Child Tax Credit Rebate 2024 You qualify for the full amount of the 2023 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than 200 000 400 000 if filing a joint return Parents and guardians with higher incomes may be eligible to claim a partial credit Use our Interactive Tax Assistant to check if you

What the Child Tax Credit is and who qualifies for it 03 22 as well as to get more money back in their annual tax refund 1 900 in 2024 and 2 000 in 2025 Child tax credit 2023 taxes filed in 2024 For 2023 the child tax credit is worth 2 000 per qualifying dependent child if your modified adjusted gross income is 400 000 or below married

Child Tax Credit Rebate 2024

Child Tax Credit Rebate 2024

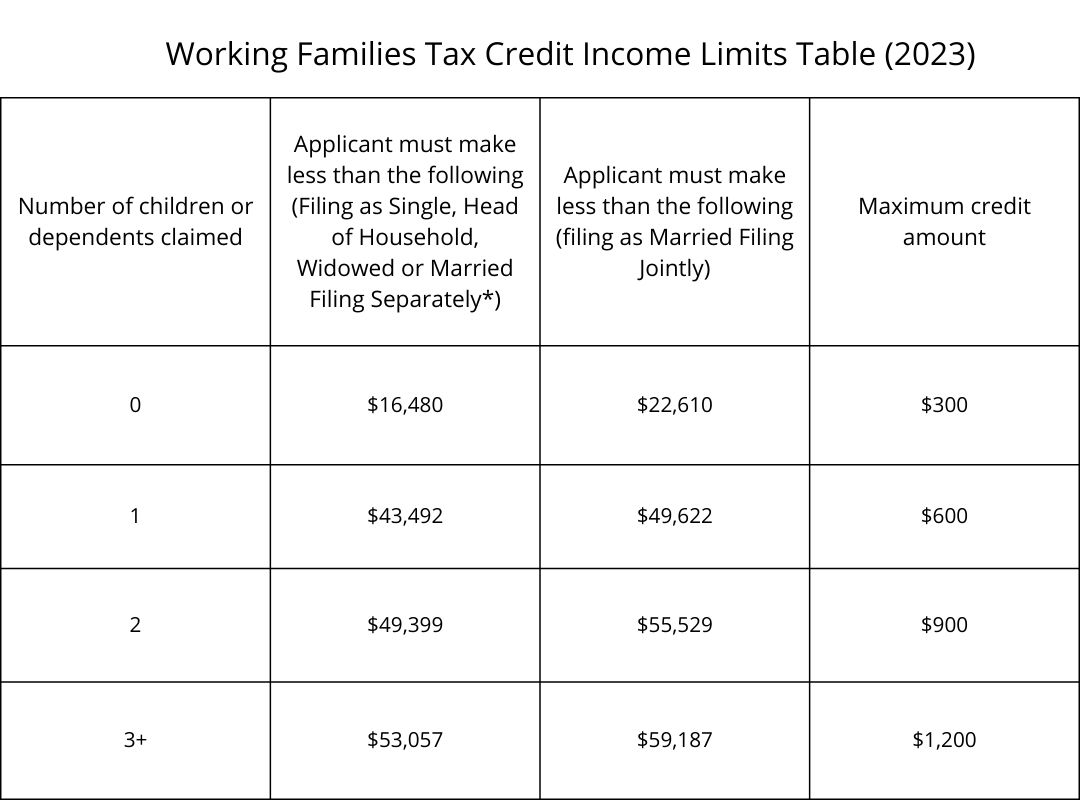

https://www.wataxcredit.org/wp-content/uploads/2023/01/WFTC-Income-Table-.jpg

Advance Child Tax Credit Payments Start Tomorrow KM M CPAs

https://kmmcpas.com/wp-content/uploads/2021/07/7-14-21-child-tax-credit-poster.jpg

Child Tax Credit 88 Of Children Covered By Monthly Payments Starting In July As Part Of

https://www.masslive.com/resizer/hVi-KLhmrqkjnfObTht2voR0Lto=/1280x0/smart/cloudfront-us-east-1.images.arcpublishing.com/advancelocal/RJQNYTGHYJCMJAGCH5BVNC5BIE.jpg

Flexible Income Lookback Taxpayers can choose to use either current or prior year income to calculate the child tax credit in 2024 and 2025 providing flexibility in determining eligibility Inflation Adjustment Starting in 2024 the child tax credit will be adjusted for inflation to keep up with the rising cost of living Business tax relief This is a refundable tax credit which means you could receive the amount of the credit as a tax refund if you qualify For 2024 the credit is worth up to 7 830 up from 7 430 for 2023 with

