Cit Rebate Ya 2024 Learn how to file Estimated Chargeable Income ECI for YA 2024 and get a 50 CIT Rebate of the corporate tax payable Find out if your company qualifies for the ECI filing waiver or is not required to file ECI

All companies will enjoy a 50 CIT rebate capped at SGD 40 000 and net of any CIT cash grant received for YA 2024 Companies with at least one local employee will receive SGD 2 000 CIT cash grant by third quarter of 2024 CIT Rebate of 50 of tax payable will be granted for YA 2024 Companies that have employed at least one local employee in 2023 will receive a minimum benefit of 2 000 in the form of a cash payout CIT Rebate Cash Grant The maximum total benefits of CIT Rebate and CIT Rebate Cash Grant is 40 000 Refundable Investment Credit

Cit Rebate Ya 2024

Cit Rebate Ya 2024

https://m.media-amazon.com/images/I/91JorPYWOEL.jpg

Tolminator 2024

https://tolminator.mojekarte.si/design/tolminator/img-tolminator/logo-2024-1.png

Rebate YouTube

https://i.ytimg.com/vi/T_z7SGbhgxk/maxresdefault.jpg

CIT Rebate of 50 of tax payable will be granted for YA 2024 Companies that have employed at least one local employee in 2023 will receive a minimum benefit of 2 000 in the form of a cash payout CIT Rebate Cash Grant The maximum total benefits of CIT Rebate and CIT Rebate Cash Grant is 40 000 To help companies manage rising costs Budget 2024 includes a proposal to grant a CIT rebate of 50 of the CIT payable for YA 2024 It is also proposed that companies that have employed at least one local employee in 2023 the local employee condition would receive a minimum benefit of SGD 2 000 in the form of a cash payout

Benefits of CIT Rebate and CIT Rebate Cash Grant that a company may receive is 40 000 CIT Rebate Cash Grant by 3Q 2024 CIT Rebate less any CIT Rebate Cash Grant received after filing of CIT returns for YA2024 NA Contact Inland Revenue Authority of Singapore IRAS via ctmail iras gov sg Please refer to Annex B 2 of the 2024 Budget The government has also introduced various schemes providing support for businesses including a new CIT Rebate for year of assessment YA 2024 and a CIT Rebate Cash Grant enhanced

Download Cit Rebate Ya 2024

More picture related to Cit Rebate Ya 2024

Corporate Taxation In Singapore CIT Rebate Start Up Tax Exemption IR Global

https://i0.wp.com/www.aseanbriefing.com/news/wp-content/uploads/2018/08/ASEAN-Briefing-Corporate-Tax-in-Singapore-002.jpg?ssl=1

Businesses To Get S 1 4b Boost CIT Rebate Extended To YA2018 Business News AsiaOne

https://www.asiaone.com/sites/default/files/styles/a1_og_image/public/original_images/Feb2017/20170221_WORK.jpg?itok=P35Qc_br

Pensioner Rebate Doubled To Provide Support Bundaberg Now

https://www.bundabergnow.com/wp-content/uploads/2023/06/Pensioner-rebate-1920x1380.jpg

A Corporate Income Tax CIT Rebate for YA 2024 with a CIT Rebate Cash Grant for eligible companies Companies will receive a 50 corporate income tax rebate capped at 40 000 CIT Rebate of 50 of tax payable will be granted for YA 2024 Companies that have employed at least one local employee in 2023 will receive a minimum benefit of 2 000 in the form of a cash payout CIT Rebate Cash Grant The maximum total benefits of CIT Rebate and CIT Rebate Cash Grant is 40 000 Refundable Investment Credit RIC

IRAS will automatically compute and allow the CIT Rebate in the company s YA 2024 tax assessment based on the submitted tax forms Finalised YA 2024 tax assessments impacted by these changes will receive amended notices of assessment by 31 August 2024 The CIT Rebate less any CIT Rebate Cash Grant received will be automatically incorporated in companies tax assessments raised after they file their CIT returns for YA 2024 For example Company A hired two local employees in 2023 It has a CIT assessment of 30 000 for YA 2024

Blockchaincon Latam 2024

https://blockchaincon.la/wp-content/uploads/2023/05/fondoblock-1.jpg

Traderider Rebate Program Verify Trade ID

https://traderider.com/rebate/assets/img/rebate-forex.jpg

https://www.iras.gov.sg/taxes/corporate-income-tax/...

Learn how to file Estimated Chargeable Income ECI for YA 2024 and get a 50 CIT Rebate of the corporate tax payable Find out if your company qualifies for the ECI filing waiver or is not required to file ECI

https://www.grantthornton.sg/insights/2024...

