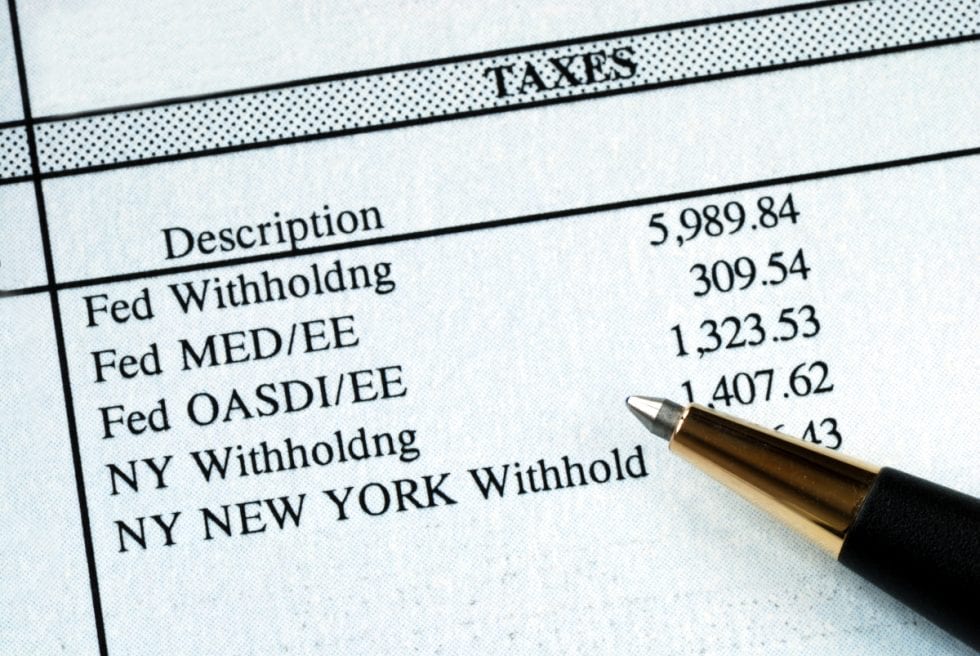

Employer Payroll Tax Rebate 2024 In most cases the federal payroll tax rate is about 15 3 with the employee covering 7 65 and the employer covering 7 65 If you re self employed as a sole

Payroll Tax levied under the Payroll Tax Act 1995 and the Payroll Tax Rates Act 1995 is a tax on all employers self employed persons and deemed employees on the Starting in the first quarter of 2023 the payroll tax credit is first used to reduce the employer share of social secur ity tax up to 250 000 per quarter and any remaining credit

