Heehra Rebates 2024 On Aug 16 2022 President Joseph R Biden signed the landmark Inflation Reduction Act which provides nearly 400 billion to support clean energy and address climate change including 8 8 billion for the Home Energy Rebates

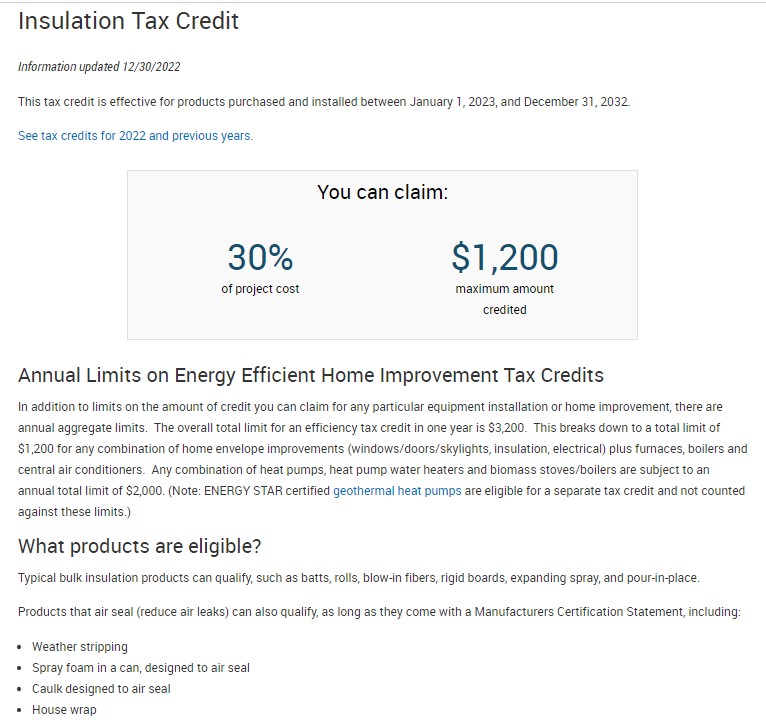

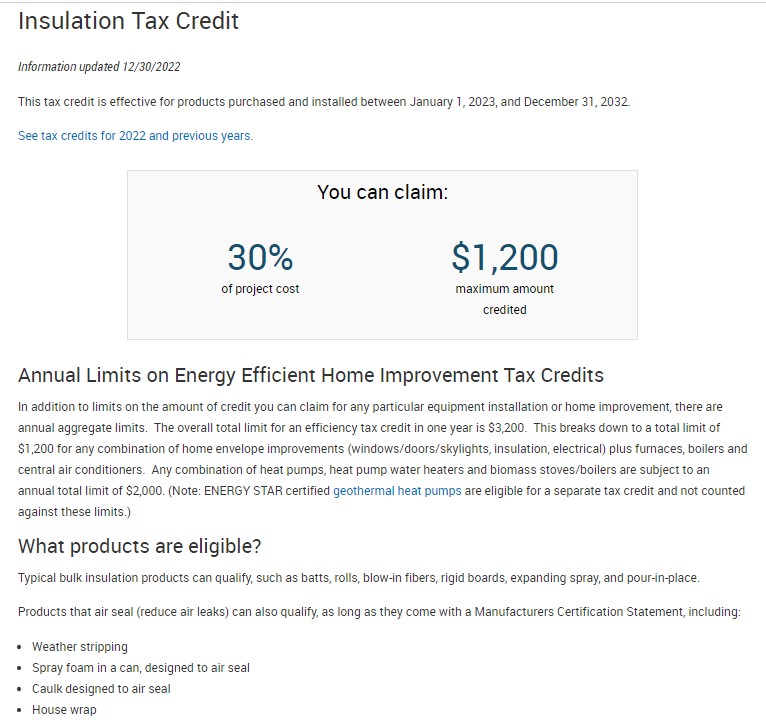

For heat pump and heat pump water heater projects the tax credit amount is 30 of the total project cost includes equipment and installation up to a 2 000 maximum So if your project The High Efficiency Electric Homes and Rebates Act HEEHRA allocates 4 5 billion dollars to the states to create point of sale rebates for home electrification projects for low and moderate income households Program specifics are still being determined and will vary from state to state

