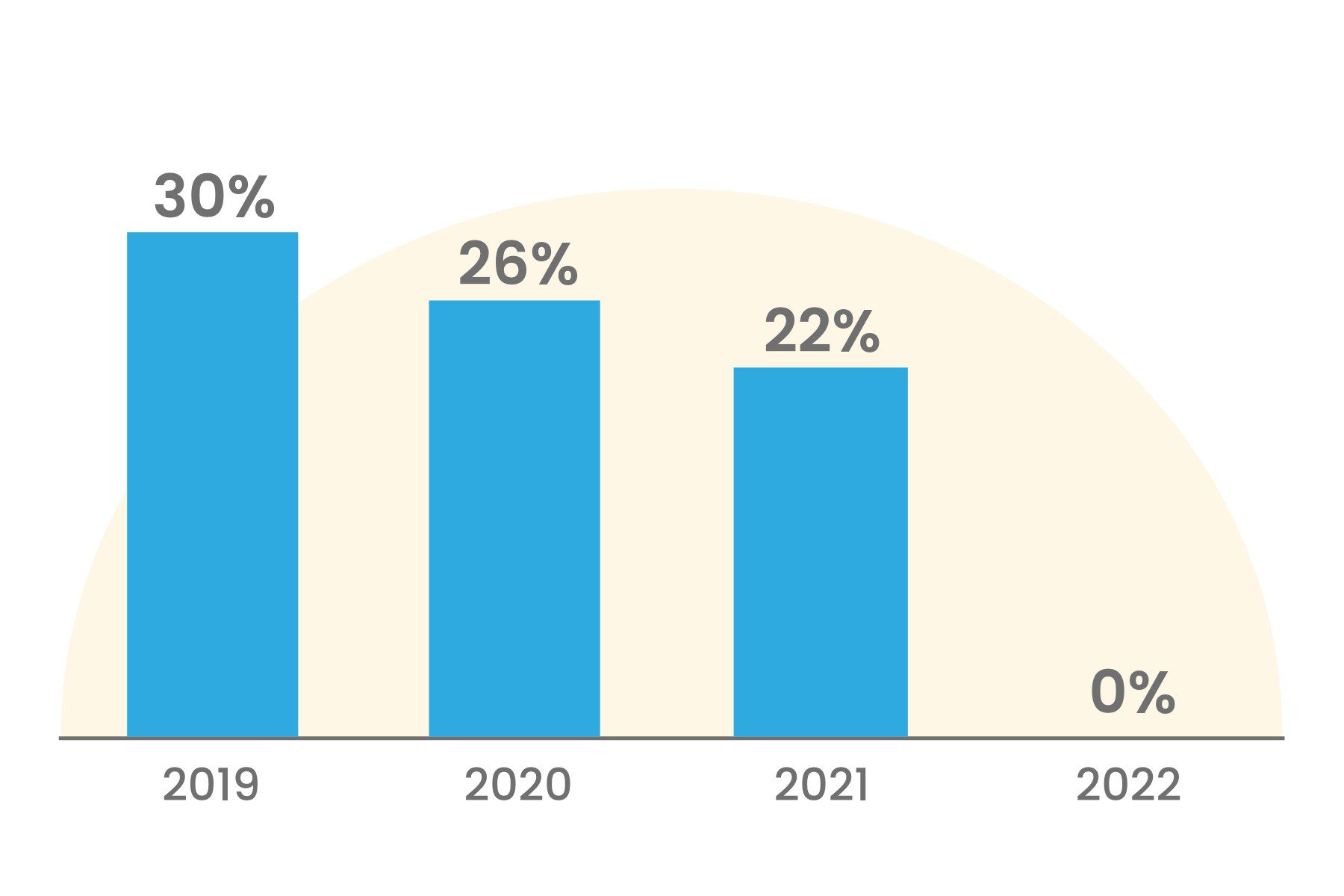

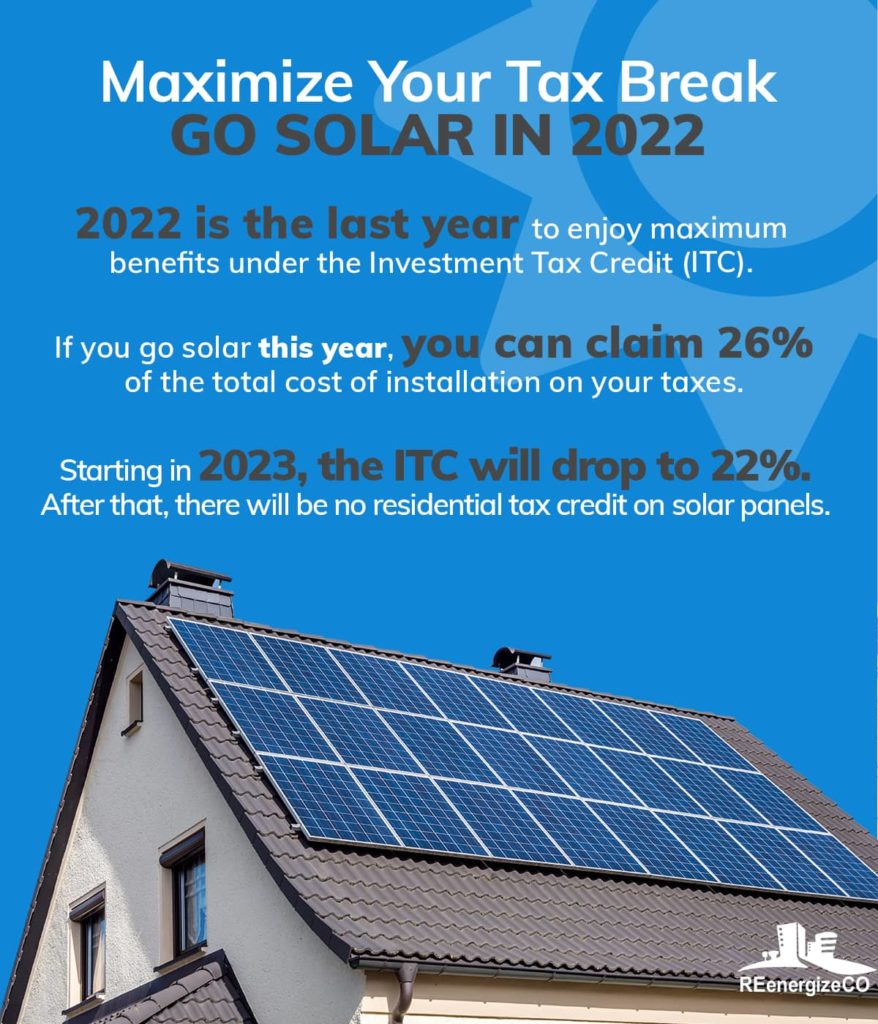

How Many Years Can You Claim The Solar Tax Credit How many years can you carry forward the solar credit The solar tax credit can be rolled over for as long as the credit is in effect which is currently scheduled through 2034 In August 2022 the signing of the Inflation Reduction Act increased the credit value to 30 for 2022 2032 The tax credit steps down to 26 in 2023 and 22 in 2034

If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax credit The federal solar tax credit can cover up to 30 of the cost of a system in 2024 The amount you can claim directly reduces the amount of tax you owe

