Ct Child Tax Rebate 2024 Tracker Upcoming CT DRS webinar Select to register for the upcoming Withholding Forms W 2 and 1099 Annual Filing Webinar on Wednesday January 15 2025 at 10 00 a m 2022 Child Tax

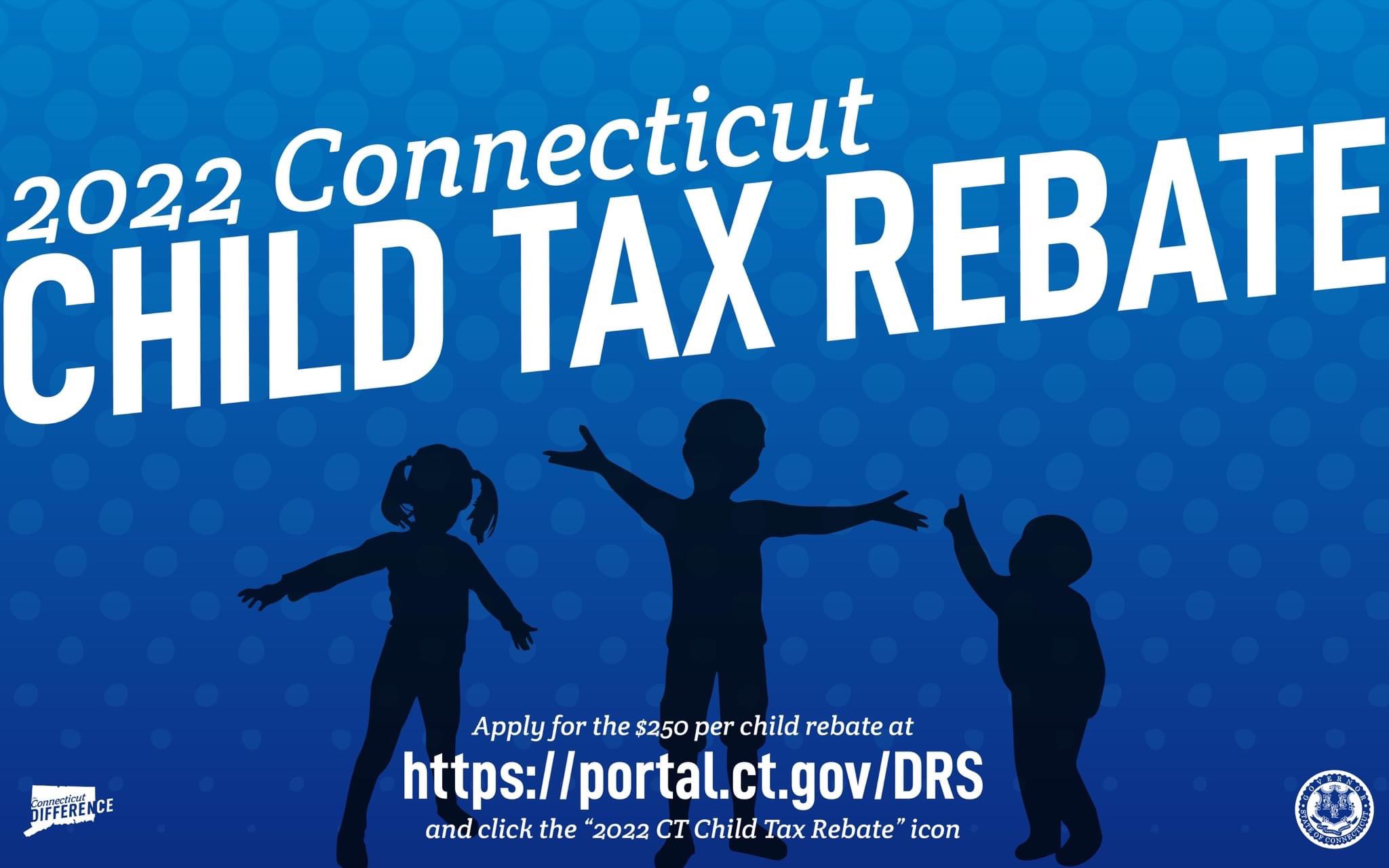

CT families could see some relief as bill with child tax credit passes Progressive policy group urges CT to expand tax relief for families The child tax rebate which was recently authorized by the Connecticut General Assembly and signed into law by Governor Ned Lamont is intended to help Connecticut families with children You may be eligible for a child tax rebate of

