Federal Government Energy Rebates 2024 1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit

The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax credits and deductions that will help reduce energy costs and demand as we transition to cleaner energy sources Tax Credits for Home Builders Tax Deductions for Commercial Buildings Fuel cells Battery storage beginning in 2023 The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 to 2032 30 no annual maximum or lifetime limit 2033 26 no annual maximum or lifetime limit 2034 22 no annual maximum or lifetime limit

Federal Government Energy Rebates 2024

Federal Government Energy Rebates 2024

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA1cGWIS.img?w=1920&h=1080&m=4&q=94

The Federal Government Wants To Regulate Tampons For Men The Counter Signal

https://thecountersignal.com/wp-content/uploads/2022/10/MEN-1024x576.jpeg

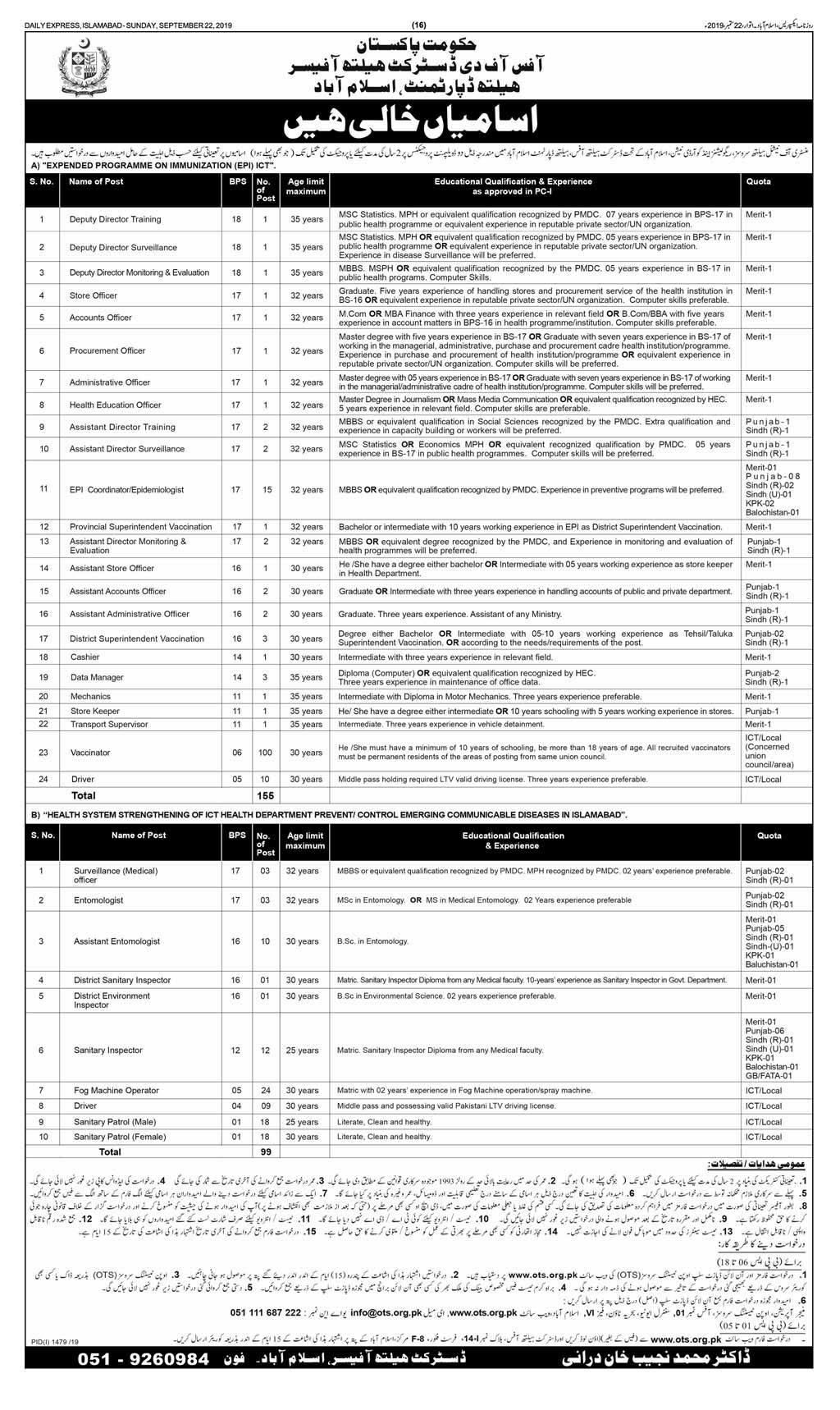

Government Of Pakistan Health Department Islamabad Jobs 2019 OTS

https://filectory.com/wp-content/uploads/2019/09/Federal-Government-of-Pakistan-Health-Department-Islamabad-Jobs-2019-OTS.jpg

