Ev Point Of Sale Rebate 2024 Oct 6 2023 If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles Qualified two wheeled plug in electric vehicles may also be eligible for this credit

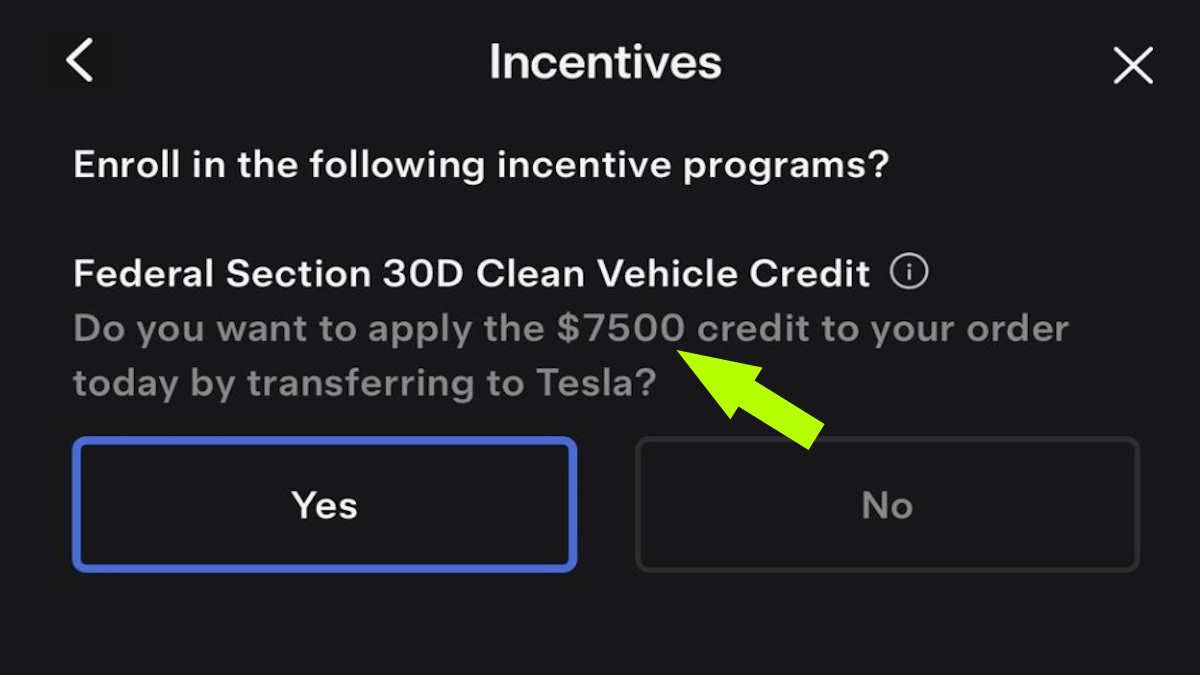

For all of 2023 the EV tax credit is just that a non refundable tax credit Starting January 1 2024 the EV tax credit becomes redeemable at the point of sale In other words you can take your federal incentive as a cash discount when you buy your car at the dealership or online in the case of Tesla Rivian and Lucid For EV customers everything changes on January 1 2024 The Treasury Department has now issued new rules that will turn the federal EV tax credit into what is basically a point of sale

Ev Point Of Sale Rebate 2024

Ev Point Of Sale Rebate 2024

https://www.torquenews.com/sites/default/files/styles/amp_1200x675_16_9/public/images/tesla_7500_ev_tax_credit_point_of_sale.jpg?itok=Ws2JfEQF

The Minnesota EV Rebate Explained

https://d2q97jj8nilsnk.cloudfront.net/images/minnesota-ev-rebate-tax-credit.jpg

Claiming California EV Rebate 2024 Details And Application Process SarkariResult SarkariResult

http://www.sarkariexam.com/wp-content/uploads/2023/12/ClaimingCaliforniaEVRebate2024_DetailsandApplicationProcess.jpg

