Arizona Child Tax Rebate 2024 Payment Schedule Stimulus Phoenix AZ The Arizona Department of Revenue ADOR is sending this information to assist taxpayers as the 2024 tax filing season begins The IRS has determined the Arizona Families Tax Rebate recently sent to eligible taxpayers is subject to federal income tax and is required to be reported as part of the federal adjusted gross income

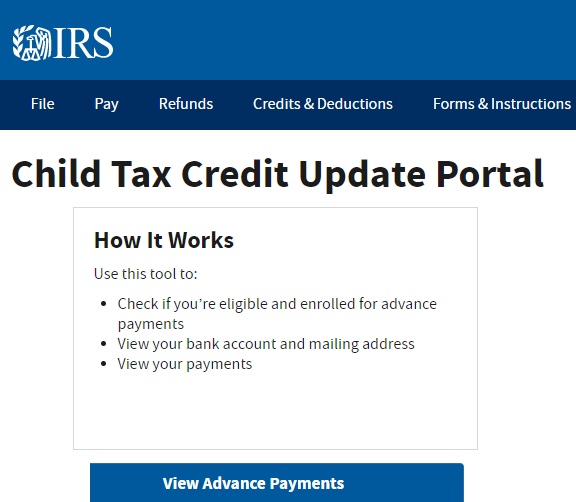

AZ Families Tax Rebate Claim Portal 2023 Arizona Families Tax Rebate You can use this page to check your rebate status update your rebate address or to make a claim for your rebate Instructions Enter the qualifying tax return information from tax year 2021 into each of the fields Fields marked with are required IRS says Arizona child tax rebate is taxable As Kiplinger reported Arizona faced a significant budget surplus of over 2 billion During state budget negotiations lawmakers allocated

Arizona Child Tax Rebate 2024 Payment Schedule Stimulus

Arizona Child Tax Rebate 2024 Payment Schedule Stimulus

http://refundschedule.us/wp-content/uploads/2022/01/IRS-Child-Tax-Credit-Portal-Login-Advance-Update-Bank-Information-Payments-Dates-Phone-Number-Stimulus.jpg

Virginia Tax Rebate 2024

https://www.taxuni.com/wp-content/uploads/2023/01/Virginia-Tax-Rebate.jpg

CT Families Should Begin Receiving Child Tax Rebates This Week Governor NBC Connecticut

https://media.nbcconnecticut.com/2022/08/child-tax-rebate-news-conference.jpeg?quality=85&strip=all&resize=1200%2C675

These states plan to send child tax credit checks to families in 2024 Note that not all are fully refundable which means you may need an income to receive the full amount owed to you California IRS will classify Arizona s child tax rebate as taxable income forcing families to pay taxes on it Story by William Pitts T he IRS will tax a state tax rebate that was given to

Published Oct 31 2023 at 12 34 PM PDT PHOENIX 3TV CBS 5 Gov Katie Hobbs says a new tax rebate is now available to hundreds of thousands of Arizona families The announcement comes For dependents under 17 the rebate is 250 per child For dependents who are 17 and older the rebate is 100 When will rebates be processed and sent The Department of Revenue has a

Download Arizona Child Tax Rebate 2024 Payment Schedule Stimulus

More picture related to Arizona Child Tax Rebate 2024 Payment Schedule Stimulus

Child Tax Credit 2022 Huge Direct Payments Up To 750 Already Going Out To Families See Full

https://www.the-sun.com/wp-content/uploads/sites/6/2022/10/EP_TAX_REBATE_BLOG_COMP.jpg?strip=all&quality=100&w=1500&h=1000&crop=1

One stop Guide To Child Tax Credit Resources SaverLife

https://partner.saverlife.org/wp-content/uploads/2021/07/CTC-payment-schedule-2.gif

2022 Connecticut Child Tax Rebate Bailey Scarano

https://baileyscarano.com/wp-content/uploads/2022/06/Depositphotos_329030836_XL.jpg

State officials say the rebate which is essentially a one time child tax rebate is designed to provide relief to Arizonans dealing with the challenges of high inflation Reportedly around Families earning up to 150 000 will get payments over the next year that add up to 3 600 per child under age 6 and 3 000 for children ages 6 17 The money is from the expanded federal

October 3 2023 News Governor Hobbs recently signed Senate Bill 1734 approving Arizona Families Tax Rebate to Arizona residents who meet the requirements If you are an Arizona resident you meet the criteria if you Filed an Arizona full year resident personal income tax return for tax year 2021 Those who claimed the dependent child tax credit on their 2021 tax return and paid at least 1 in income tax to the state in 2019 2020 and 2021 were eligible for a rebate The payment will be

Minnesota Rebate Checks And Child Tax Credit Coming Soon Kiplinger

https://cdn.mos.cms.futurecdn.net/6s7GLrUiaDFw4PtLwHLk5U-1024-80.jpg

Child Tax Credit Latest Stimulus Payment Schedule And Next Deadline To Opt Out HNGN

https://1075914428.rsc.cdn77.org/data/images/full/265731/child-tax-credit-latest-stimulus-payment-schedule-and-next-deadline-to-opt-out.jpg

https://azdor.gov/news-center/arizona-families-rebate-recipients-will-need-report-rebate-income-tax-returns

Phoenix AZ The Arizona Department of Revenue ADOR is sending this information to assist taxpayers as the 2024 tax filing season begins The IRS has determined the Arizona Families Tax Rebate recently sent to eligible taxpayers is subject to federal income tax and is required to be reported as part of the federal adjusted gross income

https://familyrebate.aztaxes.gov/

AZ Families Tax Rebate Claim Portal 2023 Arizona Families Tax Rebate You can use this page to check your rebate status update your rebate address or to make a claim for your rebate Instructions Enter the qualifying tax return information from tax year 2021 into each of the fields Fields marked with are required

How To Use The Recovery Rebate Credit To Claim Your Missing Stimulus Payment Forbes Advisor

Minnesota Rebate Checks And Child Tax Credit Coming Soon Kiplinger

Child Care Tax Rebate Payment Dates 2022 2023 Carrebate

CT Child Tax Rebate Checks Are In The Mail Lamont Across Connecticut CT Patch

Top 10 600 California Stimulus Check 2022

Military Journal Ri Child Tax Rebate Child Tax Credits Are One Of The Most Important Ways

Military Journal Ri Child Tax Rebate Child Tax Credits Are One Of The Most Important Ways

What Is The Amount Of The Child Tax Credit For 2023 Leia Aqui How Much Is The Qualifying Child

The 1 100 Per Child Tax Rebate Bonus For Divorced And Unmarried Parents

Recovery Rebate Credit 2021 Tax Return

Arizona Child Tax Rebate 2024 Payment Schedule Stimulus - July 14 2021 The federal government will begin making direct payments this week to taxpayers with children an expansion of the child tax credit that will advance taxpayers some of the money they would otherwise have to wait until tax season to get The payments of up to 300 per child will come monthly through December