2024 South Carolina Tax Rebate DEPARTMENT OF REVENUE SOUTH CAROLINA EMPLOYEE S dor sc gov WITHHOLDING ALLOWANCE CERTIFICATE Rev 11 30 23 3527 2024 Give this form to your employer Keep the worksheets for your records The SCDOR may review any allowances and exemptions claimed Your employer may be required to send a copy of this form to the SCDOR

South Carolina lawmakers in June approved the parameters for a tax rebate of 1 billion for South Carolinians Eligible taxpayers have received up to 800 by direct deposit or paper CHARLOTTE N C South Carolina s Department of Revenue announced it will begin accepting 2023 individual income tax returns on Jan 29 and there are three changes you need to know about

2024 South Carolina Tax Rebate

2024 South Carolina Tax Rebate

https://printablerebateform.net/wp-content/uploads/2022/02/Primary-Rebate-South-Africa-2022.png

SC 2022 Rebate How To Calculate Your Rebate Amount YouTube

https://i.ytimg.com/vi/E9XarfIfXzQ/maxresdefault.jpg

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

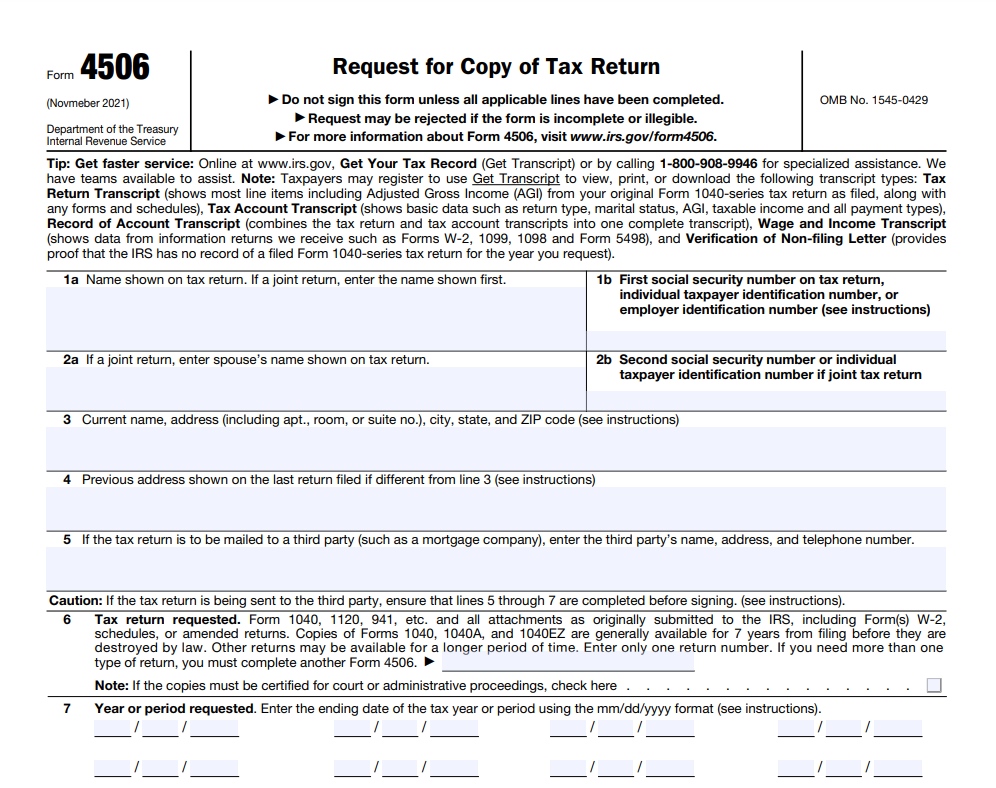

Here s the earliest folks in SC can get their tax refunds in 2024 2024 01 21 BY PATRICK MCCRELESS pmccreless thestate So when is the soonest a South Carolina taxpayer can get a tax refund IRS The IRS will begin processing tax returns on Jan 29 If you file your tax return online and opt for direct deposit on Jan 29 then you 06 September 2023 The IRS announced that taxpayers anywhere in South Carolina affected by Hurricane Idalia now have until February 15 2024 to file various individual and business tax returns and make tax payments According to the IRS release IRS 2023 163 September 6 2023 the tax relief is provided after a recent disaster declaration

