Federal Rebate For Solar Panels 2024 Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed on or before December 31 2019 were also eligible for a 30 tax credit

The maximum credit you can claim each year is 1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit The Federal Solar Tax Credit for 2024 is 30 this is an increase from 26 in recent years and extends through to 2032 Tax credits and incentives can help bring the price down such as

Federal Rebate For Solar Panels 2024

Federal Rebate For Solar Panels 2024

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2023-05/Summary-ITC-and-PTC-Values-Chart-2023.png?itok=_P0koCpu

The Victorian Solar Homes Rebate Explained Half Price Solar Starting Now

https://www.solarquotes.com.au/blog/wp-content/uploads/2018/08/victoria-solar-rebate-1024x692.jpg

Federal Solar Tax Credit What It Is How To Claim It For 2023

https://www.ecowatch.com/wp-content/uploads/2022/10/Solar-Investment-Tax-Credit-5-1-2.png

Solar wind and geothermal power generation Solar water heaters Fuel cells Battery storage beginning in 2023 The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 to 2032 30 no annual maximum or lifetime limit 2033 26 no annual maximum or lifetime limit The U S government offers a solar tax credit that can reach up to 30 of the cost of installing a system that uses the sun to power your home Simple tax filing with a 50 flat fee for every

On Aug 16 2022 President Joseph R Biden signed the landmark Inflation Reduction Act which provides nearly 400 billion to support clean energy and address climate change including 8 8 billion for the Home Energy Rebates An average 20 000 solar system is eligible for a solar tax credit of 6 000 The Inflation Reduction Act extended the federal solar tax credit until 2035 To qualify for the federal solar tax credit you must own the solar panels have taxable income and it must be installed at your primary or secondary residence

Download Federal Rebate For Solar Panels 2024

More picture related to Federal Rebate For Solar Panels 2024

Solar Panel Rebate How It Works And How To Get It

https://www.solarquotes.com.au/wp-content/uploads/2020/07/solar-rebate-1.jpg

Make The Most Of Your Solar System Canberra With Attractive Solar Panels Government Rebate

