2024 Homeowner Tax Rebate Ny Your qualified gross income is 250 000 or less you owned and primarily resided for six months or more of the tax year in real property that received the STAR exemption or that qualified you for the STAR credit any rent you received from nonresidential use of your residence was 20 or less of the rental income and

Definition of income for the homeowner tax rebate credit For the homeowner tax rebate credit income was defined as federal adjusted gross income FAGI from two years prior tax year 2020 modified so that the net amount of loss reported on federal Schedule C D E or F is 3 000 or less The income limit for this program for 2024 is 98 700 The Bulletin Seagulls swirl around the Statue of Liberty at the end of the day in New York City on December 7 2023 New York state

2024 Homeowner Tax Rebate Ny

2024 Homeowner Tax Rebate Ny

https://www.informnny.com/wp-content/uploads/sites/58/2022/06/GettyImages-985842598-2.jpg?w=1920&h=1080&crop=1

Confusion Over When Eligible New Yorkers Will Get Their Homeowner Tax Rebate Check WSTM

https://cnycentral.com/resources/media2/16x9/full/1024/center/80/bb776db9-9697-43c3-882f-8577bedc9e89-large16x9_tax_rebate.PNG

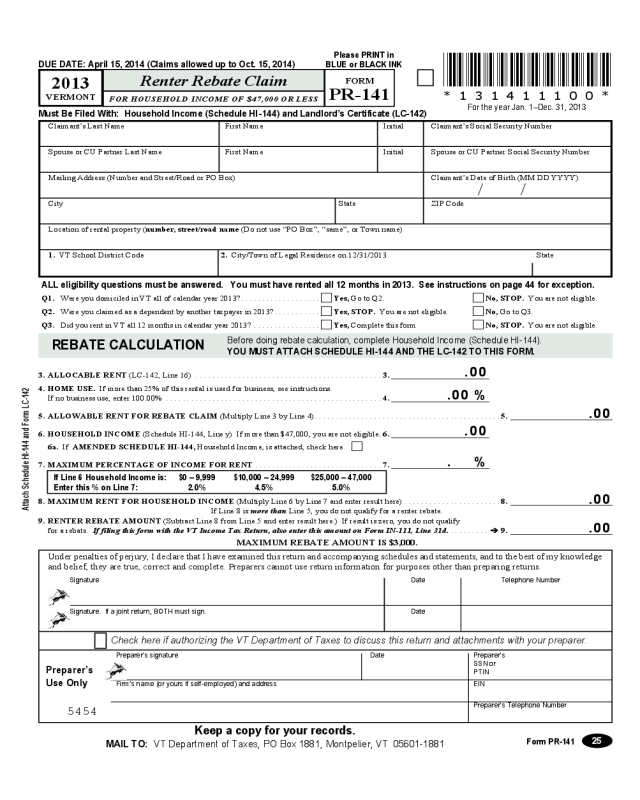

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/585/571/585571881/large.png

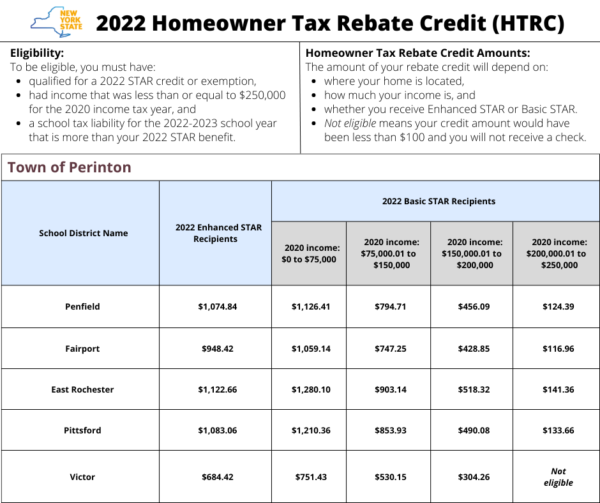

How to register 1 Gather the following information Property Key at the top of your letter names and Social Security numbers for all owners of the property and their spouses primary residence of the owners and their spouses approximate date the owners purchased the property and the names of the sellers address of any residential property 2022 Homeowner Tax Rebate Credit Check Lookup Note The homeowner tax rebate credit was a one year program which ended in 2022 The credit is not available for future years If you have questions about the program or received a letter regarding your 2022 payment see Frequently asked questions Lost stolen destroyed and uncashed checks