Heehra Rebates 2024

Heehra Rebates 2024

https://i0.wp.com/www.usrebate.com/wp-content/uploads/2023/06/Heehra-Rebates.jpg?resize=620%2C735&ssl=1

What To Know About HEEHRA Rebates

https://media.angi.com/s3fs-public/Couple-home-getting-letters-bills-1395273146-.jpeg

HEEHRA Rebates SafeAire Heating Cooling

https://tlchelps.com/wp-content/uploads/2023/02/HEEHRA-Rebate-Amounts-American-Mechanical-1.png

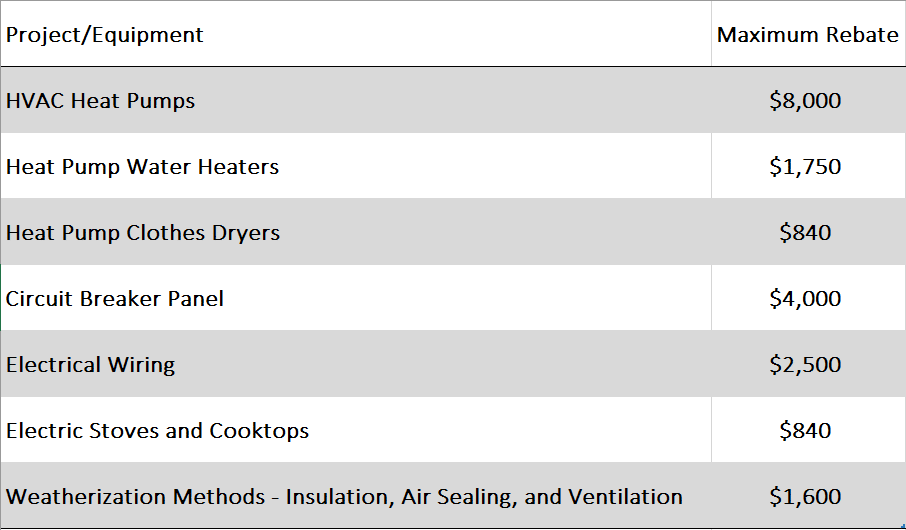

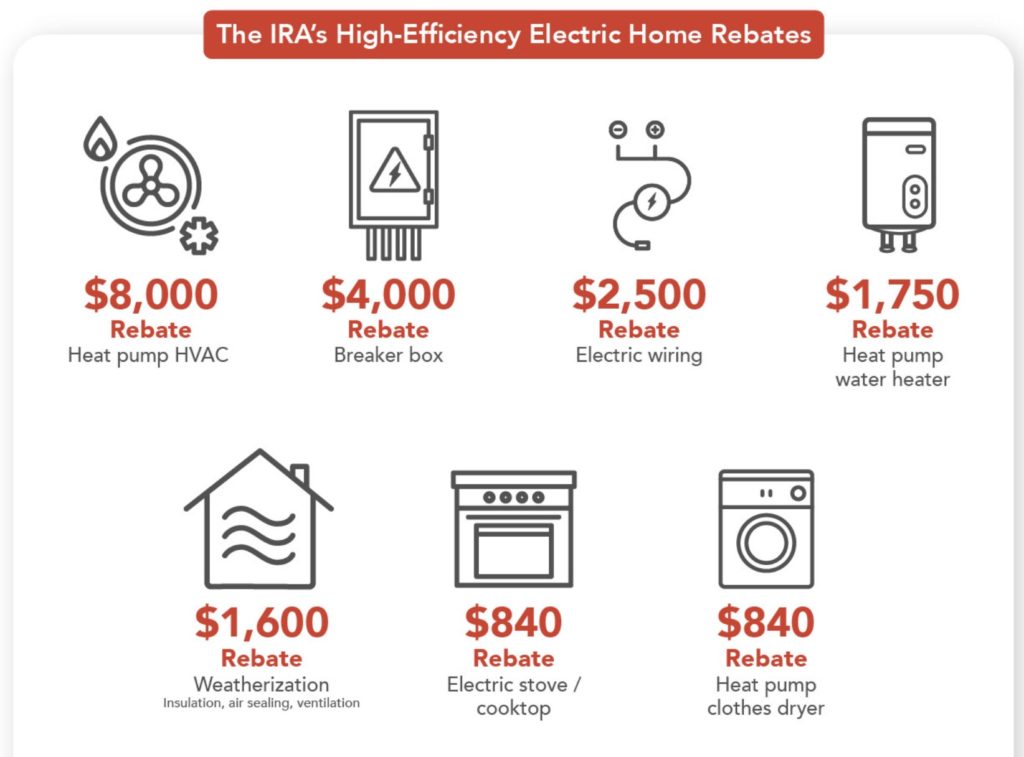

Resources IRA HEEHRA rebate program Easy to understand guide Will brand new legislation help you save money on energy efficient home upgrades Let s find out Energy Efficiency Rebates Incentives HEEHRA rebates are a huge game changer for households with low and moderate income levels who want powerful home energy upgrades January 2024 Table of Contents o How rebates will be provided to eligible recipients o The state s expectation for which party is carrying the cost between the point of sale transaction and reimbursement by the state o Maximum time allowed for rebate reimbursement from the state and how the

