How Much Are The Mlr Rebates For 2024 More families could be eligible for the child tax credit as soon as 2024 if new legislation passes Congress iStock 7 min Comment 295 Congressional negotiators announced a roughly 80 billion

Currently 1 600 of the 2 000 credit per child is refundable The credit s phaseout threshold is 400 000 for married earners filing jointly and 200 000 for head or single households At the But some people may get a boost in 2024 the typical refund check jumped 15 5 to almost 3 300 in 2022 when taxpayers received generous tax credits like the expanded Child Tax Credit

How Much Are The Mlr Rebates For 2024

How Much Are The Mlr Rebates For 2024

https://brokerblog.wordandbrown.com/wp-content/uploads/2022/05/iStock-1270623471-2-1080x586.jpg

MLR Rebates

https://www.basusa.com/hubfs/Stock Images/Business Graphics/iStock-1181224377.jpg

MLR Rebates Under ACA Expected To Top 2 Billion This Fall BenefitsPRO

https://images.benefitspro.com/contrib/content/uploads/sites/412/2021/04/MLRRebates.png

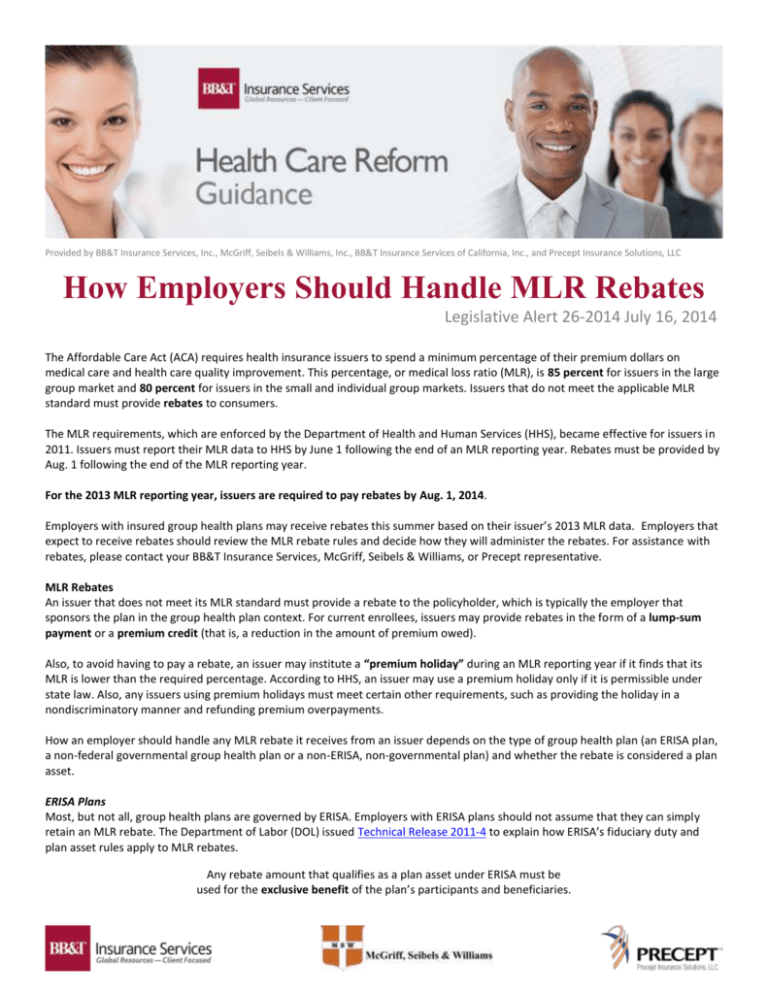

While less generous than the enhanced child tax credit enacted during the Covid 19 pandemic the changes would boost the maximum refundable tax break to 1 800 per child for 2023 up from the The MLR rebate checks in the group market are generally small ranging from about 10 00 to 30 00 per participant Forwarding these funds to employees can be a challenge because the funds may result in additional taxable income and can be a burden on payroll

