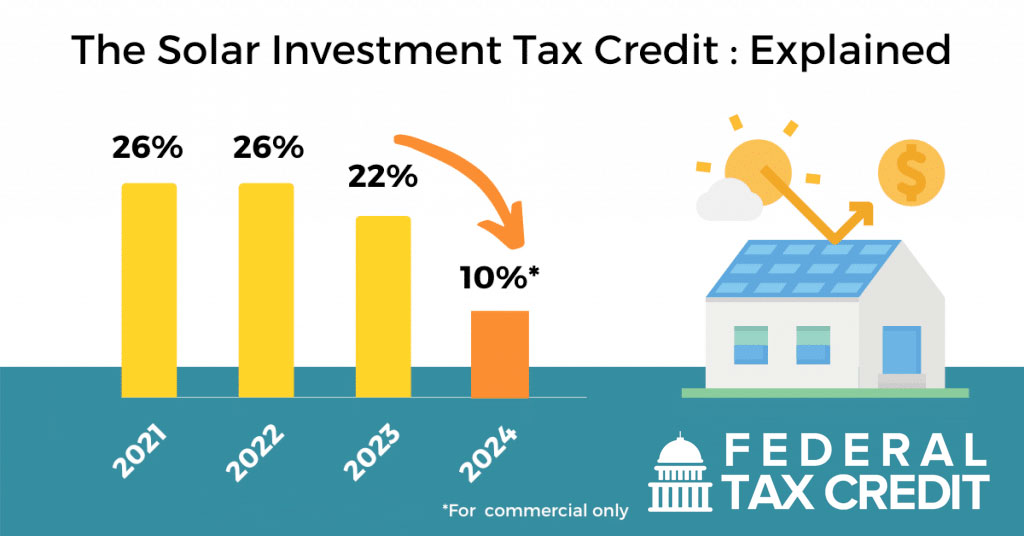

2024 Federal Government Solar Rebates The Federal Solar Tax Credit for 2024 is 30 this is an increase from 26 in recent years and extends through to 2032 Tax credits and incentives can help bring the price down such as the

2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit Get details on the Energy Efficient Home Improvement Credit Residential Clean Energy Credit The U S government offers a solar tax credit that can reach up to 30 of the cost of installing a system that uses the sun to power your home Simple tax filing with a 50 flat fee for every

2024 Federal Government Solar Rebates

2024 Federal Government Solar Rebates

https://i.ebayimg.com/images/g/h-IAAOSwFWJk6QPZ/s-l1600.jpg

2024 Federal Pay Period Calendar

https://i2.wp.com/girlicity.com/wp-content/uploads/2015/09/Screen-Shot-2020-12-19-at-9.13.50-AM.png

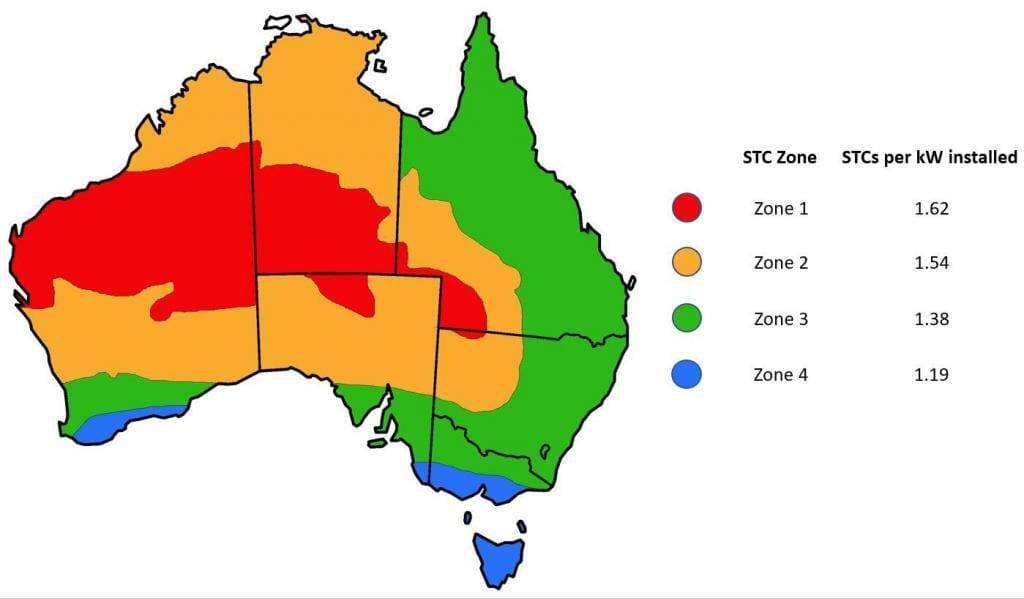

Household Solar Rebates State By State 2022 SolarRun

https://www.solarrun.com.au/wp-content/uploads/2022/05/shutterstock_370520669.jpeg

