2021 separated by topic Do not call the IRS Our phone assistors don t have information beyond Unless they unenroll the monthly payment amount will be up to 300 per month for each qualifying child under age six at the end of 2021 and up to 250 per month for each

Irs Child Tax Credit 2021 Eligibility

Irs Child Tax Credit 2021 Eligibility

https://static.twentyoverten.com/5d5413591d304774fba39eb3/6kFYVeqmtJC/Adjusted-Gross-Income.jpg

Written By Diane Kennedy CPA On March 12 2022

https://www.ustaxaid.com/wp-content/uploads/2022/03/1928846-1536x1024.jpg

Child Tax Credit Payment Schedule 2022 Child Tax Credit Payment

https://i2.wp.com/www.taxpolicycenter.org/sites/default/files/model-estimates/images/T05-0195.gif

Recent Updates New and Improved ChildTaxCredit gov This website exists to help people Get the Child Tax Credit Understand how the 2021 Child Tax Credit works Find out if they are The IRS determined your advance Child Tax Credit payment amounts by estimating the amount of the Child Tax Credit that you would be eligible to claim on your 2021

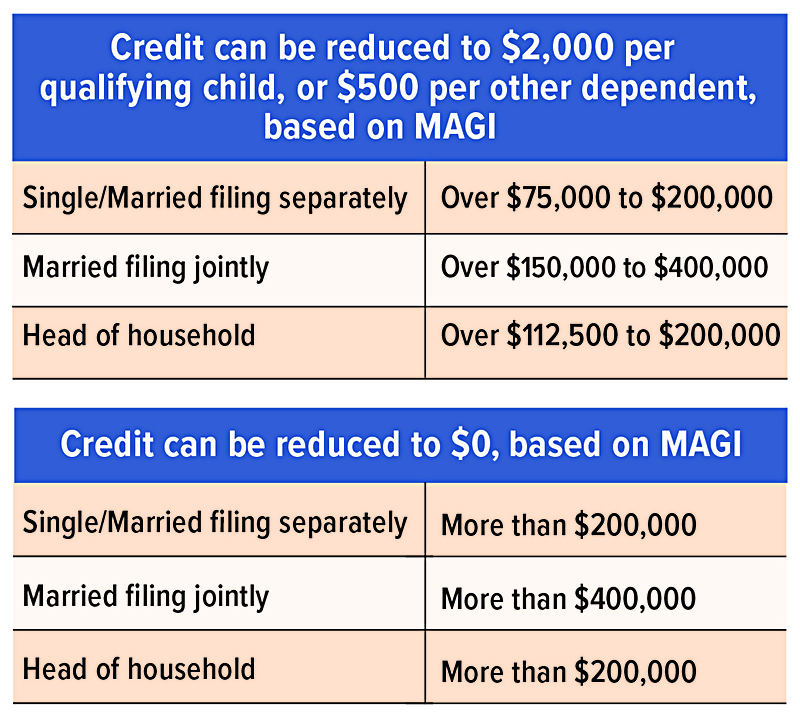

Eligible families will receive a payment of up to 300 per month for each child under age 6 and up to 250 per month for each child age 6 and above The American Rescue The child tax credit credit for other dependents and the additional child tax credit are entered on Form 1040 The intake and interview sheet along with the Volunteer Resource Guide Tab G

Download Irs Child Tax Credit 2021 Eligibility

More picture related to Irs Child Tax Credit 2021 Eligibility

The Proposed 2022 Child Tax Credit How Will The Changes Affect You

https://lirp.cdn-website.com/md/pexels/dms3rep/multi/opt/pexels-photo-6863513-1920w.jpeg

Dependent Care Fsa Or Child Tax Credit 2022 Kitchen Cabinet

https://i2.wp.com/static.twentyoverten.com/5afae91ee233a94fd2b8b963/AyQa5SwvUG/1616431432591.png

3 600 Child Tax Credit 2021 250 300 Monthly Payment How Much You

https://i.ytimg.com/vi/k2134EiKQ3Y/maxresdefault.jpg

2021 may be eligible to claim the ACTC if they meet the following conditions Taxpayers with more than 2 500 of taxable earned income may be eligible for the additional child tax credit if More than 96 of families with children 17 and younger are eligible for the child tax credit The IRS interactive eligibility assistant lets families quickly learn if they qualify

In the legislation the IRS is directed to to establish a program to make periodic advance payments of equal amounts of the child tax credit to eligible taxpayers Periodic Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers The Child Tax Credit Update portal is no

Taking A Stand For Children Through The Child Tax Credit Tax Credits

https://i0.wp.com/www.taxcreditsforworkersandfamilies.org/wp-content/uploads/2022/02/TCWF_knockout_horizontal.png?w=4439&ssl=1

Claiming Advance Child Tax Care Credits For Tax Year 2021 Haugen Law

https://haugenlawgroup.com/wp-content/uploads/2022/01/Form-6419-1024x594.jpg

https://www.irs.gov/credits-deductions/2021-child...

If you are eligible for the Child Tax Credit but did not receive advance Child Tax Credit payments you can claim the full credit amount when you file your 2021 tax return

https://www.irs.gov/credits-deductions/2021-child...

Below are frequently asked questions about the Advance Child Tax Credit Payments in 2021 separated by topic Do not call the IRS Our phone assistors don t have information beyond

Child Tax Credits Ending In 2022 Dailynationtoday

Taking A Stand For Children Through The Child Tax Credit Tax Credits

2021 Child Tax Credit And Payments What Your Family Needs To Know

The Child Tax Credit 2021 What Is Changing This Year Christian Fee

Your First Look At 2023 Tax Brackets Deductions And Credits 3

The 2021 Child Tax Credit An Overview Letitia Berbaum

The 2021 Child Tax Credit An Overview Letitia Berbaum

What The New Child Tax Credit Could Mean For You Now And For Your 2021

Child Tax Credit For 2021 Will You Get More Allen Associates

Details From IRS About Enhanced Child Tax Credits

Irs Child Tax Credit 2021 Eligibility - Eligible families will receive a payment of up to 300 per month for each child under age 6 and up to 250 per month for each child age 6 and above The American Rescue