More families could be eligible for the child tax credit as soon as 2024 if new legislation passes Congress iStock 7 min Comment 295 Congressional negotiators announced a roughly 80 billion Key Takeaways The Child Tax Credit CTC can reduce the amount of tax you owe by up to 2 000 per qualifying child If you end up owing less tax than the amount of the CTC you may be able to get a refund using the Additional Child Tax Credit ACTC ACTC is refundable for the unused amount of your Child Tax Credit up to 1 600 per qualifying child tax year 2023 and 2024

Download Child Tax Credit Rebate 2024

More picture related to Child Tax Credit Rebate 2024

Did The Child Tax Credit Change For 2022 What You Need To Know

https://www.usatoday.com/gcdn/presto/2022/12/02/USAT/7dc53c6e-753d-4dbe-9927-b86d99089807-XXX_IMG_MONEY_CHILDTAXCREDIT_1_1_U6UQQIVP.JPG?crop=1897,1067,x224,y0&width=1897&height=1067&format=pjpg&auto=webp

Monthly Child Tax Credit Payments Start Thursday Here s What To Know

https://www.courier-journal.com/gcdn/-mm-/a75b61cdf29c924e642301138dcb5b5b73c5e5d5/c=0-30-1998-1159/local/-/media/2018/01/31/Louisville/Louisville/636530052069237063-IMG-3796.jpg?width=1998&height=1129&fit=crop&format=pjpg&auto=webp

CT Families Should Begin Receiving Child Tax Rebates This Week Governor NBC Connecticut

https://media.nbcconnecticut.com/2022/08/child-tax-rebate-news-conference.jpeg?quality=85&strip=all&resize=1200%2C675

Currently 1 600 of the 2 000 credit per child is refundable The credit s phaseout threshold is 400 000 for married earners filing jointly and 200 000 for head or single households At the The child tax credit is limited to 2 000 for every dependent you have who s under age 17 1 600 being refundable for the 2023 tax year That increases to 1 700 for the 2024 tax year Modified adjusted gross income MAGI thresholds for single taxpayers and heads of household are set at 200 000 to qualify and 400 000 for joint filers

What to do with a Child Tax Credit refund If you qualify for a refund consider making the most of it by devising a plan for how you ll use it ahead of time The contribution limits for 2024 are 7 000 for those under age 50 and 8 000 for those age 50 or older Add it to your emergency fund to ensure a safety net in the event of job The American Rescue Plan increased the Child Tax Credit from 2 000 per child to 3 000 per child for children over the age of six and from 2 000 to 3 600 for children under the age of six and

Minnesota Rebate Checks And Child Tax Credit Coming Soon Kiplinger

https://cdn.mos.cms.futurecdn.net/6s7GLrUiaDFw4PtLwHLk5U-1024-80.jpg

How To Track Down Your Child Tax Credit Payment If You Still Haven t Received It The US Sun

https://www.the-sun.com/wp-content/uploads/sites/6/2021/07/kc-child-tax-credit-comp-2.jpg?w=1560

https://www.irs.gov/credits-deductions/individuals/child-tax-credit

You qualify for the full amount of the 2023 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than 200 000 400 000 if filing a joint return Parents and guardians with higher incomes may be eligible to claim a partial credit Use our Interactive Tax Assistant to check if you

https://www.cbsnews.com/news/child-tax-credit-increase-heres-who-would-benefit/

What the Child Tax Credit is and who qualifies for it 03 22 as well as to get more money back in their annual tax refund 1 900 in 2024 and 2 000 in 2025

You May Be Able To Get More Money From Federal Child Tax Credits By Filing Your 2021 Taxes SLLS

Minnesota Rebate Checks And Child Tax Credit Coming Soon Kiplinger

Child Tax Credits 1st Payments Sent July 15 Welcomed By Chicago Area Families ABC7 Chicago

Topic Child Tax Credit Change

Military Journal Ri Child Tax Rebate Child Tax Credits Are One Of The Most Important Ways

Child Tax Credit CTC Update 2024

Child Tax Credit CTC Update 2024

What Who And How Of Child Tax Credit 2021 TaxMaster Experts

Child Tax Credit Checks Arriving July 15 For Iowa Families How It Works

Child Tax Credit Payments Have Begun Should You Opt Out USDAILY REPORT

Child Tax Credit Rebate 2024 - More families could be eligible for the child tax credit as soon as 2024 if new legislation passes Congress iStock 7 min Comment 295 Congressional negotiators announced a roughly 80 billion