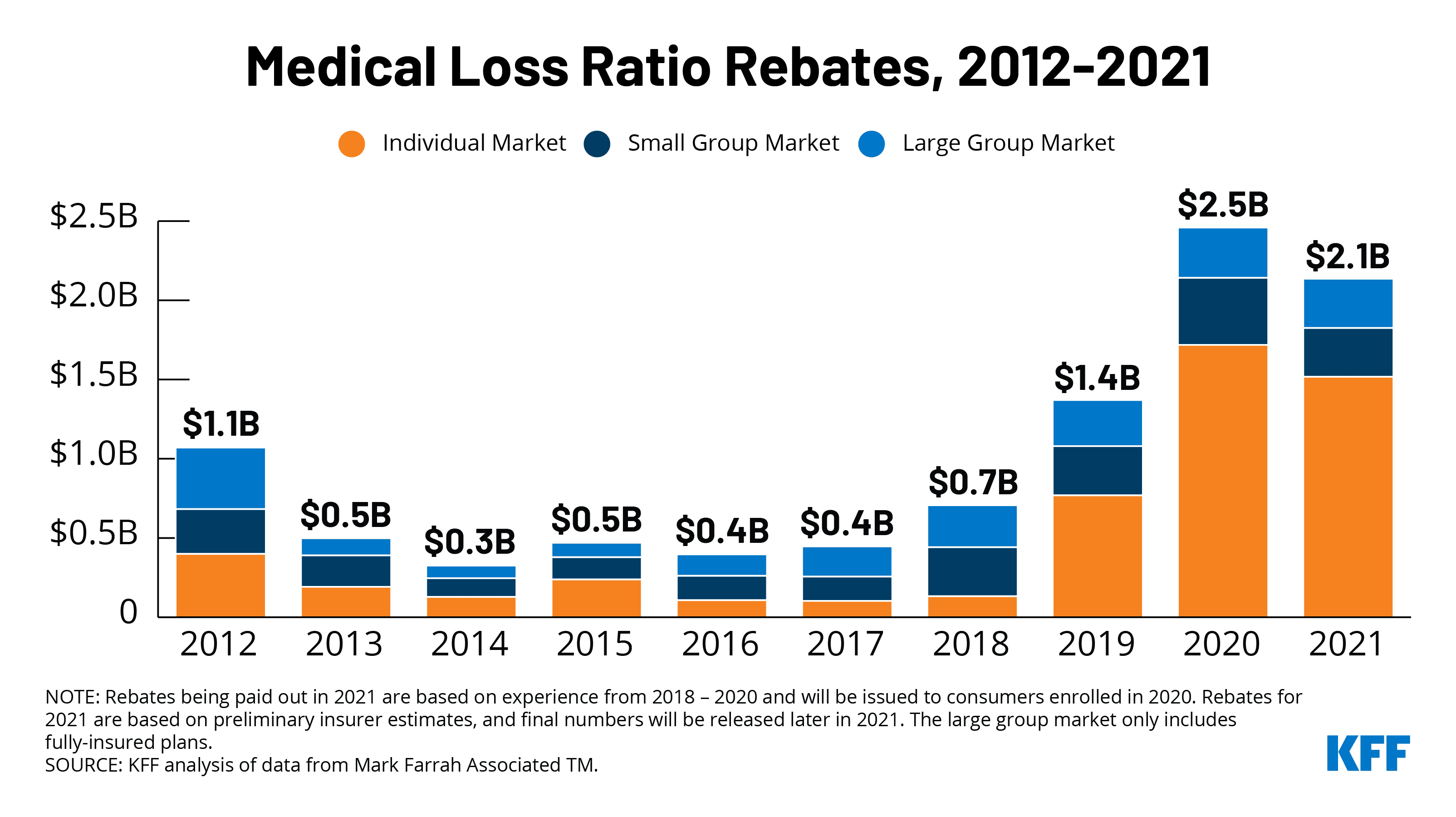

MLR rebates are based on a 3 year average meaning that rebates issued in 2023 will be calculated using insurers financial data in 2020 2021 and 2022 and will go to people and businesses On December 7 2011 the Department of Health and Human Services HHS issued final rules on the calculation and payment of medical loss ratio MLR rebates to health insurance policyholders Rebates are scheduled to begin being paid during 2012 The following questions and answers provide information on the federal tax consequences to a health

Download How Much Are The Mlr Rebates For 2024

More picture related to How Much Are The Mlr Rebates For 2024

Anthem Provides Update On 2021 MLR Rebates

https://ga.beerepurves.com/previews/anthem-provides-update-on-2021-mlr-rebates-1663268623903.png

