2024 Federal Energy Rebates On Aug 16 2022 President Joseph R Biden signed the landmark Inflation Reduction Act which provides nearly 400 billion to support clean energy and address climate change including 8 8 billion for the Home Energy Rebates

The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax credits and deductions that will help reduce energy costs and demand as we transition to cleaner energy sources Tax Credits for Home Builders Tax Deductions for Commercial Buildings What Is the Heat Pump Tax Credit How to Qualify for the Heat Pump Tax Credit Related Tax Credits Heat Pump Tax Rebate State Heat Pump Installation Incentives How to Apply for Heat Pump

2024 Federal Energy Rebates

2024 Federal Energy Rebates

https://i.ebayimg.com/images/g/h-IAAOSwFWJk6QPZ/s-l1600.jpg

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The Inflation Reduction Act

https://www.autopromag.com/usa/wp-content/uploads/2022/08/EV-Federal-Tax-Credits-5MgJUp.jpeg?is-pending-load=1

NJ Clean Energy Rebates Incentives In 2024

https://www.electricrate.com/wp-content/uploads/2023/01/nj-rebates-for-energy-efficient-appliances.jpg

Taxpayers planning to claim the Internal Revenue Code IRC 41 Credit for Increasing Research Activities R D tax credit are likely to face increased reporting requirements beginning with the 2024 tax year The R D tax credit allows taxpayers who meet the eligibility requirements to claim a credit that offsets either their income tax or OVERVIEW Two tax credits for renewable energy and energy efficiency home improvements have been extended through 2034 and expanded starting in 2023 TABLE OF CONTENTS What are energy tax credits targeting home improvements Energy Efficient Home Improvement Credit Residential Clean Energy Credit Click to expand Key Takeaways

The IRA devotes a total of 8 8 billion for two initiatives the Home Efficiency Rebates program which offers up to 8 000 and the Home Electrification and Appliance Rebates program up to The 8 8 billion Home Energy Rebates HER program provides an unprecedented opportunity for states territories and Tribes to make American homes more comfortable while reducing soliciting any sub recipient or contractor that may receive federal funds States can only 1 24 2024 2 09 27 PM

Download 2024 Federal Energy Rebates

More picture related to 2024 Federal Energy Rebates

2023 2024 Federal Budget To Boost Small Business Opportunities

https://quickbooks.intuit.com/oidam/intuit/sbseg/en_au/blog/images/image/sbseg-en-au-blog-Federal-Budget.jpg

CARFAC RAAV s Submission For The 2024 Federal Budget Consultation CARFAC

https://www.carfac.ca/carfacwp2019/wp-content/uploads/PRE-BUDGET-2023-1-e1691501333752.png

The President s 2024 Federal Budget Reforming The Taxation Of High Income Taxpayers TaxSlaw

https://images.bannerbear.com/direct/y0aJ23zRDdqMxX4OGl/requests/000/035/170/843/VJqEKwxkyzGwv5bJzNP8dj4vL/1c509a3cd30a202dd841c728e1ae4cc9045ef891.png

It s almost time for tax season again and one of the biggest changes for 2024 is the expansion of home energy credits thanks to the Inflation Reduction Act of 2022 If you took steps to make On Aug 16 2022 President Biden signed the landmark Inflation Reduction Act The law includes nearly 400 billion to support clean energy and address climate change including 8 8 billion in Home Energy Rebates which will provide two separate rebates to consumers

Energy Efficiency Tax Credits for 2024 Update The tax credits listed below became available on January 1 2023 and can be claimed when you file your income taxes for 2023 As of January 1 2023 there is a federal tax credit for exterior windows and doors The Energy Efficient Home Improvement Credit is worth 30 of the total cost of the Beginning with the 2023 tax year the credit is equal to 30 of the costs for all eligible home improvements made during the year It is also expanded to cover the cost of certain biomass stoves

Budget 2023 2024 Federal Budget Will Present Today Breaking News YouTube

https://i.ytimg.com/vi/yZol3aKOF10/maxresdefault.jpg

How To Look For Energy Rebates In Your Location YouTube

https://i.ytimg.com/vi/CLOWU0qwUkg/maxresdefault.jpg

https://www.energy.gov/scep/home-energy-rebates-programs

On Aug 16 2022 President Joseph R Biden signed the landmark Inflation Reduction Act which provides nearly 400 billion to support clean energy and address climate change including 8 8 billion for the Home Energy Rebates

https://www.energystar.gov/about/federal_tax_credits

The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax credits and deductions that will help reduce energy costs and demand as we transition to cleaner energy sources Tax Credits for Home Builders Tax Deductions for Commercial Buildings

