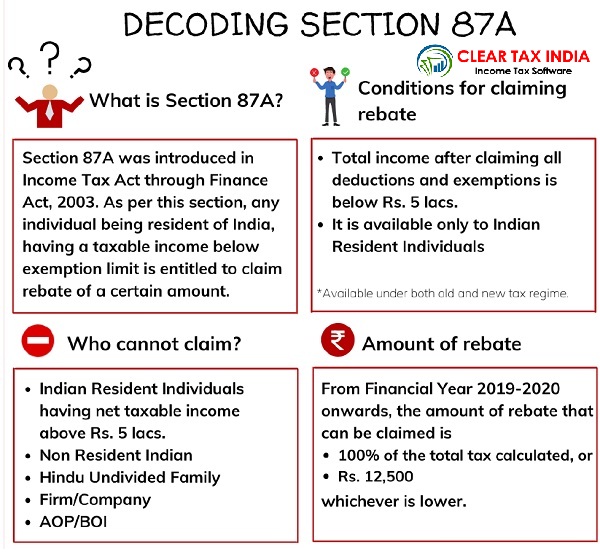

87a Rebate For Ay 2024 24 Section 87A of the Income Tax Act 1961 provides for a 100 tax rebate if the income tax liability is up to Rs 12 500 in respect of AY 2023 24 and onwards for resident individuals with taxable income up to Rs 500 000 under the existing tax regime

Rebate u s 87A for FY 2021 22 AY 2022 23 and FY 2022 23 AY 2023 24 For the fiscal years 2021 22 and 2022 23 AY 2022 23 and AY 2023 24 senior citizens with taxable income up to Rs 5 00 000 can claim a tax rebate u s 87A The rebate amount is either Rs 12 500 or the amount of tax payable whichever is lower This return is applicable for an Individual or Hindu Undivided Family HUF who is Resident other than Not Ordinarily Resident or a Firm other than LLP which is a Resident having Total Income up to 50 lakh and having income from Business or Profession which is computed on a presumptive basis u s 44AD 44ADA 44AE and income from any of

87a Rebate For Ay 2024 24

87a Rebate For Ay 2024 24

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhjaMWWuh9Yw1oHqfkfrIaYbLGaB376RebKDTPXR4-jMTYYQRhPBXomiwY9EVzEmXIgQ2oXuDWoror_llXVa0a4CVcBPyG3JecnKbrFpU1YAcL3BqdldNxiSh81eUspfAXJiNGbHbVcluzwXjoIUmqkZimUhTYHrQKq1Zu6xuaat2LRf6h-UCOGnP3s/w640-h596/87a.jpg

FAQs On Rebate U s 87A FinancePost

https://financepost.in/wp-content/uploads/2019/04/rebate.png

Income Tax Rebate U S 87A For AY 2024 25 FY 2023 24

https://arthikdisha.com/wp-content/uploads/2023/05/Screenshot_20230524_084225_Microsoft-365-Office.jpg

87A Rebate of income tax in case of certain individuals 88 Rebate on life insurance premia contribution to provident fund etc omitted for determining the income tax payable in respect of the total income for FY 2023 24 AY 2024 25 of an individual or Hindu undivided family or association of persons other than a co operative society The rebate amount under Section 87A allows a tax rebate of up to Rs 12 500 for individuals with taxable income up to Rs 5 00 000 FY 2022 23 Under Budget 2023 the government announced that any individual opting for the new tax regime and having taxable income up to Rs 7 lakh will be eligible for a tax rebate of Rs 25 000

Section 87A of the Income tax Act 1961 allows an individual to claim tax rebate provided their taxable income does not increase the specified level This tax rebate effectively makes zero tax outgo of an individual Budget 2023 has proposed to extend the amount of tax rebate under new tax regime from taxable income of Rs 5 lakh to Rs 7 lakh Section 87A rebate does not allow in old regime if your income go above 5 00 000 But A New proviso inserted in section 87A by the Finance Act 2023 w e f 1 4 2024 Applicable from FY 2023 24 Provided that where the total income of the assessee is chargeable to tax under sub section 1A of section 115BAC and the total income

Download 87a Rebate For Ay 2024 24

More picture related to 87a Rebate For Ay 2024 24

Income Tax Rebate U S 87A For AY 2024 25 FY 2023 24

https://i0.wp.com/arthikdisha.com/wp-content/uploads/2023/06/Income-Tax-Rebate-US-87A-for-AY-2024-25-FY-2023-24-1-1.png?resize=1024%2C576&ssl=1