Complete guide to the 2024 federal solar tax credit By Catherine Lane Updated 11 30 2023 Key takeaways The Residential Clean Energy Credit is a dollar for dollar income tax credit equal to 30 of solar installation costs An average 20 000 solar system is eligible for a solar tax credit of 6 000 What Is the Solar Tax Credit If you install solar energy equipment in your residence any time this year through the end of 2032 you are entitled to a nonrefundable credit off your federal

WASHINGTON Today the U S Department of the Treasury and Internal Revenue Service IRS in partnership with the Department of Energy DOE announced remarkable demand in the initial application period for solar and wind facilities through the Inflation Reduction Act s Low Income Communities Bonus Credit Program The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the taxpayer Other types of renewable energy are also eligible for similar credits but are beyond the scope of this guidance

Download 2024 Federal Government Solar Rebates

More picture related to 2024 Federal Government Solar Rebates

Our Guide To The Government Solar Rebate WA IBreeze

https://ibreeze.com.au/wp-content/uploads/2022/09/Solar-Panel-Government-Rebates.jpg

Complete Guide For WA Solar Panel Rebates 2023

https://www.empowersolaraustralia.com.au/wp-content/uploads/2023/05/d235aa88-c955-4234-ae4c-5b9c2f6a3814.jpg

2022 ACT Solar And Battery Rebates Who Qualifies Solar Rebates ACT

https://www.solarrun.com.au/wp-content/uploads/2022/02/Solar-Panels-Canberra-1200x657-1.jpg

On Aug 16 2022 President Joseph R Biden signed the landmark Inflation Reduction Act which provides nearly 400 billion to support clean energy and address climate change including 8 8 billion for the Home Energy Rebates According to our 2023 survey of homeowners with solar respondents paid an average of 15 000 to 20 000 for their solar panel systems When you factor in the 30 federal solar tax credit the

1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit WASHINGTON June 28 2023 Today the U S Environmental Protection Agency EPA launched a 7 billion grant competition through President Biden s Investing in America agenda to increase access to affordable resilient and clean solar energy for millions of low income households

Solar Panel Rebates Incentives Grants Available In Alberta

https://www.livezeno.com/wp-content/uploads/2022/04/Solar-rebates-1440x720.png

The Federal Government Is Paying Homeowners To Go Solar The Price Chopper

https://www.thepricechopper.com/wp-content/uploads/2022/01/solar_gov_tax_incentive.jpg

https://www.forbes.com/home-improvement/solar/solar-tax-credit-by-state/

The Federal Solar Tax Credit for 2024 is 30 this is an increase from 26 in recent years and extends through to 2032 Tax credits and incentives can help bring the price down such as the

https://www.irs.gov/credits-deductions/home-energy-tax-credits

2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit Get details on the Energy Efficient Home Improvement Credit Residential Clean Energy Credit

Federal Solar Tax Credit What It Is How To Claim It For 2023

Solar Panel Rebates Incentives Grants Available In Alberta

Mass Save Rebate Form 2021 PrintableRebateForm

What Types Of Government Rebates Are Available For Solar Panels In VIC NSW Solar Emporium

Federal Incentives Solar Rebates For Solar Power Solar Choice

The President s 2024 Federal Budget Reforming The Taxation Of High Income Taxpayers TaxSlaw

The President s 2024 Federal Budget Reforming The Taxation Of High Income Taxpayers TaxSlaw

2023 2024 Federal Budget To Boost Small Business Opportunities

Budget 2023 2024 Federal Budget Will Present Today Breaking News YouTube

Federal Government Solar Incentives What Incentives Are Available How To Claim Trusted

2024 Federal Government Solar Rebates - Colorado passed a clean energy bill in 2023 that included funding to streamline permitting local solar energy projects This comes in addition to state and local solar incentives Additional utility based solar incentives in Colorado The following Colorado utilities also offer some form of rebate or rewards program