2024 Homeowners Tax Rebate How to maximize your 2024 tax refund according to a CPA 02 34 Homeowners who tapped expanded home energy tax credits might get a bigger refund he noted

On January 19 2024 the Ways and Means Committee made a significant bipartisan move by approving the Tax Relief for American Families and Workers Act of 2024 This legislation is designed to provide crucial support to American job creators small businesses and working families By accelerating the end of the COVID era Employee Retention Tax The maximum credit you can claim each year is 1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit

2024 Homeowners Tax Rebate

2024 Homeowners Tax Rebate

https://ld16nj.com/wp-content/uploads/2022/10/Homeowners-2.jpg

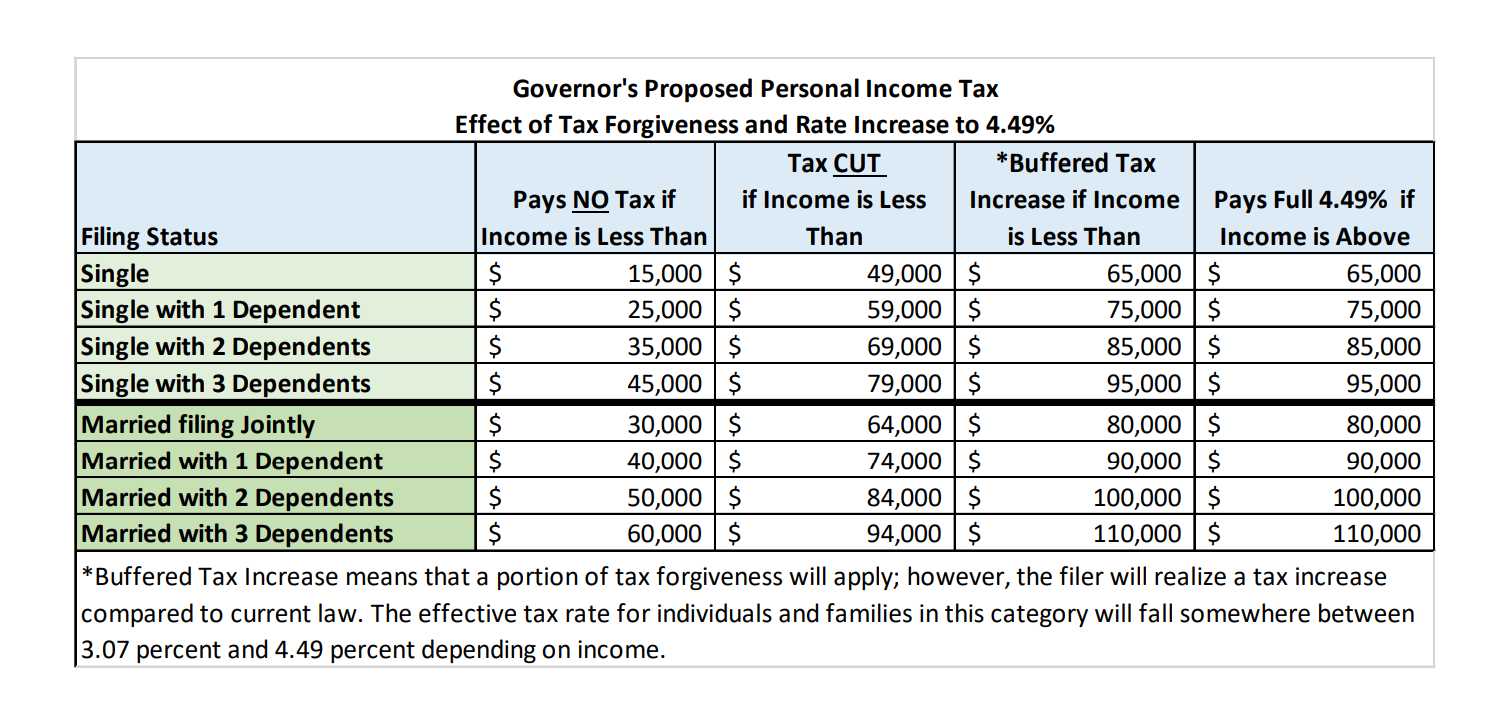

Income Tax Rates 2022 Vs 2021 Caroyln Boswell

http://thumbor-prod-us-east-1.photo.aws.arc.pub/r-5-lDAfA7hx2qRoVpXX6UhZ43k=/arc-anglerfish-arc2-prod-advancelocal/public/U5MVCZVZI5COTCDGVU3MWDQABQ.png