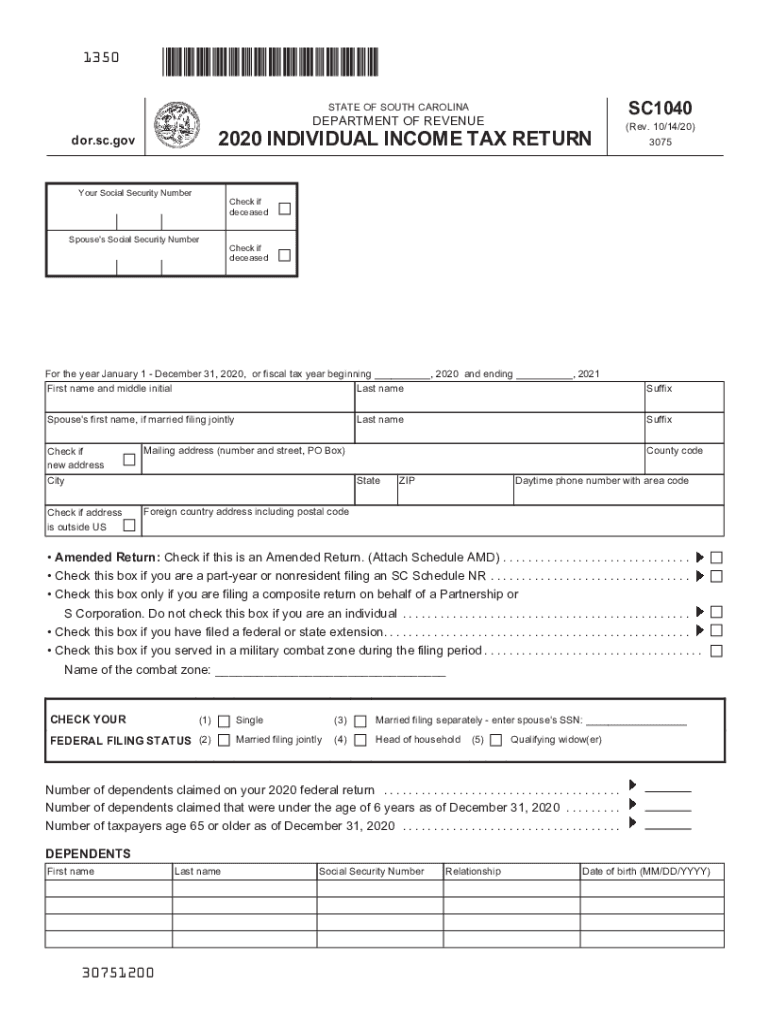

The South Carolina Department of Revenue SCDOR will begin distributing almost 1 billion in state tax rebates later this year What you nee d to know You must file a South Carolina Individual Income Tax return SC1040 for tax year 2021 by October 17 2022 You must have a tax liability Following an IRS decision to postpone the federal Individual Income Tax extension deadline to February 15 2024 South Carolina taxpayers who requested an extension can also wait until then to file their state 2022 returns