New Income Tax Slab And Tax Rebate Credit Under Section 87A With Automated Income Tax Revised

https://1.bp.blogspot.com/-Ke4rAxpKLcE/XePaYI8rcnI/AAAAAAAALKI/-yZ-xBI_4fojq9hdLG6dgXgOF6VVPgeoQCNcBGAsYHQ/s1600/Tax%2BSlab%2Bfor%2BF.Y.%2B2019-20.jpg

What Is TAX REBATE U s 87A EXAMPLES Of Tax Rebate Budget 2019 New Tax Rebate FinCalC TV

https://i.ytimg.com/vi/Yo8nxqN-uJg/maxresdefault.jpg

Individuals can claim rebate u s 87A of the Income Tax Act if they satisfy these conditions Only resident individuals can claim a rebate under this section The total taxable income after deductions under Chapter VI A if applicable must not be more than INR 5 00 000 till AY 2023 24 a For Assessment Year 2023 24 a resident individual whose net income does not exceed Rs 5 00 000 can avail rebate under section 87A It is deductible from income tax before calculating education cess The amount of rebate is 100 percent of income tax or Rs 12 500 whichever is less

Rebate u s 87A for FY 2023 24 AY 2024 25 Under the new income tax regime the amount of the rebate under Section 87A for FY 2023 24 AY 2024 25 has been modified by Finance Act 2023 A resident individual with taxable income up to Rs 7 00 000 will receive a tax rebate upto Rs 25 000 tax The rebate under former old tax regime if chosen Section 87A Rebate for AY 2023 24 Income Tax Rebate under section 87A of Income Tax Act 1961 provides a rebate from income tax up to Rs 12500 to an individual resident assessee whose total income taxable income does not exceed Rs five lakhs

Tax Rebate Under Section 87A In Old New Tax Regime FinCalC

https://fincalc-blog.in/wp-content/uploads/2023/02/tax-rebate-under-section-87A.webp

Rebate U s 87A Of Income Tax Act 87A Rebate For AY 2022 23 In Hindi Income Tax Computation

https://i.ytimg.com/vi/jocxPhsi0f0/maxresdefault.jpg

https://caclub.in/income-tax-rebate-u-s-87a-individuals/

Section 87A of the Income Tax Act 1961 provides for a 100 tax rebate if the income tax liability is up to Rs 12 500 in respect of AY 2023 24 and onwards for resident individuals with taxable income up to Rs 500 000 under the existing tax regime

https://greatsenioryears.com/guide-rebate-u-s-87a-for-senior-citizens/

Rebate u s 87A for FY 2021 22 AY 2022 23 and FY 2022 23 AY 2023 24 For the fiscal years 2021 22 and 2022 23 AY 2022 23 and AY 2023 24 senior citizens with taxable income up to Rs 5 00 000 can claim a tax rebate u s 87A The rebate amount is either Rs 12 500 or the amount of tax payable whichever is lower

Sec 87A Rebate Income Tax Malayalam AY 2022 23 CA Subin VR YouTube

Tax Rebate Under Section 87A In Old New Tax Regime FinCalC

Is Section 87A Rebate For Everyone SR Academy India

Examples Of Rebate U s 87A For A Y 2020 21 And A Y 2019 20 Fully Explained YouTube

Rebate Us 87A For AY 2023 24 Budget 2023 Old Vs New Tax Regime YouTube

Rebate Under 87A Income Tax Act 1961 Ay 2021 2022 YouTube

Rebate Under 87A Income Tax Act 1961 Ay 2021 2022 YouTube

Rebate U S 87A AY 2018 19 Proper Clarification CA Taranjit Singh RIPE YouTube

Section 87A New Rebate 87A Of Income Tax In Budget 2023 Tax Save Under Section 87 A Budget

Rebate U s 87A Of Income Tax Act Rebate AY 2023 24 Income Tax Computation YouTube

87a Rebate For Ay 2024 24 - The rebate amount under Section 87A allows a tax rebate of up to Rs 12 500 for individuals with taxable income up to Rs 5 00 000 FY 2022 23 Under Budget 2023 the government announced that any individual opting for the new tax regime and having taxable income up to Rs 7 lakh will be eligible for a tax rebate of Rs 25 000