Illinois Tax Rebate 2024 Status El Departamento de Ingresos de Illinois anuncia el inicio de la temporada de impuestos de 2024 The Illinois Department of Revenue IDOR announced that it will begin accepting and processing 2023 tax returns on January 29 the same date the Internal Revenue Service begins accepting federal income tax returns

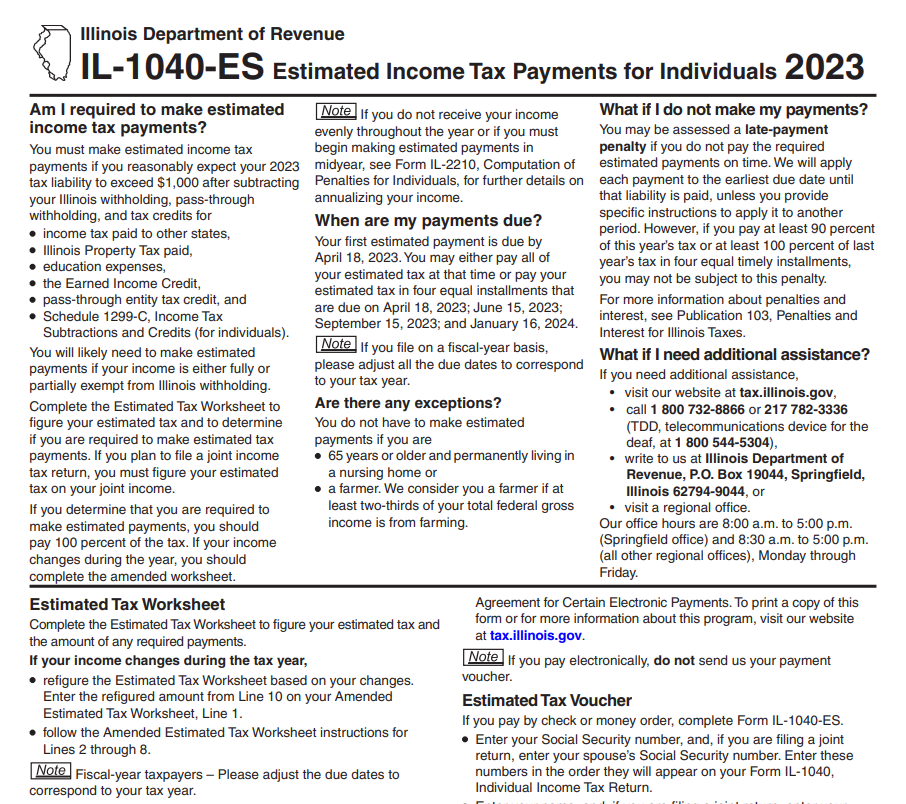

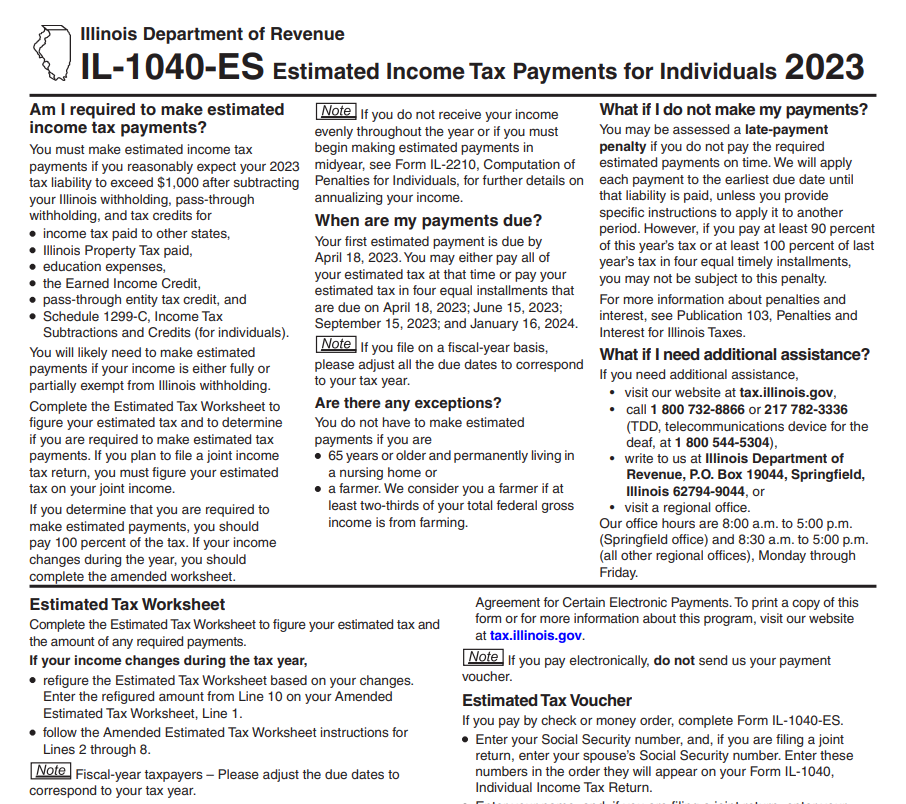

This bulletin summarizes changes for 2023 Illinois Income Tax forms and schedules for individuals and businesses 2024 Withholding Income Tax forms and schedules and tax preparers and software developers FY 2024 15 New Payment Equals Agreement Statute Effective January 1 2024 for Sales Use and Excise Taxes and Fees How Do I Check the Status of my Rebates For additional information or to check on the status of a rebate visit tax illinois gov rebates Those needing can also call 1 800 732 8866