How Many Years Can You Claim The Solar Tax Credit

How Many Years Can You Claim The Solar Tax Credit

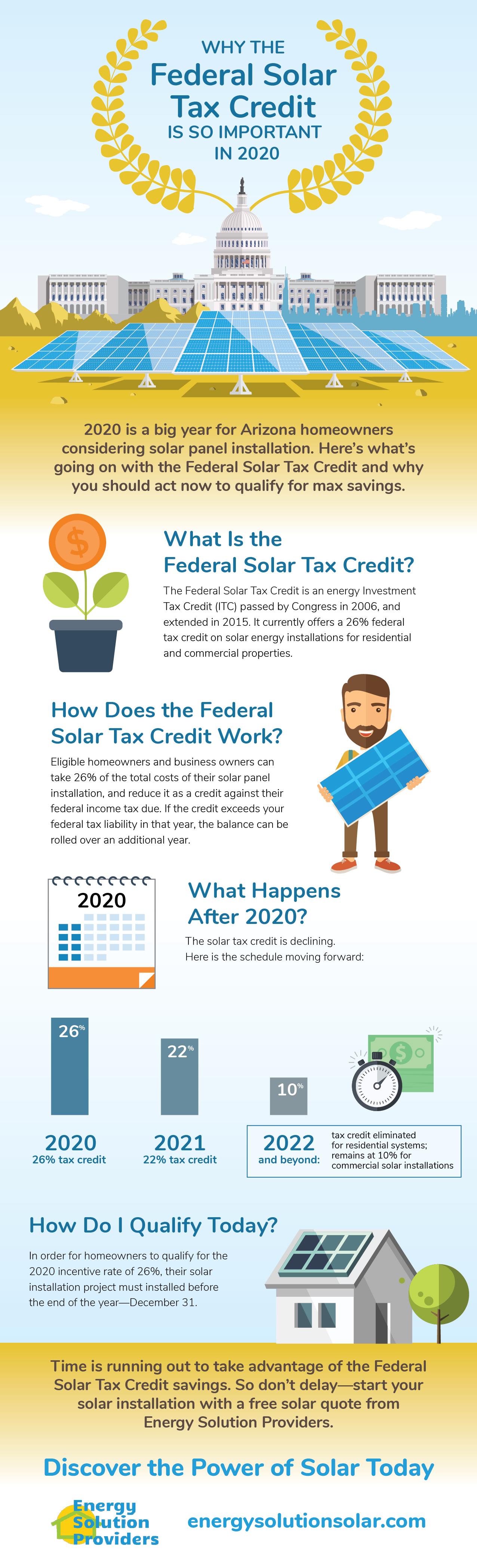

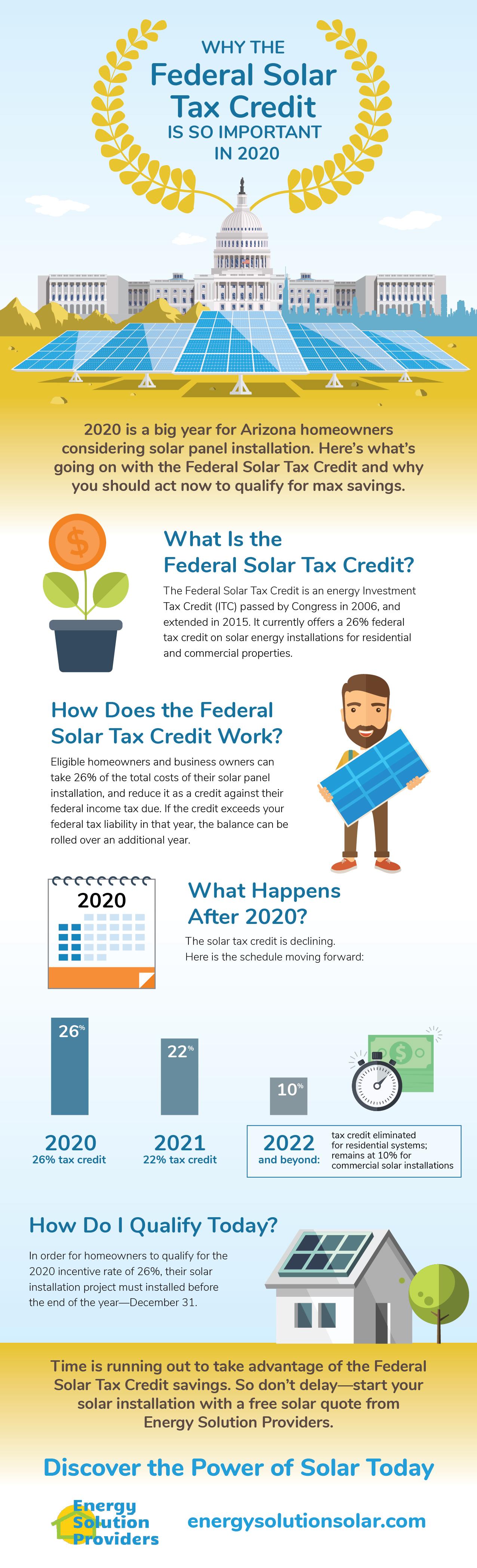

https://energysolutionsolar.com/sites/default/files/styles/panopoly_image_original/public/federalsolartax2020-03_1.jpg?itok=EB_bqkCL

Understanding The Solar Tax Credit

https://njsolarpower.com/wp-content/uploads/2022/03/iStock-618951772.jpg

Can You Claim The Solar Tax Credit More Than Once Solar Power Nation

https://solarpowernation.com/wp-content/uploads/2023/06/solar-tax-crdit.png

You can claim the federal solar tax credit this year as long as you have a tax bill for 2023 However if you don t owe any taxes this year you can carry the credit forward each year until 2034 when the ITC is set to expire There is no lifetime limit for either credit the limits for the credits are determined on a yearly basis For example beginning in 2023 a taxpayer can claim the maximum Energy Efficient Home Improvement Credit allowed every year that eligible improvements are made

