Electric Car Tax Credit 2024 Uk As announced at Autumn Budget 2024 the government will introduce legislation in Finance Bill 2024 25 to increase the main rates of Capital Gains Tax CGT from 10 and

1 Benefit in Kind BiK Tax Rates Remain Low for EVs One of the most impactful announcements in Budget 2024 is the retention of low BiK tax rates for electric company cars Currently EVs enjoy a BiK rate much lower Zero emission vehicles Tax incentives continue for pure electric vehicles with the percentage rate increasing gradually by 2 each year up to a cap of 9 in 2029 30 Hybrid vehicles Hybrid company cars emitting 1 50 g

Electric Car Tax Credit 2024 Uk

Electric Car Tax Credit 2024 Uk

https://i.pcmag.com/imagery/articles/04InvhVC1HTje7XJcv9Tb7Q-4.fit_lim.v1681756100.jpg

Electric Vehicle Tax Credit Explained Rhythm

https://www.gotrhythm.com/_next/image?url=https:%2F%2Fimages.ctfassets.net%2F81o0exmdkv18%2F1Ih7Xkv6V29tej0lozgZnI%2F69087ff2f2f4a2c9e28b5d50b26157fa%2FEVBlog_TaxCredit.jpg&w=3840&q=100

Which Electric Vehicles EVs Qualify For A Tax Credit

https://images.axios.com/dTZ_jXrSHE_gtdpeMc1xB0j_LCM=/0x0:1920x1080/1366x768/2023/04/17/1681767737027.jpg

This tax information and impact note sets out an extension to the availability of the 100 first year allowances for zero emission cars and electric vehicle charge points UK News Website of the Year 2024 News Sport Business Petrol drivers will pay at least 100 more in tax the year after buying a car while electric vehicles

Electric cars with zero emissions fall into the lowest benefit in kind tax band resulting in lower tax liabilities for employees This makes electric vehicles very attractive for businesses and employees As a comparison the Under the plans laid out today electric cars registered from April 2025 will pay the lowest rate of 10 in the first year then move to the standard rate which is currently 165 The standard

Download Electric Car Tax Credit 2024 Uk

More picture related to Electric Car Tax Credit 2024 Uk

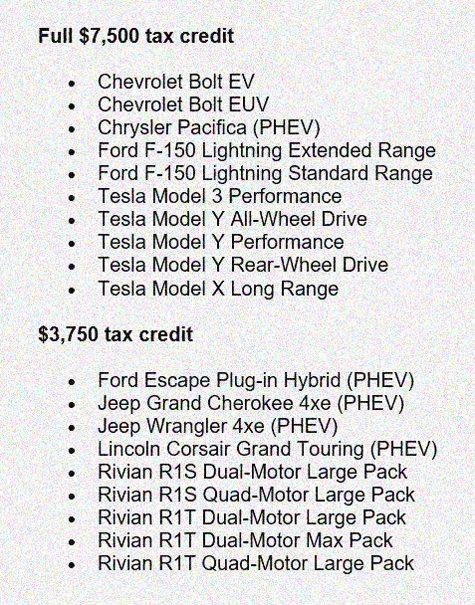

Confused As To Which Plug in Cars Still Qualify For Tax Credits

https://i.pinimg.com/originals/1c/4f/58/1c4f58b145760d2daedeac553af67fb6.jpg

7 500 EV Tax Credit Use It Or Lose It YouTube

https://i.ytimg.com/vi/W6QEuZFy5GI/maxresdefault.jpg

Frequently Asked Questions 2023 Clean Energy And Electric Vehicle Tax

https://alloysilverstein.com/wp-content/uploads/2022/09/Clean-Vehicle-Credit-2022.png

Whilst keeping the UK tax system internationally competitive with lower rates Autumn Budget 2024 41 verify changes in Universal Credit UC claims saving 250 million in 2029 30 and Electric vehicles EVs currently enjoy free road tax also called Vehicle Excise Duty However from 1 April 2025 drivers of electric cars in the UK will need to pay for road tax for the first time

The government is yet to finalise all the terms of its restructured VED scheme but it has confirmed its new first year car tax rates Now any electric car registered on or after 1 The UK s Autumn Budget 2024 brings significant adjustments aimed at supporting electric vehicle EV adoption with an emphasis on expanding charging infrastructure

U S Car Brands Will Benefit Most From Electric Vehicle Tax Breaks

https://static01.nyt.com/images/2023/04/17/multimedia/17ev-credits-1-vbpt/17ev-credits-1-vbpt-videoSixteenByNine3000.jpg

New Rules Which Electric Vehicles Qualify For The Federal Tax Credit

https://s.hdnux.com/photos/01/27/02/00/22814758/4/rawImage.jpg

https://www.gov.uk › government › publications

As announced at Autumn Budget 2024 the government will introduce legislation in Finance Bill 2024 25 to increase the main rates of Capital Gains Tax CGT from 10 and

https://electriccarguide.co.uk

1 Benefit in Kind BiK Tax Rates Remain Low for EVs One of the most impactful announcements in Budget 2024 is the retention of low BiK tax rates for electric company cars Currently EVs enjoy a BiK rate much lower

How To Calculate Electric Car Tax Credit OsVehicle

U S Car Brands Will Benefit Most From Electric Vehicle Tax Breaks

New Clean Vehicle Tax Credit Wiztax

2023 Electric Vehicle Tax Credit BenefitsFinder

Facts About Electric Car Tax Credits Signature Auto Group NYC

What To Know About The Electric Vehicle Tax Credits And How To Get

What To Know About The Electric Vehicle Tax Credits And How To Get

2024 EV Tax Credit Rule Adjustments Shrink Availability The Each Day

:quality(70)/arc-anglerfish-arc2-prod-cmg.s3.amazonaws.com/public/Z5JIUHPLHW7PPAT2HJ32OKHXYI.png)

Electric Vehicle Tax Credit Amount Electric Vehicle Tax Credits What

Electric Vehicle Tax Credit Complete Guide 2024

Electric Car Tax Credit 2024 Uk - In the 2023 Autumn Statement Jeremy Hunt announced that the Benefit in Kind BiK tax will remain at 2 until 2025 and then rise by 1 every year thereafter until it reaches