Employer Payroll Tax Rebate 2024

Employer Payroll Tax Rebate 2024

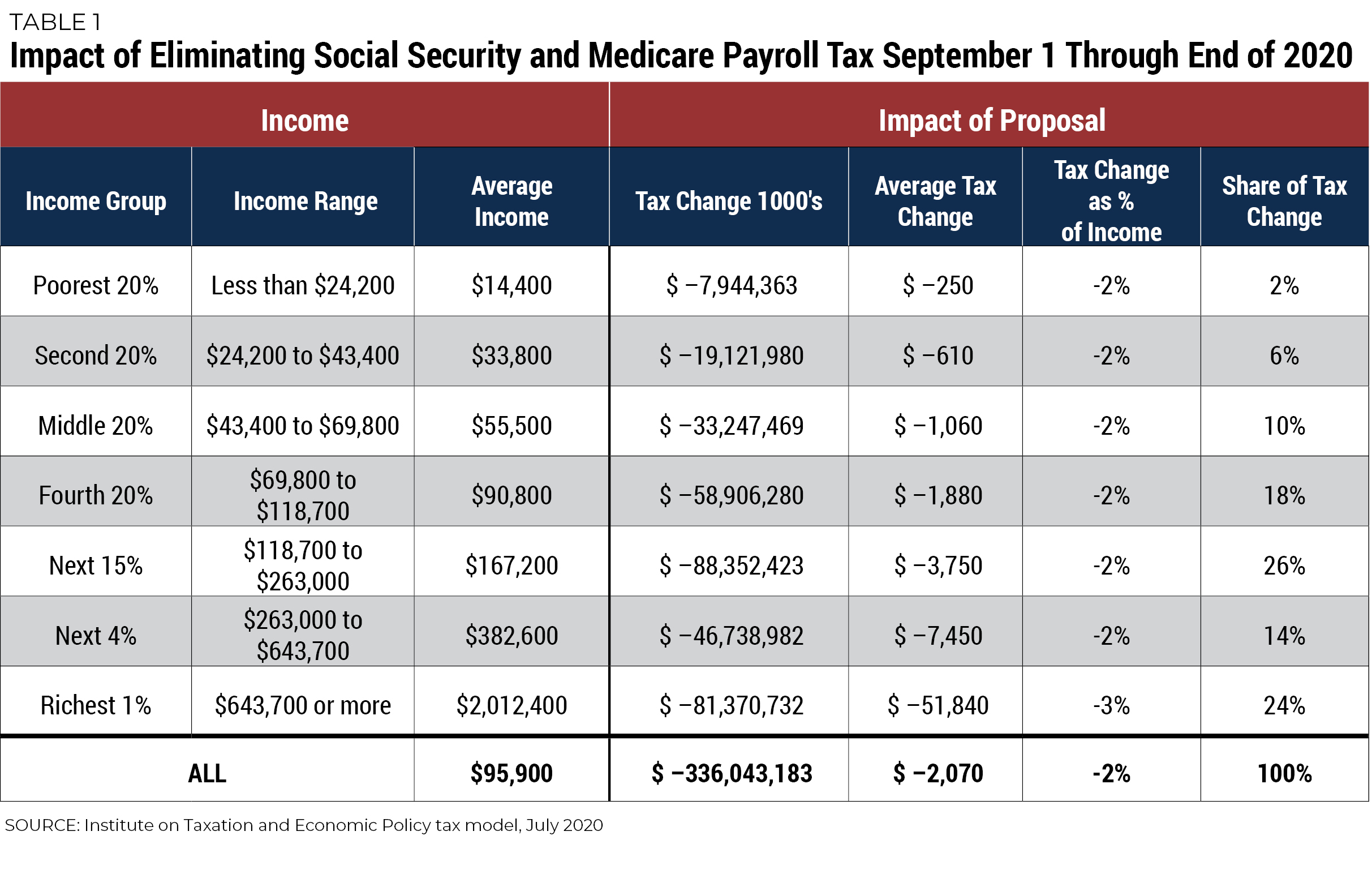

https://itep.sfo2.digitaloceanspaces.com/table-1.jpg

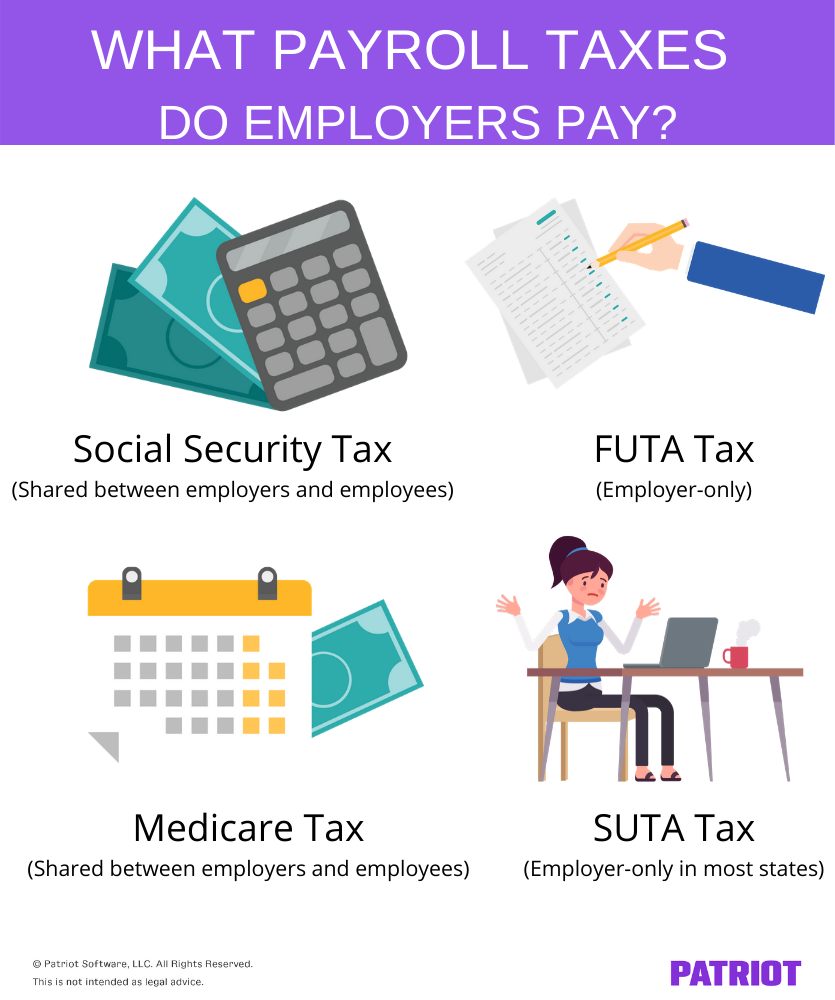

Pin On Small Business Taxes

https://i.pinimg.com/736x/de/e8/03/dee8030aed40d5079769d4bfea19e4ed.jpg

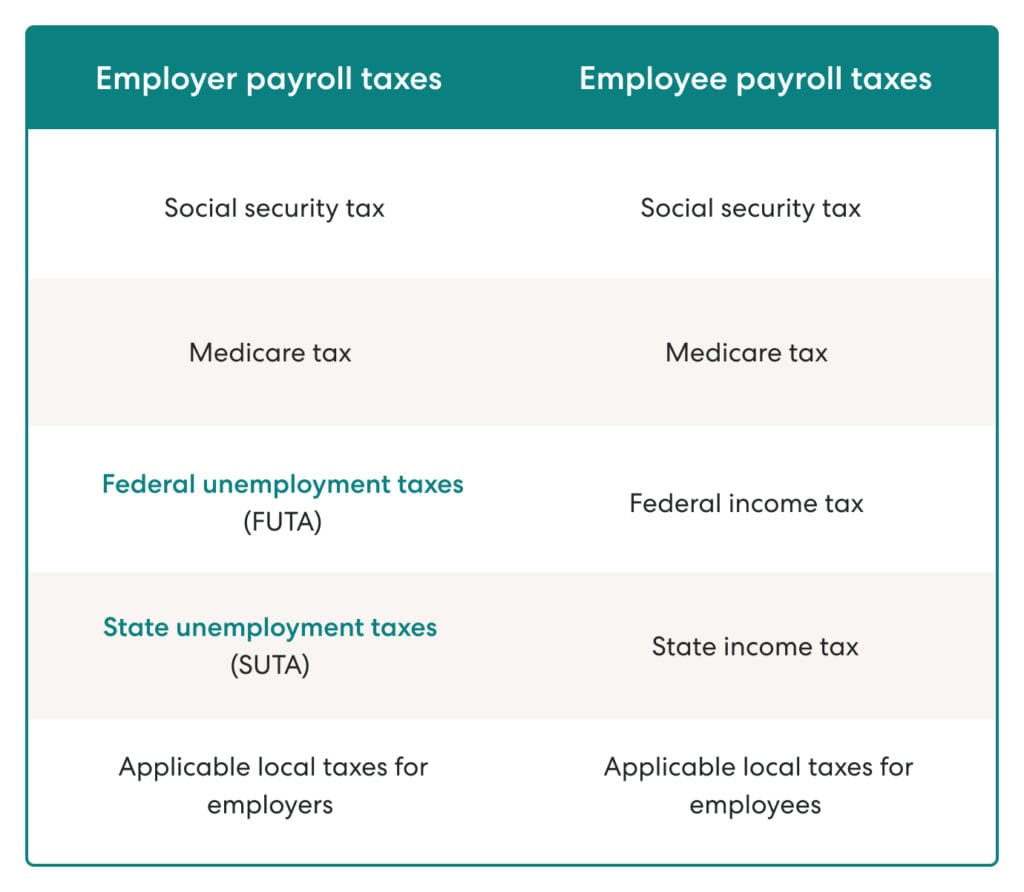

What Are Employee And Employer Payroll Taxes Ask Gusto

https://gusto.com/wp-content/uploads/2019/02/employee-employer-payroll-taxes-1024x892.jpg

Whoever processes your payroll your company is ultimately responsible for any errors or omissions so it s important to get it right the first time and on time for the The Employee Retention Credit ERC sometimes called the Employee Retention Tax Credit or ERTC is a refundable tax credit for certain eligible businesses