MLR Rebate Maxwell Agency Insurance Services

https://www.maxwellagency.com/wp-content/uploads/sites/34/2020/09/Screen-Shot-2020-09-26-at-8.48.38-AM-1025x500.png

MLR Rebates To Be Paid By September 30 Caravus Your Health Coverage Partner

http://static1.squarespace.com/static/5b48b7111aef1d9c5ce96aca/5ba54af664549a319035f132/5f44654212ef3956120a2c04/1598325915270/jp-valery-lVFoIi3SJq8-unsplash-lr.jpg?format=1500w

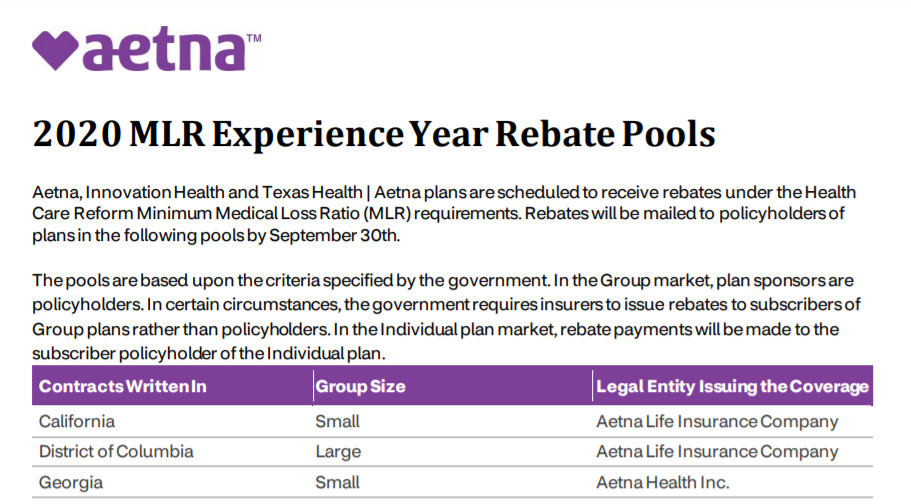

This check is an MLR rebate which insurance companies are required to distribute annually by September 30 th each year It s important to note that employers are required to follow certain rules with regards to handling of the MLR rebate check How an employer may use the rebate amount will depend on how coverage premiums are paid What will the rebate amount be Carriers determine MLR on a state basis by market segment individual small group or large group Carriers do not disaggregate by type of plan within these markets e g PPO v HMO v HDHP or by policyholder so the carrier will have to let you know the amount