2021 Form PA PA 1000 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/585/571/585571881/large.png

Last quarterly payment for 2023 is due on Jan 16 2024 Taxpayers may need to consider estimated or additional tax payments due to non wage income from unemployment self employment annuity income or even digital assets The Tax Withholding Estimator on IRS gov can help wage earners determine if there s a need to consider an additional tax Homeowners may be able to save thousands of dollars by claiming tax credits and rebates under the Inflation Reduction Act of 2022 Property Credit was set to expire in 2024 However the

Thanks to the new tax credits and rebates they ll come at a significant discount for qualified households Households with income less than 80 of AMI 840 rebate up to 100 of equipment and installation costs Households with income between 80 150 AMI 840 rebate up to 50 of equipment and installation costs The Residential Clean Energy Credit equals 30 of the costs of new qualified clean energy property for your home installed anytime from 2022 through 2032 The credit percentage rate phases down to 26 percent for property placed in service in 2033 and 22 percent for property placed in service in 2034

Download 2024 Homeowners Tax Rebate

More picture related to 2024 Homeowners Tax Rebate

Buy Appointment Book 2023 2024 Weekly Appointment Book 2023 2024 8 X 10 Jul 2023 Jun

https://m.media-amazon.com/images/I/91JorPYWOEL.jpg

Property Tax Rebate Pennsylvania LatestRebate

https://www.latestrebate.com/wp-content/uploads/2023/02/form-pa-1000-property-tax-or-rent-rebate-claim-benefits-older-2.png

NWC Tryouts 2023 2024 NWC Alliance

https://nwcalliancesoccer.demosphere-secure.com/_files/tryouts-2023-2024/NWC 2023-2024.JPG

Through 2032 federal income tax credits are available to homeowners that will allow up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent In addition to the energy efficiency credits homeowners can also take advantage of the modified and extended Residential Clean Energy credit which provides a 30 These credits which can provide cash back or lower any tax you might owe are available to Californians with incomes up to 30 950 for CalEITC and up to 30 931 for YCTC and FYTC CalEITC can be worth up to 3 529 while YCTC and FYTC can be up to 1 117 Individuals earning less than 63 398 may also qualify for the federal EITC

What Is the Heat Pump Tax Credit How to Qualify for the Heat Pump Tax Credit Related Tax Credits Heat Pump Tax Rebate State Heat Pump Installation Incentives How to Apply for Heat Pump Today s Homeowner Tips To qualify for the maximum credit you must have your upgrades installed by 2032 Beginning in 2033 the maximum percentage of your installation cost you can deduct is 26 which drops to 22 in 2034 Beyond 2034 the credit expires you cannot claim any percentage credit for new installations

Income Tax Rebate Under Section 87A

https://www.wintwealth.com/blog/wp-content/uploads/2023/01/Income-Tax-Rebate-Income-Tax-Rebate-Under-Section-87A.jpg

Tax Rebate For First Time Homeowners How To Claim Your Tax Rebate

https://asapapartmentfinders.com/wp-content/uploads/2016/12/tax-rebate.jpg

https://www.cbsnews.com/news/tax-refund-2024-what-to-expect-when-will-i-get/

How to maximize your 2024 tax refund according to a CPA 02 34 Homeowners who tapped expanded home energy tax credits might get a bigger refund he noted

https://tax.thomsonreuters.com/blog/understanding-the-tax-relief-for-american-families-and-workers-act-of-2024/

On January 19 2024 the Ways and Means Committee made a significant bipartisan move by approving the Tax Relief for American Families and Workers Act of 2024 This legislation is designed to provide crucial support to American job creators small businesses and working families By accelerating the end of the COVID era Employee Retention Tax

N J s New ANCHOR Property Tax Program Your Questions Answered Nj

Income Tax Rebate Under Section 87A

Tolminator 2024

Eligibility For Homeowners Tax Rebate YouTube

Resources

Tax Rebate In Thailand For 2023 Save Up To 40 000 THB

Tax Rebate In Thailand For 2023 Save Up To 40 000 THB

Buy The New 2023 2024 Calender Planner 2023 2024 With Weekly Monthly Spreads 16 month 2023

What Is A Tax Rebate U s 87A How To Claim Rebate U s 87A Scripbox

2024 Annual Meeting Save The Date

2024 Homeowners Tax Rebate - This earned income tax credit EITC is a refundable tax break for low income taxpayers with and without children For 2023 taxes filed in 2024 the credit ranges from 600 to 7 430 depending