Download 2024 South Carolina Tax Rebate

More picture related to 2024 South Carolina Tax Rebate

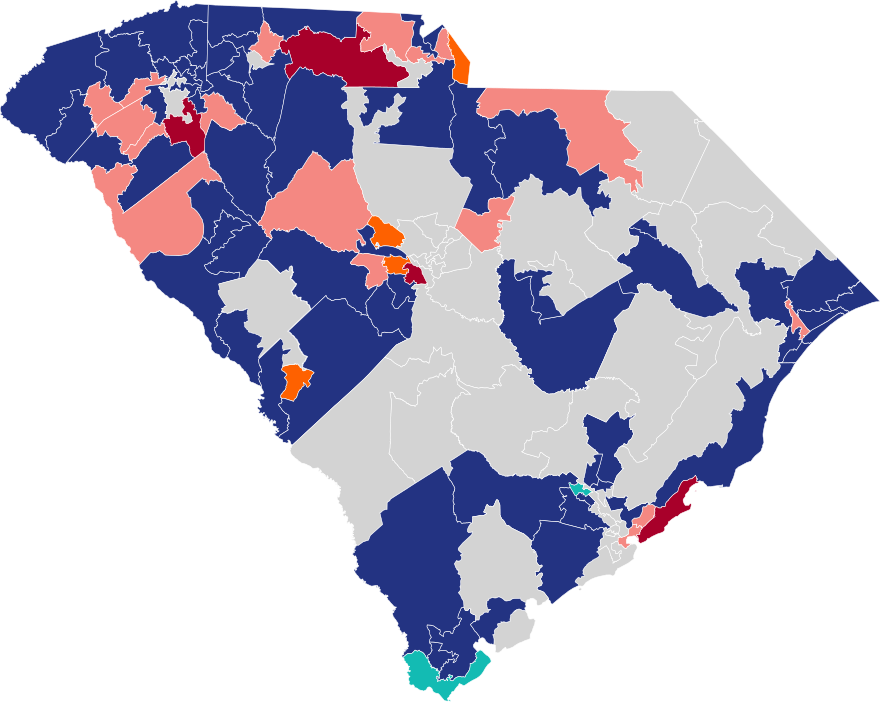

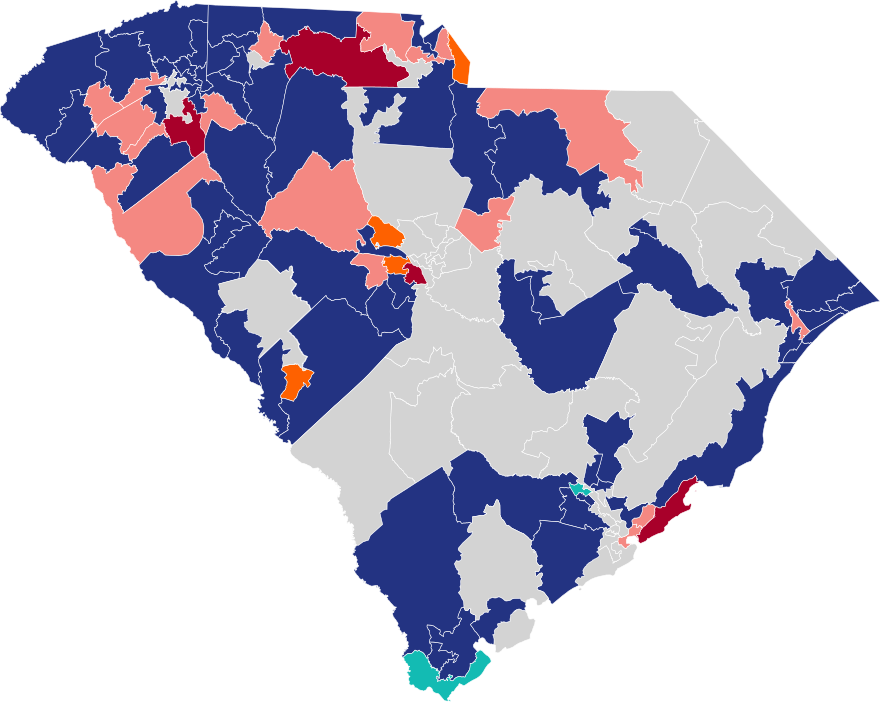

The 2024 Republican Presidential Primaries Part Three The Florida And South Carolina Primaries

https://preview.redd.it/the-2024-republican-presidential-primaries-part-three-the-v0-75ylj6g2rhz91.png?width=2560&format=png&auto=webp&s=299ccb34abd45713e596b1c1564af568449ee463