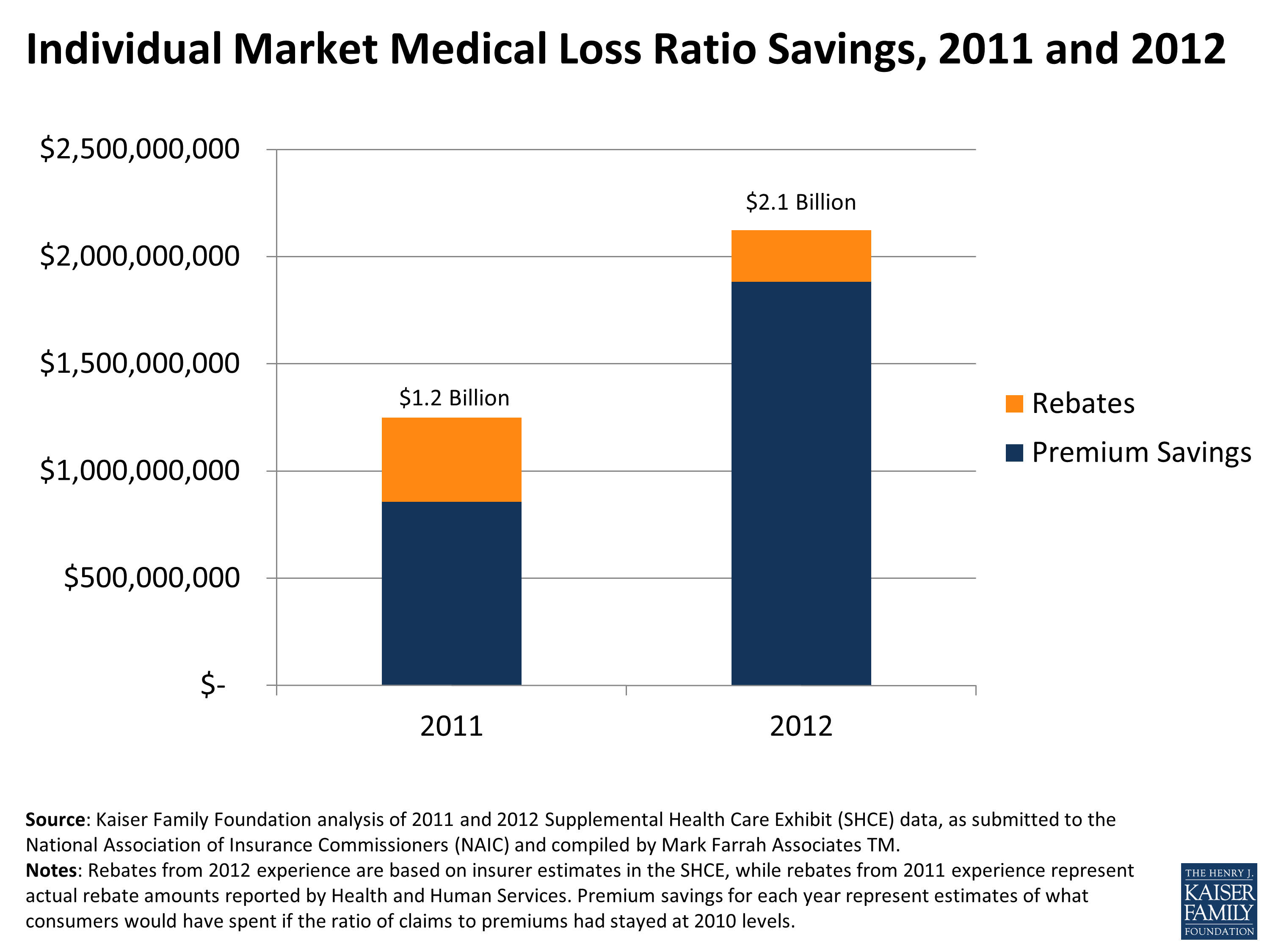

KFF Headquarters 185 Berry St Suite 2000 San Francisco CA 94107 Phone 650 854 9400 Washington Offices and Barbara Jordan Conference Center 1330 G Street NW Washington DC 20005 Phone How much are the MLR rebates The rebate amount is calculated on a three year rolling average From 2012 through 2022 insurers had returned about 10 8 billion to insureds mostly employers but some individuals in the form of rebates for premiums that ultimately ended up being too high ie the insurers didn t spend at least 80 or 85 of the collected premiums on medical costs and

