Income Tax Rebate On Electric Cars You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022

Learn about Section 80EEB of the Income Tax Act which offers a tax deduction of up to Rs 1 5 lakh on loans for electric vehicles Find out eligibility conditions and benefits EV buyers can claim up to 1 5 lakh income tax deduction on the interest paid for vehicle loans under section 80EEB of the IT Act The all electric Hyundai Ioniq 5 launched

Income Tax Rebate On Electric Cars

Income Tax Rebate On Electric Cars

https://images.hamodia.com/hamod-uploads/2022/10/31155542/Purchase-Tax-on-Electric-Cars-Set-to-Double.docx-p-1024x668.jpg

Federal Tax Rebates Electric Vehicles ElectricRebate

https://www.electricrebate.net/wp-content/uploads/2022/09/rebates-and-tax-credits-for-electric-vehicle-charging-stations-2.jpg

How To Calculate Electric Car Tax Credit OsVehicle

https://cdn.osvehicle.com/how_is_tax_credit_for_ev_calculated.png

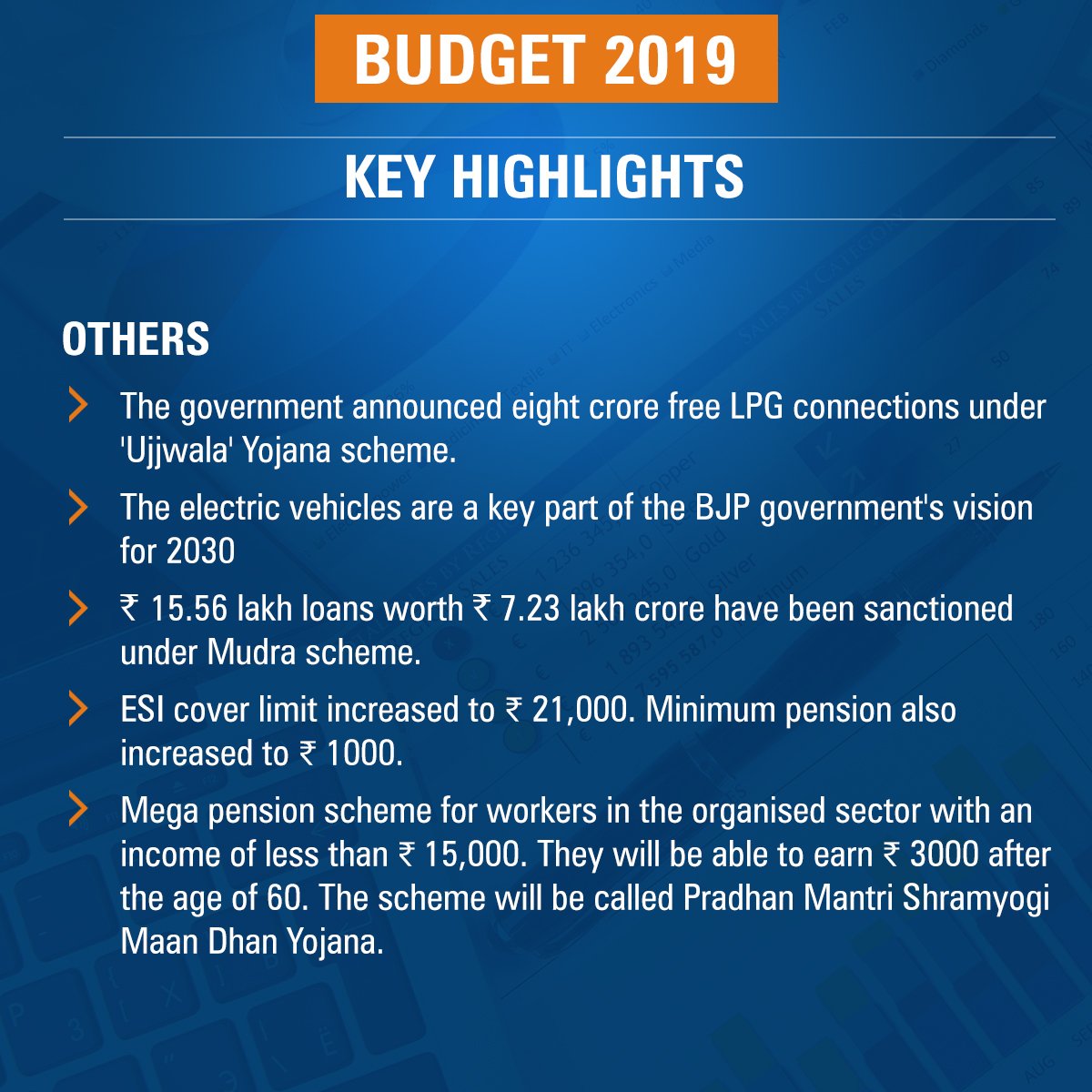

Section 80EEB offers electric car tax relief Here s the list of benefits and top features of Section 80EEB GST rate reduced from 12 to 5 For business usage Tax Benefit MOST IMPORTANT THING You get a deduction of Rs 1 50 000 under section 80EEB on the interest paid on loan taken to buy Electric vehicles Low GST rate The government has reduced the rate of

