2024 Child Care Rebate The IRS website Note Jackson Hewitt which helped drive child poverty to a record low Jan 29 According to a Washington Post report Form 1040 Schedule 8812 Credits for Qualifying Children and

How Much Is the Child Tax Credit for 2024 Various family tax credits and deductions including the 2024 child tax credit have been adjusted for inflation Here s what they re worth Image The child tax credit is worth up to 2 000 per qualifying dependent under the age of 17 The credit is nonrefundable but some taxpayers may be eligible for a partial refund of up to 1 600

2024 Child Care Rebate

2024 Child Care Rebate

https://www.sandcastleschildcare.com.au/wp-content/uploads/sites/60/2023/03/G8_CCS_2023-2024Graph_Web_Mar2023-scaled.jpg

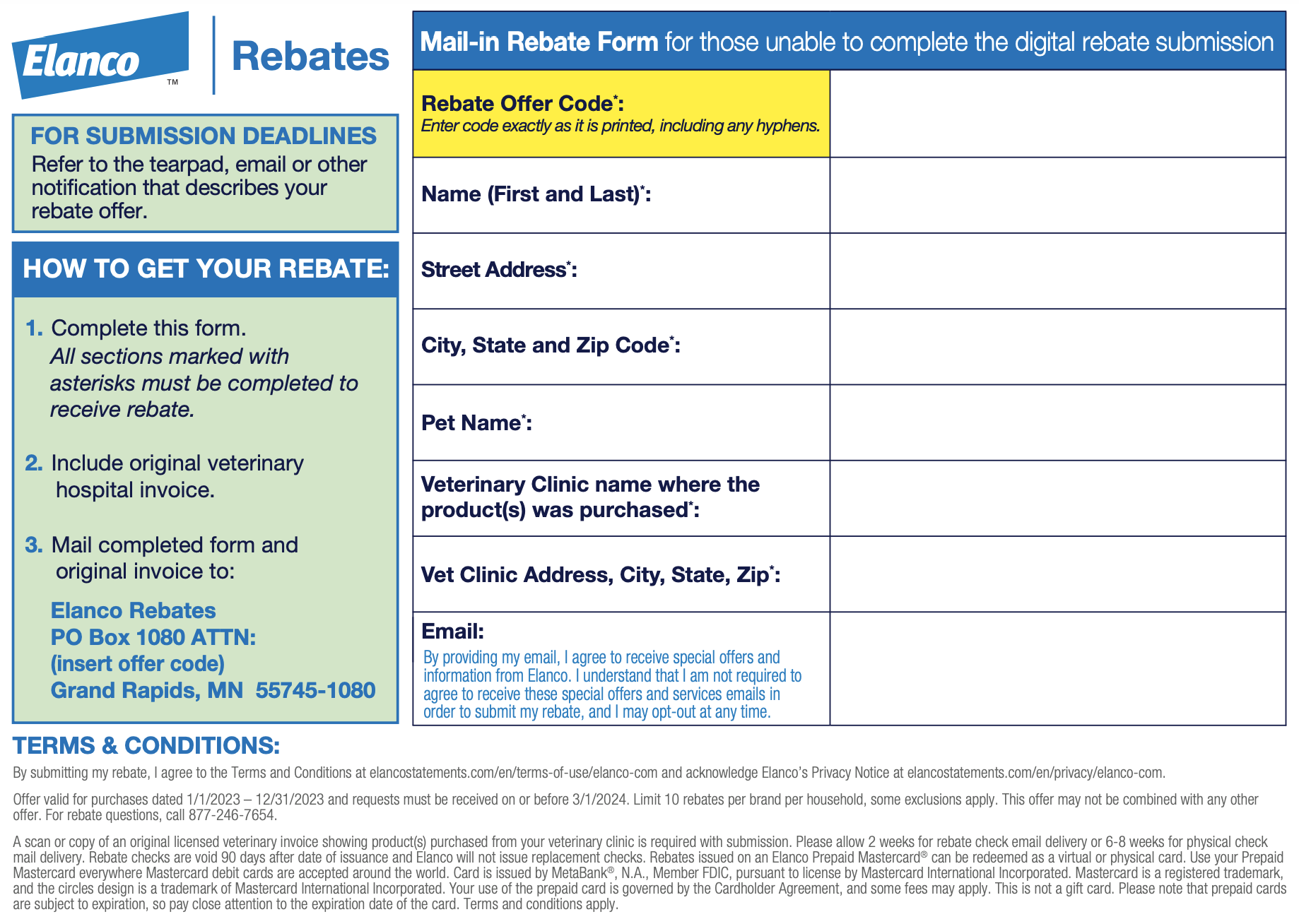

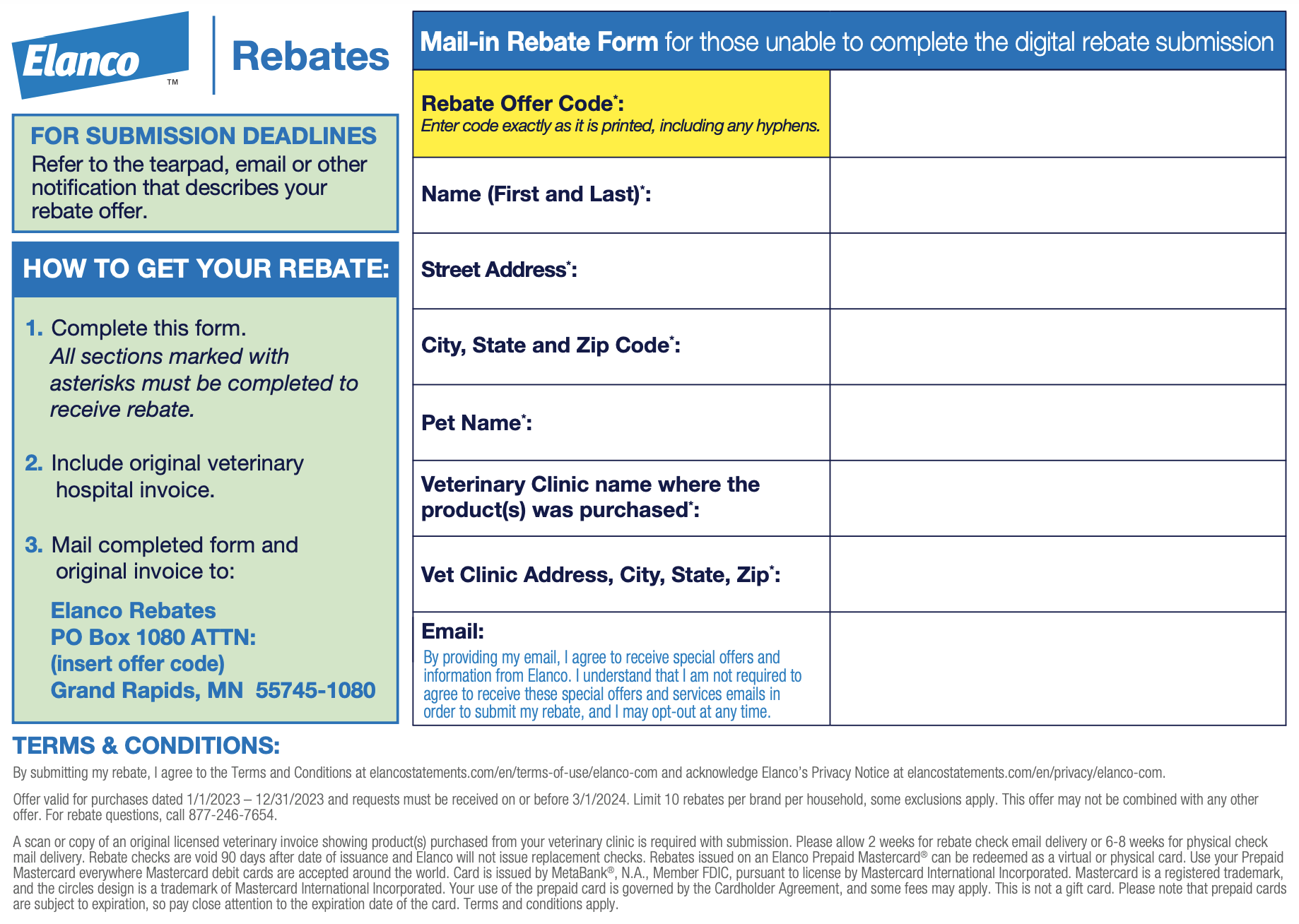

Elanco Rebates 2023 Save On Pet Care Products Today

http://printablerebateform.net/wp-content/uploads/2022/02/Elanco-Rebate-Form-2023.png

Trifexis 50 Rebate Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/07/Trifexis-Rebate-Form-2021-768x506.jpg

Currently 1 600 of the 2 000 credit per child is refundable The credit s phaseout threshold is 400 000 for married earners filing jointly and 200 000 for head or single households At the Qualifying children This policy would be effective for tax years 2023 2024 and 2025 Modification in Overall Limit on Refundable Child Tax Credit Under current law the maximum refundable child tax credit is limited to 1 600 per child for 2023 even if the earned income limitation described above is in excess of this amount

These states plan to send child tax credit checks to families in 2024 Note that not all are fully refundable which means you may need an income to receive the full amount owed to you Jan 19 2024 12 31 PM PST By Sahil Kapur and Scott Wong WASHINGTON The House Ways and Means Committee voted 40 3 on Friday to approve a bipartisan tax package that includes an expansion of

Download 2024 Child Care Rebate

More picture related to 2024 Child Care Rebate

Child Care Tax Rebate Payment Dates 2022 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/06/child-care-tax-credit-payment-dates-2022-drift-hestia-bloger-1.jpg