The FY 2024 Budget adds 50 million for a Homeowner Stabilization Fund to finance home repairs in 10 communities across the state that have been identified as having high levels of low income homeowners of color and homeowner distress When you file your tax return you must decide whether to take the standard deduction 13 850 for single tax filers 27 700 for joint filers or 20 800 for heads of household or married filing

Download 2024 Homeowner Tax Rebate Ny

More picture related to 2024 Homeowner Tax Rebate Ny

Property Tax Rebate Pennsylvania LatestRebate

https://www.latestrebate.com/wp-content/uploads/2023/02/form-pa-1000-property-tax-or-rent-rebate-claim-benefits-older-2.png

New York State Begins Mailing Out Homeowner Tax Rebate Credit Checks Wgrz

https://media.wgrz.com/assets/WGRZ/images/a07fcd1f-3754-4e57-bce5-9be83e9634c0/a07fcd1f-3754-4e57-bce5-9be83e9634c0_1140x641.jpg

Over 3M New Yorkers To Receive Homeowner Tax Rebate Checks This Summer Port Washington NY Patch

https://patch.com/img/cdn20/shutterstock/23121104/20220610/034752/styles/patch_image/public/shutterstock-228062581___10154715779.jpg?width=1200

ALBANY N Y In June Governor Kathy Hochul announced the one time Homeowner Tax Rebate Credit would be sent out available to eligible New Yorkers The state s Department of Taxation and For the property tax relief credit income is defined as federal adjusted gross income FAGI from two years prior modified so that the net amount of loss reported on Federal Schedule C D E or F doesn t exceed 3 000 the net amount of any other separate category of loss doesn t exceed 3 000 and

Back to Inflation Reduction Act Combine IRA Savings with State Incentives to Upgrade Your Home and Ditch Fossil Fuels The Inflation Reduction Act IRA helps New Yorkers get the latest clean energy technologies and equipment that will save energy for years to come The New York Department of Taxation and Finance will soon begin sending direct financial assistance to 1 75 million New Yorkers who received the Empire State Child Credit and or the Earned Income Credit on their 2021 state tax returns including a gas tax moratorium and a homeowner tax rebate credit Our families have felt the effects of a

When Will NY Homeowners Get New STAR Rebate Checks Syracuse

https://www.syracuse.com/resizer/d5Fht24Xbm2Z-MQedKvKt1kuy_M=/800x0/smart/cloudfront-us-east-1.images.arcpublishing.com/advancelocal/QIMGUVTTIFFGFPKEIOPG2ECTTU.jpg

Homeowner Tax Rebate Program For People Who Live In Their Home YouTube

https://i.ytimg.com/vi/Dk6m3vyq3cY/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4AbYIgAKAD4oCDAgAEAEYOSBUKHIwDw==&rs=AOn4CLAiLu8JQ1ipHT9vjuy4jqjIumoU2g

https://www.tax.ny.gov/pit/credits/real-property-tax-relief-credit.htm

Your qualified gross income is 250 000 or less you owned and primarily resided for six months or more of the tax year in real property that received the STAR exemption or that qualified you for the STAR credit any rent you received from nonresidential use of your residence was 20 or less of the rental income and

https://www.tax.ny.gov/pit/property/homeowner-tax-rebate-credit.htm

Definition of income for the homeowner tax rebate credit For the homeowner tax rebate credit income was defined as federal adjusted gross income FAGI from two years prior tax year 2020 modified so that the net amount of loss reported on federal Schedule C D E or F is 3 000 or less