Find out if your electric vehicle EV or fuel cell vehicle FCV qualifies for a tax credit based on type purchase date and business or personal use GST rate for electric vehicles is reduced to 5 from 12 Upon RC renewal after 15 years a tax will be applied but electric cars are exempt from the green tax

Download Income Tax Rebate On Electric Cars

More picture related to Income Tax Rebate On Electric Cars

Budget 2023 India May Allow Income Tax Rebate On Electric Vehicles

https://www.edatabook.com/assets/news/1674195433tax.jpeg

How Can Taxpayers Obtain Income Tax Rebate In India

https://navi.com/blog/wp-content/uploads/2022/03/income-tax-rebate-1.jpg

Income Tax Rebate Astonishingceiyrs

https://www.aseanbriefing.com/news/wp-content/uploads/2018/08/asb-Partial-Tax-Exemption-Scheme-for-Companies-Available-for-All-Companies-YA-2018-002.jpg

If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles Qualified two wheeled plug in Tax credits up to 7 500 are available for eligible new electric vehicles and up to 4 000 for eligible used electric vehicles You can work with your dealership to process the vehicle tax credit Tax credits are available for home chargers and

Explore the benefits of Section 80EEB providing a deduction for interest paid on loans for Electric Vehicles EVs Understand the eligibility criteria quantum of deduction and conditions for availing this tax benefit Effective immediately after enactment of the Inflation Reduction Act after August 16 2022 the tax credit is only available for qualifying electric vehicles for which final assembly occurred in

Mivo Link Tax Credits On Electric Cars Heat Pumps Will Help Low

https://oregoncapitalchronicle.com/wp-content/uploads/2022/09/DSC04259-scaled.jpg

Federal Tax Rebate For Electric Cars 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2023/05/federal-tax-rebate-on-electric-cars-2022-carrebate-9.jpg

https://www.irs.gov › credits-deductions › credits-for...

You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022

https://www.efiletax.in › blog

Learn about Section 80EEB of the Income Tax Act which offers a tax deduction of up to Rs 1 5 lakh on loans for electric vehicles Find out eligibility conditions and benefits

EV Rebate Across Ditch Limited To 25 000 Cars

Mivo Link Tax Credits On Electric Cars Heat Pumps Will Help Low

How To Apply State Tax Rebate On Electric Cars 2023 Carrebate

The Florida Hybrid Car Rebate Save Money And Help The Environment

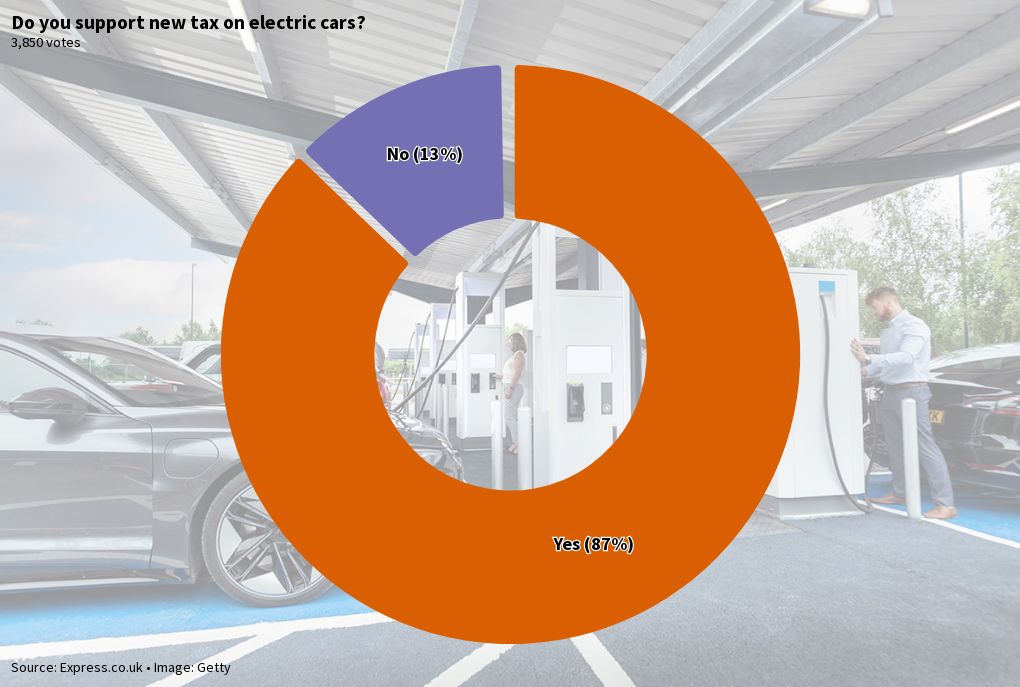

Do You Support New Tax On Electric Cars Flourish

Electric Car Available Rebates 2024 Carrebate

Electric Car Available Rebates 2024 Carrebate

Income Tax

Rebate And Releif Of Tax Rebate 87a Of Income Tax Rebate And Relief

ICICIdirect On Twitter Income Tax Rebate Revised Interest Rates New

Income Tax Rebate On Electric Cars - As of Jan 1 2024 eligible buyers can take the EV tax credit as a discount when purchasing a qualifying vehicle However one of the most important points is that there are