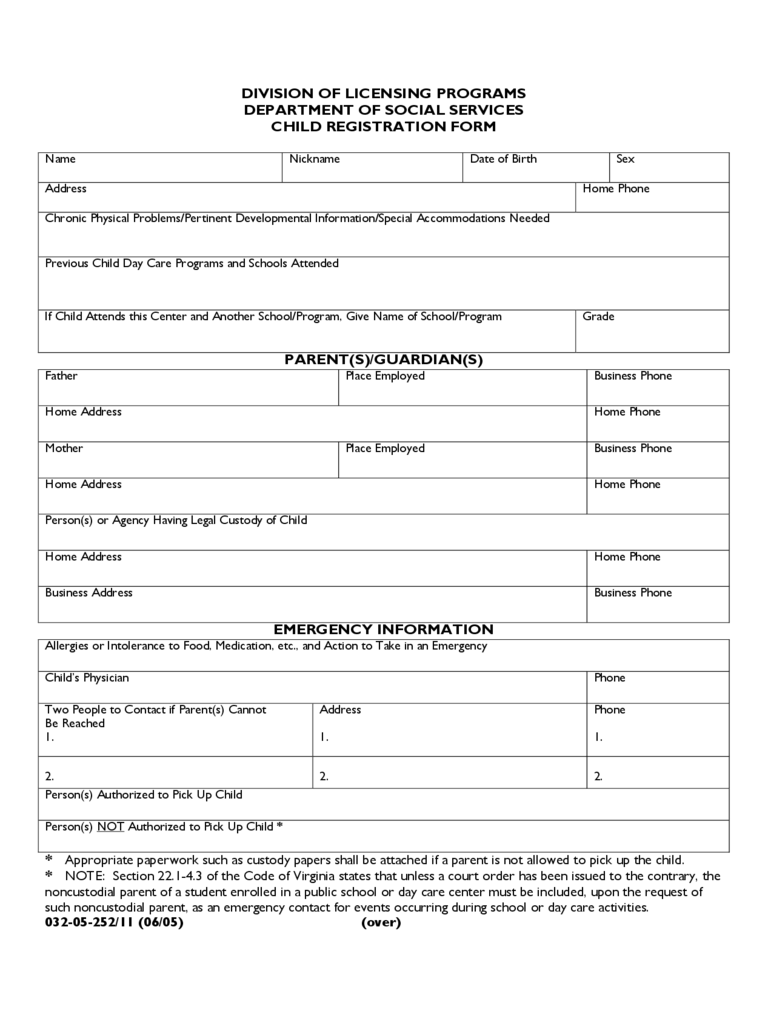

2024 Child Registration Form Fillable Printable PDF Forms Handypdf

https://handypdf.com/resources/formfile/images/fb/source_images/child-registration-form-virginia-d1.png

Your Ultimate Guide To The Child Care Benefit And Child Care Rebate Petit Journey

https://www.petitjourney.com.au/wp-content/uploads/2017/01/how-to-apply-for-child-care-rebate-e1513120609516.jpg

Senate committee approves increased investment in our country s child care and early learning system ARLINGTON VA July 27 2023 The U S Senate Committee on Appropriations today approved with bipartisan support their proposed Labor Health and Human Services Education and Related Agencies Fiscal Year 2024 Appropriations bill including a 1 billion increase for early learning 3 000 per child 6 17 years old 3 600 per child under 6 years old All working families will get the full credit if they make up to 150 000 for a couple or 112 500 for a family with a single

Work related expenses Q18 Q23 The child and dependent care credit is a tax credit that may help you pay for the care of eligible children and other dependents qualifying persons The credit is calculated based on your income and a percentage of expenses that you incur for the care of qualifying persons to enable you to go to work look for The American Rescue Plan increased the amount of the Child Tax Credit from 2 000 to 3 600 for qualifying children under age 6 and 3 000 for other qualifying children under age 18 The credit was made fully refundable By making the Child Tax Credit fully refundable low income households will be entitled to receive the full credit benefit

Child Care Rebate Tax Brackets 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/08/how-canada-s-revamped-universal-child-care-benefit-affects-you.png