How It Works Who Qualifies Qualified Expenses Qualified Clean Energy Property How to Claim the Credit Related Resources How It Works The Residential Clean Energy Credit equals 30 of the costs of new qualified clean energy property for your home installed anytime from 2022 through 2032 9 30 2024 Notice of Funding Opportunity Rural Energy for America Program REAP Department of Agriculture To help agricultural producers and rural small businesses invest in renewable

Four states California Hawaii New Mexico and New York are the first to submit funding applications for the U S Department of Energy s DOE Home Energy Rebates program a historic 8 8 billion investment to lower costs for American families through energy efficiency and electrification thanks to President Biden s Inflation Reduction Act You ll get a 30 tax break for expenses related to qualified improvements that use alternative power like solar wind geothermal or biomass energy The tax credit had dropped to 26 in 2021 but

Download Federal Government Energy Rebates 2024

More picture related to Federal Government Energy Rebates 2024

Federal Government Considers Household Energy Rebates 10 News First Household Negotiation

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=1209073469679549&get_thumbnail=1

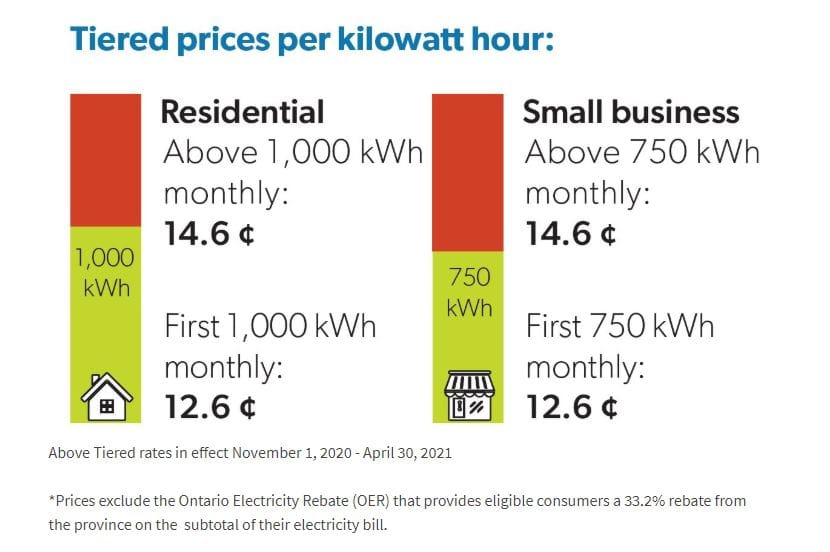

Ontario Energy Rebates 2023 Rebate2022

https://www.rebate2022.com/wp-content/uploads/2022/08/ontario-government-energy-rebates-2021-6-benefits-announced-in-the-1.jpg

President Biden Signs Executive Order To Make Federal Government Carbon Neutral By 2050 Silicon

https://i.insider.com/61b13749b4cecd001803d6e7?format=jpeg

Key Takeaways The Federal Solar Tax Credit for 2024 is 30 this is an increase from 26 in recent years and extends through to 2032 Tax credits and incentives can help bring the price down such WASHINGTON President Biden s Inflation Reduction Act is the most significant legislation to combat climate change in our nation s history and one of the largest investments in the American economy in a generation Already this investment and the U S Department of the Treasury s implementation of the law has unleashed an investment and manufacturing boom in the United States unlike

High Efficiency Electric Home Rebate Act HEEHRA This provides rebates for low and middle income families to electrify their homes such as by installing heat pumps or electric clothes The federal government wants the rebates to be deducted from the price of heat pumps and other high efficiency electric appliances at the time of sale Business Why natural gas prices and