The solar tax credit which is among several federal Residential Clean Energy Credits available through 2032 allows homeowners to subtract 30 percent of the cost of installing solar The 30 solar tax credit is available until 2032 before reducing to 26 in 2033 22 in 2034 and expiring completely in 2035 To qualify for the federal solar tax credit you must own the solar panels have taxable income and it must be installed at your primary or secondary residence

Download How Many Years Can You Claim The Solar Tax Credit

More picture related to How Many Years Can You Claim The Solar Tax Credit

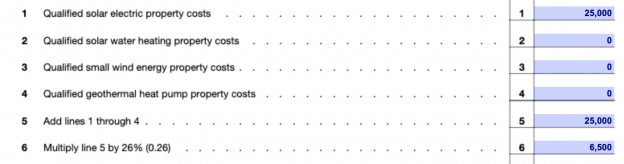

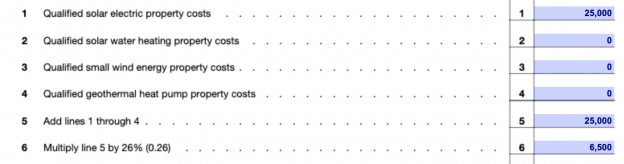

How To Fill Out IRS Form 5695 To Claim The Solar Tax Credit Federal

https://094777.com/774f1ba6/https/d98b8f/images.prismic.io/palmettoblog/283c592c-9e38-4b57-a6d0-f70cf6ce54f4_form-5695.jpg?auto=compress,format&rect=0,0,1200,800&w=1200&h=800

Everything You Need To Know About The Solar Tax Credit

https://gospringsolarnow.com/wp-content/uploads/2022/08/Everything-You-Need-To-Know-About-The-Solar-Tax-Credit-scaled-2560x1280.jpeg

Rent Tax Credit

https://www.finegael.ie/app/uploads/2023/02/RTC_webpage.png

You would be able to claim 5 000 of the tax credit the first year and then the remaining 4 000 can be carried over to the next year The IRS hasn t announced new rules on this yet but in the past the federal solar tax credit could be carried over for as many years as the incentive was active How many times can you claim the solar tax credit You can only claim the solar tax credit one time for your solar power installation If you have any unused amount remaining on your tax credit that you are unable to claim in a single tax year you may be able to carry over that tax credit value for up to five years Can you claim the

Key takeaways In 2024 the ITC currently allows both homeowners and businesses to claim 30 of their solar system costs as a tax credit The tax credit will stay at 30 for the next nine years until 2033 at which point it will drop to 26 The Residential Clean Energy Credit also known as the solar investment tax credit or ITC is a tax credit for homeowners who invest in solar and or battery storage Thanks to the Inflation Reduction Act the 30 credit is available for homeowners that install solar from 2022 to 2032

The Solar Lowdown Customers Ask What Is The Solar Tax Credit Skyline

https://skylinesmartenergy.com/wp-content/uploads/2023/05/Hero-Locations.jpg

How Many Times Can You Claim Solar Tax Credit Gov Relations

https://www.gov-relations.com/wp-content/uploads/2023/05/How-Many-Times-Can-You-Claim-Solar-Tax-Credit.jpg

https://www.solar.com/learn/frequently-asked...

How many years can you carry forward the solar credit The solar tax credit can be rolled over for as long as the credit is in effect which is currently scheduled through 2034 In August 2022 the signing of the Inflation Reduction Act increased the credit value to 30 for 2022 2032 The tax credit steps down to 26 in 2023 and 22 in 2034

https://www.irs.gov/credits-deductions/residential-clean-energy-credit

If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax credit

Solar Tax Credit Guide And Calculator

The Solar Lowdown Customers Ask What Is The Solar Tax Credit Skyline

What Is Solar Tax Credit How Does It Work Supreme Solar Electric

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

Colorado Government Solar Tax Credit Big History Blogger Photography

How To Claim The Solar Tax Credit Energy Solution Providers AZ

How To Claim The Solar Tax Credit Energy Solution Providers AZ

The Federal Solar Tax Credit What You Need To Know 2022

How To Claim The 26 Commercial Solar Tax Credit Boston Solar MA

Can You Claim Solar Tax Credit Twice Energy Theory

How Many Years Can You Claim The Solar Tax Credit - The solar tax credit which is among several federal Residential Clean Energy Credits available through 2032 allows homeowners to subtract 30 percent of the cost of installing solar