All companies will enjoy a 50 CIT rebate capped at SGD 40 000 and net of any CIT cash grant received for YA 2024 Companies with at least one local employee will receive SGD 2 000 CIT cash grant by third quarter of 2024

REBATE YouTube

Blockchaincon Latam 2024

Organisateurs Salomon 2024

Government Solar Rebate QLD Everything You Need To Know

Rebate Management HubHero

2024 Campaign Kick Off The Birmingham Jewish Federation

2024 Campaign Kick Off The Birmingham Jewish Federation

What Is A Rebate YouTube

Side Events Opportunity Festival 2024

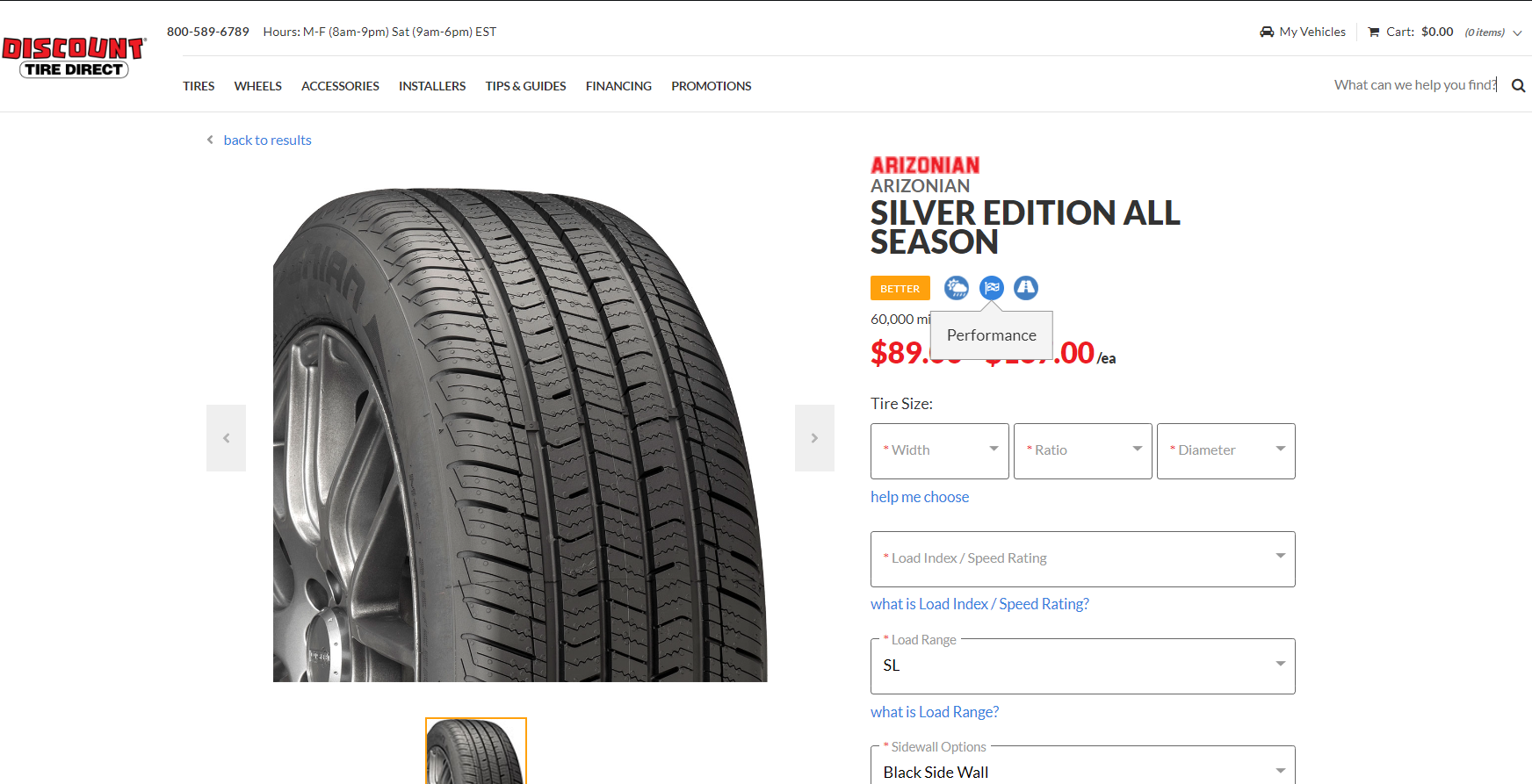

Arizonian Tire Rebate 2023 A Comprehensive Guide To Saving Big On Your Next Tire Purchase

Cit Rebate Ya 2024 - To help companies manage rising costs Budget 2024 includes a proposal to grant a CIT rebate of 50 of the CIT payable for YA 2024 It is also proposed that companies that have employed at least one local employee in 2023 the local employee condition would receive a minimum benefit of SGD 2 000 in the form of a cash payout