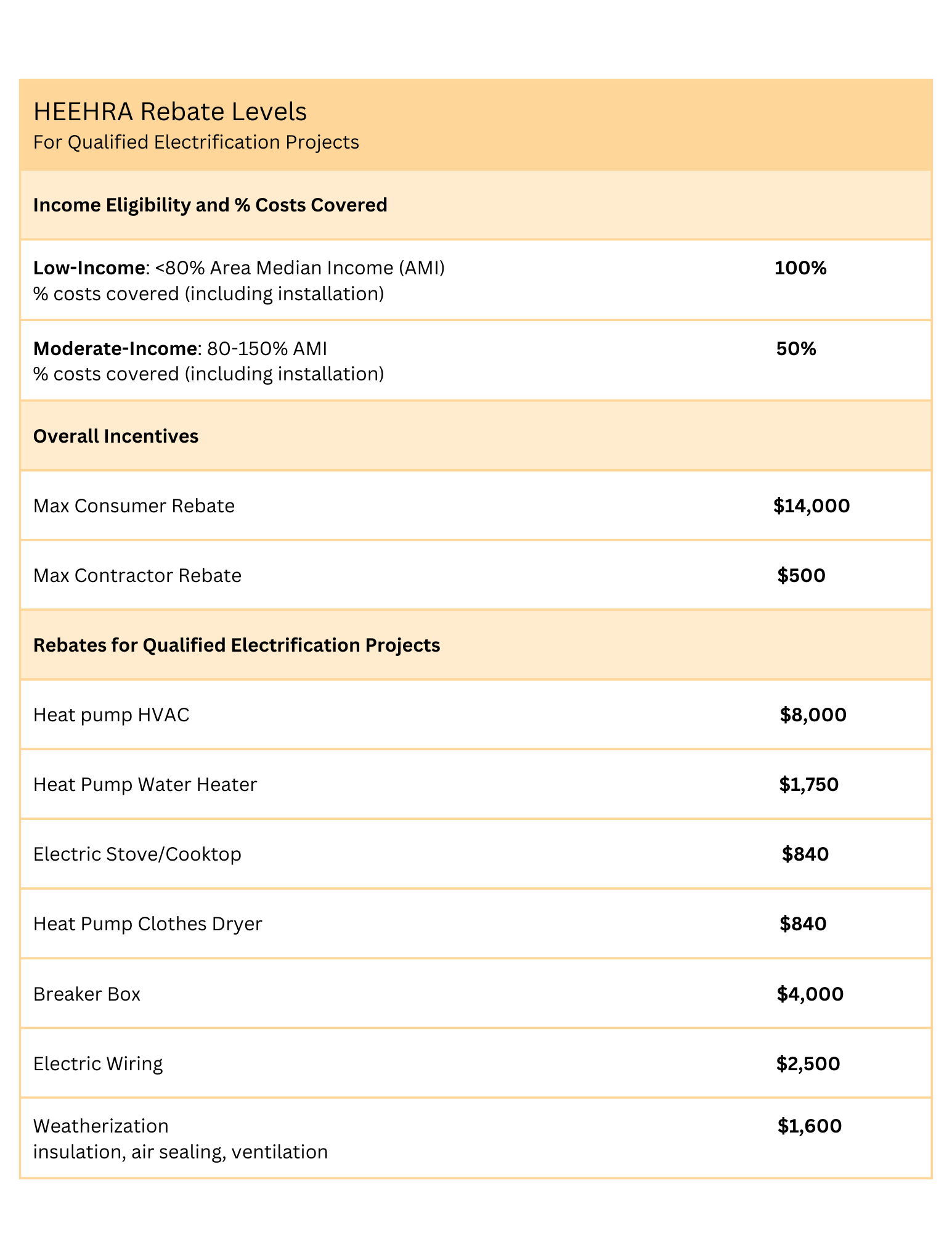

The HEEHRA program is only applicable to low to moderate income households Low income families have annual incomes less than 80 of the local median income and are eligible for 100 discounts up to 14 000 Moderate income families have annual incomes of 80 to 150 of the local median income and are eligible for 50 discounts up to 14 000 Beginning in 2024 taxpayers have the option to transfer this tax credit as a point of sale rebate by a dealership to directly lower the price of the vehicle by the credit amount at the time of purchase High Efficiency Electric Home Rebate HEEHRA Up to 14 000 Rollout Timing TBD DESCRIPTION Americans can save hundreds of dollars

Download Heehra Rebates 2024

More picture related to Heehra Rebates 2024

What To Know About HEEHRA Rebates

https://media.angi.com/s3fs-public/Couple-paying-bills-online-1283779141-.jpeg?impolicy=leadImage

TikToker Shares How HEEHRA Rebates Can Save You 14 000 Lower Bills Heat Pump Water Heater

https://i.pinimg.com/originals/4d/1d/42/4d1d427598fb7c7f965f3d1248218cf6.jpg

HEEHRA Rebate Program 2023 Get Full Details Here

https://www.acdirect.com/media/wysiwyg/what-is-heehra3.jpg

The Electrification Rebates provide point of sale consumer discounts to enable low and moderate income households across America to electrify their homes Notably households will experience HEEHRA s point of sale rebates as immediate off the top discounts when making qualifying electrification purchases HEEHRA is a voluntary program that covers 100 percent of electrification project costs up to 14 000 for low income households and 50 percent of costs up to 14 000 for moderate income households

The HEEHRA program provides up to 14 000 per household in point of purchase rebates for low and moderate income families who are looking to replace fossil fuel burning equipment such as oil boilers or gas clothes dryers with more efficient electricity powered units Rebates are available to both homeowners and renters The