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/585/571/585571881/large.png

South Carolina Tax Rebate Checks Being Sent Out YouTube

https://i.ytimg.com/vi/Yizo6hJJwiw/maxresdefault.jpg

The South Carolina General Assembly voted in 2022 to reduce the top income tax rate if certain General Fund growth tests were met Following the tax rate cut the SCDOR updated the state The South Carolina tax calculator is updated for the 2024 25 tax year The SC Tax Calculator calculates Federal Taxes where applicable Medicare Pensions Plans FICA Etc allow for single joint and head of household filing in SCS

COLUMBIA S C AP The South Carolina Senate unanimously passed a 2 billion income tax cut and rebate bill setting up what will likely be intense negotiations with the House over the 1 billion tax cut it passed last month Thursday s vote came just three weeks after Senate Finance Committee Chairman Harvey Peeler first proposed the cut The proposal would send a rebate of at least To claim exemption from withholding certify that you meet both of the conditions above by writing Exempt on Form W 4 in the space below Step 4 c Then complete Steps 1 a 1 b and 5 Do not complete any other steps You will need to submit a new Form W 4 by February 15 2025

2024 South Carolina Republican Presidential Primary Wikipedia

https://upload.wikimedia.org/wikipedia/commons/thumb/d/d1/2024_United_States_presidential_election_Republican_primary_South_Carolina_House_endorsements.svg/880px-2024_United_States_presidential_election_Republican_primary_South_Carolina_House_endorsements.svg.png

Here Are The Federal Tax Brackets For 2023 Vs 2022 Narrative News

https://s.yimg.com/ny/api/res/1.2/9OoVAtst.kBuEKSi3_7vLA--/YXBwaWQ9aGlnaGxhbmRlcjt3PTk2MA--/https://s.yimg.com/os/creatr-uploaded-images/2023-01/256761a0-9a65-11ed-b57b-4f397ac4ee71

http://dor.sc.gov/forms-site/Forms/SCW4_2024.pdf

DEPARTMENT OF REVENUE SOUTH CAROLINA EMPLOYEE S dor sc gov WITHHOLDING ALLOWANCE CERTIFICATE Rev 11 30 23 3527 2024 Give this form to your employer Keep the worksheets for your records The SCDOR may review any allowances and exemptions claimed Your employer may be required to send a copy of this form to the SCDOR

https://www.thestate.com/news/state/south-carolina/article272403323.html

South Carolina lawmakers in June approved the parameters for a tax rebate of 1 billion for South Carolinians Eligible taxpayers have received up to 800 by direct deposit or paper

800 TAX REBATE SOUTH CAROLINA SC TAX REBATE 2022 SENDING WHEN LINE 10 ON TAX RETURN

2024 South Carolina Republican Presidential Primary Wikipedia

Your Money South Carolina Tax Rebate 2022

South Carolina Rebate Checks 2023 Printable Rebate Form

South Carolina Tax Rebate 2023 Tax Rebate

2022 South Carolina Tax Rebate What You Need To Know Wltx

2022 South Carolina Tax Rebate What You Need To Know Wltx

2020 Form SC DoR SC1040 Fill Online Printable Fillable Blank PdfFiller

Retirement Income Tax Rebate Calculator Greater Good SA

South Carolina Income Tax Brackets 2024

2024 South Carolina Tax Rebate - Here s the earliest folks in SC can get their tax refunds in 2024 2024 01 21 BY PATRICK MCCRELESS pmccreless thestate So when is the soonest a South Carolina taxpayer can get a tax refund IRS The IRS will begin processing tax returns on Jan 29 If you file your tax return online and opt for direct deposit on Jan 29 then you