Child Care Tax Rebate Payment Dates 2022 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/06/child-care-tax-credit-payment-dates-2022-drift-hestia-bloger.jpg

https://www.msn.com/en-us/money/personalfinance/child-tax-credit-2024-how-much-is-it-and-who-qualifies/ar-AA17D0rH

The IRS website Note Jackson Hewitt which helped drive child poverty to a record low Jan 29 According to a Washington Post report Form 1040 Schedule 8812 Credits for Qualifying Children and

https://www.kiplinger.com/taxes/how-much-is-the-child-tax-credit-for-2024

How Much Is the Child Tax Credit for 2024 Various family tax credits and deductions including the 2024 child tax credit have been adjusted for inflation Here s what they re worth Image

2023 Youth 1 Day TCEP

Child Care Rebate Tax Brackets 2023 Carrebate

Introducing The New Child Care Subsidy Montessori Academy

Child Care And Early Childhood Learning Future Options PC News And Other Articles

September Calendar 2024 Printable For Kids School Catha Daloris

Changes To The Child Care Benefit And Child Care Rebate How Will They Affect You Grandma s Jars

Changes To The Child Care Benefit And Child Care Rebate How Will They Affect You Grandma s Jars

Changes To The Child Care Benefit And Child Care Rebate How Will They Affect You Grandma s Jars

Your Ultimate Guide To The Child Care Benefit And Child Care Rebate Petit Journey

What The Changes To Child Care Rebates Mean For YOUR Family

2024 Child Care Rebate - ADMINISTRATIVE Rev Proc 2023 34 page 1287 This revenue procedure sets forth inflation adjusted items for 2024 for various Code provisions as in effect on November 9 2023 The inflation adjusted items for the Code sections set forth in section 3 of this revenue procedure are generally determined by reference to 1 f of the Code