Energy Rebates For 2024 1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit

2034 22 no annual maximum or lifetime limit Get details on the Residential Clean Energy Credit Resources Inflation Reduction Act of 2022 Frequently asked questions about energy efficient home improvements and residential clean energy property credits Credits and deductions under the Inflation Reduction Act of 2022 1 What is the Inflation Reduction Act 2 Which provisions in the Inflation Reduction Act IRA establish home energy rebates 3 HOW MUCH MONEY IS THERE FOR HOME ENERGY REBATES 4 What is U S Department of Energy s timeline for distributing these funds to states and Indian Tribes 5

Energy Rebates For 2024

Energy Rebates For 2024

https://atlantickeyenergy.com/wp-content/uploads/2022/10/what-solar-energy-rebates-and-incentives-are-available-1-1278x581.jpg

Energy Rebates Don t Leave Money On The Table Schmidt Associates

http://schmidt-arch.com/wp-content/uploads/2018/02/Energy-Rebates-Charts.jpg

Federal Solar Tax Credits For Businesses Department Of Energy

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2023-05/Summary-ITC-and-PTC-Values-Chart-2023.png?itok=_P0koCpu

Here s how making energy efficiency part of your 2024 New Year s Resolutions could help you lower your energy costs and save our planet Resolution 1 Save Money Thanks to the Department of Energy s Savings Hub you can easily help determine what clean energy and energy efficiency incentives for home upgrades and appliances are best for you The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax credits and deductions that will help reduce energy costs and demand as we transition to cleaner energy sources Tax Credits for Home Builders Tax Deductions for Commercial Buildings

Energy Efficiency Tax Credits for 2024 Update The tax credits listed below became available on January 1 2023 and can be claimed when you file your income taxes for 2023 If you don t qualify for energy efficiency rebates there are tax credits in the Inflation Reduction Act that can reduce the cost of home electrification projects The Home Efficiency Rebates program provides up to 4 3 billion in formula grants to state energy offices to fund whole home energy efficiency upgrades in single and multi family houses Meanwhile

Download Energy Rebates For 2024

More picture related to Energy Rebates For 2024

Apply Energy Rebates Ontario

https://assets.cdn.filesafe.space/2ONudgiDZKVQR7h1o2sC/media/6411ebd362300014f8cee92c.png