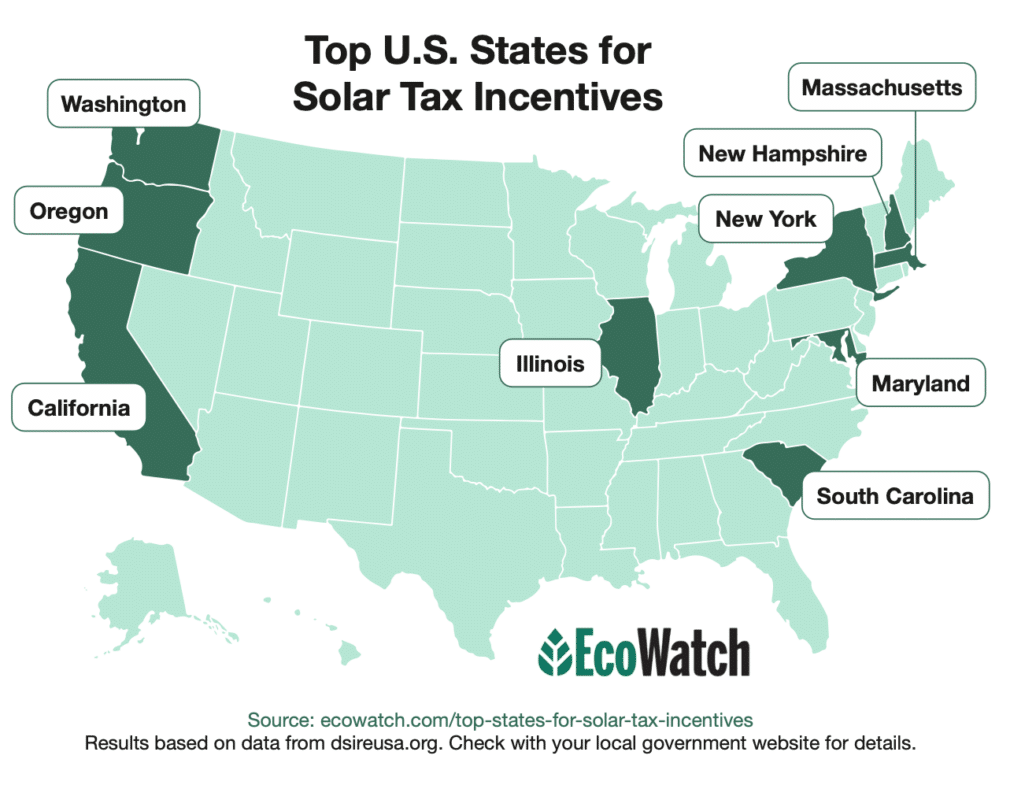

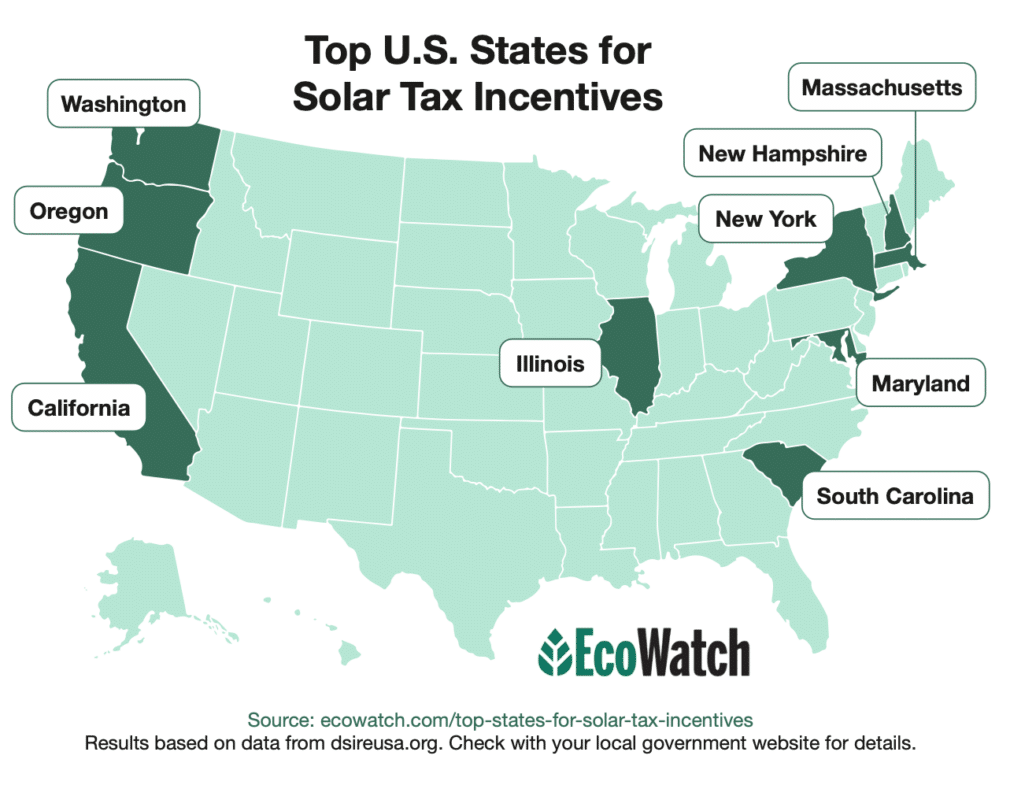

2024 Solar Incentives And Rebates By States Ranked Top 9

https://www.ecowatch.com/wp-content/uploads/2023/03/Top-States-Solar-Incentives-2023-1036x800.png