NYS Homeowner Tax Rebate Credit HTRC Info Town Of Perinton

When Will NY Homeowners Get New STAR Rebate Checks Syracuse

Tax Time Already 2022 Tax Deductions For Homeowners A COVID Rebate

Minnesota Fillable Tax Forms Printable Forms Free Online

Your Stories Q A Are You Still Waiting For Your Homeowner Tax Rebate Credit Check YouTube

New York State To Mail Out Homeowner Tax Rebate Credit Checks DSJ

New York State To Mail Out Homeowner Tax Rebate Credit Checks DSJ

Tax Time Already 2022 Tax Deductions For Homeowners A COVID Rebate

Your Stories Q A Where Is My NYS Homeowner Tax Rebate Credit Check YouTube

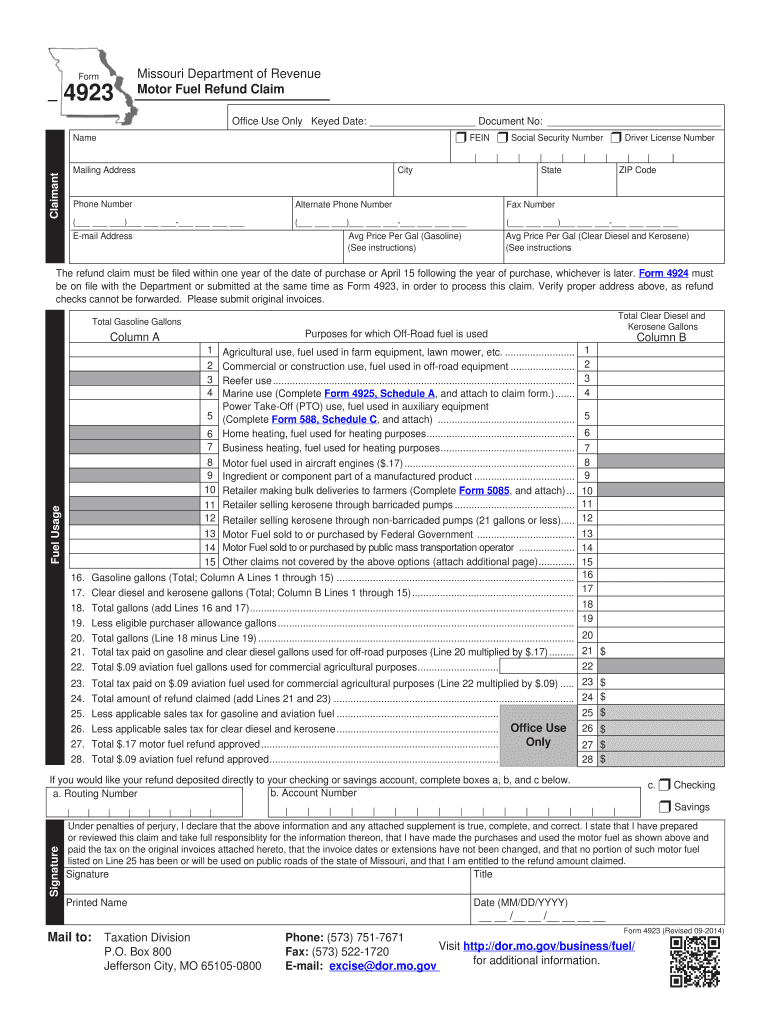

4923 H 2014 2024 Form Fill Out And Sign Printable PDF Template SignNow

2024 Homeowner Tax Rebate Ny - How to register 1 Gather the following information Property Key at the top of your letter names and Social Security numbers for all owners of the property and their spouses primary residence of the owners and their spouses approximate date the owners purchased the property and the names of the sellers address of any residential property