The federal EV tax credit will shift to a point of sale dealership rebate in 2024 giving customers instant access to the credit the U S Treasury Department confirmed Friday in a press Let s start with the good news Starting January 2024 new and used federal electric vehicle credits can be applied as a point of sale discount on a car s purchase price or as a rebate

New rules for 2024 will allow buyers to get the EV tax credit at the point of sale rather than waiting for tax season Unlike current rules consumers won t need to have a tax liability to get it The federal EV tax credit will shift to a point of sale dealership rebate in 2024 giving customers instant access to the credit the U S Treasury Department confirmed Friday in a press release Under current rules buyers can t claim the credit of up to 7 500 for new vehicles and 4 000 for used vehicles until they file their taxes

Download Ev Point Of Sale Rebate 2024

More picture related to Ev Point Of Sale Rebate 2024

EV Tax Credit Changing To Point of sale Rebate R electricvehicles

https://external-preview.redd.it/LFkcGX90CkWFnqWBb-YaKkJPbCy_ztR4eUVO7bdsrVk.jpg?auto=webp&s=fcda06539cf132bd0a36dd01f267005bea7c2898

Ev Car Tax Rebate Calculator 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/06/tax-credits-drive-electric-northern-colorado.png

Bought Leased A New EV In New Jersey In 2020 Big Check Might Come Your Way

https://cdn.motor1.com/images/mgl/2Xykg/s1/new-jersey-ev-rebate.jpg

Starting in 2024 the Inflation Reduction Act establishes a mechanism that will allow car buyers to transfer the credit to dealers at the point of sale so that it can directly reduce the purchase price 1 Beginning in 2023 qualifying used EV purchases can fetch taxpayers a credit of up to 4 000 limited to 30 of the car s purchase price Some other qualifications Used car must be plug in

In 2023 the required percentage of battery materials is 40 This will increase by 10 annually maxing out at 80 in 2027 For a car to qualify for the other half an additional 3 750 of the Starting Jan 1 the tax credit will also become redeemable as a point of sale rebate among dealers registered with the IRS whereas previously car buyers needed to claim it on their taxes the

How Do The Used And Commercial Clean Vehicle Tax Credits Work Blink Charging

https://blinkcharging.com/wp-content/uploads/2023/04/BlogGraphic_AprilWk2-scaled.jpg

California EV Rebate Program Clean Vehicle Rebate Program

https://www.ny-engineers.com/hubfs/ev rebate program.jpg

https://www.irs.gov/newsroom/qualifying-clean-energy-vehicle-buyers-are-eligible-for-a-tax-credit-of-up-to-7500

Oct 6 2023 If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles Qualified two wheeled plug in electric vehicles may also be eligible for this credit

https://caredge.com/guides/2024-point-of-sale-ev-tax-credit

For all of 2023 the EV tax credit is just that a non refundable tax credit Starting January 1 2024 the EV tax credit becomes redeemable at the point of sale In other words you can take your federal incentive as a cash discount when you buy your car at the dealership or online in the case of Tesla Rivian and Lucid

Potential Missed Deadline For 2023 Sales As Numerous Dealers Fail To Provide Point of Sale

How Do The Used And Commercial Clean Vehicle Tax Credits Work Blink Charging

Alcon Rebate Form 2023 Printable Rebate Form

Trifexis Rebate Form 2022 Printable Rebate Form

Rebate For Electric Car In California EvCarsInfo

Infrastructure Bill EV Rebate Update 500 4500 7500 12500 November 2021 YouTube

Infrastructure Bill EV Rebate Update 500 4500 7500 12500 November 2021 YouTube

Printable Alcon Rebate Form 2023 Printable Forms Free Online

Get Up To A 300 Rebate On Bausch Lomb Contact Lenses Sunshine Optometry

Contact Lens Rebate Forms

Ev Point Of Sale Rebate 2024 - Rules for claiming the federal tax credit for electric vehicles have changed for 2024 Here s what you need to know if you want to buy an EV Image credit Getty Images By Kelley R Taylor