https://solar4life.com.au/wp-content/uploads/2021/08/s4l-44443e-1024x512.jpg

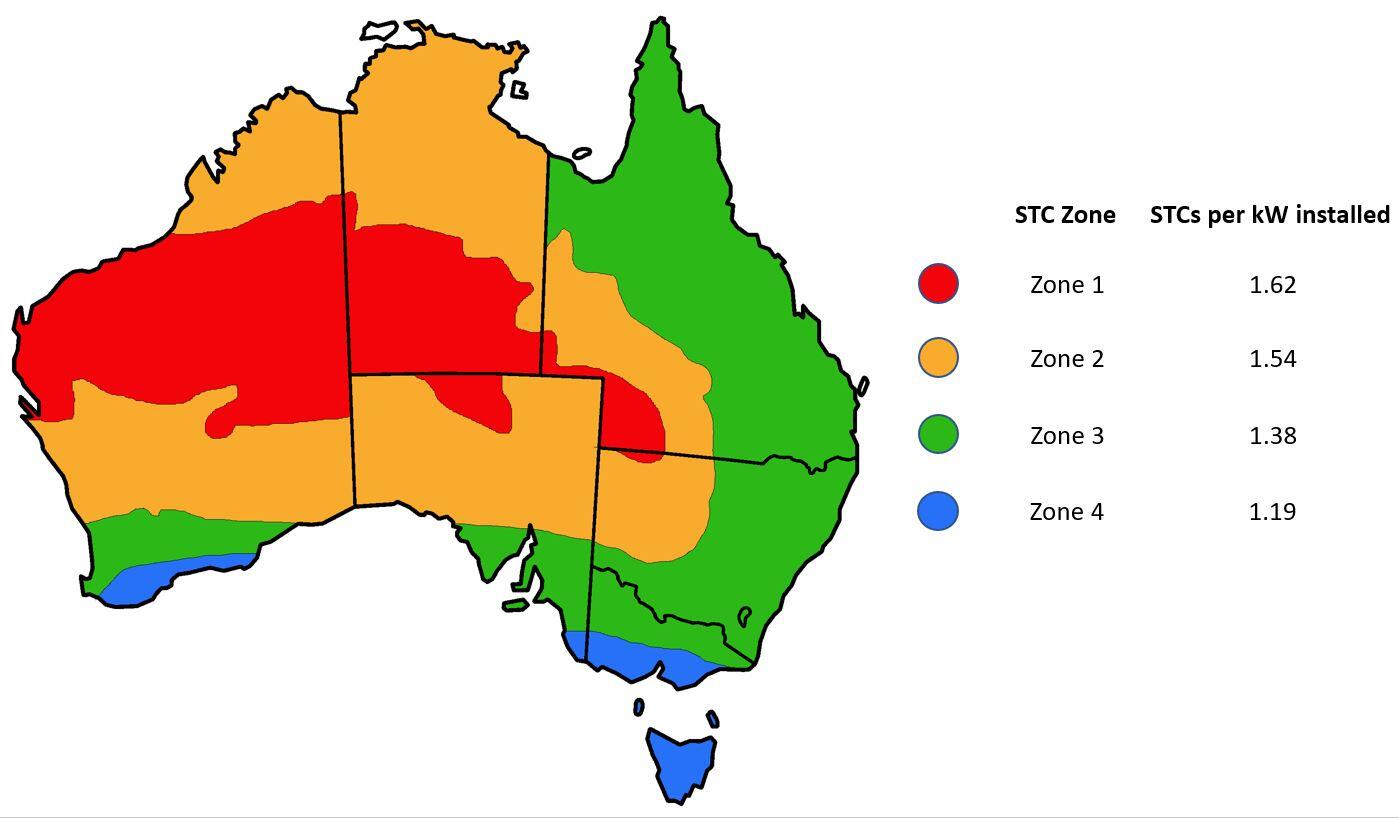

Government Solar Rebate Solar Power Incentives Solar Choice

https://www.solarchoice.net.au/wp-content/uploads/STC-Zones-in-Australia-as-of-1st-January-2019.jpg

The solar tax credit which is among several federal Residential Clean Energy Credits available through 2032 allows homeowners to subtract 30 percent of the cost of installing solar The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system 2 Other types of renewable energy are also eligible for similar credits but are beyond the scope of this guidance

The solar investment tax credit ITC also called the federal solar tax credit allows qualifying property owners to get a tax credit for 30 of the cost to install a solar energy system The tax credit is currently set at 30 of your total solar panel system installation cost Tax credits help to reduce the amount of money you owe in taxes So for example if you claim a tax credit of 4 000 the total amount you owe in income taxes will be reduced by 4 000 It s important to note that this is not a tax deduction which

Government Rebate Solar Panels Compare Solar Quotes

https://www.comparesolarquotes.net.au/wp-content/uploads/2021/10/Government-Rebate-Solar-Panels-768x576.jpg

Solar Tax Credits Rebates Missouri Arkansas

https://soleraenergyllc.com/wp-content/uploads/2022/07/Graphic-1000x1024.jpg

https://www.energy.gov/eere/solar/homeowners-guide-federal-tax-credit-solar-photovoltaics

Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed on or before December 31 2019 were also eligible for a 30 tax credit

https://www.irs.gov/credits-deductions/energy-efficient-home-improvement-credit

The maximum credit you can claim each year is 1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit

Image Of Newly Installed Solar Panels On Roof Of Home As Part Of NSW Rebate Solar Austockphoto

Government Rebate Solar Panels Compare Solar Quotes

2021 Energy Federal Tax Credit And Rebate Programs Epic Energy

Solar Panels Rebate 2022 Rebate2022

The Federal Solar Tax Credit Can Save You Thousands Green Ridge Solar

How To Apply For A Rebate On Your Solar Panels REenergizeCO

How To Apply For A Rebate On Your Solar Panels REenergizeCO

Best Solar Panels Australia Solar Power Systems Captain Green Solar

Rebate On Solar Panels For New Homes Corowa Free Press

Does Installing Solar Panels Void Roof Warranty Construction How

Federal Rebate For Solar Panels 2024 - At 30 the tax credit is worth 7 500 for a 25 000 solar system effectively knocking the price down to 17 500 The credit was previously at 26 for systems installed in 2022 and scheduled to step down to 22 in 2023 before going away entirely in 2024