EMPLOYEES TAX 2024 TAX YEAR PAYE GEN 01 G18 QUICK REFERENCE CARD In his Budget Speech on 22 February 2023 the Minister of Finance announced new tax Employers of all sizes that face closure orders or suffer economic hardship due to COVID 19 are incentivized to keep employees on the payroll through a 50 credit on up to

Download Employer Payroll Tax Rebate 2024

More picture related to Employer Payroll Tax Rebate 2024

Pin On Payroll Accounting

https://i.pinimg.com/originals/38/4c/a5/384ca54b487af8d84263dae734038c6d.jpg

Payroll Taxes Paid By Employer Overview For Employers

https://www.patriotsoftware.com/wp-content/uploads/2020/02/Employer-Payroll-Taxes.png

The Ultimate Cheat Sheet On Payroll Enerpize

https://onpay.com/wp-content/uploads/2019/09/2020-12-16_13-48-28.png

In addition to limiting ERC claims to those filed before Feb 1 2024 the bill also contains provisions that 1 increase penalties for aiding and abetting the The tax credit is 50 of the wages paid up to 10 000 per employee capped at 5 000 per employee If the amount of the tax credit for an employer is more than the amount of

Special Notice Payroll Deductions Tables T4032 Who should use this guide What if your pay period is not in this guide Which provincial or territorial tax Income Tax Rebates For Resident Individual With Chargeable Income Less Than RM35 000

How To Do Payroll In Excel In 7 Steps Free Template 2022

https://fitsmallbusiness.com/wp-content/uploads/2021/10/Screenshot_of_Employer_Payroll_Taxes_Tab.jpg

Understanding California Payroll Tax Finansdirekt24 se

https://www.patriotsoftware.com/wp-content/uploads/2022/08/Copy-of-Payroll-Taxes-in-California-835-×-986-px-1.png

https://www.forbes.com/advisor/business/payroll-tax-rates

In most cases the federal payroll tax rate is about 15 3 with the employee covering 7 65 and the employer covering 7 65 If you re self employed as a sole

https://www.gov.bm/payroll-tax

Payroll Tax levied under the Payroll Tax Act 1995 and the Payroll Tax Rates Act 1995 is a tax on all employers self employed persons and deemed employees on the

