H R Block Recovery Rebate Credit 2024 We make it simple No loan fees and 0 interest Enjoy no loan fees and 0 APR with a Refund Advance loan High approval rates Don t stress Refund Advance has high approval rates And you could get approved within minutes of filing Easy process

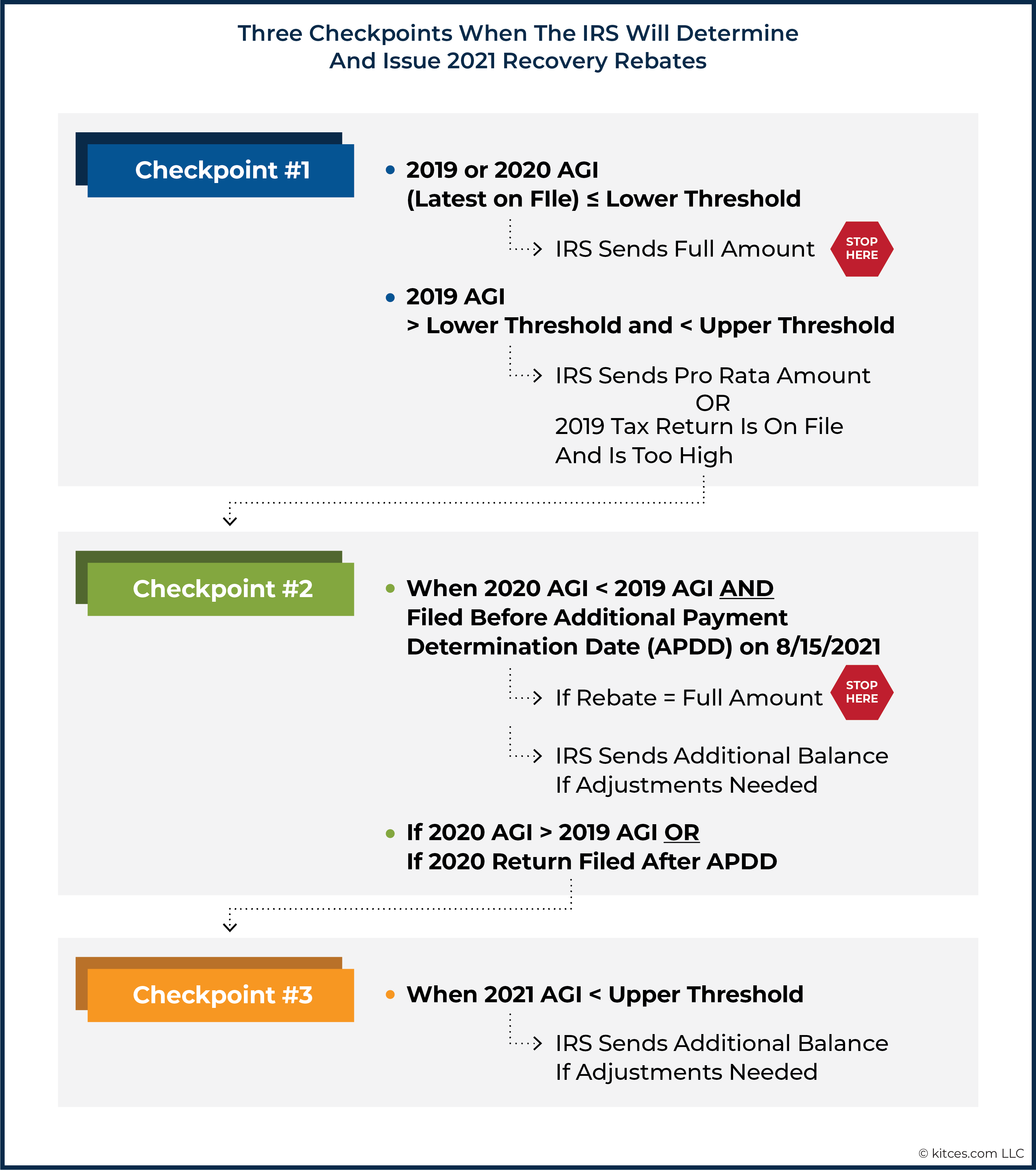

The third round of Economic Impact Payments including the plus up payments were advance payments of the 2021 Recovery Rebate Credit claimed on a 2021 tax return It was issued starting in March 2021 and continued through December 2021 Individuals should review the information below to determine their eligibility to claim a Recovery Rebate Your Recovery Rebate Credit will be included in your tax refund If you re eligible to claim the 2020 Recovery Rebate Credit you must file a tax return by May 17 2024 to claim the credit If you re eligible to claim the 2021 Recovery Rebate credit you must file a tax return by April 15 2025 to claim the credit Recovery Rebate Credit

H R Block Recovery Rebate Credit 2024

H R Block Recovery Rebate Credit 2024

https://i0.wp.com/southernmarylandchronicle.com/wp-content/uploads/2021/04/Recovery-Rebate-Credit.png?fit=1200%2C675&ssl=1

Recovery Rebate Credit On The 2020 Tax Return

https://www.taxgroupcenter.com/wp-content/uploads/2021/05/Recovery-rebate-credit.jpg