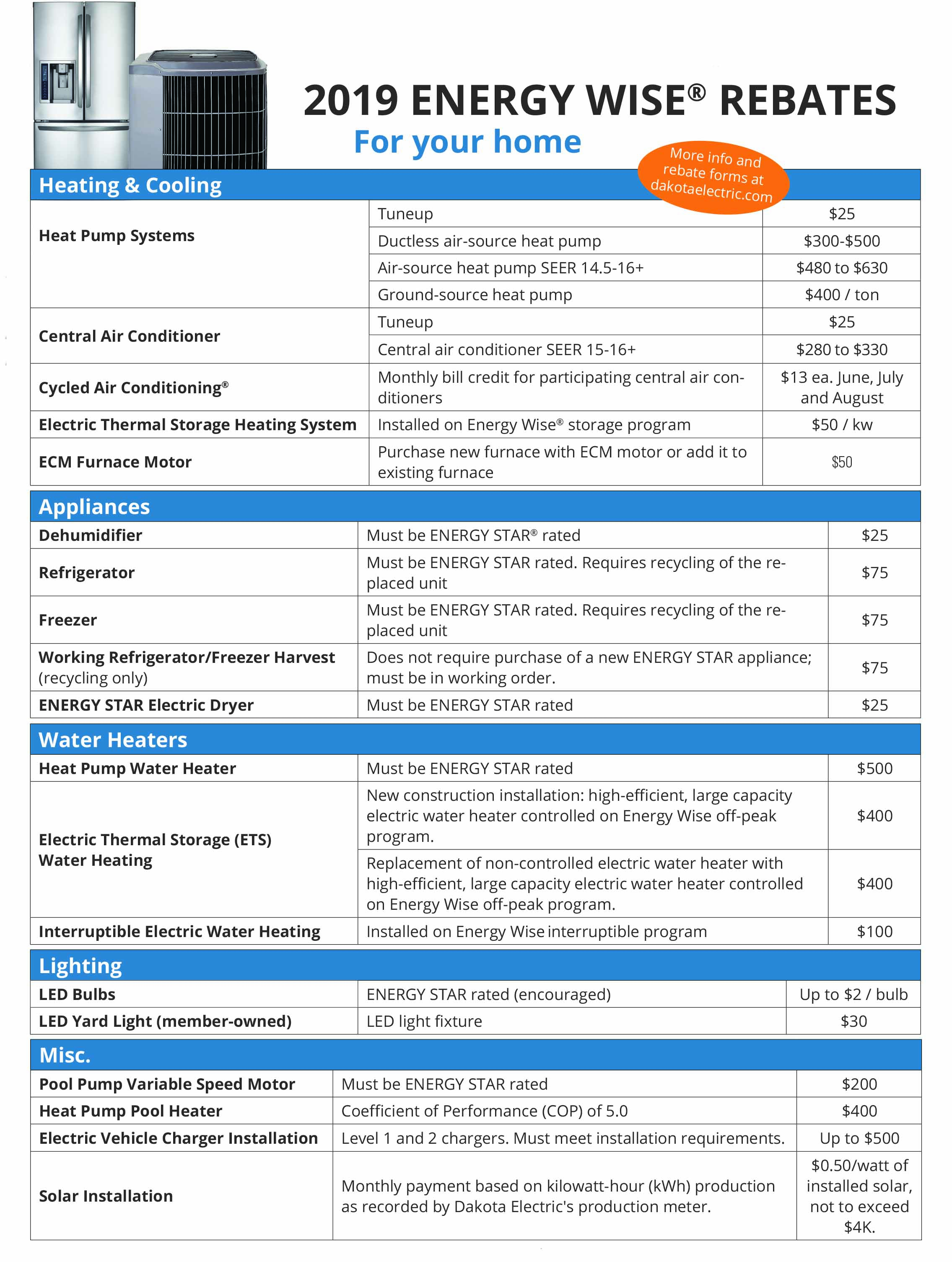

2019 Energy Wise Rebates Dakota Electric Association

https://www.dakotaelectric.com/wp-content/uploads/2019/01/RebateSummary2019-e1548880063852.jpg

Energy Rebates And Incentives For Single Family Housing Pay Off

https://s.propertyware.com/wp-content/uploads/2014/05/energy-rebates.jpg

The Residential Clean Energy Credit equals 30 of the costs of new qualified clean energy property for your home installed anytime from 2022 through 2032 The credit percentage rate phases down to 26 percent for property placed in service in 2033 and 22 percent for property placed in service in 2034 According to the Department of Energy you can save as much as 10 a year on heating and cooling by turning your thermostat down 7 F 10 F for 8 hours a day in the fall and winter So find your favorite blanket and some cozy socks to start saving energy today 6 Get your duct system professionally cleaned

Two tax credits for renewable energy and energy efficiency home improvements have been extended through 2034 and expanded starting in 2023 Must file between November 29 2023 and March 31 2024 to be eligible for the offer Includes state s and one 1 federal tax filing Intuit reserves the right to modify or terminate this TurboTax Live What Is the Heat Pump Tax Credit How to Qualify for the Heat Pump Tax Credit Related Tax Credits Heat Pump Tax Rebate State Heat Pump Installation Incentives How to Apply for Heat Pump Tax

Canadian Clean Energy Rebates Incentives The Sundamentals Project

https://sundamentals.ca/wp-content/uploads/2022/02/Rebates-1.png

Compare Energy Rebates And Concessions In Vic LIFESTYLE BY PS

https://cdn.shopify.com/s/files/1/0162/2116/articles/Energy_Rebates_1200x1200.jpg?v=1629980940

https://www.irs.gov/credits-deductions/energy-efficient-home-improvement-credit

1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit

https://www.irs.gov/credits-deductions/home-energy-tax-credits

2034 22 no annual maximum or lifetime limit Get details on the Residential Clean Energy Credit Resources Inflation Reduction Act of 2022 Frequently asked questions about energy efficient home improvements and residential clean energy property credits Credits and deductions under the Inflation Reduction Act of 2022

2022 Home Energy Rebates Grants And Incentives Top Rated Barrie Windows Doors Company

Canadian Clean Energy Rebates Incentives The Sundamentals Project

How To Look For Energy Rebates In Your Location YouTube

Energy Rebates YouTube

Energy Efficiency Rebates And Tax Credits 2023 New Incentives For Home Electrification Solar

Seresto Rebate Form PrintableRebateForm

Seresto Rebate Form PrintableRebateForm

InlandNWrealestategal

2024 YouTube

Florida Energy Rebates For Air Conditioners 300 Federal Tax Credit For Air Conditioners Kobie

Energy Rebates For 2024 - Energy Efficiency Tax Credits for 2024 Update The tax credits listed below became available on January 1 2023 and can be claimed when you file your income taxes for 2023 If you don t qualify for energy efficiency rebates there are tax credits in the Inflation Reduction Act that can reduce the cost of home electrification projects