Energy Rebates Don t Leave Money On The Table Schmidt Associates

Budget 2023 2024 Federal Budget Will Present Today Breaking News YouTube

Unpacking The 2023 2024 Federal Budget Webinar HLB Mann Judd

Apply Energy Rebates Ontario

2022 Home Energy Rebates Grants And Incentives Top Rated Barrie Windows Doors Company

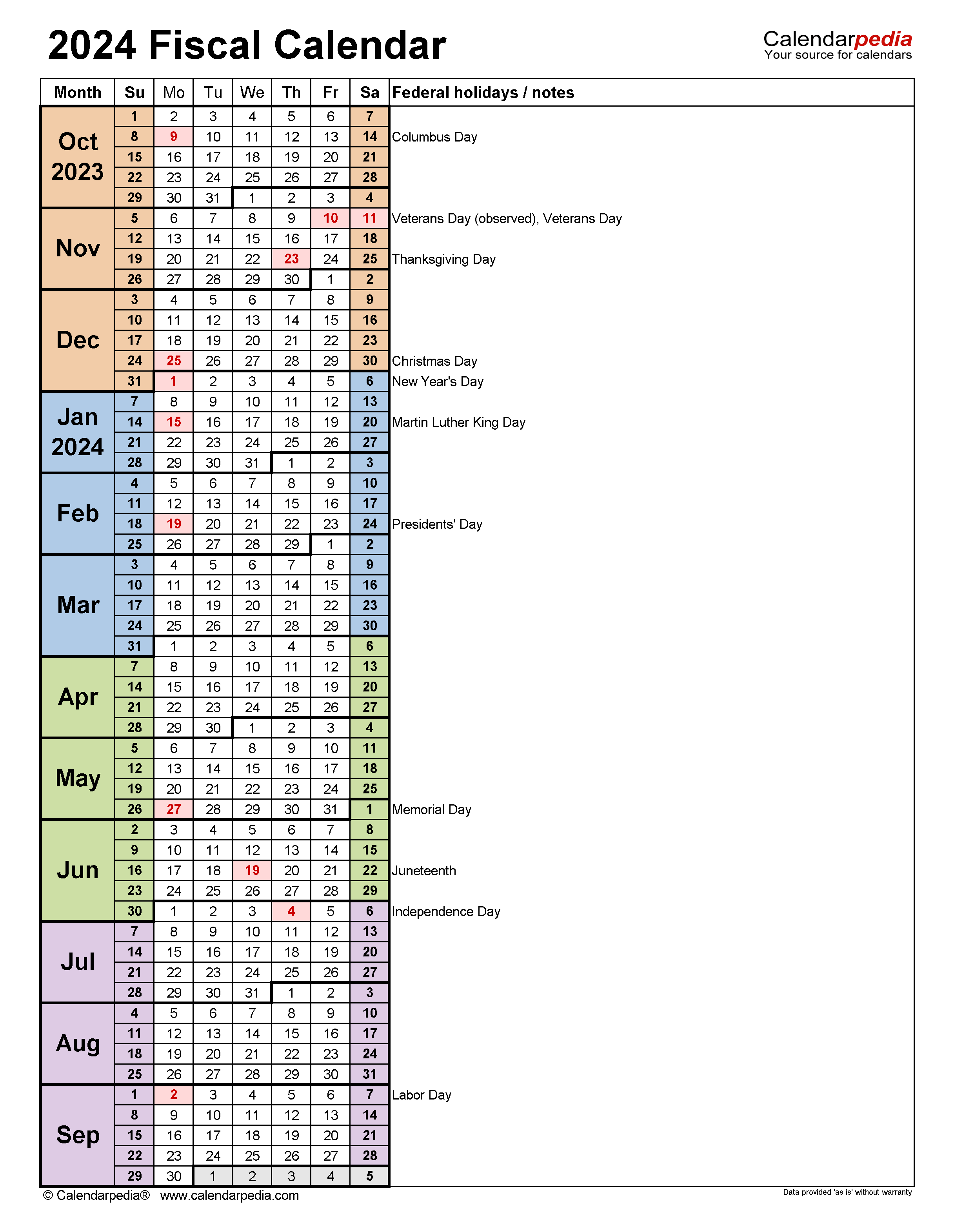

January 2024 Printable Calendars Vrogue

January 2024 Printable Calendars Vrogue

Biden s 2024 Budget May Save You Money Diverse Outlook

Seresto Rebate Form PrintableRebateForm

Rebate And Tax Credit Management Quick Electricity

2024 Federal Energy Rebates - 9 30 2024 Notice of Funding Opportunity Rural Energy for America Program REAP Department of Agriculture To help agricultural producers and rural small businesses invest in renewable