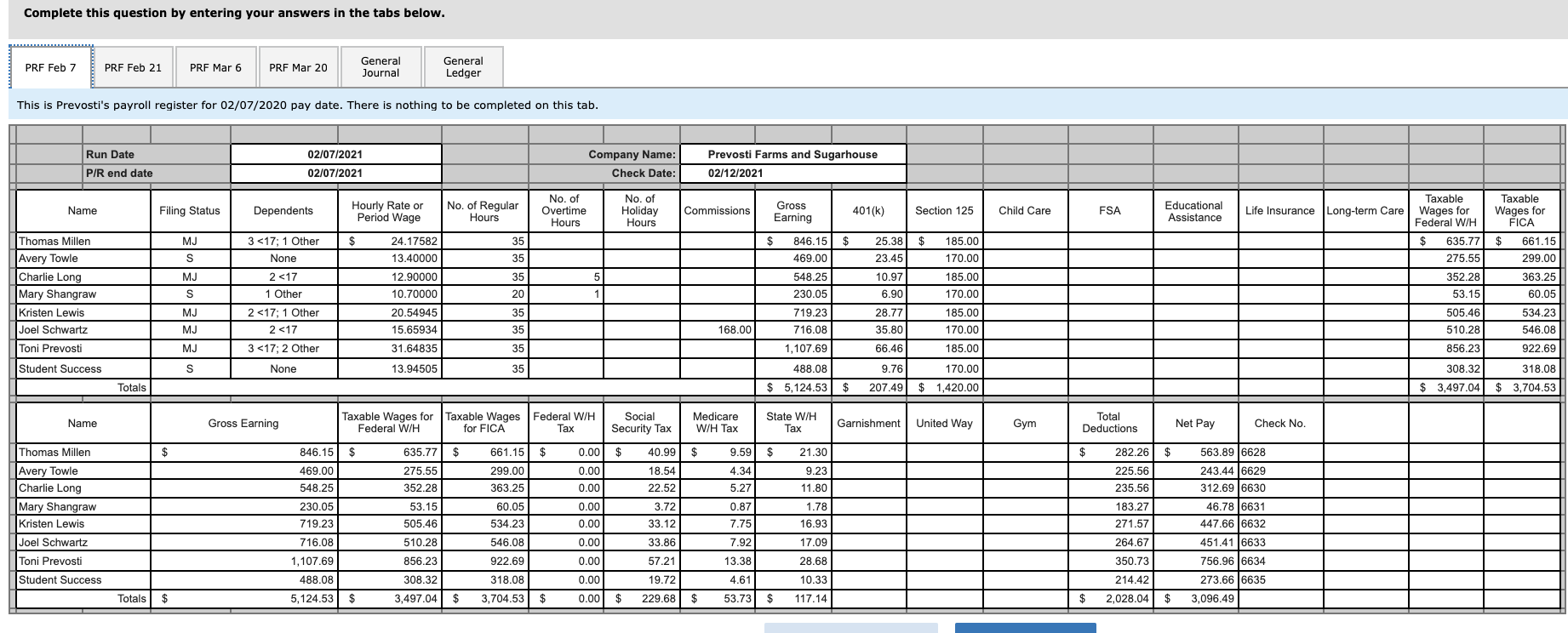

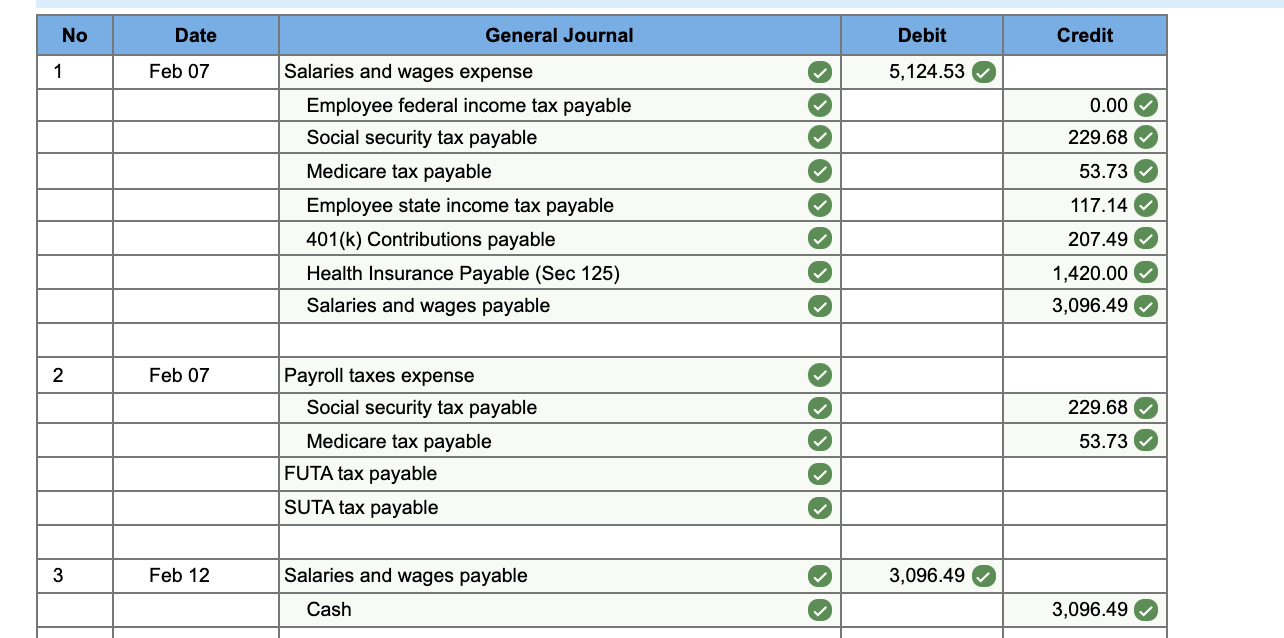

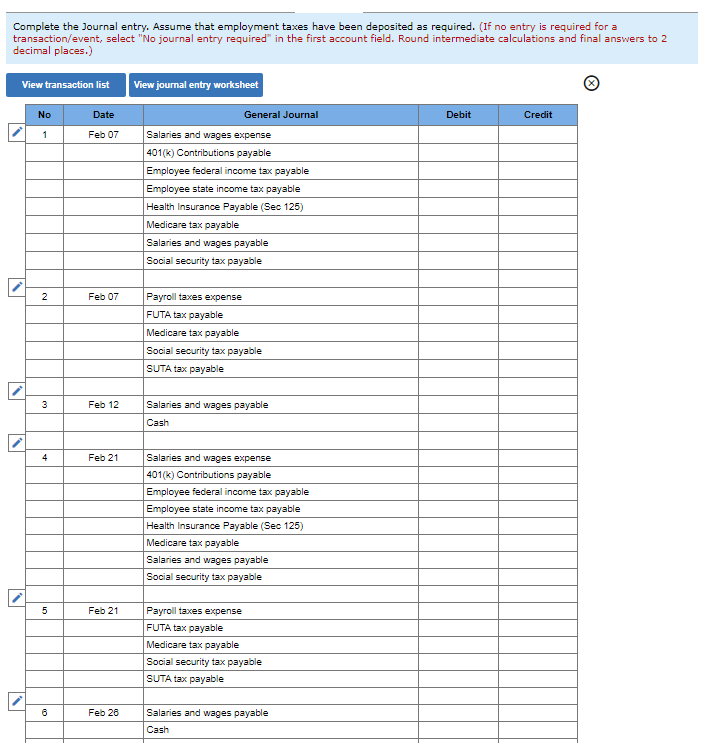

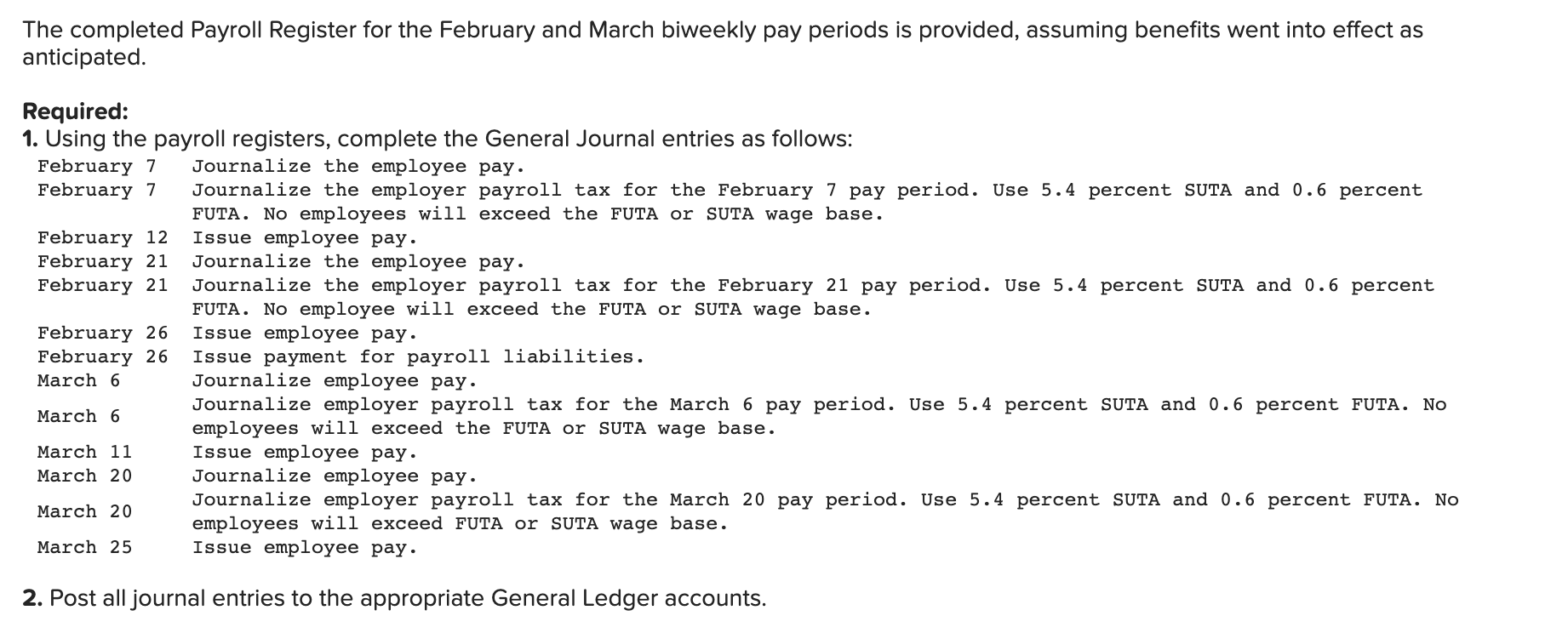

The Completed Payroll Register For The February And Chegg

How To Do Payroll In Excel In 7 Steps Free Template 2022

Employer Payroll Tax Issues And What To Do About Them The Becerra Group