:max_bytes(150000):strip_icc()/current-u-s-federal-government-spending-3305763_FINAL-97fae60c01ba4ca2b67a244ca2dcce58.gif)

Current U S Federal Government Spending

https://www.thebalancemoney.com/thmb/GkC_zgbAJ29k0wzlO_DMi-UaZE8=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/current-u-s-federal-government-spending-3305763_FINAL-97fae60c01ba4ca2b67a244ca2dcce58.gif

https://www.irs.gov/credits-deductions/energy-efficient-home-improvement-credit

1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit

https://www.energystar.gov/about/federal_tax_credits

The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax credits and deductions that will help reduce energy costs and demand as we transition to cleaner energy sources Tax Credits for Home Builders Tax Deductions for Commercial Buildings

2023 Energy Rebates And Incentives List For Oregon Portland Home Energy Score

2024 Solar Incentives And Rebates By States Ranked Top 9

Federal Government Department Jobs 2022 PO Box No 3104 Islamabad Filectory

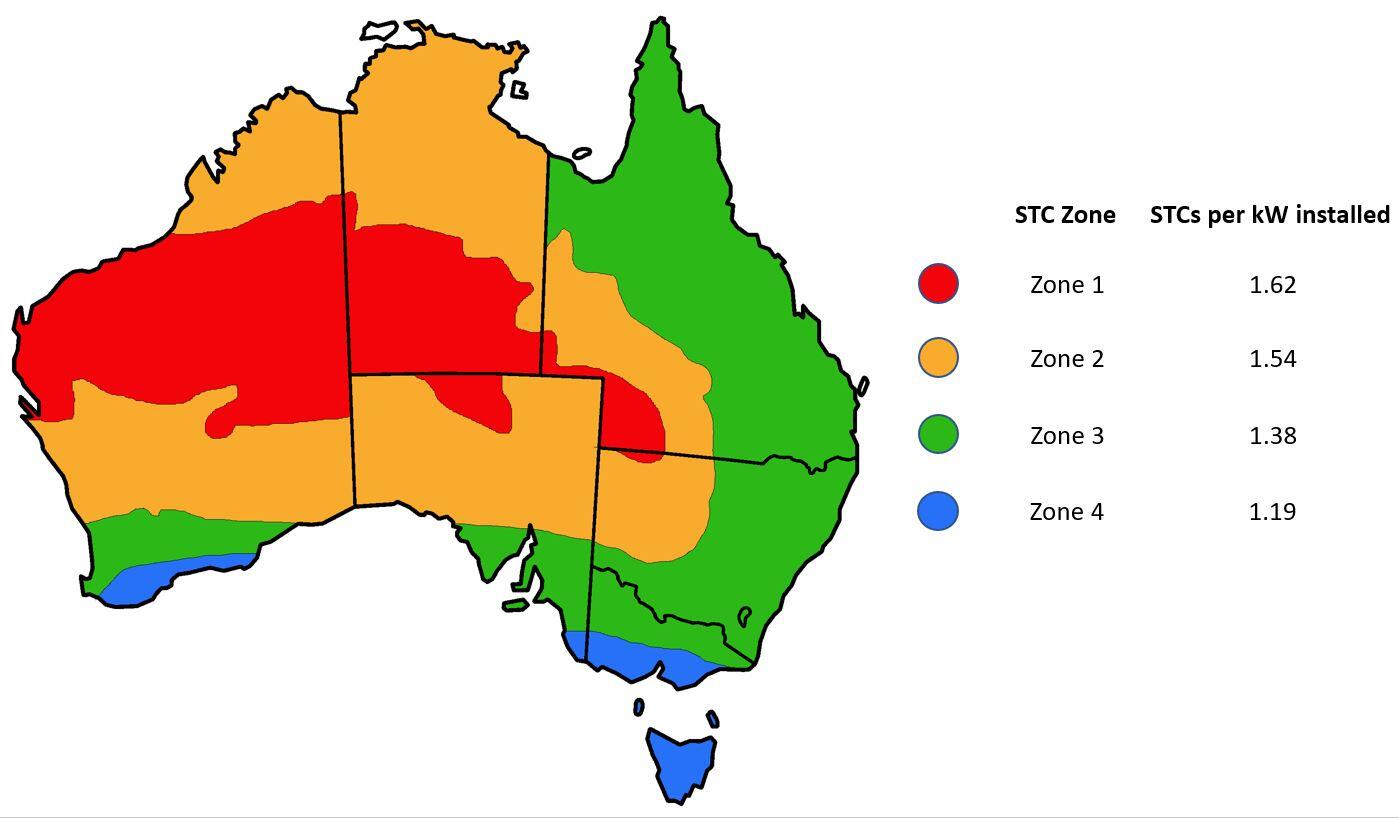

Federal Incentives Solar Rebates For Solar Power Solar Choice

Apply Energy Rebates Ontario

Rebate And Tax Credit Management Quick Electricity

Rebate And Tax Credit Management Quick Electricity

District Of Columbia Student Loan Forgiveness Programs Washington Dc State District Of

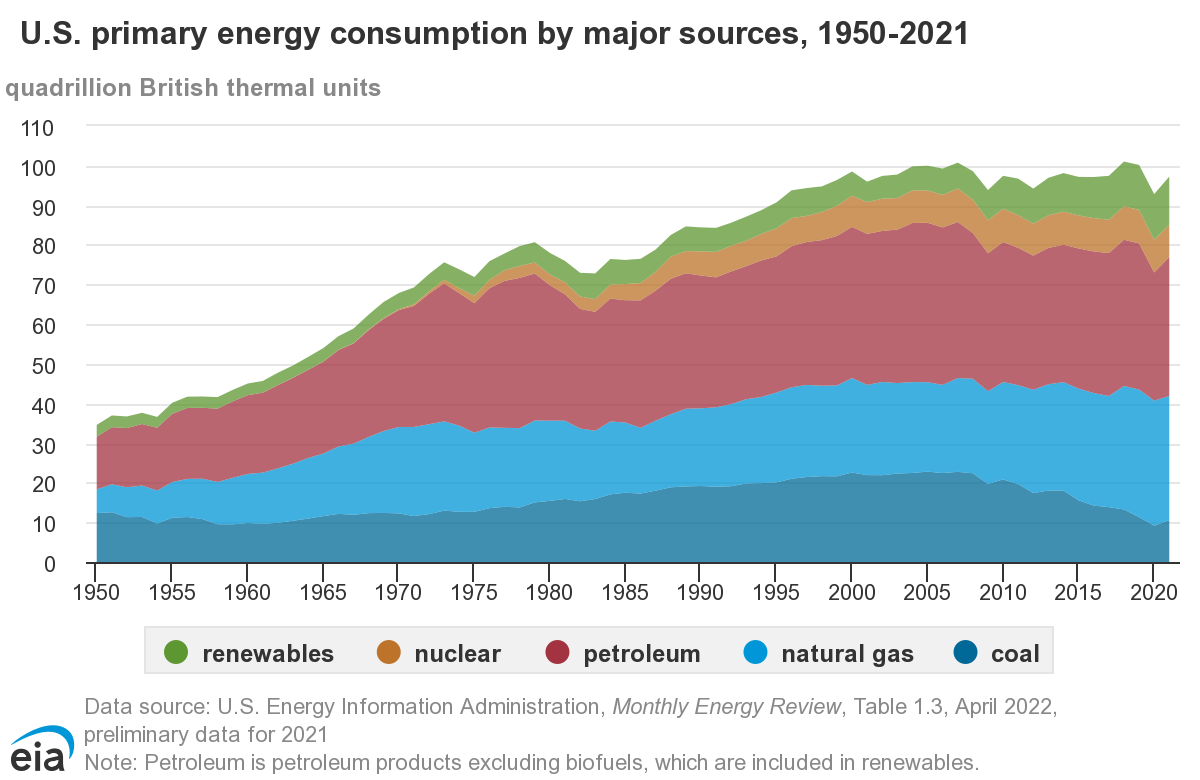

Energy Production And Consumption In The United States EBF 301 Global Finance For The Earth

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

Federal Government Energy Rebates 2024 - WASHINGTON Today the U S Department of the Treasury and Internal Revenue Service IRS released additional guidance under President Biden s Inflation Reduction Act IRA to lower Americans energy bills by providing clarity on eligibility for incentives to install electric vehicle charging stations and other alternative fuel refueling stations The Department of Energy is also