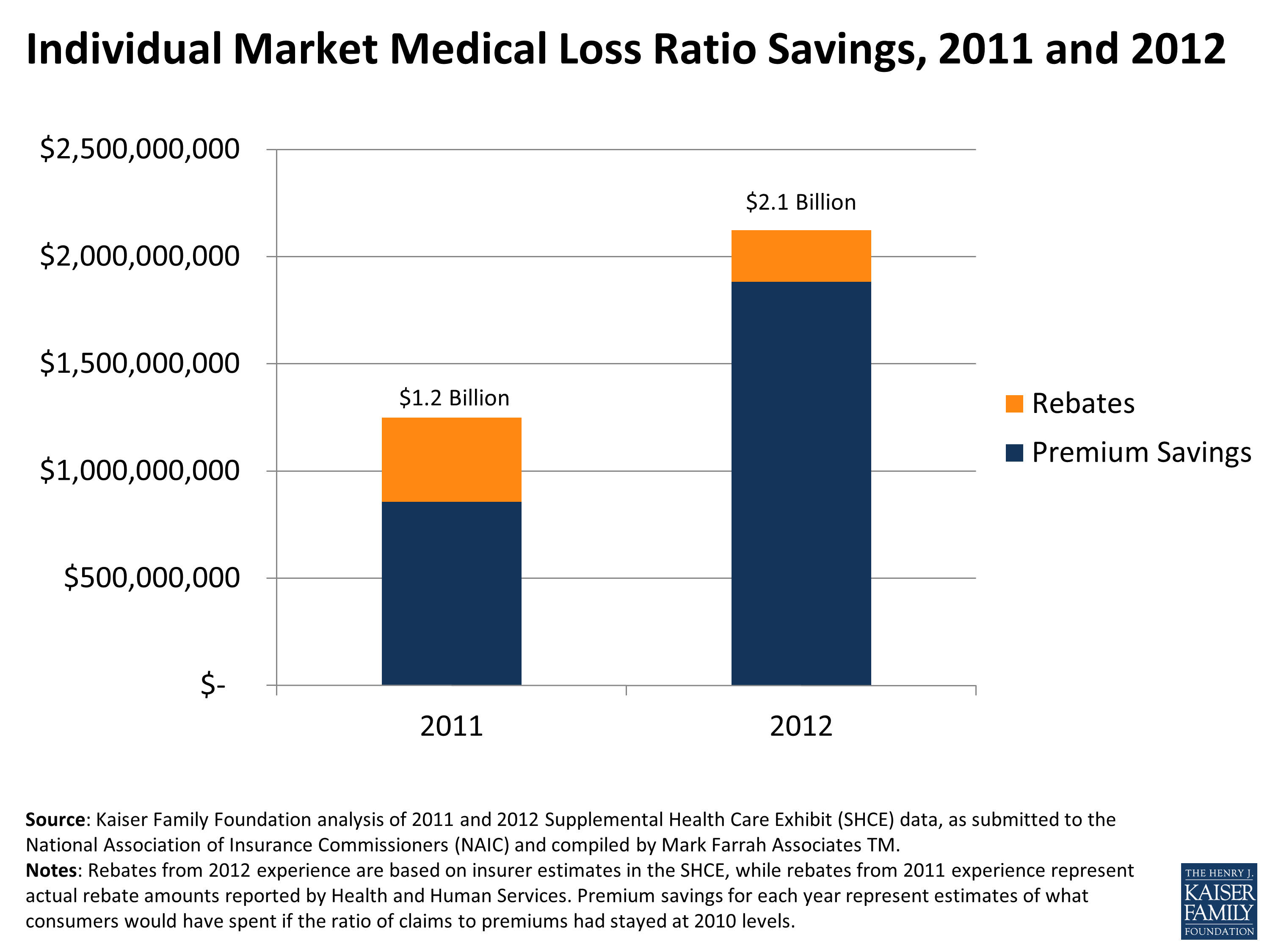

Beyond Rebates How Much Are Consumers Saving From The ACA s Medical Loss Ratio Provision KFF

https://www.kff.org/wp-content/uploads/2013/06/individual_market_mlr_savings.png?resize=1024

Kaiser Permanente Provides Update On 2020 MLR Rebates

https://ga.beerepurves.com/previews/kaiser-permanente-provides-update-on-2020-mlr-rebates-1631028954855.png

https://www.washingtonpost.com/business/2024/01/15/child-tax-credit-increase-2024/

More families could be eligible for the child tax credit as soon as 2024 if new legislation passes Congress iStock 7 min Comment 295 Congressional negotiators announced a roughly 80 billion

https://www.bloomberg.com/news/articles/2024-01-18/child-tax-credit-2024-will-it-go-up-who-s-eligible-impact-what-it-is

Currently 1 600 of the 2 000 credit per child is refundable The credit s phaseout threshold is 400 000 for married earners filing jointly and 200 000 for head or single households At the

MLR Rebates How Employers Should Handle Them KBI

Beyond Rebates How Much Are Consumers Saving From The ACA s Medical Loss Ratio Provision KFF

Ask The Experts Medical Loss Ratio MLR Rebates Blog Strategic Services Group

Aetna Provides Update On 2020 MLR Rebates

Issuing MLR Rebates 2021

CAT Rebates W L Inc

CAT Rebates W L Inc

How Employers Should Handle MLR Rebates

News Caravus Your Health Coverage Partner

Employers Must Follow Guidelines When Issuing MLR Rebates

How Much Are The Mlr Rebates For 2024 - Total MLR reimbursements are projected to be 1 1 billion in 2023 which is about the same level as last year When an employer receives a MLR rebate check they will need to consider if any portion of the rebate is considered plan assets under the Employee Retirement Income Security Act ERISA