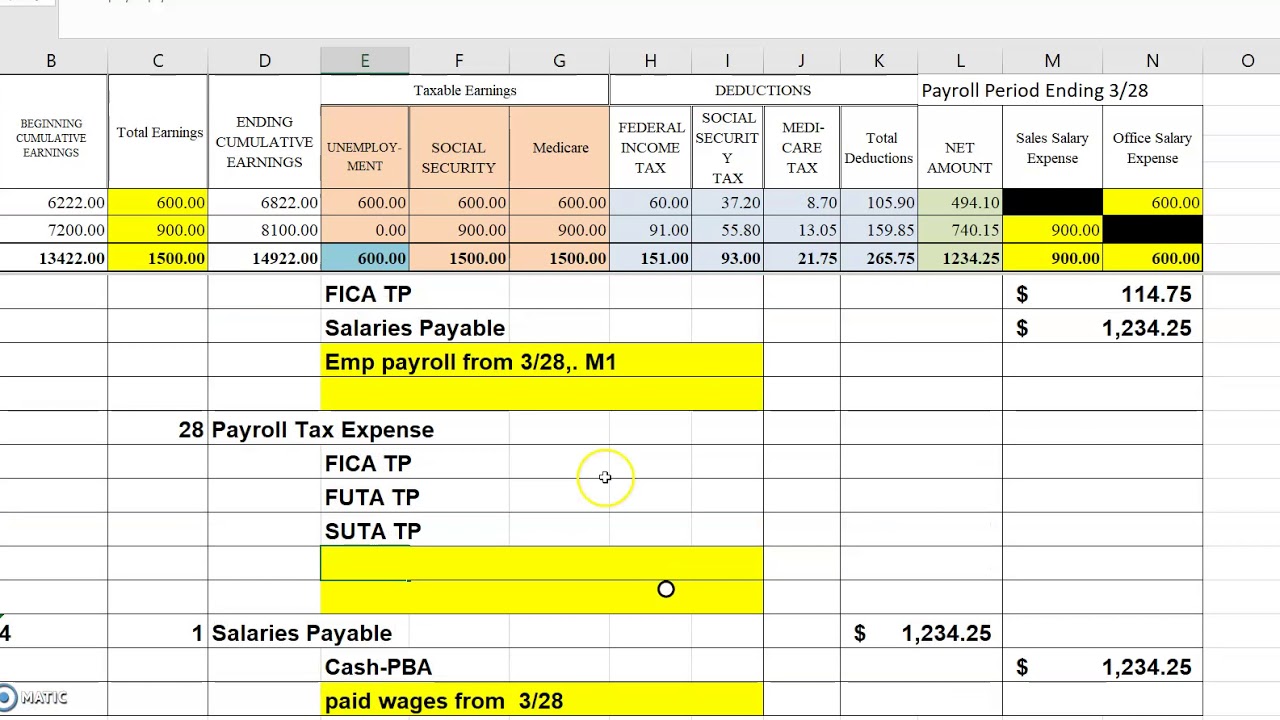

Solved 1 Using The Payroll Registers Complete The General Chegg

The Completed Payroll Register For The February And Chegg

Tax Rebate Service No Rebate No Fee MBL Accounting

Tax Rebate Service No Rebate No Fee MBL Accounting

:max_bytes(150000):strip_icc()/work-57910b405f9b58cdf3c601e9.jpg)

Employer Payroll Tax Deferral Provision What It Is How It Works

The Completed Payroll Register For The February And Chegg

C8 Sample Lesson Payroll Tax Expense Part I Employer Payroll Tax Expense YouTube

Employer Payroll Tax Rebate 2024 - EMPLOYEES TAX 2024 TAX YEAR PAYE GEN 01 G18 QUICK REFERENCE CARD In his Budget Speech on 22 February 2023 the Minister of Finance announced new tax