HEEHRA creates a winning combination of rebates that specifically address the concerns of America s most energy vulnerable households and goes further than ever before to make home electrification possible for everyone If one thing is certain about the next decade the implications of the HEEHRA will be significant and far reaching

Climate Incentives Timeline Depends On Government Guidelines State Adoption

https://www.anndyl.com/wp-content/uploads/2023/03/Contractor-Survey-Pie-Chart.png

2023 HVAC Rebates And Tax Incentives HEEHRA Rebates 2023

https://airetexas.com/wp-content/uploads/2023/01/HEEHRA-REBATES.jpg

https://www.energy.gov/scep/home-energy-rebates-programs

On Aug 16 2022 President Joseph R Biden signed the landmark Inflation Reduction Act which provides nearly 400 billion to support clean energy and address climate change including 8 8 billion for the Home Energy Rebates

https://www.forbes.com/home-improvement/hvac/heat-pump-tax-credit/

For heat pump and heat pump water heater projects the tax credit amount is 30 of the total project cost includes equipment and installation up to a 2 000 maximum So if your project

Understanding The High Efficiency Electric Home Rebate Act HEEHRA Rebate2022

Climate Incentives Timeline Depends On Government Guidelines State Adoption

BPA Journal Understanding The High Efficiency Electric Home Rebate Act HEEHRA Building

.png)

Insights From The DOE s HOMES And HEEHRA Guidance Part 1 On Your Marks Get Set Apply

Power Rebates For Washing Machines PowerRebate

HOMEOWNER REBATES AND TAX CREDITS FOR 2023 Radiant Barrier USA

HOMEOWNER REBATES AND TAX CREDITS FOR 2023 Radiant Barrier USA

HVAC Tax Credits Rebates In Salt Lake City HEEHRA

Smith Wesson Shield EZ Holiday Rebate H H Shooting Sports Oklahoma City

Rebates For Seniors Mark Coure MP

Heehra Rebates 2024 - HEEHRA is a voluntary program that covers 100 of electrification project costs up to 14 000 for low income households and 50 of costs up to 14 000 for moderate income households