Illinois Tax Rebate 2024 Status

Illinois Tax Rebate 2024 Status

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2023/05/illinois-tax-rebate-2022-cray-kaiser-1.png

Illinois Tax Rebate 2023 Everything You Need To Know Printable Rebate Form

http://printablerebateform.net/wp-content/uploads/2023/03/Illinois-Tax-Rebate-2023.png

Illinois Tax Rebate Check Status Rebate2022

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2023/05/unsure-if-you-ll-receive-illinois-tax-rebate-checks-here-s-what-steps.jpg

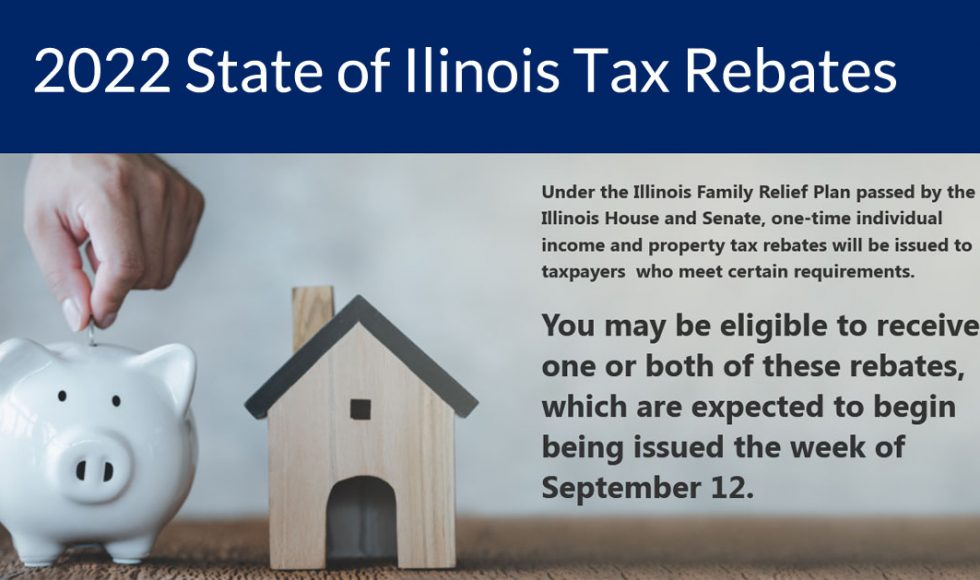

Jan 29 2024 marks the first day the IRS began accepting and processing 2023 tax returns That means taxpayers have to file their returns between that date and April 15 If you need more Published September 29 2022 8 20 pm Illinois has now started to send out income and property tax rebates to eligible taxpayers About six million residents are estimated to receive the