Recovery Rebate Credit 2023 2024 Credits Zrivo

https://www.zrivo.com/wp-content/uploads/2022/05/Recovery-Rebate-Credit-zrivo-1.jpg

You may be eligible to claim a 2021 Recovery Rebate Credit on your 2021 federal tax return Individuals can view the total amount of their third Economic Impact Payments through their individual Online Account Through March 2022 we ll also send Letter 6475 to the address we have on file for you confirming the total amount of your third You do not need to complete any information about the Recovery Rebate Credit on your 2020 Form 1040 or 1040 SR if your Economic Impact Payment in 2020 was 1 200 2 400 if married filing jointly

KANSAS CITY Mo Jan 24 2022 GLOBE NEWSWIRE As record inflation continues to pressure Americans paychecks H R Block NYSE HRB is here to help people get their biggest refund possible in a year in which tax law changes require reconciling past federal payments such as stimulus checks and the advance child tax credit Recovery Rebate Credit next tax year If you had a change in circumstances in 2021 that would qualify you to receive additional third stimulus money you can claim a Recovery Rebate Credit when you file your 2021 taxes in 2022 Read about how the Recovery Rebate Credit works for the first and second stimulus payments

Download H R Block Recovery Rebate Credit 2024

More picture related to H R Block Recovery Rebate Credit 2024

45 Off H R BLOCK Discount Code Promo Code Updated 2023

https://thetrendingreviews.com/storage/uploads/2020/05/New-Project-2021-05-24T174316.110.png

How To Claim Recovery Rebate Credit Turbotax Romainedesign Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/how-to-claim-recovery-rebate-credit-turbotax-romainedesign-3.png?fit=633%2C623&ssl=1

9 Easy Ways What Is The Recovery Rebate Credit 2021 Alprojectalproject

https://i1.wp.com/www.gannett-cdn.com/presto/2022/01/31/PDTF/ed4d450c-c21d-4e0c-8df6-4637a89241b9-Lett_6475.jpg

The IRS will internally adjust your refund if you claimed the Recovery Rebate Credit but didn t qualify or overestimated the amount you should have received If a correction is needed the IRS will calculate the correct amount of the 2020 or 2021 Recovery Rebate Credit make the correction to the tax return and continue processing it Illinois is issuing a one time individual income tax rebate of 50 per individual and 100 per dependent up to three in July 2022 FAQs Who is eligible Each taxpayer who files an individual Tax Year 2021 income tax return by October 17 2022 and

Tax Refund Reduction 250 to 550 A popular tax deduction for the 43 million Americans with student loan debt is the student loan interest deduction To claim this deduction you must pay at least 600 in student loan interest during the tax year You can only deduct up to a maximum of 2 500 in interest paid H R Block offers easy to use software for tax filers who want to complete their taxes online or using their desktop computer H R Block online tax prep consistently ranks as the runner up in annual listings of the most popular online tax preparation software and is our second favorite option for doing your taxes online

Does A Tax Credit Give You Money Leia Aqui Do You Get Money From Tax Credit

https://img.money.com/2022/03/News-Recovery-Rebate-Credit.jpg

The Recovery Rebate Credit Calculator MollieAilie

https://lithium-response-prod.s3.us-west-2.amazonaws.com/turbotax.response.lithium.com/RESPONSEIMAGE/8ef1fcbc-bcb1-4839-8055-0e43edd81c8d.default.png

https://www.hrblock.com/offers/refund-advance/

We make it simple No loan fees and 0 interest Enjoy no loan fees and 0 APR with a Refund Advance loan High approval rates Don t stress Refund Advance has high approval rates And you could get approved within minutes of filing Easy process

https://www.irs.gov/newsroom/recovery-rebate-credit

The third round of Economic Impact Payments including the plus up payments were advance payments of the 2021 Recovery Rebate Credit claimed on a 2021 tax return It was issued starting in March 2021 and continued through December 2021 Individuals should review the information below to determine their eligibility to claim a Recovery Rebate

2022 Irs Recovery Rebate Credit Worksheet Recovery Rebate

Does A Tax Credit Give You Money Leia Aqui Do You Get Money From Tax Credit

How To Claim Recovery Rebate Credit With No Income Recovery Rebate

IRS Updates Info On Recovery Rebate Credit And Pandemic Response Scott M Aber CPA PC

IRS Letter Needed To Claim Stimulus Check With Recovery Rebate Credit

The Recovery Rebate Credit Calculator ShauntelRaya

The Recovery Rebate Credit Calculator ShauntelRaya

Do Dependents Get Recovery Rebate Credit Leia Aqui Why Did I Get A Letter From The IRS About

What Is The Recovery Rebate Credit 2023 Detailed Information

Recovery Rebate Credit 2023

H R Block Recovery Rebate Credit 2024 - Recovery Rebate Credit I m using H R Block program to prepare 2021 tax Got question as to whether I received third stimulus check Answered No and got a 2800 credit for my wife I IRS rejected this amount when evaluating my return Can t figure out why Thanks 1 Sort by Open comment sort options Remarkably shifty 2 yr ago