Ct Child Tax Rebate 2024 Tracker

Ct Child Tax Rebate 2024 Tracker

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA10eoKa.img?w=1568&h=1045&m=4&q=81

CT Child Tax Rebate Checks Are In The Mail Lamont Across Connecticut CT Patch

https://patch.com/img/cdn20/users/22994611/20220825/105526/styles/patch_image/public/money-bills___25105510368.jpg

West Hartford Residents Apply By July 31 For CT Child Tax Rebate We Ha West Hartford News

https://we-ha.com/wp-content/uploads/2022/06/Screen-Shot-2022-06-07-at-4.57.30-PM.png

Efforts to expand the federal child tax credit will likely fall short during this session of Congress after Senate Republicans blocked a bipartisan bill with tax breaks for low income families The temporary credit provided qualifying low and middle income families a rebate of up to a maximum of 750 or 250 annually per child up to three children The Connecticut Child Tax Credit Coalition led by the United

The state will start sending child tax rebate checks out this week according to Gov Ned Lamont Eligible families had to apply by July 31 to receive 250 per child up to 750 per family Eligible families can begin applying next month for Connecticut s new one year child tax rebate program that s included in the newly revised state budget Gov Ned Lamont

Download Ct Child Tax Rebate 2024 Tracker

More picture related to Ct Child Tax Rebate 2024 Tracker

Who s Eligible For The Connecticut Child Tax Rebate

https://media.marketrealist.com/brand-img/mxVSc8gb7/1280x670/connecticut-ct-child-tax-rebate-check-1660116086071.jpg?position=top

Advocates Push For CT Child Tax rebate Program To Return In 2023

https://s.hdnux.com/photos/01/30/22/71/23146052/3/rawImage.jpg

CT Families Should Begin Receiving Child Tax Rebates This Week Governor NBC Connecticut

https://media.nbcconnecticut.com/2022/08/child-tax-rebate-news-conference.jpeg?quality=85&strip=all&resize=1200%2C675

You may be eligible for a child tax rebate of up to a maximum of 750 250 per child up to three children To be eligible for this rebate you must meet all of the following requirements You must be a resident of Connecticut You must The child tax rebate is a one time rebate of up to 750 250 per child up to three children It is a rebate of taxes paid in 2021 it is not a credit that can be claimed on an income tax return

HARTFORD By early next week more than 189 000 checks worth 78 million will reach families with kids 18 years of age of younger under the state s election year child tax rebate program That enhancement increased the rebate up to 3 600 per child under age 6 and 3 000 per child age 6 to 18 Those who qualified for the full amount were working couples

Group Pushes For Return Of CT s Child Tax Rebate

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA19RRi8.img?w=1280&h=720&m=4&q=79

CT s New Child Tax Rebate Connecticut Association For Community Action

https://www.cafca.org/wp-content/uploads/2022/06/CTCTR-English-1582x2048.jpg

https://portal.ct.gov › drs › credit-programs › child-tax-rebate

Upcoming CT DRS webinar Select to register for the upcoming Withholding Forms W 2 and 1099 Annual Filing Webinar on Wednesday January 15 2025 at 10 00 a m 2022 Child Tax

https://ctmirror.org

CT families could see some relief as bill with child tax credit passes Progressive policy group urges CT to expand tax relief for families

Nearly 200 000 Families Can Still Apply For 2022 CT Child Tax Rebate Before July 31 Deadline

Group Pushes For Return Of CT s Child Tax Rebate

2022 Child Tax Rebate Stratford Crier

Connecticut Child Tax Rebate Beginning June 1 Connecticut Lamont Governor

Opinion CT Must Enact A Permanent Refundable Child Tax Credit

CT Families Eligible For Child Tax Rebate CBS New York

CT Families Eligible For Child Tax Rebate CBS New York

VIDEO Group Pushes For Return Of CT s Child Tax Rebate YouTube

Samaila Adelaiye Ph D On LinkedIn 2022 CT Child Tax Rebate

Jimmy Tickey On Twitter Starting Today 250 Per Child Tax Rebates Are Available To

Ct Child Tax Rebate 2024 Tracker - Efforts to expand the federal child tax credit will likely fall short during this session of Congress after Senate Republicans blocked a bipartisan bill with tax breaks for low income families