The Illinois Department of Revenue IDOR announced on Thursday Jan 25 that it will begin accepting and processing 2023 tax returns on Monday Jan 29 the same date the Internal Revenue Service IRS begins accepting federal income tax returns We encourage taxpayers to file electronically as early as possible as this will speed processing The property tax rebate amount your clients can receive is equal to the property tax credit they were qualified to claim on the 2021 IL 1040 with a maximum credit of 300 State of Illinois The income tax rebate works in a similar manner allowing individuals to claim a credit of 50 each with an additional 100 per dependent up to 300

Download Illinois Tax Rebate 2024 Status

More picture related to Illinois Tax Rebate 2024 Status

Illinois Income Tax Rebate 2023 Tax Rebate

https://i0.wp.com/www.tax-rebate.net/wp-content/uploads/2023/05/Illinois-Income-Tax-Rebate-2023.jpg

Illinois Tax Rebate 2022 Status Our Recipes

https://i2.wp.com/www.civicfed.org/sites/default/files/illinois_revenues_chart.png

Illinois Ev Tax Rebate 2023 Tax Rebate

https://i0.wp.com/printablerebateform.net/wp-content/uploads/2023/03/Iowa-Tax-Rebate-2023-768x683.png

The State of Illinois is also providing property tax rebates for eligible homeowners in an amount equal to the property tax credit they qualified for on their 2021 returns up to a maximum of 300 First and foremost to be eligible you must have filed taxes In regard to the Individual Income Tax Rebate a person qualifies if they were an Illinois resident in 2021 and their adjusted gross

By Payroll Office January 12 2024 The Internal Revenue Service IRS has set the official start date for the 2024 tax filing season The IRS announced it will begin accepting and processing 2023 tax returns on January 29 2024 The deadline to file 2023 federal and Illinois tax returns or an extension is April 15 2024 ROCKFORD Ill WTVO The Illinois Department of Revenue IDOR announced Thursday that it will begin accepting and processing 2023 tax returns on January 29th 2024 That is also the same

How Does Illinois s Property Tax Rebate Work

https://media.marketrealist.com/brand-img/SxFDcHPyG/1280x670/illinois-property-tax-rebate-1659496759243.jpg?position=top

Tax Rebate FAQs Rep Thaddeus Jones

https://www.repthaddeusjones.com/wp-content/uploads/2022/09/illinois_tax_rebates_2022-980x580.jpg

https://tax.illinois.gov/research/news/illinois-department-of-revenue-announces-start-to-2024-income-ta.html

El Departamento de Ingresos de Illinois anuncia el inicio de la temporada de impuestos de 2024 The Illinois Department of Revenue IDOR announced that it will begin accepting and processing 2023 tax returns on January 29 the same date the Internal Revenue Service begins accepting federal income tax returns

https://tax.illinois.gov/

This bulletin summarizes changes for 2023 Illinois Income Tax forms and schedules for individuals and businesses 2024 Withholding Income Tax forms and schedules and tax preparers and software developers FY 2024 15 New Payment Equals Agreement Statute Effective January 1 2024 for Sales Use and Excise Taxes and Fees

Illinois Tax Rebate 2022 Status Our Recipes

How Does Illinois s Property Tax Rebate Work

Retirees Need To Take Action For Latest Property Tax Rebate NPR Illinois

2022 Illinois Tax Rebates Suzanne Ness State Rep Illinois 66

2022 Taxes 100 Club Of Illinois

Nebraska Tax Rebate 2024 Eligibility Application Deadline Status PrintableRebateForm

Nebraska Tax Rebate 2024 Eligibility Application Deadline Status PrintableRebateForm

IL Tax Rebates Set To Go Out Next Week See If You Qualify Across Illinois IL Patch

REMINDER Illinois Tax Rebate Program Filing Due Date Is October 17

Virginia Tax Rebate 2024

Illinois Tax Rebate 2024 Status - A rebate cycle is open November 1 2023 through January 31 2024 The Application and Instructions are posted below Read all materials carefully to help avoid a denial The Illinois EPA has a Frequently Asked Questions document that answers many common questions